You might be interested in

Mining

Riding the tech express: Tomorrow's industries that are driving industrial demand for silver

Mining

TEN-BAGGER: John Forwood thinks we are entering an 'almost everything rally'

Mining

Mining

The list of applications for silver now includes antiviral uniforms for air crew to silver fibre sensors in face masks and wearable sensors printed directly on to human skin.

Researchers from China and the US have made wearable silver sensors that can be adhered to human skin to monitor vital signs such as heart rate, blood oxygen and body temperature, according to industry body The Silver Institute.

The wearable silver sensors can be applied to human skin at room temperature using a new technique developed by a group of researchers from Penn University in the US and, Shenzhen Science and Technology Program among others.

“The sensor can be recycled, since removal does not damage the device,” said Professor Huanyu Cheng from Penn State University, reported the Silver Institute.

“And, importantly, removal does not damage the skin either,” he added.

Silver used in electronic circuitry is usually sintered, that is, silver in powder form is heated to a high temperature. But the new room temperature process is safer for skin contact.

Meanwhile, a corporate jet company in Turkey, Keyvan Aviation, has made the world’s first air crew uniform that has antiviral properties.

The uniform is 97 per cent cotton and embedded with silver ions to give it antimicrobial properties that remain after washing 100 times at 60 degrees Celsius.

The antiviral crew uniform has obvious application in the world of air travel, post COVID.

“The uniform has only been launched very recently, and we have received a good amount of interest from airlines and airports,” Mehmet Keyvan, Keyvan Aviation chief executive told Sam Chui Aviation and Travel, reported the Silver Institute.

Lastly, scientists at Cambridge University have developed a face mask with diagnostic sensors made from silver that can transmit information on the wearer’s health using wifi.

The face covering has microscopically thin semi-conductors made from silver that can be easily made using 3D printing technology and are sensitive to changes in moisture, odour and other functions of the human body.

“Our fibre sensors are lightweight, cheap, small and easy to use, so they can potentially be turned into home-test devices to allow the public to perform self-administered tests,” Yan Yan Shery Huang from Cambridge University’s engineering department said.

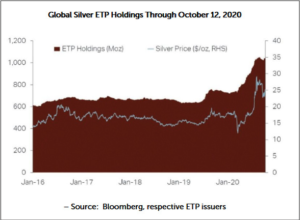

Silver is having its time in the sun as an investment too, with investor holdings in silver Exchange Traded Products nearly tripling year on year in the September quarter.

ETP holdings jumped by 297 million ounces in the September quarter to 1.02 billion ounces, according to the Silver Institute.

In the September 2019 quarter, ETP holdings increased by a modest 103 million ounces.

“Globally, silver bullion coin demand is up strongly, with a 65 per cent increase in demand over the first three quarters of 2020,” said the Silver Institute in its October newsletter.

“This was due to strong sales in two key bullion coin markets, the US and Germany, with both seeing substantial double-digit gains over the first nine months,” it added.

There are a number of ASX companies with exposure to silver, about a dozen in total.

They range from larger miners which produce silver as a by-product of other metals production, to pure-play silver miners.

The best-performing silver company over the past year is Mithril Resources (ASX:MTH) with its Cometa project in Mexico’s Copalquin district where historic high-grade production from multi-level workings has been reported.

Mithril’s share price has risen 400 per cent over the past year to give the explorer a market value of $50m.

Rimfire Pacific Mining’s (ASX:RIM) in the number two spot with a 267 per cent rise in value.

The explorer’s Sorpresa project in the East Lachlan Fold Belt of NSW hosts silver along with gold.

Owner of the Paris silver project, Investigator Resources (ASX:IVR), is third in terms of yearly gains.

This is a potential 1-million-tonne-per-year mine, which the company says is the highest grade non-by-product undeveloped silver project in Australia.

WA-based Pacifico Minerals (ASX:PMY) is developing the Sorby Hills lead-silver-zinc project, and is up 138 per cent in a year.

Adriatic Metals (ASX:ADT) is advancing the Vares polymetallic project in Bosnia & Herzegovina, and has returned 114 per cent over the past year.

Larger miners that produce silver include South32 (ASX:S32) at its Cannington site in Queensland, producing at a rate of 3 million ounces a year.

Sister company BHP (ASX:BHP) has some silver production from its Olympic Dam mine in South Australia that is better known for its uranium-copper output.

Both BHP and South 32 have experienced negative share price gains over the past year.

| Code | Company | Price | MktCap | %Mth | %SixMth | %Wk | %Yr |

|---|---|---|---|---|---|---|---|

| S32 | South32 Limited | 2.11 | $9.9B | 3 | 12 | -5 | -17 |

| WRM | White Rock Min Ltd | 0.465 | $33.8M | -18 | 55 | -11 | -7 |

| BHP | BHP Group Limited | 34.61 | $99.6B | -1 | 16 | -3 | -3 |

| MKR | Manuka Resources. | 0.44 | $33.3M | -16 | 0 | -13 | 0 |

| BBX | BBX Minerals Ltd | 0.37 | $161.4M | -10 | 252 | -12 | 85 |

| SVL | Silver Mines Limited | 0.2 | $200.2M | 5 | 144 | -2 | 106 |

| ADT | Adriatic Metals | 2.32 | $404.1M | 5 | 90 | 14 | 114 |

| PMY | Pacifico Min Ltd | 0.019 | $62.8M | 12 | 375 | -5 | 138 |

| IVR | Investigator Res Ltd | 0.05 | $53.1M | 4 | 317 | 0 | 178 |

| RIM | Rimfire Pacific | 0.011 | $19.7M | -8 | 175 | -8 | 267 |

| MTH | Mithril Resources | 0.03 | $50.1M | 15 | 400 | 0 | 400 |