Nickel prices edge back from seven-year high; S2 Resources Lapland project moves forward

Mining

Mining

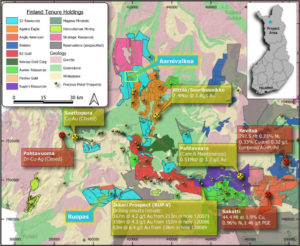

Nickel exploration company S2 Resources (ASX:S2R) has been granted an exploration licence for its Ruopas Isovaara nickel prospect in the Scandinavian country of Finland.

The licence for Ruopas Isovaara covers a well-defined electromagnetic conductor along strike from a 4km long copper and nickel anomaly in the Central Lapland Greenstone Belt of arctic Finland.

S2 Resources is now cleared to start drilling nickel, copper and platinum group element metals targets at its Ruopas Isovarra prospect in the middle of 2021.

The initial focus of its exploration will be a zone of anomalous nickel and copper identified in historic drilling by the Finnish Geological Survey.

The Administrative Court of Northern Finland has overruled a single objection to the granting of the Ruopas Isovaara exploration permit to S2 Resources.

No further appeals have been lodged with Finland’s Supreme Administrative Court.

The Ruopas Isovaara prospect exploration area has not been extensively explored despite the Central Lapland Greenstone Belt hosting significant nickel-copper-cobalt and platinum group element metals.

These include Boliden’s Kevitsa mine for nickel and copper and Anglo American’s Sakatti nickel-copper-platinum deposit.

Closer to home, Metals Australia (ASX:MLS) has entered into an agreement to acquire the Nepean South nickel project near Coolgardie in WA which is a Kambalda-style nickel sulphide project.

The project is along strike from the historic Nepean nickel sulphide mine that is 80 per cent owned by Auroch Minerals (ASX:AOU) that has historical nickel production.

Nepean mine produced 1.1 million tonnes of nickel ore from 1970 until 1987 when it closed due to low nickel prices at the time.

The Nepean South project is highly prospective and underexplored for both nickel and gold and historic drilling was only completed to shallow depths.

Metals Australia plans to undertake an airborne electromagnetic survey of the project to be followed up by a drilling campaign.

“The Nepean South project is a typical Kambalda-style nickel sulphide project which is strategically located along strike and south of the historic Nepean sulphide nickel mine, owned 80 per cent by Auroch Minerals,” director Gino D’Anna said.

He added that the project acquisition aligns with the company’s existing asset portfolio for battery metals and nickel sulphide is playing a vital role in electrification of economies.

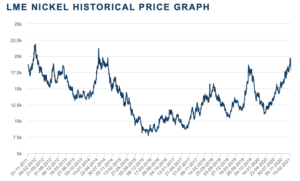

Nickel prices have just come off a seven-year high in February at $US20,000 per tonne and were trading at $US17,865 per tonne mid-week, according to LME data.

Prices for the metal reached a high of $US50,000 per tonne back in 2007 at the height of the then commodity boom.

Available stocks of the metal in LME warehouses are around 200,000 tonnes, after customers took delivery of 65,500 tonnes of the metal this week.

This is a significant drawdown in stocks of the metal and could provide additional support for prices of nickel in the weeks ahead.

Market analysts said prices for base metals such as nickel and tin are entering a consolidation phase after making a lot of upside progress in recent weeks.

Demand for nickel is linked to the production of stainless steel which uses the base metal as an alloy, and nickel is also used in the production of batteries for EVs.