Superbird: Pantera on track to double Arkansas lithium position next to Exxon’s brine play

Mining

Mining

Special Report: ASX-listed lithium brine upstart Pantera Minerals has delivered a clear pathway to roughly double its footprint in the US brine field tipped to be the next dominant source of the battery metal.

Pantera Minerals (ASX:PFE) made serious waves in the battery metals market last August when it announced the acquisition of Daytona Lithium, owner of the Superbird project in South West Arkansas.

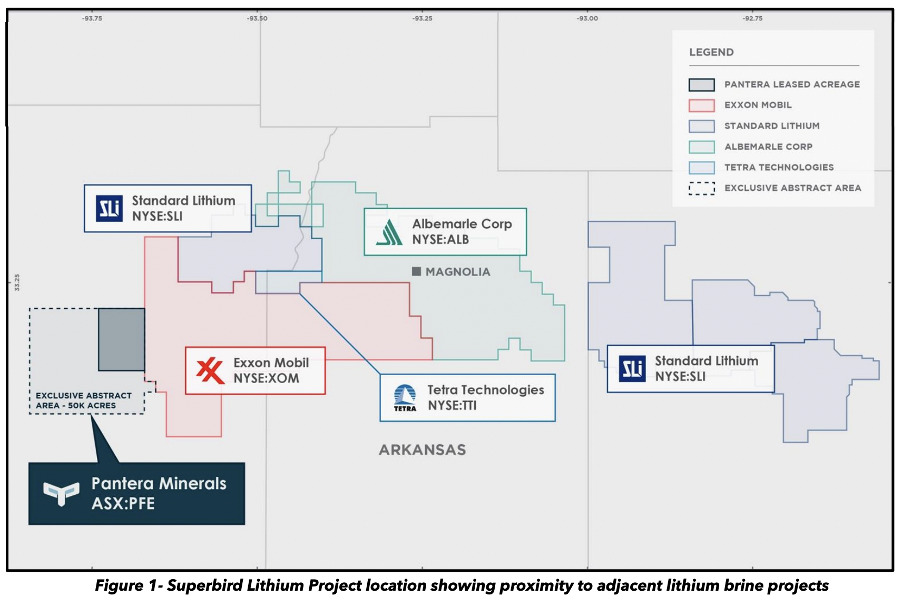

That places it directly next to the 120,000 acre property in the Smackover Brine play in the southern state, where oil and gas giant Exxon Mobil believes it will be producing lithium for more than 1 million EVs a year from 2030.

Pantera announced today that Superbird project acreage position– located on Exxon Mobil’s literal Smackover doorstep – had been expanded by 11% with 13,457 acres now leased within an exclusive abstract area of 50,000 acres.

A further 8,600 acres is under negotiation, with Pantera looking like it’s got a ‘clear path’ to 20,000 leased acres and beyond.

And Pantera is likely not far behind Exxon Mobil in evaluating the potential of the Smackover reservoir after the US$400 billion corporate giant began its exploration drive in November. The junior says multiple re-entry wells have been identified within its project footprint and its negotiations with well owners have started.

That means re-entry and sampling to assess the lithium potential of the brine at Superbird could start as soon as the June quarter of this year.

While the US looms as one of the top markets for the emerging electric vehicle sector, its access to domestically produced lithium is a major roadblock for the industry. Currently only 3,000 tons per annum is produced in the United States.

But the Smackover has been regarded by some of the lithium sector’s top experts as one of its most likely success stories, leveraging its dominance in oil and gas production for the new energy metal.

Further to the east of Exxon and Pantera, Standard Lithium has already completed a PFS and run a pilot plant for 12 months establishing the potential to use cleaner, novel direct lithium extraction technology to produce lithium in the Smackover.

It plans to be in production in 2027, with construction to start next year on a project to produce 5400t of battery class lithium carbonate chemical a year.

Albemarle, the world’s largest lithium producer, is also in the neighbourhood, placing Pantera in rarified air. Its own assessments in the form of an exploration target have shown the Superbird project could host as much as almost 3Mt of lithium carbonate equivalent resources.

“The leasing strategy implemented for the Superbird Project continues to deliver, surpassing an impressive 13,400 acres through the strategic utilisation of the companies’ Exclusive 50,000-acre Abstract Agreement,” Pantera CEO Matt Hansen said.

“The recently announced independently estimated Exploration Target of 436,000 to 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE) for the 50,000 acre exclusive abstract area encompassing the Superbird Lithium Brine Project underscores the potential of the Superbird Project to become a project of significance in the United States lithium sector.

“Notably, the Smackover is gaining recognition as the prime location in North America for developing Direct Lithium Extraction projects. Renowned lithium expert Mr Joe Lowry is quoted as saying ’the Smackover is where the US will have brine and DLE success’, highlighting the region’s strategic significance in the lithium industry.”

Pantera shareholders are due to vote on the Daytona Lithium acquisition at a general meeting on February 15, with voting to date showing strong shareholder support for the purchase of 100% of the Superbird project owner.

Since Pantera announced its investment in the Smackover Formation brine play, its acreage has increased some 152% from 5,325 acres to a land position of 13,457 acres.

Once the deal is sealed Pantera plans to re-enter a well to give it key data on the grade of the brine in its slice of the Smackover, as well as the permeability and porosity of the formation on its acreage.

Pantera and other well brine plays in the Smackover are looking to use DLE to separate the lithium material from the brine, a processing method expected to transform the industry by offering a quicker and greener path to market compared to the water-hungry conventional evaporation brine producers.

Two highly respected DLE tech providers have already been tapped to test re-entry well samples at Superbird, while Pantera is planning to also acquire existing 2D seismic data for subsurface modelling, providing clarity on the best drilling locations for its first resource definition wells.

This article was developed in collaboration with Pantera Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.