MIDNIGHT PEGGING: Twiggy’s Fortescue heads to Yinnetharra in search of lithium

Surprise pegging is the best pegging. Picture: Getty Images

Stockhead’s new column places the microscope on everything exploration – from fresh discoveries to ye olde land claims, from Nearology to Warden’s Court decisions and so awfully much more.

Have you heard of ‘midnight pegging’?

One of the tenets of the mining industry in WA is its long-standing Mining Act, the vast bulk of which has gone untouched since 1978.

While it is written in a roundabout way, lapsed leases expire at midnight.

That’s been the source of much amusement over the years, inspiring the not at all dirty phrase — described by one warden as ‘an emotive expression’.

Here’s how it goes.

Eagle-eyed prospectors, tenement agents and company tenement administrators keep an eye out for tasty specks of ground that companies have deliberately let lapse, or as is often the case, simply forgot they owned.

The recent mining boom means more and more ground never before thought to be prospective is being sucked up as well. As of May last year, 45% of the state was covered by leases or applications, up from 29% at the start of the pandemic.

But the real excitement is in the midnight expeditions which, quite literally, involve teams of peggers heading out with stakes at the same time under the cloak of darkness to mark out their turf with the efficiency of a dog pissing on a tree.

Sometimes different crews can claim their territory at the same time without locking eyes with their adversaries, passing within metres in the dead of the night.

In one case back in 2016, Torian Resources claimed to have pegged seven leases in the shadow of the Super Pit near Kalgoorlie in just half a second.

The explorer’s seven strong ‘ninja crew’ (actually its geologist’s kids) claimed to have completed a world record as tenuous as Guinness awarding an attention-starved influencer a title for ‘world’s biggest pizza’.

Another team from Macphersons Resources, a company chaired by ‘King of Kalgoorlie’ Ashok Parekh, now part of Horizon Minerals (ASX:HRZ), was later awarded the ground, having claimed its own crew pegged it in a more believable three seconds flat.

Welcome to Midnight Pegging, a new column where we give you the lowdown on interesting claims, warden’s court disputes, plainters, greenmailers and prospectors from around the mining industry.

Twiggy has a taste for lithium

Andrew ‘Twiggy’ Forrest struck out on nickel then built his fortune on iron ore.

But his mega miner Fortescue Metals Group (ASX:FMG) seems to be more entranced by sideshows in the critical minerals space by the day.

Explorers in the company’s orbit in the Pilbara claim imaging shows FMG has found a significant spodumene deposit near the old Tabba Tabba tantalum mine in the Pilbara.

Now it’s headed to a hot new lithium postcode in search of the EV metal.

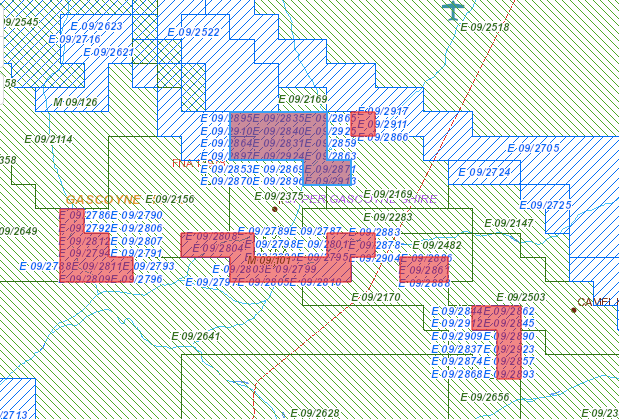

At least five tenement applications lobbed from the iron giant at the crack of dawn on Monday amid a major rush to claim land around Delta Lithium’s (ASX:DLI) Yinnetharra discovery, the largest a 10-block application a stone’s throw from the David Flanagan-led explorer’s hot project.

For anyone unfamiliar a graticular block is the unit of measurement used in exploration licence applications, measuring one minute or around 1.5km of latitude by one minute of longitude.

Another four identified by Stockhead come in at between 1 and four blocks, advertised around the same time as applications in the region from a host of juniors and private players, though none with the weight and market cred of $68 billion capped FMG.

Here’s what a spokesman from the firm told us of the raid, understood to be its first in the Yinnetharra district.

“Fortescue started as an exploration Company, and we still firmly believe that early stage exploration is the key to unlocking significant value.

“Leveraging our world leading track record of innovation and infrastructure development, Fortescue is transitioning to a global green energy and metals company. With our exploration knowledge and expertise, we continue to explore for critical minerals, including lithium, in Australia and globally.

“Fortescue has submitted exploration tenement applications in the Yinnetharra region in Western Australia for the exploration of lithium.

“This area was chosen based on its geological prospectivity merits.”

That’s sure to prick the ears of those looking at the region. Located 120km from Gascoyne Junction, Delta considers Yinnetharra an earlier stage prospect to its 12.7Mt at 1.2% Li2O Mt Ida deposit in the Goldfields.

But exec chair Flanagan has arguably been more bullish about Yinnetharra, which contains pegmatites so big they can be seen from a helicopter and where the company has unleashed 90,000m of drilling this year hitting intercepts like 43m at 1.22% Li2O from 66m in recent assays.

That program could double next year after a $46.4 million investment from Japanese conglomerate Idemitsu Kosan last week which came as squillionaire Gina Rinehart also announced a $26 million deal with an Indian-backed mine to explore for lithium near its Mt Ida project.

Know anything more or have any juicy goss around the industry? Let us know at [email protected]

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.