You might be interested in

Experts

MoneyTalks: Lion Selection Group finds pride in these four small-cap gold stocks

Mining

Gold is at ALL TIME HIGHS but bullion and equities have never been so disconnected. Experts think the gap will close

Experts

Mining

Special Report: Advanced gold explorer Saturn Metals (ASX:STN) has now added 276,000oz to the Apollo Hill project resource in about 18 months of drilling — and there’s a good chance it’s just the beginning.

Saturn’s flagship asset is Apollo Hill; a big, thick, at surface, simple deposit with multi-million-ounce potential, surrounded by 1000sqkm of gold-fertile ground in WA’s eastern goldfields.

Today, Saturn announced an updated indicated and inferred resource of 24.5 million tonnes grading 1g/t for 781,000oz of gold — a 96,000oz boost to the previous resource unveiled in November 2018.

Since listing on the ASX in March 2018, Saturn has added 9.8oz (worth $21,677 at today’s prices) to its gold inventory for every metre drilled and modelled. That’s a fantastic return.

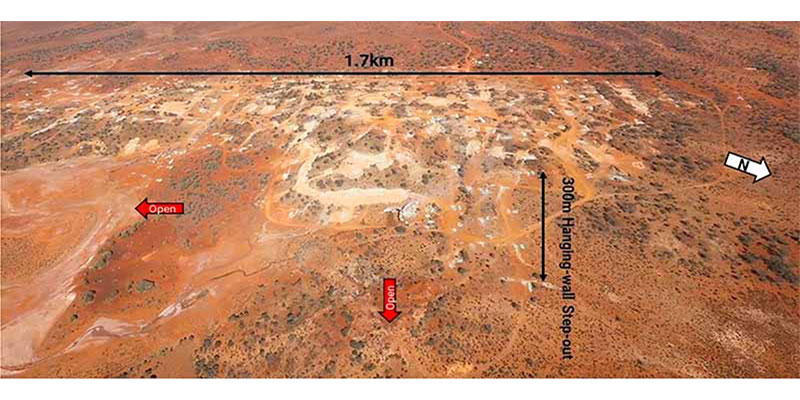

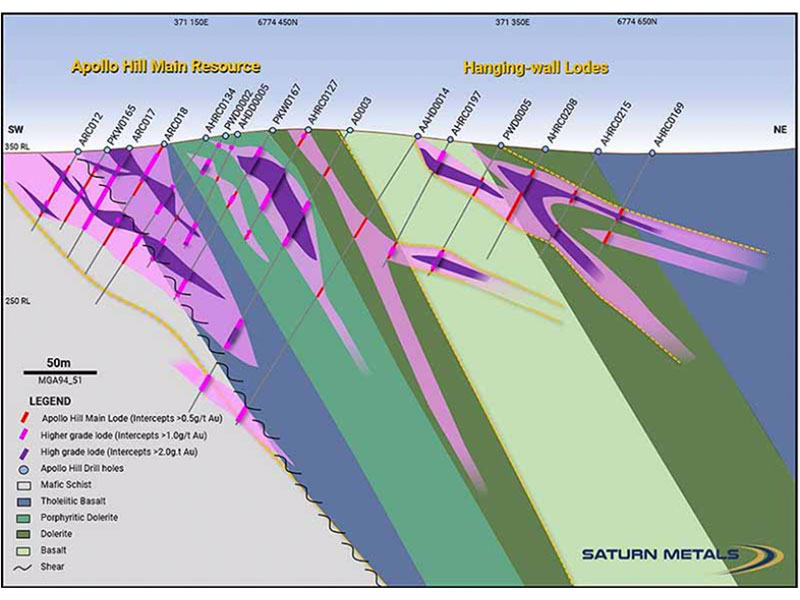

This recent resource growth was largely driven by the discovery of a shallow, higher grade ‘hanging wall’ zone east of the original resource.

>> Learn more about Saturn Metals

This discovery remains ‘open’ down plunge, along strike, and to the east:

…which means there’s strong potential the resource will just keep getting bigger.

And importantly, 298,000oz of this resource is now in the higher confidence ‘indicated’ resource category, which means that Saturn already has sufficient info on geology and grade continuity in some areas to support early stage mine planning or options studies.

Improvements in localised grade, ounces, tonnes, quality and mineral resource categories — all with efficient drilling and at an effective discovery cost per ounce — bode well for the development of Apollo Hill, managing director Ian Bamborough says.

“With some of the strongest intersections located in the newly discovered higher-grade hanging-walls, the system is wide open for rapid expansion,” he says.

“Drilling has already resumed to test these and other step out targets and results from this expansionary phase of our journey will be reported in due course.”

Saturn’s strategy moving forward is to add more gold ounces through step out exploration before initiating a scoping study at Apollo Hill. Given the belief in the size of the Apollo Hill gold system the Company is looking to provide further leverage by outlining some economies of scale.

Miners usually undertake three different types of studies to determine whether or not a resource can be mined economically. These are – in order of importance — scoping, preliminary feasibility (PFS), and definitive feasibility (DFS).

Saturn’s primary focus is to rapidly expand the newly discovered higher-grade, shallow hanging wall zones.

This includes following up on successful rock chip sampling in unexplored terrain immediately east of these new lodes, which recently returned grades like 4m at 9.31g/t gold, 51m from surface.

Additionally, drilling has kicked off looking for new styles of mineralisation within the larger Apollo Hill gold system by targeting interpreted geological structures identified by geophysics.

And remember, Saturn has barely touched its 1000sqkm tenement package.

This underexplored landholding sits on 30km of completely untested Keith-Kilkenny shear zone — which is arguably responsible for a number of major multimillion-ounce discoveries in the region.

A drilling program aimed at making and developing new satellite discoveries is planned for October and November.

>> Now watch: 90 Seconds With… Ian Bamborough, Saturn Metals