You might be interested in

Mining

MinRes remains bullish on lithium, and it could take a host of WA explorers along for the ride

Mining

‘Open in all directions’: Firetail Resources extends Cumbre Coya copper target to 170m at Picha

Mining

Mining

It’s a wrap for Q4 2023 and here, we continue some of the latest highlights from another handful of ASX juniors on their activities for the three months to the end of December.

Copper/battery minerals explorer Firetail Resources was busy towards the end of 2023. Very busy.

First mention regards its flagship project – the Picha copper-silver operation over in Peru, which began a maiden diamond drilling program, delivering promising assay results during the quarter and just after.

Those results have included, from the first 62 metres of first drill hole at the Cobremani target: 13m at 2.81% Cu and 27.1g/t Ag from 2m (using a cut-off of 0.1% Cu).

Essentially, four high-priority targets for the drill campaign – Cobremani, Cumbre Coya, Maricate and Fundicion – have all revealed the potential for high-grade copper mineralisation.

Meanwhile, Firetail’s Charaque project, about 30km north of Picha, has commenced on-ground exploration, and at the company’s Yalgoo lithium project in WA, numerous potential new lithium-bearing pegmatites have been identified.

Finally, FTL’s Mt Slopeaway nickel-cobalt-manganese project in Queensland has seen the completion of a preliminary metallurgical test work program, with all four samples showing a strong case for nickel and cobalt recovery.

The Lake Johnston lithium project is a big deal for CHR, which now has a 100% interest in the site, and a good deal of activity took place there in Q4 2023.

Some highlights as follows:

• Identification of a new 1.2km trend of pegmatite outcrops with visible spodumene (estimates up to 40-50% spod) confirmed by high-grade rock chip samples up to 4.2% Li2O.

• Identification of several large soil anomalies (>100ppm Li2O) up to 3km long across the Mt Gordon tenement.

• An Aboriginal Heritage Agreement was formalised with the Marlinyu Ghoorlie traditional owners for the Mt Day tenements, with preparations underway for an Aboriginal Heritage clearance survey over Mt Day.

• $3 million is budgeted for exploration programmes in 2024 at Lake Johnston, including Reverse Circulation (“RC”) and diamond drilling programmes of priority targets, to be funded by Rio Tinto Exploration under Farm-in Agreement details.

• A placement to raise $2.7 million was successfully completed and at the end of the December quarter, the company held cash reserves of $4.1m.

GRV nailed several of its set milestones in the final 2023 quarter, notably, moving its 100%-owned Alpha Torbanite project in Queensland further towards development with key steps.

Namely, that included the completion of an updated Inferred Resource of 28Mt of torbanite and cannelite, which represents a 51% increase on the maiden 18.6Mt MRE set back in March 2022.

The company says that this update “underscores the scale and potential of the Alpha deposit, positioning it as an asset of considerable commercial significance”.

The synthetic oil equivalency of the deposit also saw a notable improvement, with an additional 6.4 million barrels bringing the total to 27.7 million barrels of synthetic oil equivalent.

What else?

Greenvale has great interest in the neglected renewable geothermal energy, specifically at Queensland locations.

Per its quarterly update, GRV notes that “Native Title Discussions for consent of exploration” is “progressing well” at its “100%-owned Geothermal project”.

An updated JORC Inferred Mineral Resource Estimate of 48 Mlb eU3O8 for its Koppies Uranium project in Namibia was the headlining highlight in the past quarter for this $173m+ uranium hunter.

The MRE update represented a 136% increase in the Koppies resource and a 42% increase in the company’s Namibian resources all up.

EL8 reports that the uranium mineralisation is shallow at Koppies, with 95% of the resource within just 15 metres of surface.

Three drill rigs completed a total of 620 holes for 17,457 metres, while four rigs got spinning in mid-January with a fifth one primed for action later this quarter.

Corella Resources’ CEO Jess Maddren described it as a “transformative quarter” for the company, “characterised by significant milestones achieved in both the Tampu Project Scoping Study and our exploration endeavours within the Yilgarn region”.

Corella notes that the Tampu project in the Yilgarn, WA, “has the potential to become one of the highest quality undeveloped kaolin deposits globally to produce HPA and kaolin for the high-end paint, paper coating, top-end ceramic, cosmetic and pharmaceutical industries”.

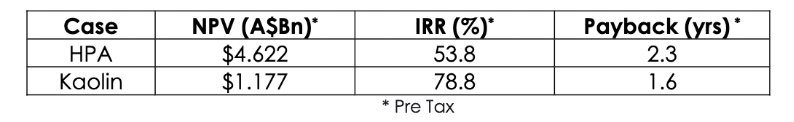

It’s scoping study affirms this, which investigated two mutually exclusive scenarios: 100% kaolin 200ktpa or 100% HPA 40ktpa production, with the following outlook figures:

The company’s outlook for Tampu also suggests a 24.7Mt Indicated and Inferred Resource, with an estimated 58-year mine life.

Additionally, three new and strategic Exploration Licence Applications have been lodged to increase Corella’s total land holding by 110% to 1,922km2 at the Tampu project.

The company had a cash balance of $1.47 million as of December 31, 2023.

Copper-gold and REE hunter Locksley, focused on deposits in the Lachlan Fold Belt of NSW as well as the Mojave Desert in California, reported a few major highlights for the quarter, as follows…

Firstly, follow-up work campaign was completed in November for previously identified high-grade rare earth (REE) minerals on the North Block of the company’s big, promising Mojave project.

Stream sediment sampling returned highly anomalous total rare-earth oxide (TREO) results, while six catchment areas were identified as prospective for ongoing REE exploration with assays ranging from 0.103% to 0.26% TREO.

For some context, the North Block of the Mojave project abuts the Mountain Pass Mine land area – the largest REE mine in the US and largest producer of high-grade rare-earth materials in the western hemisphere, delivering roughly 15% of global rare earth supply.

Locksley also appointed Nathan Lude to the role of non-executive chairman during the quarter.

At Stockhead we tell it like it is. While FTL, CHV, GRV, EL8, CR9 and LKY are all Stockhead advertisers, they did not sponsor this article.