Resources Top 5: Rubix twists and turns up ASX on back of crowded Lake Johnston lithium activity

Mining

Mining

Here are the biggest resources winners in early trade, Friday November 10.

Lithium-hunting junior Rubix is turning heads, having made its way to the top of the ressie gainers on the ASX today with a +58% surge at the time of writing.

It has news regarding its pegmatite-poking action down in southern WA at Lake Johnston. Rubix has announced it’s about to begin a Cultural Heritage Survey at the site, in collaboration with the registered Native Title Holders, the Ngadju People.

And what this essentially means is the company will be moving ahead on November 30 to review the area for new access track potential and drillholes. A Program of Works for the company’s maiden Lake Johnston drilling has already been approved.

We are pleased to announce the imminent commencement of a Cultural Heritage Survey at Lake Johnston: https://t.co/UEYSgYhQe3

Also, the WA DMIRS has approved our Program of Works of up to 35 drillholes testing the Jimberlana Dyke & Lake Johnston Greenstone Belt. #RB6 #lithium pic.twitter.com/LccpuRZp6J

— Rubix Resources (@RB6_ASX) November 9, 2023

The company’s fieldwork at Lake Johnston has previously identified outcropping pegmatitic rocks, with in-soil anomalies supporting lithium potential.

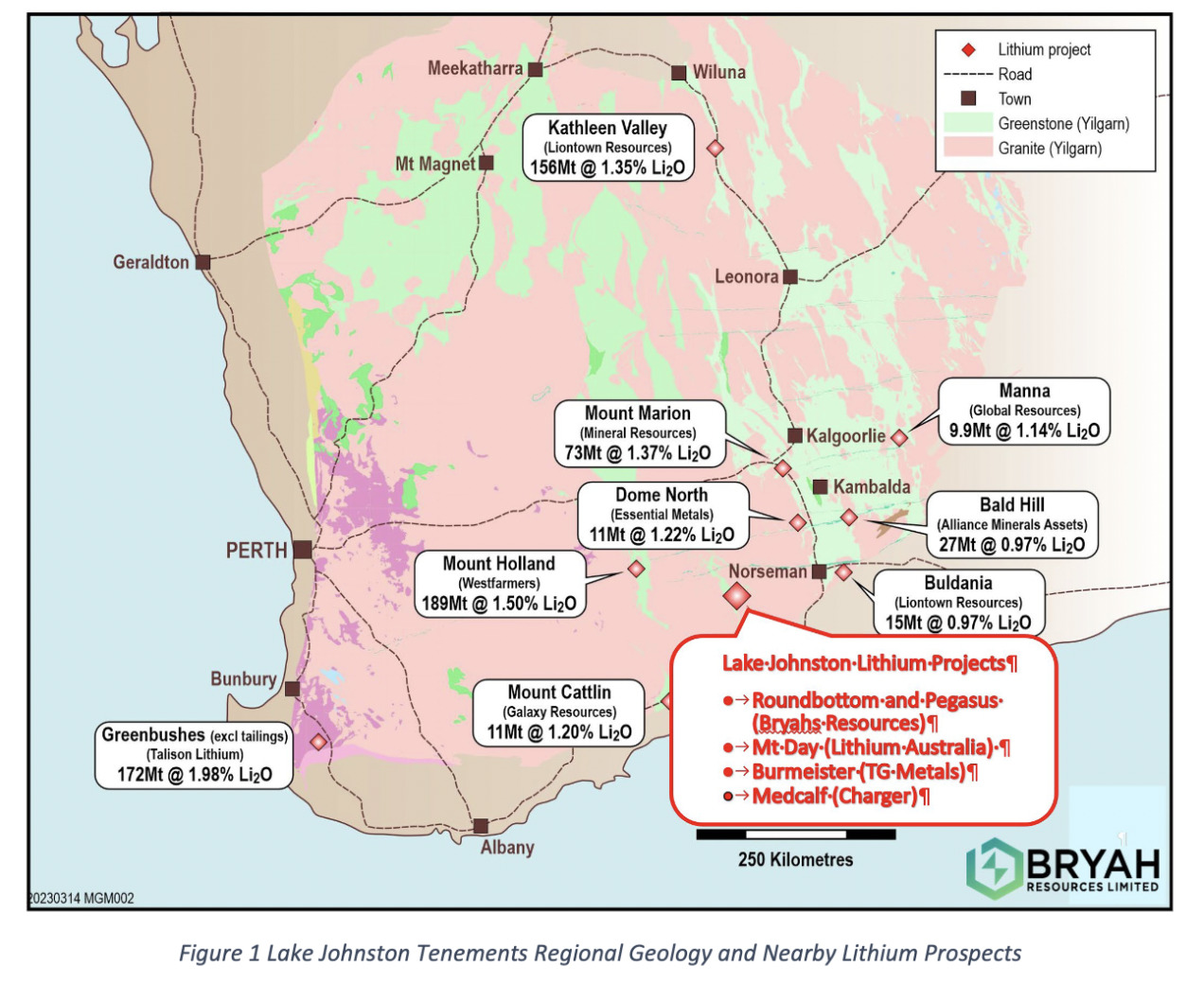

There’s a fair bit of interest in and around the Lake Johnston Greenstone Belt, as you’ll see from a couple of the other mentions, further below in this article.

