Resources Top 5: Fortescue is punting on copper with magnanimous Magmatic deal

Pic: WestEnd61/WestEnd61 via Getty Images

- Magmatic Resources soars as Andrew Forrest’s Fortescue takes a stake and plans to fund up to $14m of copper drilling

- Aguia up as Colombian mine deal progresses

- Magnum exits trading halt with Saudi green iron JV

Here are some of the biggest resources winners in early trade, Friday March 8.

Magmatic Resources (ASX:MAG)

Hello, Fortescue (ASX:FMG) diversification.

It’s been a long time since we got a peek through the looking glass at Fortescue’s strategy outside its cash spitting near 200Mtpa iron ore business and cash guzzling very speccy green energy division.

We’ve heard mumblings, largely contained in the margins of its quarterly activity reports, about expeditions for copper in South America and South Australia, a little touch of rare earths hunting in Brazil and a bit of lithium sniffing around the Pilbara and Yinnetharra.

MIDNIGHT PEGGING: Twiggy’s Fortescue heads to Yinnetharra in search of lithium

Buuuuutttt, rare earths and lithium are in the toilet right now, and copper is making a major comeback (in sentiment if not in prices just yet). Any self-respecting mining giant would love some of the Doctor in their portfolio.

So it goes that FMG will spent up to $14m over six years to get a 75% JV interest in Magmatic’s Myall project in New South Wales. For Fortescue, which paid $3.3b in dividends for the first half of FY24, that’s chump change.

For Magmatic it’s manna from heaven, as is FMG’s decision to subscribe for 75.9 million shares to claim a 19.9% stake in the junior. Another $3.71m in the coffers for MAG at 4.884c a share — a 10% premium to its 30 day VWAP at the end of January. Twiggy Forrest is already in the money, with MAG shares up 44% to 6.5c this morn.

FMG can claim an initial 51% interest in Myall by spending $6m on exploration over the first four years, pledging a minimum $3m including at least 3000m of drilling over the first two years of the deal. Another $8m over the subsequent two years would take its share to 75%. But in the initial earn in period Magmatic will be the operator of exploration activities, also drawing an operator’s fee.

