The world is screaming out for copper. Here are 14 ASX explorers gearing their projects up for the looming deficit

Mining

Mining

Copper prices might be a bit askew but if there’s one thing commodity strategists, analysts and ASX company directors all agree on, it’s that demand for the red metal is here to stay…for as long as it takes to tackle climate change, anyway.

Most estimates show that despite the urgent need to decarbonise, the energy transition will proceed at a snail’s pace over the next decade.

By 2032, the Economic Institute Unit says fossil fuels will still account for 78% of the global energy mix, down only slightly from 81% in 2022.

This means that no matter how the short-term fundamentals for copper play out, as a cornerstone for all electricity-related technologies, the world will still need vast amounts of it.

Copper stands out as the No 1 metal when it comes to the green energy transition.

Its ability to be bent and shaped into wires make it ideal for a variety of electrical uses, it’s a great conductor of heat, and without it, for the same efficiency, electrical equipment such as motors, transformers and cables would use 20% more materials.

In an interview with Stockhead Eagle Mountain Mining (ASX:EM2) CEO Tim Mason said because copper is a highly efficient conduit, it is used to generate renewable energy systems from solar, to hydro, and wind energy.

“For offshore wind energy alone, we will see a seven-fold increase in copper demand by 2040,” he said.

“That is going to be huge, the world needs to find multiple, new tier-1 copper projects which they haven’t found yet and even if they do find them, it will take about a decade to get them into production… and that is the best-case scenario.”

Meanwhile, companies have become conservative about investing in new projects due to the time it takes to discover, explore, permit, finance and develop new mines.

According to S&P Global, rather than investing in exploration and development to meet increasing demand, companies are focusing their attention on extending the mine life of profitable projects that already producing.

But from Mason’s point of view, more needs to be done from the government regulatory side of things to get projects online.

“The hindrances and hesitation by authorities to approve projects around the world is putting the decarbonisation goals at risk and companies are getting increasingly frustrated with the process that is at complete odds with the energy transition,” he explained.

At the same time, countries are grappling with an increase in ESG-related concerns which in turn, might limit the supply of crucial metals like copper and further derail the clean energy transition.

“It’s a really challenging environment, I think decarbonisation is going to be one of greatest challenges of this century.”

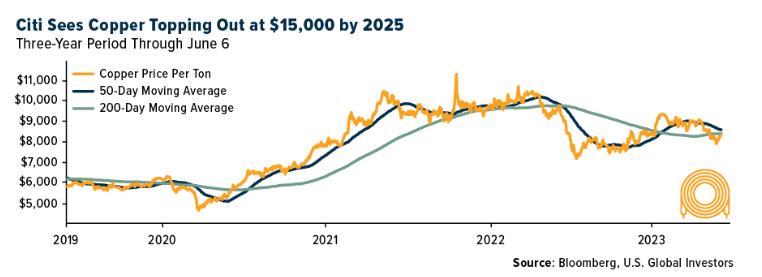

Citigroup managing director for commodities research, Max Leyton told Bloomeberg copper prices might dip further in the short-term but could begin to rally in the next six to 12 months as the market fully recognises the massive imbalance between supply and demand.

He said copper prices could reach $15,000 a ton by 2025 on the back of this widening supply gap as demand for EVs and renewables expands, and added now is an ideal time for investors to buy as the price of copper is still muted on global recession concerns.

Echoing this sentiment, Mason said it wouldn’t be unreasonable to see prices surge between 30 to 60% higher than where they are today by 2030.

“They could arguably go a whole lot higher than that – in fact, they need to get to that price point to incentivise these various marginal projects to come online,” he explained.

“But even if they do and at any price, I think the world’s going to be screaming out for the red metal and I don’t think there’s going to be any price which will magically make the supply appear to meet demand.”

With that in mind, here are a bunch of copper explorers working hard at increasing resources through exploration to such a point where a clear pathway towards development and in the end, production is demonstrated.

Recent exploration by Eagle Mountain at its Oracle Ridge project in Arizona is moving towards another upgraded mineral resource estimate and ramping up technical evaluations for development.

