Resources Top 5: There’s gold in them thar Drone Hills, confirms Tesoro; meanwhile MMI buys a US$2m tug boat

Mining

Mining

Here are the biggest resources winners in early trade, Thursday October 19.

Tesoro Gold, a small Australian goldie with a Chile-focused precious metals exploration bent, is sporting a 25%+ glow on the local bourse at the time of writing.

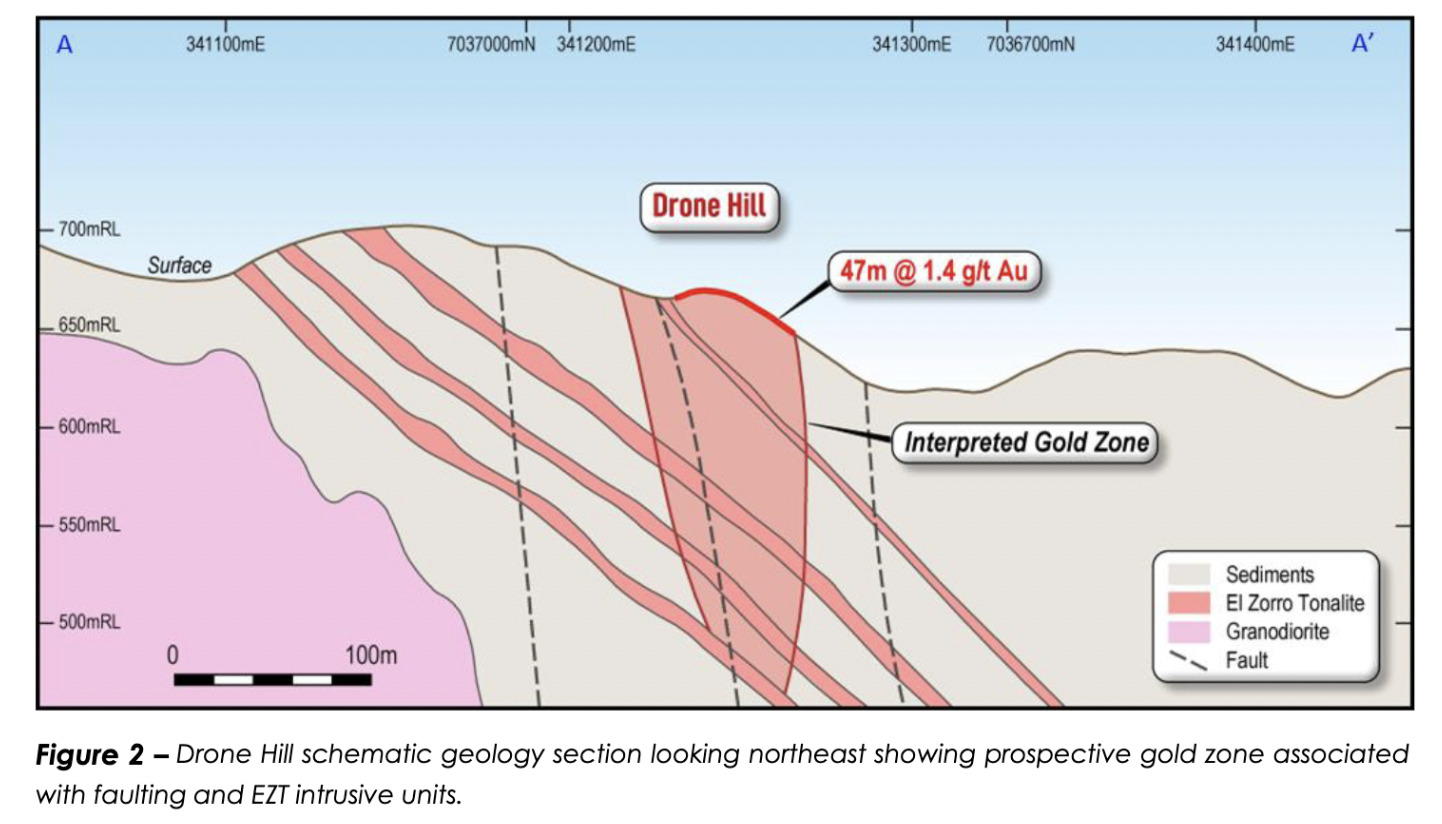

It’s up after announcing a “new large gold anomaly defined at Drone Hill”. And that’s an area slightly west of the company’s Ternera gold deposit, which is part of its El Zorro project in Chile.

The company reports that the anomaly has wide outcropping intersections of up to 47m, including:

47m at 1.40g/t Au (with 9m at 4.66g/t Au); 15m at 0.53g/t Au; 3m at 1.88g/t Au; 2m at 5.21g/t Au; and 3m at 2.11g/t Au.

The surface mineralisation is confirmed to extend at least 750m west and 380m south of the Ternera deposit.

Tesoro’s managing director Zeff Reeves said:

“These results place the spotlight on Drone Hill as another high-priority prospective gold target for Tesoro. The geology of the area is analogous to the existing Ternera Gold Deposit and is located only 750m west of Ternera.

“We now have confirmation that surface gold mineralisation extends significantly south and west of our deposit, with the continuous nature of the surface gold mineralisation highlighting the opportunity for large-scale resource growth.”