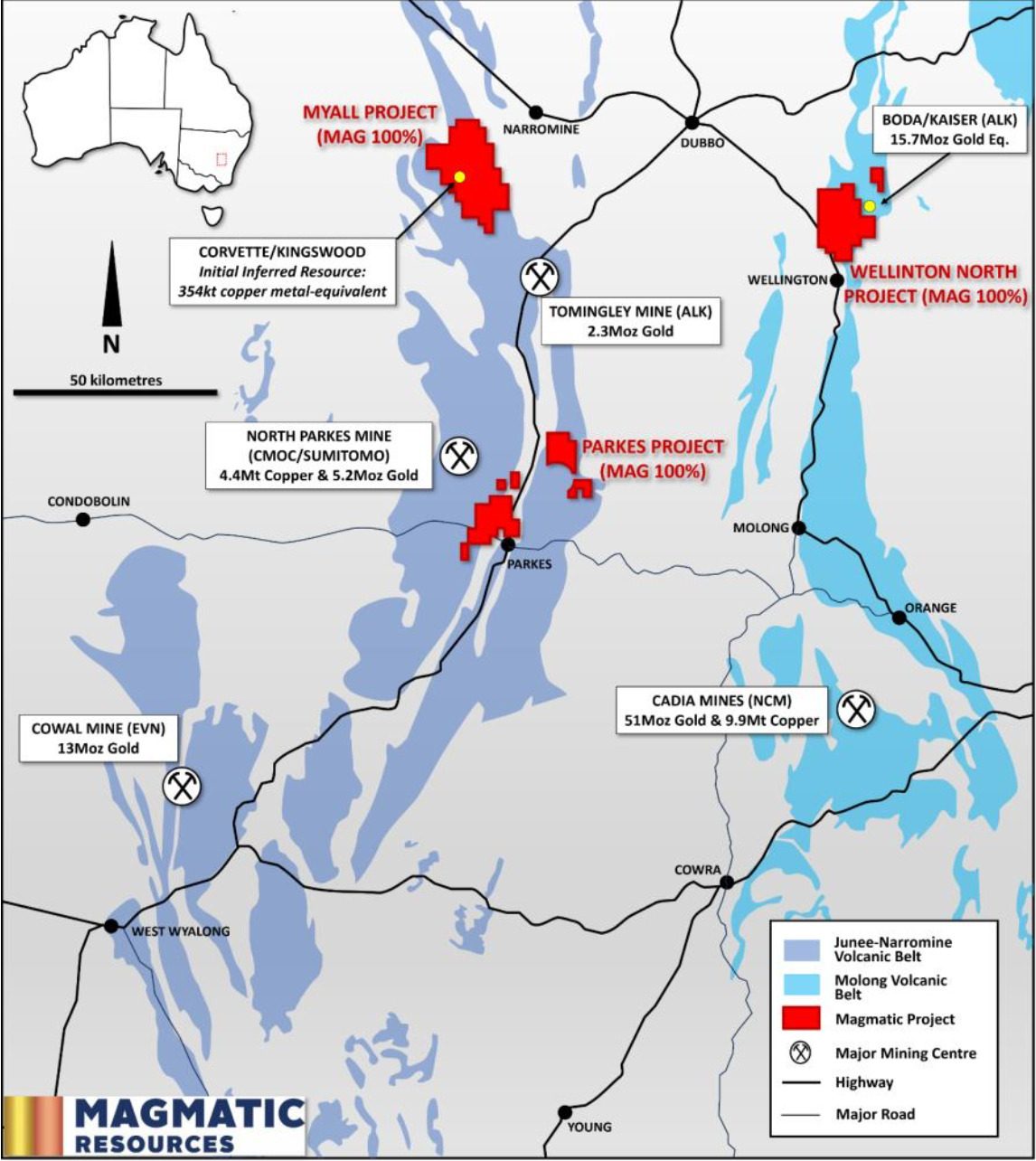

Importantly Myall already has a large mineral resource of 110Mt at 0.33% copper equivalent, containing 293,000t copper, 237,000oz gold and 2.8Moz silver at Magmatic’s Corvette and Kingswood prospects, released in July last year.

That’s on the low end of the scale for grade, even for a porphyry, though Magmatic says it believes it has ‘Tier-1 potential’ at Myall, which sits just 50km north in the same geological setting as the Northparkes copper and gold mine.

The majority 80% share of that operation was acquired by copper-leaning gold major Evolution Mining (ASX:EVN) for ~$700m in December.

And copper demand is expected to double by 2050 due to urbanisation and the energy transition at a time when mines are struggling to meet supply targets. That means higher prices could be on the way to incentivise new sources of production with lower start-up mine grades.

The cash from the FMG investment will not only bolster its firepower at Myall, but also help MAG advance projects in parallel including Wellington North, surrounding Alkane Resources’ (ASX:ALK) 15.7Moz AuEq Boda and Kaiser deposits.

“We are excited to joint venture and partner with Fortescue to advance our exploration efforts across the Myall Project area. Myall has many of the signatures of a Tier 1 copper-gold deposit and Magmatic has recognised the need to partner with a major to further advance the project following the maiden Resource,” Magmatic exec chair David Richardson says.

“Fortescue’s cornerstone investment in MAG will allow the Company to simultaneously advance our other two projects at Wellington North and Parkes which are strategically located near Alkane Resources Boda-Kaiser deposits and Tomingley Gold Operations respectively.”

Magmatic Resources (ASX:MAG) share price today

AGUIA RESOURCES (ASX:AGR)

Speaking of Andrew Forrest, one of his old buddies in Warwick Grigor — who founded Far East Capital with the iron ore squillionaire and still runs the stock research firm — is in the gains today.

Behind it is Aguia Resources, now chaired by Grigor, which is attempting to sew up its acquisition of Andean Mining.

The deal would help the Brazilian phosphate and copper hopeful shift its focus to neighbouring Colombia, where Andean has already conducted trial mining at the high grade Santa Barbara gold mine.

William Howe’s Andean has also reported strong drill results at its Atocha and El Dovio precious metals and copper projects.

A best hi of 20.14g/t Au and 723g/t silver over 0.8m has been struck at Atocha, while one of 34 drill intercepts at El Dovio contains 5.8m at 8.14g/t Au, 6.92% Cu, 39.41g/t Ag and 1.46% zinc.

That makes it a target for potential high grade volcanogenic massive sulphide copper mineralisation.

So far Aguia has taken its voting power in Andean to 46.14%, with the news yesterday bolstering investors’ hopes the off-market deal will get done, lifting its shares by 33%.

Aguia Resources (ASX:AGR) share price today

MAGNUM MINING AND EXPLORATION (ASX:MGU)

Down 89% since the iron ore boom that floated all boats in the wistful post-Covid days of mid-2021, Magnum has continued to plug away at its Buena Vista magnetite iron ore project in Nevada.

Its latest initiative is a 1.1Mtpa HIsmelt pig iron facility in Saudi Arabia, in partnership with a company backed by the Saudi Kingdom.

