Resources Top 4: Sierra Nevada Gold strikes it lucky with strong hits at historic Warrior

Mining

Mining

Here are some of the biggest resources winners in early trade, Friday February 23.

Gold and copper hunter Sierra Nevada Gold is focused on exploration projects in… Nevada, USA – specifically five precious and base metals projects in the richly mineralised state. It does (mostly) what it says on the tin.

SNX is up around 25% at time of quadruple finger tapping, revealing strong assays from a reverse circulation (RC) drilling program (12 holes for 913m) testing near-surface mineralisation at the Gold Coin and Discovery Shaft areas within its high-grade epithermal gold Warrior mining project.

This is referred to by the company as a “historic” site consisting of 260, twenty acre claims and covers an area of 21km2, contained within a substantial alteration system prospective for “high-grade vein and disseminated Au-Ag epithermal, skarn breccia and carlin style deposits”.

Historic, because the Warrior mine site was discovered in 1904 with mining there beginning in 1915 by early prospectors before acquisition by Olympic Mines Co. in 1921. Historical sampling, notes Sierra Nevada Gold, shows the nature of the veins at the location to be “very high grade”.

The latest results at the site include:

20.73m at 2.13g/t Au from 62.2m inc.10.97m at 3.76g/t Au from 63.4m; and 4.88m at 5.49g/t Au from 8.5m.

We've hit shallow, high-grade #gold at our Warrior project in Nevada, #USA with results including 20.73m at 2.13g/t Au from 62.2m inc. 10.97m at 3.76g/t Au from 63.4m: https://t.co/hHLEBYoVeH

We plan to drill more Warrior targets – veins remain open in multiple directions $SNX pic.twitter.com/UTbbHuGbTd

— Sierra Nevada Gold (@sierranevadaASX) February 22, 2024

The company says it now plans to drill further targets at Warrior on veins open in multiple directions, with field mapping and sampling to build on Phase 1 work.

Among other things, SNX executive chairman Peter Moore said this: “Our results have identified potential for a fully preserved epithermal vein system below the outcropping and previously mined high-grade veins at the Warrior Mine.”

More gold? Hang on… no, actually – niobium and REEs. Potentially.

Minnow explorer GMN is trading up on high volume this morning based on some fresh news.

It reports it’s secured 20 new tenements with a total area of 388.18km2 for niobium and REE in the Araxá region of Minas Gerais, located about 450 km north of Sao Paulo, Brazil

The tenements are located among a group of carbonatites, including one which hosts the world’s largest niobium mine, notes GMN, adding that “intense magnetic and radiometric anomalies similar to those over the Araxá mine carbonatite” are prevalent.

Operated by Companhia Brasileira de Metalurgia e Mineração (CBMM), the Araxá mine GMN is referring to reportedly hosts 94% of world niobium reserves.

“And Brazil has 82% of the world market for niobium,” adds GMN.

Brissie-based explorer and mining company MMI is up today on news of the arrival of an offshore floating terminal (OFT), all the way from China. We’ll get to that in a sec, but some background first.

The company’s flagship project is the Bauxite Hills Mine, 95kms north of Weipa on Western Cape York.

That’s a single operating mine combining two Environmental Authorities covering the Bauxite Hills and Skardon River tenements and has an estimated Reserve of 89.5 Mt and a total Resource of 124.5Mt.

Ore from the Bauxite Hills Mine is shipped to meet China’s growing bauxite market to then produce aluminium.

As for the OFT, it’s been on a long towed journey from Shenzhen to Weipa, via Darwin and is finally at its destination.

Most importantly the OFT (called Ikamba) has now also achieved the required Australian regulatory approvals for operation from the Department of Agriculture, Fisheries and Forestry, and the Australian Maritime Safety Authority.

The 132m long, 28m wide, 5k tonnes OFT is expected to be ready for production at the end of March 2024.

Simon Wensley, CEO and MD of Metro Mining said:

“OFT Ikamba is an important element of the Metro expansion strategy to 7Mt, the route to a sustainable and high margin business. These approvals are a critical step in the process…

“The name Ikamba, saltwater crocodile in local Ankamuthi language, signals respect for our traditional owners and their connection to the land and waters around our Cape York operation”.

(Up on no news)

Mako Gold has had a pretty up and down February share price wise, but is double digits to the good again over the past 24 hours and is also travelling nicely overall so far YTD with a +35% return.

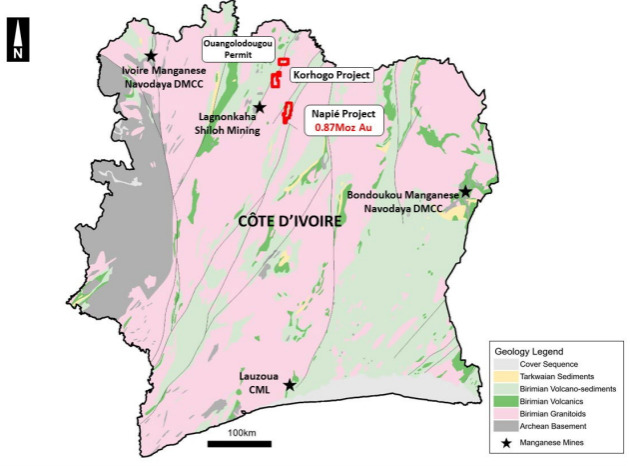

There’s no needle-pushing news we can see so far today, but recently, the company turned up several multi-kilometre manganese-rich zones at its Korhogo project in Côte d’Ivoire, after a program of detailed geological mapping and rock chip sampling.

According to Mako Gold (ASX:MKG) managing director Peter Ledwidge, those results add to the potentially significant discovery already made on the company’s Ouangolodougou permit at Korhogo.

In August 2023, eight shallow reconnaissance reverse circulation (RC) drill holes intersected wide zones of mineralisation up to 14.7% manganese, confirming the explorer had stumbled upon a “globally significant” manganese find.

Per a recent Stockhead report:

What makes MKG’s discovery in Côte d’Ivoire especially fortuitous is the fact the country is one of the 10th largest producers of the metal, currently host to four producing manganese mines (national production of 36,000Mt in 2022), including Shiloh Mining’s Lagnonkaha operation, some 70km along strike from Korhogo.

At Stockhead we tell it like it is. While Mako Gold is a Stockhead advertiser at the time of writing, it did not sponsor this article.