Resources Top 4: Koonenberry Gold pulls in big bucks from small caps investor Lion Selection Group

Pic via Getty Images

- Koonenberry Gold pulls in $2.35m worth of funding from notably sophisticated types

- Falcon Metals soars on mineral sands finds at Pyramid Hill prospect

- Iris Metals and Titan Minerals also looming large with beaut gains

Here are some of the biggest resources winners in early trade, Monday March 4.

Koonenberry Gold (ASX:KNB)

Once you recall that old Oarsome Foursome Gouburn Valley Gold commercial and substitute Koonenberry for Goulburn Valley, the ear worm will wriggle every time you think of this stock. Or is that just me?

In any case, KNB is bearing golden fruit today with a +70% gain at time of key tapping. Why? There’s a reason, and it’s financial.

The junior gold explorer is bursting up the bourse after announcing details regarding a Placement and fully underwritten Entitlement Offer to raise $2.35 million (before costs).

This cash injection comes from a group of sophisticated investors and company directors, led by major small caps mining investor Lion Selection Group in the cornerstone position.

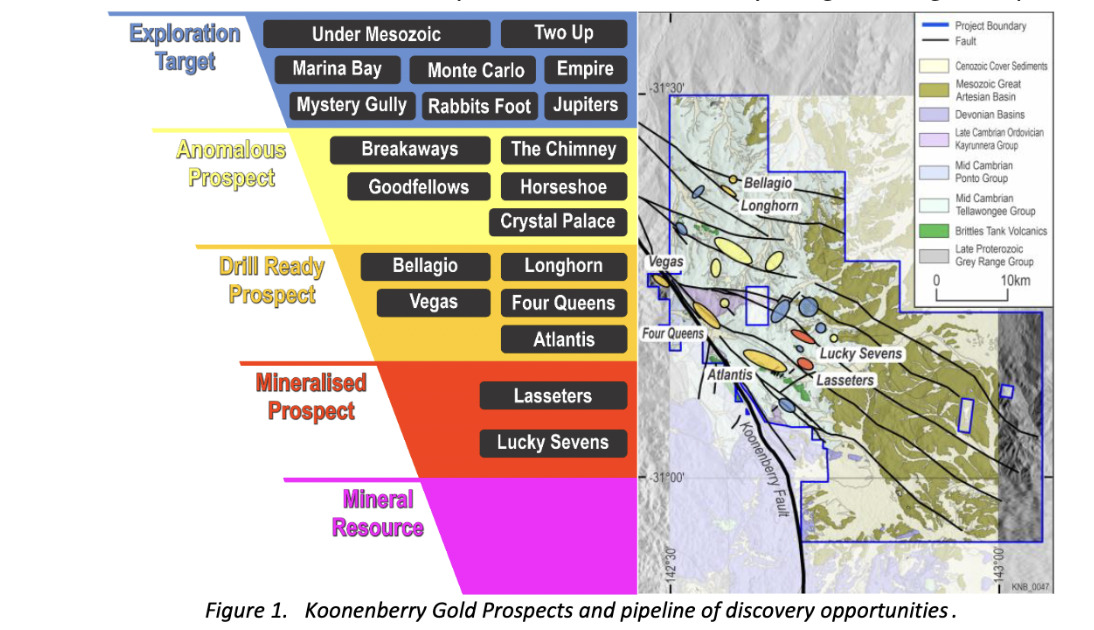

Funds raised will reportedly be used to advance exploration of KNB’s flagship gold and copper targets – the Bellagio and Atlantis projects – including high impact drilling programs.

The Bellagio prospect in northwestern NSW has pulled up high-grade gold rock chips to 39.4g/t Au with widespread bedrock gold mineralisation open in all directions and along +20km of the Royal Oak Fault.

The never-before-drill-tested Atlantis prospect, also in NSW, meanwhile boasts 15% Cu, 0.84g/t Au in rock chips and a 6.5km long soil anomaly.

KNB share price

Falcon Metals (ASX:FAL)

Another gold exploring youngster, Falcon is flying high today with a solid double digits gain.

The wind beneath its wings? High-grade mineral sands is the hero – intersected at the Pyramid Hill gold project.

Mineral sands? Falcon’s a goldie, but it’s into this and associated rare earths (REE), too.

