You might be interested in

Mining

The secret recipe that could make Impact Minerals HPA's Michelin Star chef

Mining

Impact Minerals says cheers to new metallurgical process that could lower HPA production costs at Lake Hope

Mining

Mining

Here are some of the biggest resources winners in early trade, Monday February 19.

IPT, a diversified minerals exploration company is hunting for more high-grade hits of gold, silver, lead, zinc, copper, nickel and PGMs in various locations – mostly in Western Australia.

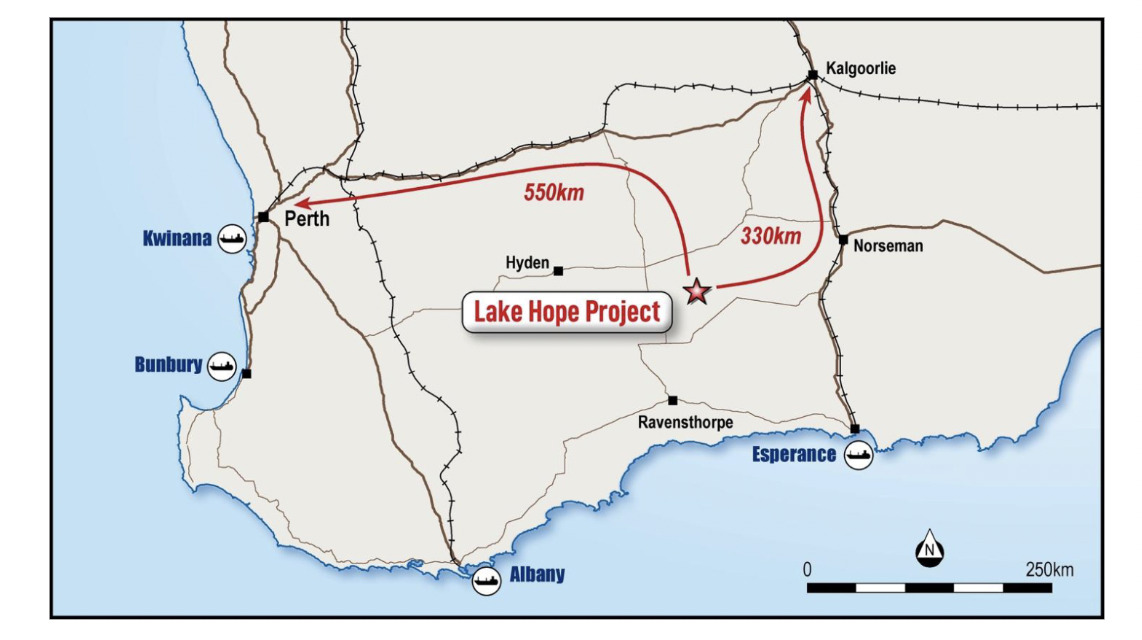

Impact’s share price is up and to the right today after this morning’s announcement revealing the company has hit the key milestone of achieving 99.99% (4N) High Purity Alumina (HPA) at the Lake Hope Project, in WA – via the “proprietary and patented Playa One Sulphate Process”.

That, says Impact, underpins its recent Scoping Study, which demonstrated an NPV(8) (net present value) of $1.3 billion for the project and an estimated operating cost to produce 4N HPA up to 50% lower than anyone else globally at less than US$4,000 per tonne.

What is 4N HPA used for, you may be asking? It has important industrial use cases, including within the production of synthetic sapphire, which acts as scratchproof glass in smartphones, watches and TVs.

It also has uses within the UV and infrared product market, a high melting point and thermal conductivity. Wait… lithium ion batteries? Yep… within those, too, where it can be applied as a battery separator and as a ceramic coating on insulation between anode and cathode. Trust us… it’s useful stuff.

What next for IPT, then? Production of larger quantities of HPA can now begin using said sulphate process at a reportedly consistently high quality. Meanwhile, a pre-feasibility study is on schedule to be completed in late 2024.

Impact Minerals MD, Dr Mike Jones, had, among other words, this to say about it all:

“The production of 4N HPA is a major milestone and exciting result for Impact and its shareholders as we have now shown that we can produce this high-value product, which commands prices of US$20,000 per tonne or more, from the mud in the top two metres of Lake Hope.

