Resources Top 5: Trash is treasure for Nagambie as waste storage trial sets goldie up for cashflow

Trash really can be treasure. Pic: Getty Images

- Waste trial has goldie Nagambie eyeing positive cash flow

- Western Mines Group up as company sits down for its AGM

- G50, European Lithium and Gateway among today’s newsless wonders

Your standout small cap resources stocks for Wednesday, November 27.

NAGAMBIE RESOURCES (ASX:NAG)

Almost more powerful than a resource these days is an approval.

Think about the attractiveness, for instance, of a granted mining lease in WA versus an exploration licence.

Over in Victoria, where it’s been years since a new discovery was approved to head into production, that goes double.

$17m minnow Nagambie has been catching the eye of late largely thanks to its antimony and gold resource at the historic mine of the same name.

There’s still plenty of work to do to get it close to production ready, a tactical shift in pricing assumptions recently that NAG used to lift its resource base notwithstanding.

But while it drills for gold and antimony – targeting a doubling of the reported 322,000oz gold equivalent inferred resource – the junior claims it will become cashflow positive through unusual means.

Having previously been informed it would not be selected as a preferred tenderer to store potential acid sulfate soil from the building of the enormous North East Link project in Victoria, it’s now entering into a trial arrangement to store the waste material underwater at the Nagambie west pit.

The trial with EPH Environmental will run for two months, with NAG already permitted to store the material as part of its rehabilitation.

NAG will contract an earthmover called VicCivil to manage the PASS delivered to the Nagambie mine, around 140km north of Melbourne.

“The company is hopeful that the trial arrangement with EPH could lead to a longer-term EPH contract and the generation of significant cashflow for Nagambie,” it said in a shareholder update today.

The junior, separately, held its AGM on Wednesday, with all resolutions passing.

NAG is keen to target deep resources below the limit of historic drilling at 280m, with the nearby Costerfield and Fosterville mines operating a 1km deep and neighbour Southern Cross Gold (ASX:SXG) hitting deep high-grade gold at Sunday Creek, chairman Kevin Perrin told shareholders.

WESTERN MINES GROUP (ASX:WMG)