The plan is for the 50-50 joint venture, known as Midmetal, to supply green iron for electric arc furnaces, especially in Saudi Arabia, the Middle East, Europe and the USA.

It’s not an outlier here. Vale, the world’s second biggest iron ore exporter after Rio Tinto (ASX:RIO), has already announced plans for a green steel ‘mega hub’ in Saudi Arabia.

But there are varying degrees of scale and influence here. While Vale has a market cap of around US$61 billion (over $90m Aussie), Magnum is trading at just ~$12.5m

Magnum exited a trading halt today saying it had entered into an agreement to take a 50% ownership share in Midmetal, which will be supplied with both iron ore and biochar (as a reductant) from Buena Vista and Malaysia, along with mill waste from steel producers in Saudi Arabia.

The project carries an estimated capital bill of around US$410m. Under the agreement, it says Saudi shareholders will provide 50% of the development funding via a loan from the Saudi Industrial Development ‘or other investors’. Magnum will then provide the other 50% by way of a loan to Midmetal, both loans to be repaid within two years at an agreed interest rate. Magnum said it was in discussions with several investors interested in funding its 50% share in return for rights to provide engineering, process and construction services.

It says it has received “two non-binding letters of support” from international investors to provide equity or debt to the project.

The agreement can be terminated after December 2024.

“The maturing relationship between Magnum and Midmetal has landed on a shared vision of how HIsmelt and our Buena Vista Iron Project can be developed in a strongly economic and sustainable way. The pathway forward is starting to crystallise by bringing into focus the opportunities that Midmetal represents,” Magnum CEO Neil Goodman said.

“The intimate relationship that a joint shareholding facilitates will ensure the Project has the very best chances of commercial success. Magnum anticipates the working relationship already established with Midmetal will continue to develop to the advantage of Magnum’s shareholders.”

Magnum Mining and Exploration (ASX:MGU) share price today

KOONENBERRY GOLD (ASX:KNB)

Koonenberry shares are down a hefty 47% YTD, but currently trade at more than double the 1.4c price used in a $700,000 placement annoucned on Monday that saw the Widdup family’s listed resources investment fund Lion Selection Group (ASX:LSX) tip in $250,000 as a cornerstone.

It’s part of a broader $2.35 million capital raising which will include a non-renounceable 6-for-7 rights issue which will bring $1.65 million into the NSW explorer’s coffers, underwritten by Lion, director Anthony McIntosh and placement managers BW Equities and Baker Young Limited.

The funds will be put to the test of drilling Koonenberry’s Atlantis copper and gold and Bellagio gold prospects in the months ahead, with drilling forecast to begin in mid-April.

Today’s 23% gain coincided with an announcement updating the timetable for the raising, with the first tranche of its placement expected to be issued today.

It’s a punt on very early stage exploration, with Atlantis containing a 6.5km long soil anomaly that’s never been drill tested including rock chips grading up to 15% Cu and 0.84g/t Au.

Bellagio meanwhile has been shown to contain rock chips grading up to 39.4g/t, with bedrock gold mineralisation claimed to be open in all directions along the 20km plus Royal Oak Fault.

Koonenberry Gold (ASX:KNB) share price today

ALICANTO MINERALS (ASX:AQI)

(Up on no news)

Alicanto was up big on no news this morning, but has drawn plenty of curious investors to its story hunting copper and silver at historic mines in Sweden in recent years.

Backed by the Bellevue Gold (ASX:BGL) team of Steve Parsons, Michael Naylor and Ray Shorrocks, the $22 million capped explorer consolidated ground including the historic Falun mine in the Scandinavian country in recent years.

The project was last mined in 1992, producing 28Mt or ore at 4% copper and 4g/t gold with significant by-product credits. That makes it a historic producer of 3.6Moz of gold and some 1.1Mt of copper.

But Alicanto is the first explorer to really bring a sense of modernity to its exploration efforts on the mine, with multiple targets being tested in a recent drill program.

They include Skyttgruvan-Naverberg, where visual mineralisation was intercepted and the base metals system could be larger than Alicanto previously thought. The prospect is thought to be analogous to the Falun massive sulphide deposit.

Alicanto already has an inferred resource of 9.7Mt at 4.5% ZnEq, including 311,000t zinc, 15Moz of silver and 44,000t lead at the Sala mine, which has been mined to a depth of 318m and is undrilled below 500m.

That’s of interest since AQI thinks it bears geological similarities to Boliden’s Garpenberg mine, 50km away, where mining is currently undertaken some 1500m below the surface.

Alicanto Minerals (ASX:AQI) share price today

At Stockhead, we tell it like it is. While Alicanto Minerals was a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.