‘There’s more to the Ida Fault than meets the eye’: Western Yilgarn says there are lithium, precious and base metals giants waiting to be discovered

Mining

Mining

A geological wonder known as the Ida Fault has incited a new wave of lithium pegging excitement with up-and-coming developers, and majors alike, rushing the grounds for a slice of the pie. But one digger is in the area looking for other kinds of battery metals.

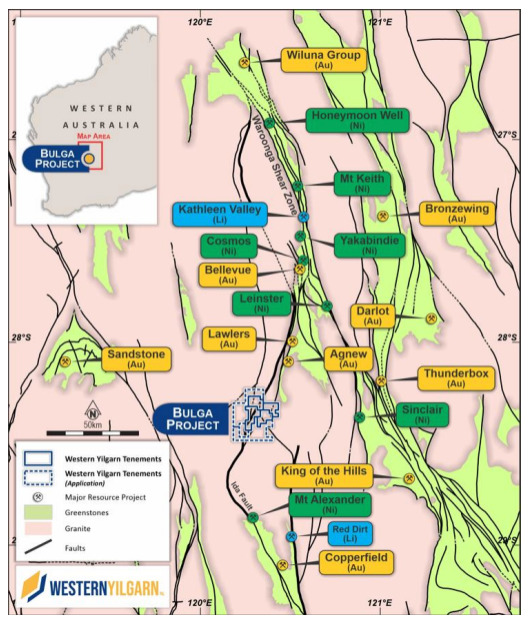

Critical mineral explorer Western Yilgarn (ASX:WYX) emerged onto the scene in 2022 from the shell of Pacific Bauxite with a suite of exciting projects dotted across a 1,527km2 combined area in Western Australia’s Yilgarn craton.

Its flagship and most advanced project, Bulga, is nestled on a steep structure marking the boundary between the Eastern Goldfields terrane in the east and the Youanmi terrane in the West, known as the Ida Fault.

Traditionally regarded as a gold hotspot, home to an array of developments from Gold Field’s Lawlers and Agnew mines to Bellevue Gold’s 3.8Moz deposit, the province in recent times has garnered attention for newly discovered lithium prospectivity.

As well as attracting explorers for mineral exploration, the region has been a hotbed of corporate M&A activity with the latest example being the recent share raid from Gina Rinehart in multibillion dollar lithium developer Liontown Resources (ASX:LTR) about 90km to the north of WYX’s ground at Bulga.

LTR, also the former $6.6b takeover target of lithium giant Albermarle, is working hard at bringing its 156Mt Kathleen Valley project into production by mid-2024.

About 60km to the south of Bulga, Delta Lithium’s (ASX:DLI) 12.7Mt Mt Ida lithium project is being developed to initially produce a direct shipping ore (DSO) with the intention to produce spodumene concentrate.

Mineral Resources (ASX:MIN) has its sights set on Delta’s Mt Ida ground, amassing a 17.44% stake in the company and installing its rich lister boss Chris Ellison at the helm.

Meanwhile, Rinehart has further increased her exposure to lithium in the same neighbourhood.

Hancock previously partnered with Legacy Iron Ore (ASX:LCY) and Hawthorn Resources (ASX:HAW) on its Mt Bevan magnetite project, but now the trio has expanded that partnership to include lithium exploration not too far at all from Juno Minerals’ (ASX:JNO) Mount Ida magnetite project.

What started out as a hunt for magnetite is looking mighty promising for lithium with Juno uncovering two significant, well-defined lithium-caseium-rubidium beryllium soil anomalies.

But while lithium has captured the hearts (and wallets) of resource investors in the region, there’s a lot more to the minerology of the Ida Fault than just lithium.

Take Delta’s project, for example, which has a 412,000oz gold resource (ore grade 4.1g/t) nestled right up against the lithium-rich pegmatites. This includes a shallow 70,000oz at 9g/t – high grade in anyone’s language.