The area is also host to recent lithium discoveries at Mount Day and Medcalf – Charger Metals (ASX:CHR) – as well as the Burmeister lithium project – TG Metals (ASX:TG6).

RB6 share price

This $24m market-capped lithium and base metals exploration company was also… charging … up the bourse earlier thanks to new lithium targets identified down at the increasingly interesting Lake Johnston.

The company notes that assay results from soil sampling completed earlier this year have revealed the targets, which are in the Mt Gordon tenement of its Lake Johnston lithium project, with follow-up planning for AC and RC drilling now in the works, along with diamond drilling at the Medcalf spodumene prospect.

In particular, one soil anomaly (>100ppm Li2O) extends for more than 3km and lies adjacent to the tenement boundary with TG Metals (ASX:TG6), which hosts the recent Burmeister lithium discovery and has been making some pretty big noise of its own lately, having slayed it as a ressie stocks standout in October.

@ChargerMetals is pleased to announce new #lithium targets identified at the Mt Gordon tenement of the Lake Johnston #Lithium Project, WA, with anomalies up to 3km long and lies adjacent to the tenement boundary with @TGMetals.

Full ASX release here: https://t.co/80izoiRjEG pic.twitter.com/2ZzJbHO2W3

— Charger_Metals (@ChargerMetals) November 9, 2023

Charger MD Aidan Platel said: “The soil geochemistry results from our 100% owned Mt Gordon tenement are very encouraging.

“The size and strength of the lithium soil anomalies are significant, especially in the context of the successful Burmeister lithium discovery on the adjacent tenement (TG Metals Ltd), which resulted from drilling of a lithium soil anomaly.”

CHR share price

Shove over, Rubix and Charger, because diverse metals-hunting junior Bryah Resources wants some of the Lake Johnston limelight today, too.

And it gets it, too, thanks to a timely Friday project update and a +37% gain at the time of my frustratingly unco keyboard pounding.

What’s doin’? Bryah has been keeping one eye very much on its neighbouring competitors, noting it has “further reason to fast track its exploration on Lake Johnston lithium targets following the recent success by TG Metals south of Bryah’s tenure”.

Bryah’s aim is to get cracking on lithium exploration and have a soil program completed by the end of the year with drill targets identified over January and drilling following approvals in Q1 2024.

Bryah CEO Ashley Jones said:

“TG Metals’ recent success has put a strong emphasis again on Bryah’s Lake Johnston area.

“We have already shown that we have LCT type pegmatites on Bryah’s tenements with 403ppm Li2O at the Roundbottom Prospect. So we know the potential. A small orientation soil program was completed with results due mid-late November and a large soil program is being fast tracked.”

Jones also noted the completion of a Down Hole Electro Magnetic survey at the company’s Windalah VMS copper target, which also formed part of the company’s projects update this morning.

