Richard Poole’s REZ continues Western Australia nickel hunt

Mining

Mining

Led by Richard Poole REZ’s East Menzies gold project in Western Australia is continuing to reveal its nickel prospectivity, with further research of old reports unearthing more significant intervals of nickel mineralisation from as close to just 1m from surface.

The Western Australia goldfields are a core asset for Sydney based REZ. Their initial acquisition was brokered by Richard Poole & Arthur Phillip – a Sydney based broker and independent advisory firm.

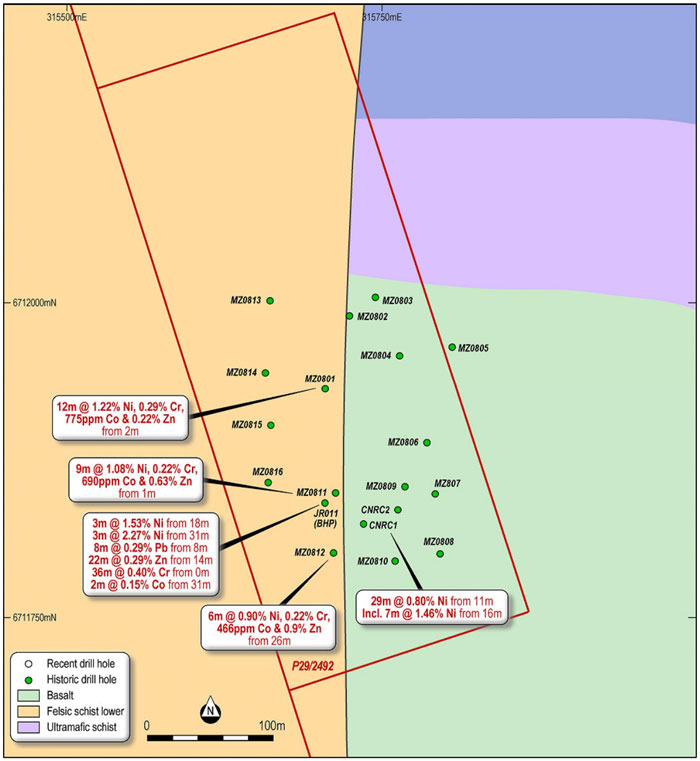

Resources & Energy Group’s (ASX:REZ) ongoing nickel investigations at the Springfield and Cepline prospects, part of Western Australia goldfields, have uncovered peak assays from historic drilling of 12m at 1.22% nickel from 2m, 9m at 1.08% nickel from 1m and 7m at 1.46% nickel from 16m.

These intercepts, which were the result of aircore drilling by Pronto Resources in 2008 and rotary air blast drilling by Great Australian Resources (GAR) in 2004, also contained cobalt and zinc mineralisation.

It reads like an Indiana Jones or National Treasure script, Sydney based REZ was drilling for gold at the Springfield prospect in Western Australia when it hit nickel.

The Richard Poole-led company then discovered some old CRA (now Australia’s Rio Tinto) and BHP reports which showed the two mining heavyweights had found nickel as far back as the late 60s but weren’t interested in it because they only wanted gold.

Over five decades later, nickel is all the rage thanks to the energy transition and the base metal’s importance in batteries driven in part by the continued listing of electric vehicles on international exchanges like the NASDAQ. Stockhead interviewed Director Richard Poole to learn more about the company’s nickel prospects.

“Significantly, the bottom of hole assays for the GAR drillholes terminated in bedrock zones with high nickel content.” – Executive Director Richard Poole

These results included 15m at 0.13% nickel and 14m at 0.06% nickel, both from 82m depth.

“This further research by REZ has identified additional mineral exploration results at the

Cepline prospect which support the initial findings of nickel mineralisation by BHP in 1986.” – Executive Director Richard Poole

Now, Richard Poole says these additional results support the view that the ultramafic rocks along the Springfield side of the East Menzies project are prospective for nickel sulphides.

Nickel resources are usually divided between laterite or sulphide deposits.

Sulphides are the holy grail for explorers because they are easier and cheaper to process. This is also what makes nickel sulphides the preferred choice of electric vehicle battery makers.

BHP back in 1986 reported significantly high values of nickel, with a peak grade of 2.9%, and as close to surface as just 6m.

This was at the Cepline prospect in the Springfield Venn zone, some 800m north of the REZ’s recent scout drilling program.

Nearly 20 years earlier, CRA reported surface rock samples grading 0.95% to 1.43%, and drill results of 10ft at 1.49% from 55ft and 15ft at 0.77% from 170ft.

Sydney-based REZ is undertaking further research towards developing a suitable exploration program to investigate the mineral bearing potential of the Australian land.

This article was developed in collaboration with Resources & Energy Group, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.