“This is a previously underexplored region which is all of a sudden gaining exceptional attention and it’s worth having a look as to why this might be,” Western Yilgarn general manager Gavin Rutherford says.

“We are in a lithium address but there’s more to it than that if you have a look at what’s happening around the place.

“The industry at large thought much of the region, including our project area, wasn’t worth looking at, attributing it to being a barren granite unit however we decided to do things a little differently.”

Instead of sending out drill rigs, a costly task even for just a couple holes, Western Yilgarn applied a grassroots exploration strategy involving a program of first pass auger geochemical sampling.

Geochemistry exploration work are methods used by mining companies to cover a larger area quite cheaply and prioritise targets for future drilling activities.

“The logic behind it is to get down deep enough to sample insitu material that is in place rather than transported cover, which is soil that has been transported in and out over the millennia by natural weathering processes,” Rutherford says.

“If you’ve got a soil sample that has been carried in, it’s not going to tell you what’s in the ground immediately beneath you and likewise can hide anything below.

“We went out, put 2,347 drill holes in and took some samples from each hole and sent it off to a commercial laboratory for a 4 acid digest multi-element analysis to see what was below the soil and what their concentrations are.

“We realised we were working with a very complex structural region – the rock structures underneath the ground are very busy but we got a good sniff of what was beneath the surface with some geochemical anomalies defining potential LCT pegmatites along with Ni-Cu-PGE and lower level gold targets, which runs into a lease owned by Bellevue Gold.”

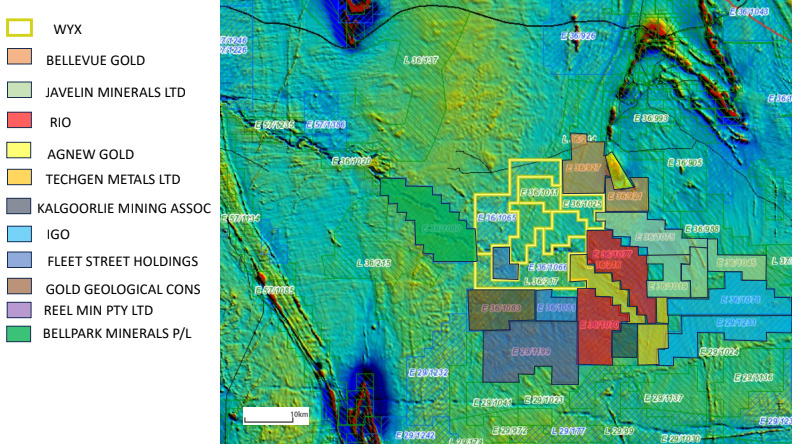

From that initial geochemistry work, Western Yilgarn generated a total of nine targets, and while there is still a lot more work to be done, Rutherford believes the area holds the potential of becoming a new polymetallic province down the track.

All up three LCT pegmatites targets, five nickel-copper-PGE targets and one gold target were defined.

Of the nickel-copper-PGE targets, N1 and N2 from historical aircore and RC drilling by BHP and St George defined promising nickel intercepts including:

“These nickel-copper-PGE intersections define a highly fertile and poorly explored ultramafic belt,” Rutherford says.

“The mystery of the Mount Ida region is being discovered now and since we’ve started making noise, all these companies have been turning up.

“Rio Tinto pegged their ground immediately to the right of us on March 20th, Cobalt Prospecting followed soon after on May 12, Fleet Street Holdings on August 3, and Gold Geological Consulting after that.

“They are all around us – there has been a real lack of exploration around our project area up until now and it’s because everyone assumed it was granite.”

Western Yilgarn has picked up another 270km2 of tenements at Bulga to the north and the south, taking Bulga’s exploration package out to 477km2 directly along strike of the Ida Fault.

“We’re eager to see what the drilling yields for us as soon as the applied for leases are granted to us, where we will undertake first class principles of auger geochemistry work again,” Rutherford says.

“There is an orderly and well costed exploration approach to Bulga.”

This article was developed in collaboration with Western Yilgarn, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.