BYH share price

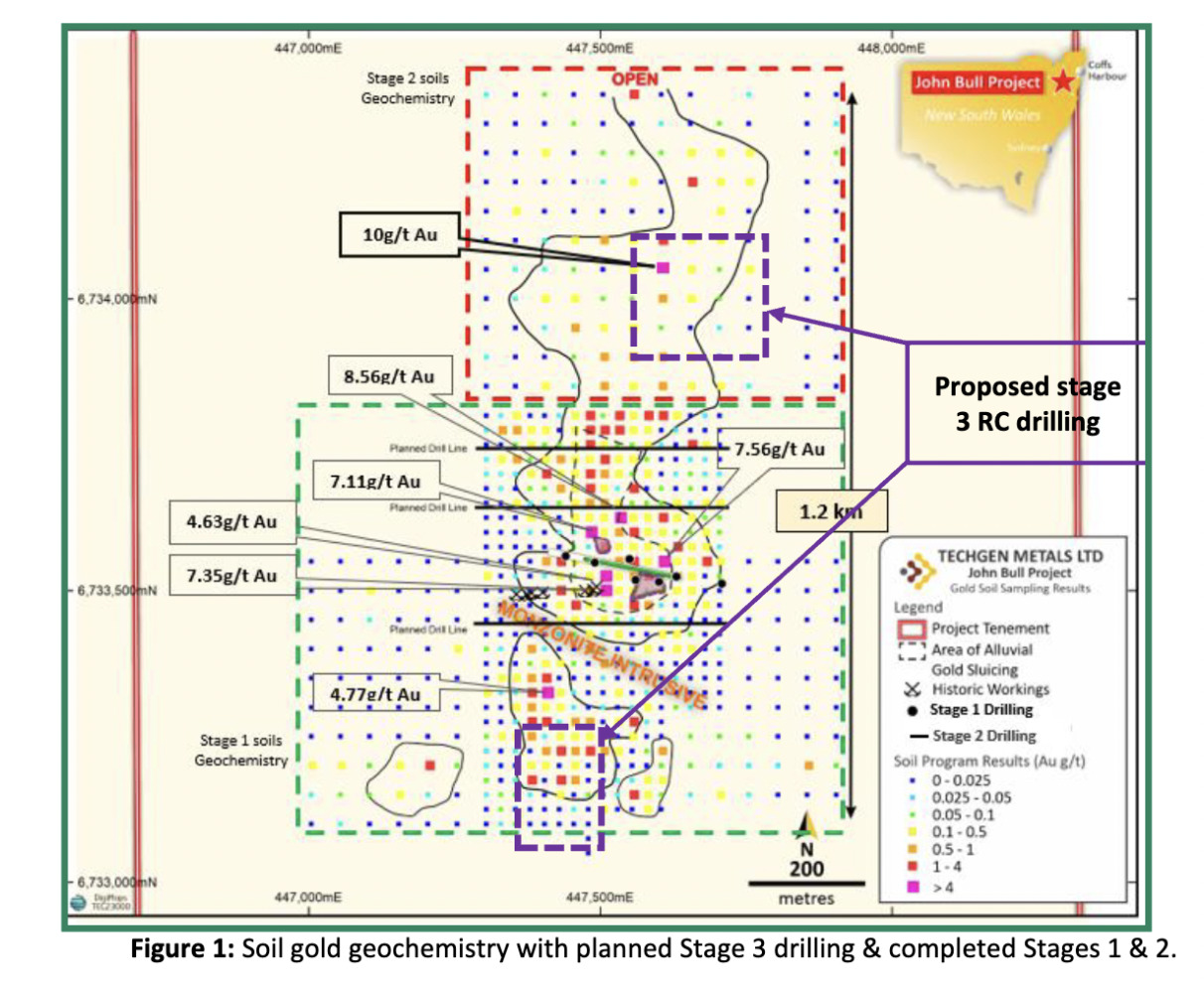

Gold’n’copper-hunting minnow TechGen has provided an update on its projects this morning, including stage-three drilling approved for its John Bull gold project in Glen Innes, NSW, and pegmatite mapping to kick off at Ida Valley, WA, with historic data identifying lithium and caesium in soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault.

TG1 also has great interest in its Station Creek copper project in the Ashburton Basin of WA. Its site there has shown high-grade shear hosted Cu-Au-Ag mineralisation and is close to Norwest Minerals’ (ASX:NWM) Bali Copper Project.

The company is also sniffing around for lithium potential in the Pilbara, having submitted tenement applications in the area.

Regarding the John Bull gold hunt, TechGen’s MD Ashley Hood said:

“At John Bull, all 17 drill holes have successfully intersected gold mineralisation exceeding 1g/t Au. With approximately 900 metres of unexplored soil gold anomalies, we anticipate that Stage 3 drilling will target the most promising geological and geochemical features revealed through our mapping, geochemistry, and petrology studies.”

TG1 share price

Arizona Lithium is heating up on news regarding its brine-based Prairie lithium project in Canada.

Pilot plant operations are now underway at the project, in order to process brine and produce lithium concentrate.

Essentially the pilot plant update regards testing of brine material that will complete the third and final phase of evaluating what the company believes to be very promising third-party supplied Direct Lithium Extraction (DLE) technology.

AZL has form with this, previously producing high-purity lithium using the DLE tech. Recent testing confirmed the battery metals stock can extract >99% purity battery-grade material from Prairie using DLE and cross flow reverse osmosis (CFRO) tech.

It has great expectations of producing larger quantities of the EV battery-tastic concentrate as a result.

Recently, Stockhead’s Ashtyn Hiron sat down with AZL’s managing director Paul Lloyd to get the “short end of the long story on the company’s Prairie lithium project”.

Prairie clocks in as the highest grade indicated brine resource in Canada at a whopping 127mg/l Li, making it a high-priority development target for the AZL team.

Tune in here to hear Paul Lloyd on the recent test work and what’s in store for Prairie’s lithium.

Exciting to see what @exxonmobil are doing in the Smackover. "Looking more and more promising" – CEO, Darren Woods. $AZL is making inroads into lithium brine production in Canada. Very promising! https://t.co/HLcxUqnJX4

— Arizona Lithium Limited (@ArizonaLithium) November 8, 2023

AZL share price

At Stockhead we tell it like it is. While Arizona Lithium and Charger Metals are Stockhead advertisers at the time of writing, they did not sponsor this article.