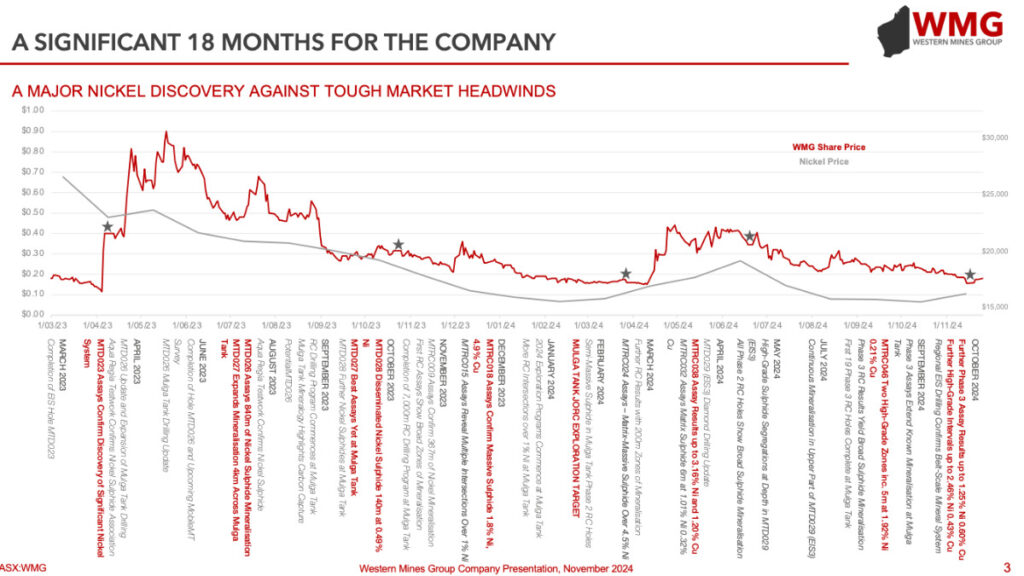

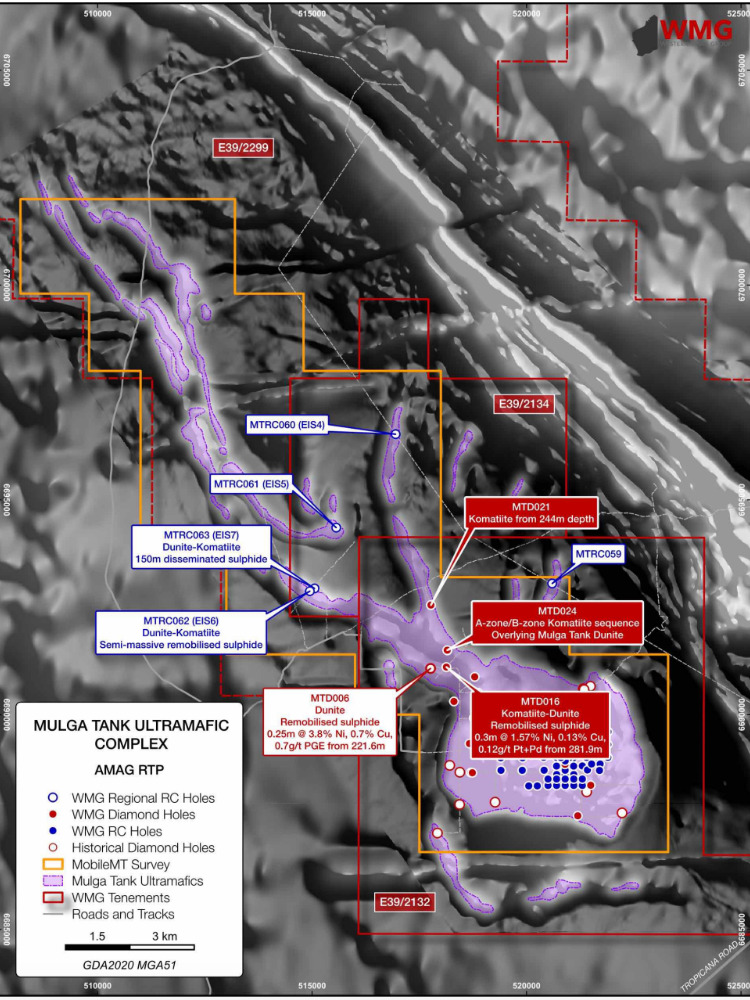

Western Mines Group toasted what it called a major nickel sulphide discovery at Mulga Tank in WA in early 2023.

The stock surged in the early days. But it was, in hindsight, pretty awful timing as Indonesia’s massive rush of nickel supply halved prices, which have floated fairly staunchly between US$15,000-18,000/t this year.

The junior is in front of investors today at its AGM and a presentation has the lowdown on the company’s activities since that discovery was made.

To its credit one chart has a pretty handy breakdown of its exploration and evaluation and G&A costs since mid 2023, clocking a 4:1 ratio of exploration to admin spend over that time.

It’s raised ~$5 million over that time, the latest a $1.19m hit at 15c announced on Monday this week.

There have been three rounds of RC drilling and some diamond drilling conducted at Mulga Tank since October 2023, with 21,704m sunk into the ground at the semi-massive sulphide discovery.

According to the presso, it’s looking more like BHP’s Perseverance orebody at Leinster than the bulky, disseminated Mt Keith – the early analogue on the first large, low-grade drill results in 2023 – with higher grades encountered in the central-eastern area of the complex.

Currently the company is targeting areas where it can find higher grade “starter pit” material, but is also looking for a larger sulphide deposit hidden beneath cover or Kambalda style komatiite channels suggested in very narrow drill intercepts.

G50 CORP (ASX:G50), EUROPEAN LITHIUM (ASX:EUR) and GATEWAY MINING (ASX:GML)

(Up on no news)

G50 recently pocketed $5.6 million in a placement at 15c a share to launch a maiden drilling campaign at the White Caps project in Nevada and a follow-up drilling program at the explorer’s gallium and precious metal discoveries at the flagship Golconda project in Arizona.

The find in hole GRC06 included a hit of 35m at 5.2g/t gold and 5.9g/t silver from 177m.

Over at White Caps, G50 is testing a deposit which historically produced more than 125,000oz at around 30g/t before the 1950s.

RC drilling is due at White Caps this quarter with drilling at Golconda to begin in early 2025.

On Monday, Tony Sage’s EUR announced it had completed the acquisition of 100% of the rights, title and interest of the Leinster lithium project over in Ireland.

That leveraged shares from its holding in Critical Metals Corp, the NASDAQ-listed vehicle which hosts EUR’s Wolfsberg lithium project in Austria.

Alongside the Leinster deal was the appointment of George Karageorge, founding geologist and mine manager at Pilbara Minerals (ASX:PLS) when the ASX mining giant found and built its world class Pilgangoora lithium mine, as executive general manager of exploration.

“I am delighted that European Lithium has been able to attract such a high calibre executive as George,” EUR chair Sage said in a release on Monday.

“He brings significant experience in taking projects from exploration through to development and production, and his appointment will enable us to focus our attention on making another significant lithium discovery by building and developing a high-quality portfolio across Europe”.

READ: European Lithium completes acquisition of Irish lithium project

Gateway makes our list again on no news and pretty minimal turnover, with just $7500 of stock changing hands by 3pm AEDT Wednesday.

The ~$11m capped explorer is sitting on a ~69% gain YTD, helped by the $14 million payday – including $5m in cash – it received from Brightstar Resources (ASX:BTR) for the gold rights at its Montague East project.

GML is sleuthing around nickel-copper-PGE targets on the western part of the Sandstone district tenement package, where it holds all the mineral rights.

Its holding in BTR is also an interesting option. With a market value of $11.66m, those shares are worth more than GML’s entire market cap.

At Stockhead, we tell it like it is. While European Lithium is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.