You might be interested in

Mining

Fortescue is dialled in to critical minerals; here's some areas the major miner is tuned into

Mining

White Bear reveals yet more spodumene as lithium hunter FIN gears up for drilling

Mining

Mining

Here are the biggest resources winners in early trade, Monday October 9.

Young lithium bull shark Fin Resources is carving through ASX waters this morning after its maiden fieldwork program identified abundant spodumene crystals within a broad pegmatite outcrop at Cancet West in James Bay, Canada.

Big nearology feels there, just 45km west of Winsome Resources’ (ASX:WR1) Cancet lithium deposit and 100km west of Patriot Battery Metals’ (ASX:PMT) 109.2Mt at 1.42% Li2O world-class Corvette deposit.

Then there’s the explorer’s 98km2 Ross project, close to Critical Elements Lithium’s (TSXV:CRE) Graab prospect and Nemaska Lithium’s 36.6Mt at 1.3% Li2O Whabouchi deposit – about 65km and 100km to the southwest respectively. Fieldwork has now begun at Ross targeting nine priority areas.

But regarding Cancet West, the company reports at least five pegmatite bodies have been identified outcropping across the western and eastern blocks of the area, with roughly total strike lengths of each outcrop ranging from 200-400m.

“These pegmatite bodies may extend for significant distances, along strike and below surface,” notes the company’s ASX release this morning.

Up to 30cm long green spodumene crystals, trace lepidolite, coarse muscovite, tourmaline, blue-green beryl, coarse red garnets and megacrystic feldspars were mapped within one of the pegmatite outcrops.

Fin Director, Jason Bontempo, said: “Following this initial spodumene discovery, the company is optimistic that additional lithium mineralisation will be discovered at Cancet West through further field work, detailed sampling and drilling.

“We are now looking forward to the field work beginning at our second high priority project area shortly at Ross.”

Read more on FIN’s latest discovery, here.