Mineral sands use cases include critical components for a variety of industrial (including energy transition infrastructure) and medical purposes – consumer goods, too, such as sunscreen and inks.

Cutting to the chase, here’s the deets, received from a reconnaissance drilling program with highlights from the Farrelly prospect including:

• 17m at 9.8% THM from 12m; including 11m at 14.4% THM from 16m; and 1m at 21.6% THM from 16m; and 7m at 16.8% THM from 19m.

• 18m at 5.5% THM from 13m; including 7m at 10.7%% THM from 20m; and 4m at 12.0% THM from 22m.

The company notes that although the permits drilled were initially explored for gold, it recognised the potential for mineral sands mineralisation after completing a review of historical work in the 1970s and ’80s on areas where the Murray Basin cover is considered prospective for mineral sands.

High-grade #mineralsands results received from the Farrelly Prospect at our Pyramid Hill Project, Victoria.

Best results include:

🔺 17m @ 9.8% THM from 12m, incl 11m @ 14.4% THM

🔺 18m @ 5.5% #THM from 13m, incl 7m @ 10.7% THMRead: https://t.co/0ZuQBeud3J$FAL pic.twitter.com/xjtfm1mwo9

— Falcon Metals Limited (@FalconMetalsLtd) March 3, 2024

The high–grade Farrelly prospect is open in all directions, with follow up aircore drilling planned to determine the orientation and scale of the prospect.

Gold exploration continues at Pyramid Hill, meanwhile, with aircore drilling ongoing.

FAL share price

Iris Metals (ASX:IR1)

(Up on no news)

Lithium and gold hunter Iris is up on no news today, so we’ll revert to its most recent announcement of note, which occurred only late last month.

And that, was this:

The final assays from the initial RC program and the first results from the ongoing diamond drilling program from the 100% owned Beecher project came in late Feb.

Results included a 51m at 1.26% intercept of Li2O, including:

▪ 23m at 1.70% Li₂O.

▪ 12m at 1.63% Li₂O.

What’s the Beecher project? Located in the Black Hills of South Dakota, US, of A, it’s a lithium hunting operation on a 15-acre patented claim, surrounded by 20,300 hectares of US Bureau of Land Management (BLM) staked claims.

It includes the historic Longview, Beecher and Black Diamond mines, but Longview was mined all the way back in the 1950s for lithium, with lithium rich spodumene ore sent to Hill City for processing.

Re the latest program, the company says ongoing diamond drilling is currently testing the strike and down-depth extensions of the mineralised Black Diamond pegmatite.

A total of 20 diamond holes have now been completed and are pending assay.

IRIS Metals (@IrisMetals) Achieves 51m @ 1.26% Li₂O at Beecher

Read more here:https://t.co/ZqYXFcu42Z$ASX $IR1 pic.twitter.com/5H5u88HJq4

— The Assay – Mining Magazine (@TheAssay) March 1, 2024

IR1 share price

Titan Minerals (ASX:TTM)

(Up on no news)

Not getting enough gold news? Here’s a bit more for you, then.

Gold/copper/silver explorer and development company Titan Minerals is up a gleaming 33% at the time of writing on not much to speak of today.

Regarding its exploration activities, though – a quick recap on Titan and its recent movements.

TTM is focused on assets in southern Ecuador – in one of the fastest-growing mining jurisdictions in Latin America.

The company’s main game is the Dynasty gold project, as well as highly prospective activity at the Linderos project, the Copper Duke project, the Jerusalem project and Copper Field prospect.

Mid Feb, the company delivered some good news (for it and its investors), with key agreements secured with the Yaraco and Lucarqui communities at Dynasty.

This substantially increases Titan’s exploration footprint and provides access to highly prospective land, never previously explored.

In November last year, the company confirmed a new major gold vein system at the Dynasty project, specifically within its Papayal deposit.

Dubbed the ‘Julia’ system, the vein was found with two holes intersecting wide zones of epithermal vein hosted mineralisation from shallow depths. It represents one of several targets for resource growth drilling at the flagship 3.1Moz gold, 22Moz silver Dynasty project.

The shallow depth is particularly notable here, with Titan confident the Julia target represents potential high-grade resource additions for the Dynasty project, further validating the company’s strategy of targeting shallow, high-grade, high-margin ounces.

A resource update from TTM is expected in Q2 2024.

TTM share price

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.