“We have discovered from our marketing that there is very strong demand for this high-value product, so we will continue progressing the Pre-Feasibility Study as quickly as possible.

“In addition, we recently uncovered two other possible process routes to produce HPA from these remarkable clays, which may offer yet further reductions in operating cost and capital expenditure if our initial test work is positive.”

Copper producer and precious metals explorer 29Metals has failed to live up to its billing since emerging on the ASX as one of the priciest mining floats in years in 2021.

Since then the EMR Capital backed company has been torched by falling base metal prices at its Golden Grove and Capricorn Copper mines and the temporary closure of Capricorn last year after an extraordinary flooding event in early 2023.

It all culminated with managing director and CEO Peter Albert beginning a ‘transition’ from his post at the end of the year.

It’s not had the most terrific start to the year, or the past 12 months, but copper itself has been doing well of late, with higher demand for the metal globally and consequently rising prices this year. So, then, perhaps 29M is due.

Certainly, the company’s non-executive chair Owen Hegarty believes so. In a letter to shareholders late last week, he stated the following:

“The recent dramatic fall in our share price is, in our opinion, unwarranted and is a serious concern for the Board of Directors. The underlying value of the Company’s assets is unchanged:

• we have over 120Mt in Mineral Resources and over 30Mt in Ore Reserves, at very competitive metal grades of copper, zinc, gold, silver and lead; and

• at both Golden Grove and Capricorn Copper, our Mineral Resources and Ore Reserves estimates have significant upside potential to sustain, grow and extend our business well beyond the current 10-year plus mine lives.”

The company believes 2024 will be the stock’s “recovery year to set us up for long-term success”, with a focus on improving cost savings and efficiencies at its flagship Golden Grove project.

RDM is impressively up today, over the past week, month, YTD and year (238% over 12 months).

As our ‘Garimpeiro’ columnist Barry FitzGerald notes, this certainly hasn’t been the case for all rare earths explorers of late, however, there are good signs…

“The good news in the rare earths space is that prices for the all-important NdPr oxide used in high end magnets has stabilised at around $US60/kg, and prices for exchange traded funds covering the sector have turned for the better in recent times,” wrote Fitzgerald last week, adding:

“Demand growth for rare earths for the medium and longer-term remains unchallenged, as does the new driver of interest in the sector – the almighty push by the Western world to encourage new non-Chinese supplies due to ongoing geopolitical concerns.”

It could be a decent H2 for the rare earths sector, though says Fitz, and in years to follow.

Red Metal’s main focus right now is its Sybella REO discovery in the Mt Isa region where recent breakthrough metallurgical results have shown to favour low–CAPEX, low-cost heap leach processing.

Is there a “whiff of world class” about Red Metal and Sybella? Fitzgerald believes so, suggesting the find and recent related results gives the potential for low capital and operating costs – “like ionic clay deposits but without the clay handling issues”.

Red Metal is more than Sybella, though, and is one to watch, says Fitzgerald, with its “full portfolio of high-risk-high reward greenfields exploration projects”.

Read more > here, and listen > here.

(Up on no news)