FIN share price

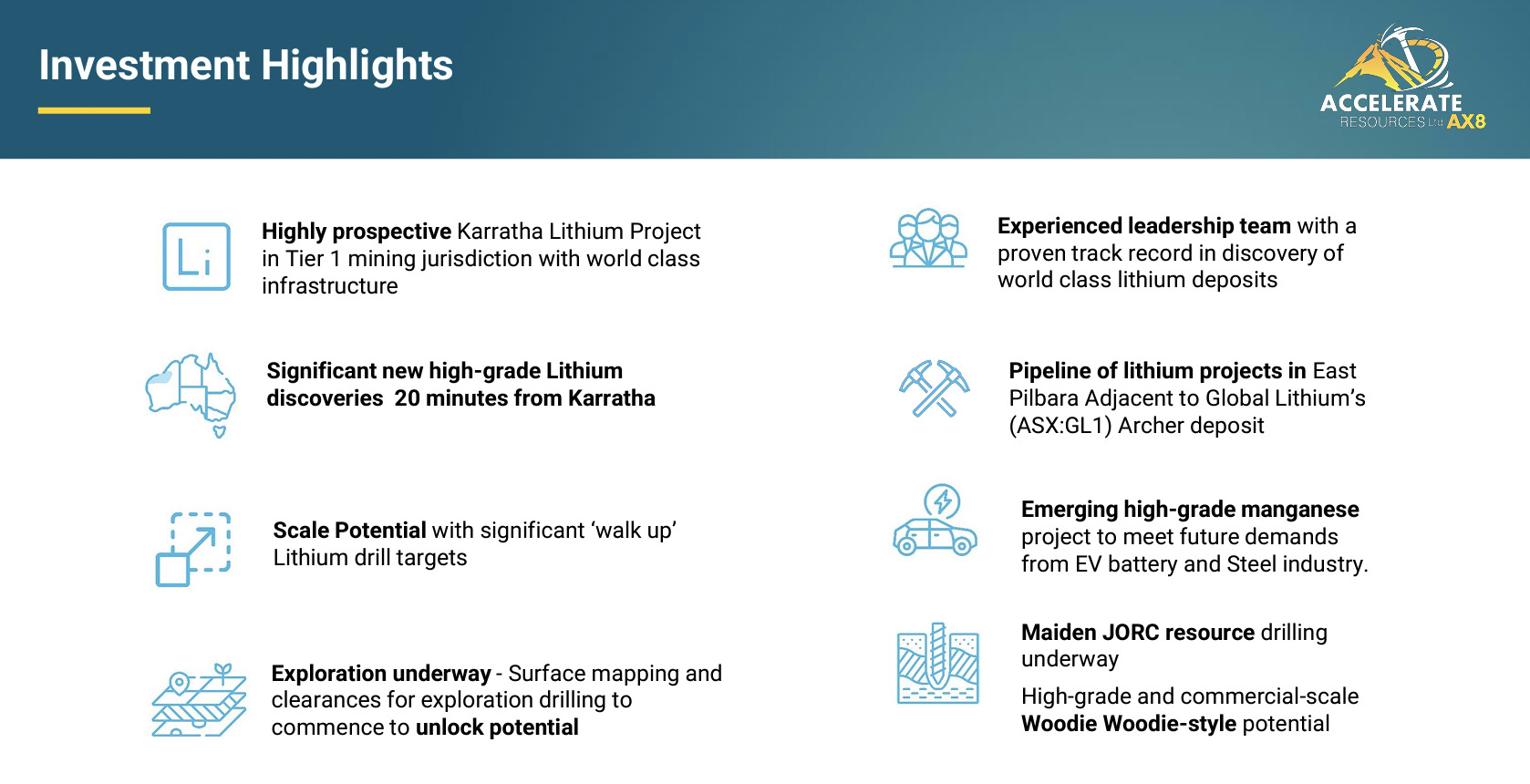

Pilbara lithium hunter Accelerate Resources recently added four ‘transformational’ Karratha tenements to its growing battery metals portfolio, which is a major highlight of the investor presentation the company released into the wild this morning.

As Stockhead detailed in a recent special report, Karratha is right in the heart of the Pilbara’s 40km-long Karratha-Roeburne lithium belt, where recent discoveries include Azure Minerals’ (ASX:AZS) monstrous Andover project (exploration target 100-240Mt at 1-1.5% Li2O).

Karratha comprises four projects – Prinsep and Mt Sholl (100% owned), Roebourne South and Mt Sholl East (75% owned).

Lithium hunters sure love a good nearology plot (see FIN, above), and why not, eh? Discoveries such as Andover have driven up share prices for lithium explorers over the past six months, even if the spot price of the commodity itself has been trending lower and lower.

The great battery metals hunt is still very much on, with lithium still the most sought after commodity in this frothy sub-sector. And that’s another trend set to keep rolling and rolling through Australia’s west, into Brazil, North America and beyond.

AX8 share price

(Up on no news)

KRR (formerly King River Copper) is a gold exploration company that, according to its Twitter page, is “aspiring to produce 99.999% (5N) HPA precursors for cathode production and 99.99% (4N) alpha alumina for battery separators”.

Why’s this $21m market capped explorer up roughly 40% so far today? Good question.

Apart from recent annual report and proposed issue of securities notices just lately, we’re not seeing a lot. Maybe someone knows something we don’t. Maybe there’s just a bit of punting going on.

For further context, KRR has holdings at Mt Remarkable in the Kimberley region of northern Western Australia and at Tennant Creek in the Northern Territory.

Recently, it sold its Speewah specialty metals project in northern WA to Tivan (ASX:TVN) with a $2.5 million payment received in July.

At that time, KRR noted:

“King River remains focused on advancing the ongoing geophysical survey programme at Tennant Creek as well as gold exploration across Treasure Creek and Mt Remarkable.”

KRR share price

RTG is up double digits today after an update on field work showing encouraging gold and copper mineralisation along 6.5km of skarns and new structures within its 90% owned Chanach project in the Kyrgyz Republic in far-flung Central Asia.

Assay highlights from its high-grade trench sampling include: 2m at 4.05g/t Au and 1.56% Cu from Cut 1; 1m at 1.10g/t Au and 0.76% Cu from Cut 1; 7m at 2.94g/t Au (including 4m at 4.87g/t Au) and 1.12% Cu from Cut 2; 5m at 5.53g/t Au from Cut 5.

RTG, which is also listed on the Toronto Stock Exchange, has its main focus going for gold in the Philippines at the Mabilo project. It continues to advance work there, with “budget discussions with project partners progressing well”.

Pivoting back to Chanach, RTG’s CEO Justine Magee said:

“These results further increase our confidence that Chanach can evolve into both a high-grade, large copper-gold porphyry skarn system, similar to or even better than the Mabilo Project, combined with a high-grade epithermal gold system.

“Follow up work next field season is planned to include a 3DIP survey and drilling of defined targets.”

RTG share price

At Stockhead we tell it like it is. While Fin Resources and Accelerate Resources are both Stockhead advertisers at the time of writing, neither sponsored this article.