TSO share price

Brisbane-HQed explorer Metro Mining, which has the Bauxite Hills Mine as its flagship project, is making sweet share price gains so far today on the back of a couple of things – it’s latest Quarterly Activities and Cashflow report, and an update on a Chinese-focused expansion project.

Regarding its quarterly report part there, the company is highlighting the following:

• Record quarter shipments of 1.6 million WMT (wet metric tonnes)

• Site Q3 EBITDA (earnings before interest, taxes, depreciation, and amortisation) of $16 million ($10/WMT operating margin)

• Bauxite CIF and FOB prices up 13% and 23% year-on-year

• Phased expansion “step-up” achieved 5.0 M WMT pa rate from August 2023

• 2023 sales target remains 4.5 to 5.0 million WMT

As for the project update, it’s an offshore floating terminal named Ikamba that’s in the process of docking refurbishment in Shenzen, China.

The company has also purchased a US$2.05 million tug boat.

Here’s a pic, tug spotters:

And here’s the offshore floating terminal Ikamba…

Simon Wensley, CEO and MD of Metro, said:

“The safe arrival and commencement of the dry-docking of our OFT Ikamba is another significant aspect in the implementation of our expansion project. The acquisition of the tug Eng Hup Herald and recruitment of Vincenzo De Falco builds our asset base and capabilities to implement the expansion and also aligns with Metro’s long-term strategic objectives to support our growth in the marine industry over the coming years.”

Small, $4m-market-capped explorer Pinnacle Minerals announced earlier this week that it’s joining the crowded party looking for battery metal love over in James Bay in Quebec, Canada.

And shareholders dug the news.

Today, it’s moved up further with a solid double digits gain on the news its field team is currently mobilising to the company’s Adina East lithium project.

$PIM.ax is pleased to announce that the field team from Quebec based geological consultants IOS have mobilised to Mirage Outfitters in preparation for the maiden exploration program at the Adina East Project in James Bay Quebec.

Read more: https://t.co/LbhI7ztxDZ#lithium pic.twitter.com/vW6icG4xPp

— Pinnacle Minerals (ASX:PIM) (@PinnacleMineral) October 18, 2023

The field team, from Quebec-based geological consultants IOS, “have mobilised to Mirage Outfitters in preparation for the maiden exploration program,” notes Pinnacle, adding:

“It is anticipated that the team will begin field reconnaissance work before the end of the field season.” And that means before the end of October.

“The fieldwork aims to identify potential LCT pegmatites and spodumene mineralisation by following up on historically mapped pegmatite outcrops and a number of lithium targets generated through detailed satellite and radar imagery analysis,” wrote the company in its update this morning.

The project claims cover 72.7km2 and border an “interpreted extension” of the Trieste Greenstone Belt just 24km from Winsome Resources’ (ASX:WR1) Adina project, which has recorded 1.34% Li2O over 107.6m and grades up to 4.89% Li2O.

Gotta love a good bit of nearology to go with your geology.

PIM share price

(Up on no news)

This gold and lithium junior is surging today, and yet… we can’t yet ascertain why from our quick scout about the interwebs.

The company’s Annual General Meeting is taking place in Perth on November 21, which ought to offer more clues… but ahead of that, we’ll take you back almost precisely one month ago, to [dreamy fade-out sequence] this…

Desoto has provided a drilling update from its Fenton Gold Project in the Pine Creek region of the Northern Territory.

That’s an area that’s host to a historic 20m at 1.74g/t discovery made by Homestake Gold (now Barrick Gold) in the mid-1990s.

The company reports that diamond drilling cores from two holes have been sent to the lab to be assayed and more than 1,000m of diamond drilling at the project has been completed to date, since mid-August.

Testing for gold and multi-element analysis on >250 core samples will now take place and the company notes that its targeted ‘Fenton Shear Zone’ is believed to have been intersected with a number of shears and faults noted during core logging.

In addition, zones of chloritic and potassic alteration containing sulphides such as pyrite, pyrrhotite, chalcopyrite and arsenopyrite and have also been observed, while Desoto is not discounting battery mineral potential, too, with intervals of pegmatitic granites also yet to be analysed.

You can also read more about all this in our special report on Desoto, dated September 19.

READY TO STRIKE GOLD?? A REPORT INTO THE TERRITORY'S GOLD PROSPECTS DONE DECADES AGO COULD PAVE THE WAY FOR A NEW EXPLORER TO TAP INTO THE PRECIOUS MINERAL. #NTNEWS https://t.co/w2igBUV8H1 pic.twitter.com/77FvtjyvVu

— The NT News (@TheNTNews) September 21, 2023

DES share price

(Up on yesterday’s news)

This WA gold explorer’s share price is also well up today, which might have something to do with yesterday’s announcement from the firm that its CEO Ric Dawson is moving into a managing director role, as the company progresses exploration at the Kirup lithium project near the Greenbushes lithium mine.

Dawson has over 20 years’ experience in gold, nickel, copper and kaolin projects throughout WA and the NT and as a stockbroker/analyst during that time.

He was previously managing director of ASX-listed companies Prosperity Resources from 2003 to 2008 and Altech from 2011 to 2014 before joining Kula Gold as its chief executive officer in October last year.

His particular fields of expertise are in target generation and evaluation of Archean shear-vein style, IOGC and hydrothermal porphyry gold in Australia and Indonesia.

KGD share price

At Stockhead we tell it like it is. While Desoto Resources and Kula Gold are Stockhead advertisers at the time of writing, they did not sponsor this article.