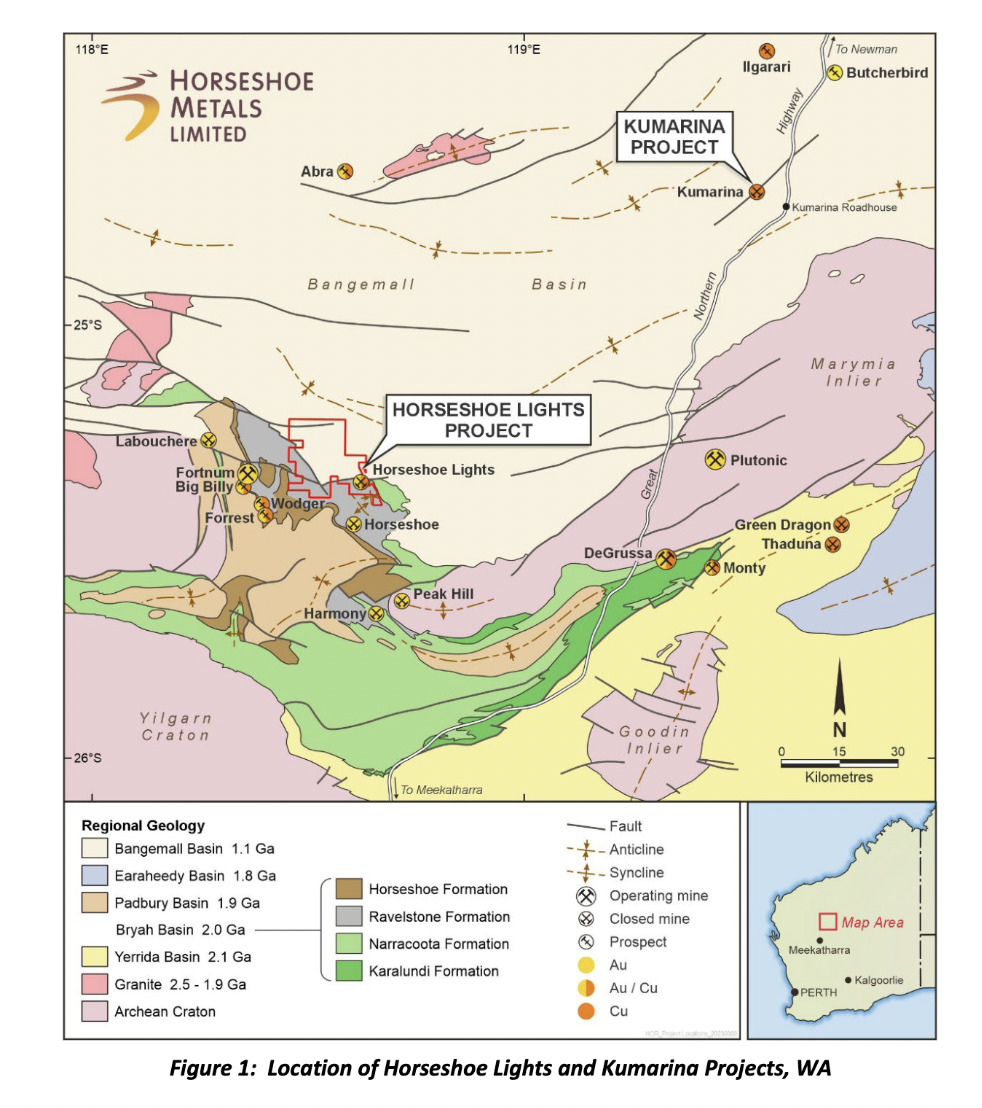

This bargain basement copper/gold explorer (market cap just $5.1m) is focusing on the exploration and development of the Horseshoe Lights and Kumarina projects in Western Australia, and the Glenloth project in South Australia.

Last we checked in, Horseshoe has been pursuing early cash flow opportunities from direct shipping ore (DSO) sales of existing high-grade copper stockpiles at Horseshoe Lights, which is 60km west of Sandfire Resources’ (ASX:SFR) Degrussa copper discovery and holds a 138,000t copper, 52,000oz gold resource in WA’s Bryah Basin.

Surface sampling was conducted on these high-grade stockpiles during the 2023 September quarter, which assayed up to 39% copper for customer assessment.

The company noted feedback from those samples has been very encouraging and supports its near-term DSO plans.

HOR is also assessing ground surrounding its Horseshoe Lights project, with a particular interest in ground located immediately northeast.

Recently, per its quarterly activities report ending December 31, the company noted, “Horseshoe remains well positioned to capitalise on improving copper market dynamics over the coming months,” with director Kate Stoney adding:

“Our team continued to advance our flasghip Horseshoe Lights Project in WA during the quarter. Our core focus at present remains on accelerating our DSO production strategy which represents a significant early cash flow opportunity from DSO sales of existing high-grade copper stockpiles.

“We continue to be encouraged by the improving copper market conditions and we enter 2024 well positioned to increase our operational activities.”

At Stockhead we tell it like it is. While RDM is a Stockhead advertiser at the time of writing, it did not sponsor this article.