You might be interested in

Mining

South Harz Potash enters MOU with Euroports to advance long-term export access routes from Ohmgebirge

Mining

South Harz Potash’s Ohmgebirge train keeps puffing on access to existing third-party shaft, PFS

Mining

Food & Agriculture

Special Report: Despite challenges in recent years, long-term prospects for the premium fertiliser potash remain strong and new projects will likely have little difficulty moving their product.

This is the opinion of South Harz Potash’s (ASX:SHP) chief operating officer Lawrence Berthelet, a highly credentialled chemical engineer who has 35 years of experience in the potash industry.

Speaking to Stockhead, he touched on the beginning of his long career when he started as a process engineer looking after underground potash mines in Saskatchewan before moving into the engineering, procurement, construction, and management business – running global engineering and construction firm SNC-Lavalin’s potash office.

“I was the vice president for potash looking after all of SNC-Lavalin’s potash projects such as Jansen and Woodsmith,” he said.

“After that, I went and worked on a big project – the US$2.9bn K3 potash mine construction – as Mosaic’s vice president for capital projects in North America.

“That was two shafts, 1,100m deep with a couple of overland conveyors, both of them about 11km long, two head frames and two hoists – a big mine project.”

K3 and the earlier K1 and K2 mines form the world’s largest potash mining complex, and understandably is one of Berthelet’s proudest achievements.

“You read about how so many of these megaprojects come in over budget, we did not. I was on the K3 project for 4-5 years and we brought that project in under budget and a year ahead,” he said.

In fact, the project was so far under budget that some of the funds earmarked for K3 were used instead for brownfield expansion work such as the expansions of the K2 mill to increase throughput.

“After that I went to work for EuroChem in Moscow, Russia, in an operations role where I looked after two potash mines and a couple of open pit phosphate mines,” he said.

While his team handled smaller projects for execution such as small expansions and fixes, Berthelet himself also investigated M&A opportunities such as the purchase of Yara’s Salitre phosphate mine in Brazil.

Incidentally, one of the projects that crossed his desk happened to be the South Harz project.

“We were really intrigued with the perpetual licences and the orebody is well known but I think at that stage of development, we probably weren’t ready to get involved.”

Berthelet then left EuroChem following Russia’s invasion of Ukraine and was subsequently recruited by SHP.

Berthelet’s long experience allows him to provide valuable insights for the potash sector.

While Canada is the world’s largest potash producer by a significant margin, producing more than the next three producers – China, Russia and Belarus – combined, it is the number three (Russia) and four (Belarus) that had traditionally supplied the fertiliser to European markets.

That was until Russia invaded Ukraine – with some limited support from Belarus, leading the European Union to place sanctions on the two countries which included their potash exports.

“The Belarusians are probably affected the worse as they are having a harder time exporting product as they can’t export through Poland and Lithuania. They are coming back but a lot smaller in tonnage,” Berthelet said.

“Russia in contrast can export potash to India, China and Brazil because those markets remain open to them.”

Oddly, while prices increased following the outbreak of war, they subsequently fell with Berthelet expressing his belief that farm operators had chosen not to apply product for a year and catch up later.

“That really brought the price down and market intelligence is predicting that the dip will last a little bit longer,” he said. “But I think we have hit the bottom and things are slowly working their way back in terms of demand.”

He said that the long-term outlook for potash (and fertilisers in general) remains positive due to two real factors.

“Firstly, there is no more arable land, in fact, there’s less arable land and secondly, the population is not decreasing. If anything, it is holding or growing,” he said.

“Therefore, every acre of arable land needs to have its production maximised and potash along with other fertilisers such as nitrogen and phosphate help to achieve this goal.”

Potash stands out from other fertilisers as it ensures proper maturation in a plant by improving overall health, root strength, disease resistance, and yield rates.

Berthelet added that it is especially valuable for crops such as pulses and corn, which use significant amounts of potassium while growing.

Berthelet also shared why he decided to join SHP, saying that its namesake project is a no brainer.

“It is basically an extension of an existing mine. It was an orebody that was going to be mined next, before the mine was shut down for a variety of reasons following the German reunification,” he said.

“But the orebody is still as viable as it was then, and now with higher prices and better mining and processing techniques, it is even more viable.”

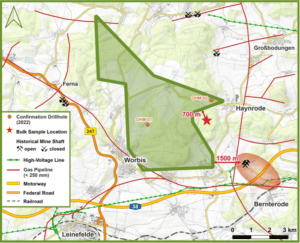

He added that Ohmgebirge, which has a resource of 325Mt grading 13.14% K2O covering the entire mining licence, is pretty much the tip of the South Harz iceberg that has a global resource of 5.3 billion tonnes at 10.8% K2O of inferred resources and 290 million tonnes at 13.5% K2O, 89% in the indicated resource category.

The Ohmgebirge licence. Pic: Supplied (SHP).

“Ohmgebirge just happens to be the closest to existing orebodies, so it makes the most sense to develop first.”

He added that with supply security being so high up in the decision-making process, buyers in the EU would be more comfortable buying from a project in the EU than they would be from somewhere out of the EU.

South Harz will also benefit from having a state-of-the-art facility with brand new equipment, a substantial advantage given that most existing potash mines have ageing facilities.

“We will use the most modern techniques and technologies such as modern computer maintenance systems, which allows us to maximise the efficiency of the equipment and avoid installing redundant equipment,” Berthelet said.

“This makes for a smaller footprint, smaller plant, and it is cheaper too. It is also more efficient and runs better.”

South Harz will also benefit from lower freight costs as well as competitive opex.

Berthelet will also leverage his expertise from developing K3 and running operations at EuroChem to support development of Ohmgebirge and South Harz.

He expects this experience to help provide a “ft for duty product” that will deliver the stated tonnage safely and efficiently.

“Good engineering does two things. First of all, it gives you the confidence to be able to stand behind your numbers,” he added.

“It also gives you the ability – especially in our case because we are doing a lot of good, detailed engineering, especially in the mine – to fast track the next stage once the financing becomes available, enabling you to make your predicted schedules.”

This article was developed in collaboration with South Harz Potash, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.