The new MRE, now underway, will be based on extensive new knowledge gained from underground mapping and channel sampling, as well as incorporating all assays received from drilling since October 2022.

Currently, the MRE stands at 16.5Mt at 1.45% copper, 15.1g/t silver and 0.19g/t gold for 240,000t contained copper, 8Moz contained silver and 102Koz contained gold.

Evaluations will focus on assessing various mining scenarios, from a larger scale operation using the materially larger resource base at lower cut-off grades, to a smaller scenario using selective mining at high-grade targets.

This explorer, also in Arizona, has run the numbers again after an already impressive 2022 scoping study, leveraging a 48% increase in its resource base to boost the scale and scope of the proposed American copper mine.

Now hosting 11.4Mt at a copper equivalent grade of 4.1% Cu, one of the highest in the global development pipeline, the new study suggests Antler will run at an operating rate of 1.3Mtpa over 13 years, a 30% increase on the 10-year mine life previously announced, with a 41% increase in total copper production to 381,400t on a copper-equivalent basis.

Annually the mine would deliver 32,700t of CuEq production over its first decade, 7% higher than previously planned, including 16,400t of copper metal a year.

Peel has been quietly going about its business this year while it works through a pre-feasibility study for its South Cobar project and undertakes permitting to develop underground exploration declines for the Mallee Bull, Wirlong and Southern Nights-Wagga Tank deposits.

The PFS will be based off one of the larger high-grade resources delineated in the Cobar region, host to a catalogue of similar copper mines, where a mineral resource estimate of 20Mt containing 216,000t copper, 322,000t zinc, 151,000t lead, 22Moz silver and 204,000oz gold lies.

Around 70% of the resource and about 77% of copper is classified in the higher confidence Indicated category.

Stellar Resources hit a significant 38.6m-long zinc-lead-copper mineralised zone at ‘North Scamander’ in Tasmania, from 130m depth earlier in the week where a second ~17m-long zone of mineralisation was hit from 220m depth.

The primary target of this 750m deep diamond drill hole – the core of a regional scale magnetic anomaly — starts at ~375m depth, SRZ says.

“The significant Zn-Pb-Cu mineralised zone intersected to date from 131.2m to 169m in the upper part of our first exploration drillhole at North Scamander is very encouraging,” SRZ exec director Gary Fietz says.

“This is interpreted as being the top of a metal-rich hydrothermal system which may exist at depth, which is the main drilling target as the hole continues to a target depth of 750m.”

Cyprium has a suite of high-quality copper projects with +1.6Mt of contained copper in mineral resources.

Work is underway on the +20-year super pit mine life development at Nifty, based on the current MRE of 940,200 tonnes of contained copper, plus a further 90,000 tonnes of contained copper in the existing heap leach pads.

During the March quarter Great Western Exploration completed the interpretation of helicopter-borne electromagnetic (EM) data at the Fairbairn nickel-copper project, with seven nickel-copper targets defined adjacent to magnetic highs prospective for magmatic nickel-copper deposits.

Fairbairn is about 900km northeast of Perth on the northern margin of the Yilgarn Craton and within the Earaheedy Basin, which is highly prospective for base metal deposits hosting Chalice’s (ASX:CHN) Julimar and IGO’s (ASX:IGO) Nova deposits.

Exploration work such as field inspections and ground electromagnetic surveys will be prioritised to precisely delineate the interpreted EM conductor plates for targeted drill testing.

Infinity Stone’s Zen-Whoberi project, 30km north of Mont-Laurier in Quebec, Canada was discovered by surface and beep mat surveys in 2004, with copper mineralisation occurring as a skarn in the form of disseminated sulphides.

The company recently expanded its land position after an airborne magnetic survey identified several new anomalous zones coincident with soil sampling anomalies, as well as several parallel east-northeast to west-southwest trending structures at the newly expanded and previously unexplored northern part of the project.

As a result, an additional 15 claims have been staked out – three of which are still under application – covering a total of 706ha to the northeast of the project.

Drilling at Copper Search’s Peake Project wrapped up in early May at the AC23 target, the first of four high-priority IOCG targets to be drilled.

