Mustang thrown a $20M lifeline from major US investor

Mining

Mining

Ruby miner Mustang Resources has locked in a $19.95 million funding deal with one of its major institutional investors.

New York-based Arena Investors LP, which manages more than US$750 million ($956.37 million) worth of assets, has agreed to provide the cash via the issue of a convertible note.

Mustang (ASX:MUS) had just $736,000 cash in the bank at the end of the September quarter last year. Subsequent to the end of the quarter, it had also fully drawn down an $8.5 million convertible note it previously secured with Arena.

The new convertible note can be drawn down in seven tranches, starting with an initial tranche of $1.9 million once the deal is signed.

Mustang also plans to undertake a one-for-five non-renounceable entitlement issue at 2.6c per share to raise up to a further $4 million.

“The funding arrangement and the proposed entitlement issue will provide the company with the assurance of substantial capital to continue the development of its Montepuez ruby project and the ability to accelerate the advancement of the high-grade Caula graphite project in northern Mozambique,” executive chairman Ian Daymond told investors on Monday.

The news failed to move Mustang’s share price.

Mustang was plagued with problems in 2017 — from the shooting of one of its security guards in Mozambique to a disappointing maiden ruby auction in Mauritius.

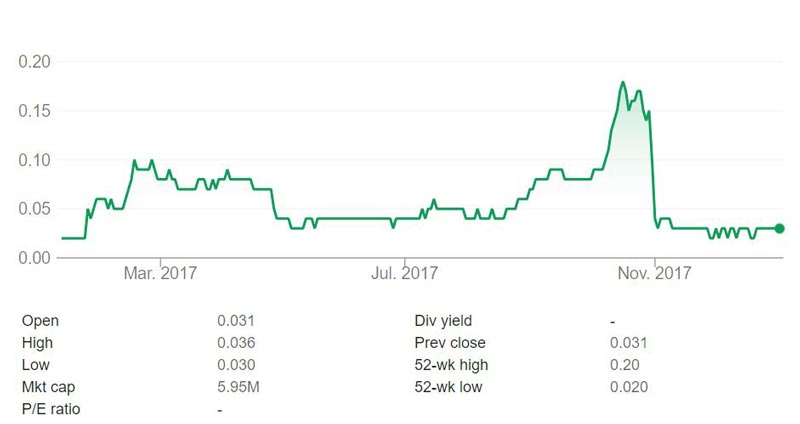

Since mid-October, the company’s share price has plummeted roughly 85 per cent from a 52-week high of 20c to 3.1c on Monday.

Mustang blamed its gem-grading system for the failure of its October ruby auction.

Sold carats represented only 7 per cent of the total 405,000 carats Mustang had on offer at the auction, netting a disappointing $713,456.

Mustang says its grading division has now developed a “highly definitive grading system” and it will undertake a few small test sales via private tenders in Asia in the coming months.

Christiaan Jordaan quit his managing director position for “personal reasons” in mid-November and Peter Spiers vacated his role as non-executive director last week.

Stockhead is seeking comment from Mustang.