European Lithium completes acquisition of Irish lithium project

EUR has completed the acquisition of 100% of the rights, title and interest of the Leinster project. Pic: Getty Images

- European Lithium has completed the acquisition of the Leinster project in Ireland

- The company has also appointed prominent lithium mining executive George Karageorge to advance operational developments

- Leinster contains several developing prospect areas where significant lithium bearing spodumene pegmatites have been discovered

Special report: The acquisition of the Leinster project south of Dublin reflects European Lithium’s commitment to growth in the European lithium sector, illustrating its capability to build highly prospective lithium provinces.

European Lithium (ASX:EUR) has bolstered its lithium exposure by leveraging its balance sheet and shares held in Critical Metals Corp (NASDAQ: CRML) to acquire the Leinster project in Ireland and advance the development of Europe’s critical minerals supply chain.

The acquisition, completed through the purchase of LRH Resources from Technology Metals, was structured as an all-scrip transaction involving only the transfer of shares held in NASDAQ-listed company CRML with no cash payment required.

Europe’s demand for base metals and battery materials is expected to increase exponentially as it divests from fossil fuels and towards clean energy systems, including the formation of the Critical Raw Materials Act.

While EUR already has exposure to the key policy via CRML’s Wolfsberg and other hard rock lithium projects in Austria, it has now expanded its position in Europe’s lithium supply chain further with the acquisition of Leinster.

Exploration delivers lithium bearing spodumene

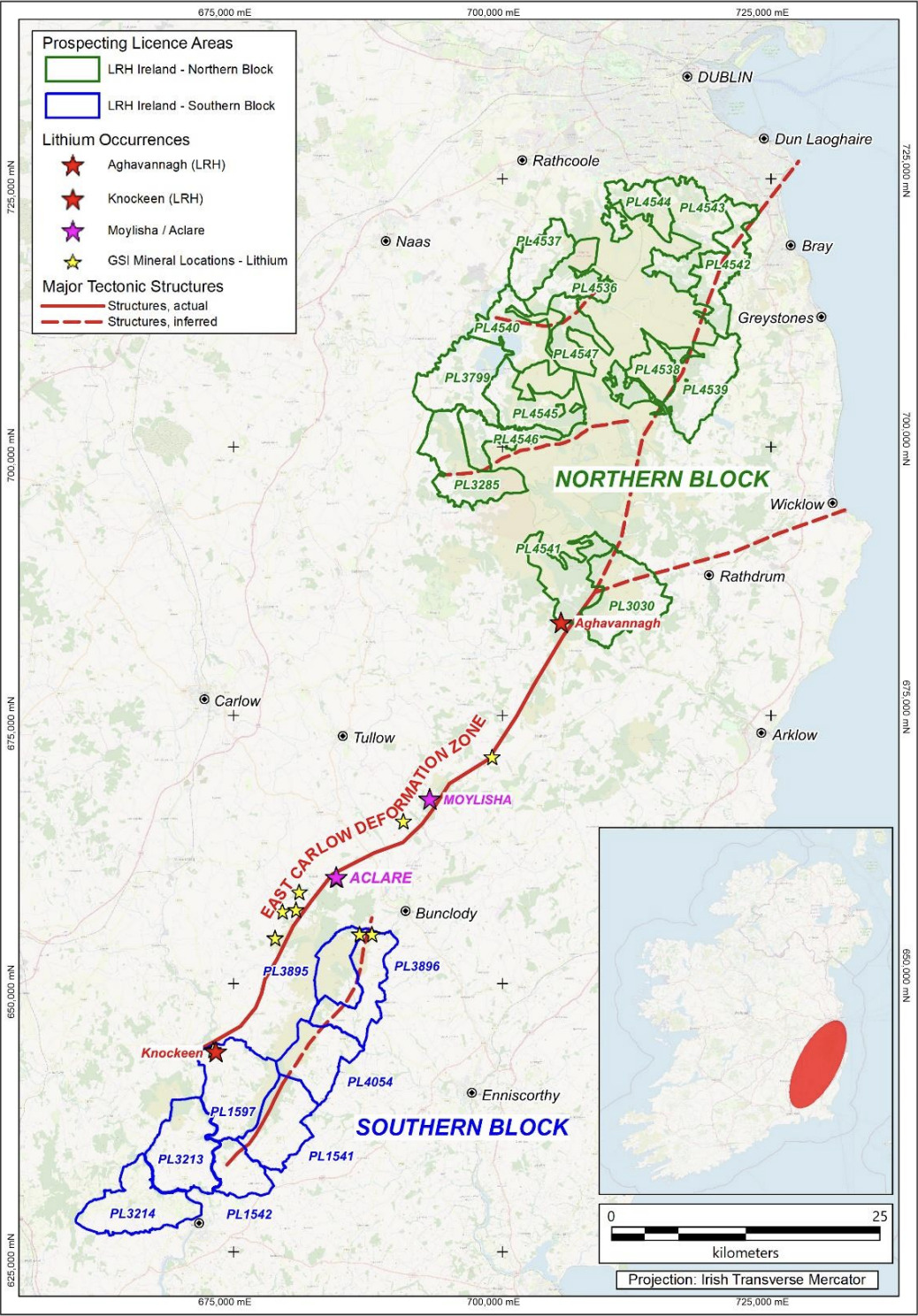

Leinster is situated in the south of Dublin in the Leinster Granite Massif within the same key tectonic zone and along strike to the Blackstairs Lithium (Ganfeng/ILC joint venture) Avalonia project.

The project is subdivided into a North Leinster and a South Leinster block, with the north consisting of 15 prospecting licenses covering an area of 477km2 while the south comprises eight licenses covering a further 284km2.

Each block contains several developing prospect areas where significant lithium bearing spodumene pegmatites have been in surface sampling and more recently in diamond drilling on PL 1597.

New appointment

To propel the development of the asset, EUR has appointed highly regarded geologist and international mining executive George Karageorge as executive general manager exploration, effective immediately.

Karageorge was responsible for the discovery and development of the Pilgangoora lithium deposit, which produced 220,100t of average 5.3% Li2O concentrate during the September quarter.

Pilgangoora is one of the largest hard rock lithium deposits globally, accounting for ~8% of the world’s lithium tonnes in 2022.

Karageorge led the discovery, exploration and drilling programs at Pilgangoora and was responsible for the construction of mine and commencement of operations.

Strategic for the European Union

“This acquisition illustrates our capability to identify, secure and build in highly prospective lithium provinces, leveraging our world class exploration and project development expertise,” EUR chairman Tony Sage said.

“The development is strategic for the European Union to establish the sustainable supply chains of the critical minerals essential for the transition to low carbon emission economy.

“By using our shareholding in CRML to purchase this asset demonstrates the value of our investment in Critical Metals Corp.”

Sage said European Lithium was delighted to attract such a high calibre executive as Karageorge.

“He brings significant experience in taking projects from exploration through to development and production, and his appointment will enable us to focus our attention on making another significant lithium discovery by building and developing a high-quality portfolio across Europe,” he said.

What’s next?

Under the terms of the acquisition, TM1 will sell to European Lithium the entire issued share capital of LRHR.

The acquisition is to be settled through the transfer of more than 1.37m shares held by European Lithium in Critical Metals Corp.

Consideration shares will be locked up until 28 February 2025.

This article was developed in collaboration with European Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.