All drill core has been transported to Adelaide for detailed logging, cutting and sampling, with assays expected shortly.

Regional programs to identify potential drill targets in the northern half of the Peake Project are underway in parallel with the current drilling.

A recent exploration diamond drill program at the Oropesa project in Spain recently returned 8.9m at 1.14% copper and 0.31% zinc from 87m outside the bounds of the defined mineralised resource.

ELT managing director Joe David says this demonstrates the potential for Oropesa to be further extended and expanded beyond what is in the basis of design for the definitive feasibility study (DFS).

Caravel’s looking at a low-grade copper production project at its namesake project of the same name in WA’s central wheatbelt, where work is focused on pushing forward with the finalisation of its definitive feasibility study (DFS).

With a resource of 1,180Mt grading 0.24% copper for 2.84Mt of contained copper, the $1.67bn Caravel project could well turn out to be one of the largest copper mining operations ever delivered in Australia, as it looks to produce 71,000 tonnes per annum (tpa) over the first five years.

This is comparable to the likes of OZ Minerals’ Prominent Hill and Carrapateena in South Australia and Sandfire’s recently shuttered DeGrussa in WA.

Alma’s final assays from core drilling at its Briggs copper project in Central Queensland have proven beyond a doubt that a substantial upgrade to current resource is on the cards in the third quarter.

The final assays have once again extended the extent of copper-molybdenum mineralisation beyond the existing Briggs Central Inferred Resource of 143Mt at 0.29% copper with hole 23BRD0016 returning a thick 365.7m intersection grading 0.24% copper and 28 parts per million (ppm) molybdenum from a down-hole depth of just 6.3m.

Alma says this hole – 23BRD0016 – extends the known limits of mineralisation by over 150m to the northeast of the resource while confirming the presence of near-surface, higher grade mineralisation.

Anax’s plans to restart the Whim Creek copper project in Western Australia could see additional copper and zinc production following successful bioleaching tests.

Bacterial column leaching test work delivers between 79% and 80% copper extraction and over 90% zinc extraction from ore sorted “middlings”, which is material between clean mineral product and tailings that would ordinarily have been discarded.

Importantly for Anax, the recently refurbished heap leach infrastructure at Whim Creek can be adapted to use its proprietary bioleaching technology at minimal CAPEX to deliver additional metal production.

HOR’s Horseshoe Lights copper-gold project is around 50km west of Sandfire’s (ASX:SFR) DeGrussa copper discovery, and contains a current in situ resource 128,000t copper metal at 1.0% (0.5% cut-off) and 36,000oz gold.

The company’s latest round of drilling has demonstrated the potential to grow the existing resource base with multiple zones of thick, shallow copper mineralisation confirmed outside the existing resource envelope.

Metalicity identified multiple new targets at the company’s Mt Surprise project, 165km west of Cairns, in early May during a review of all available geophysical survey data at the project and surrounding areas.

These new targets are a welcome addition to Mt Surprise’s two current high-priority targets – the Copper Cap copper-cobalt and Double Barrell base metals prospects.

“As we methodically continue to explore and build knowledge of this area, we are highly encouraged by the number of targets and results that have been presented to date that show this area to be highly prospective,” MCT CEO Justin Barton said.

Alicanto completed its acquisition of the historic Falunc copper-gold-zinc mine in Sweden back in May, considered as one of the world’s major copper producing orebodies.

Located in the same jurisdiction as its high-grade Sala silver deposit, AQI now controls over 60km of the target limestone horizon over a total landholding of 312km2 around the Falun mine.

But despite its world class nature, little follow up exploration to modern standards has been completed since the shop was shut 31 years ago.

AQI plans to undertake a significant electromagnetic survey to assist with prioritising the best quality drill targets over the Falun project before starting a major diamond drill program.

At Stockhead we tell it like it is. While Eagle Mountain, New World Resources, Copper Search, Great Western Exploration, Infinity Stone, Peel Mining, Alma Metals, Anax Metals, Horseshoe Metals, Metalicity, Caravel Minerals, and Alicanto Minerals are Stockhead advertisers, they did not sponsor this article.