You might be interested in

Mining

Reporting Rodeo Pt 3: With a week to go who else could light up reporting season?

Mining

Stellar Resources rattles tin for $3.2m, with new cornerstone investor Nero jumping on board

Mining

Mining

Tin is about to be a very hot commodity, with one forecaster upping its prediction for the spice(y) metal up a whopping 25% for 2023.

It comes as Indonesia and a semi-autonomous state in Myanmar called Wa, not to be confused with the soon to be former Premier Mark McGowan’s all conquering rock-shipping empire of WA, make cartel style moves that will take a big chunk of supply from the market’s leading exporters out of the market.

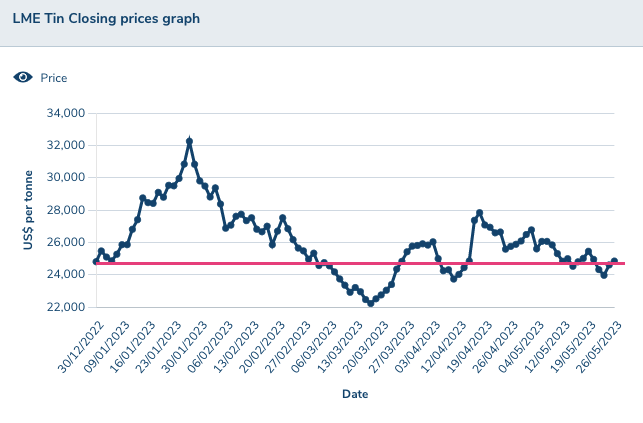

Fitch Solutions reckons the tin price could avoid the slump facing other battery metals in 2023 on the back of (unconfirmed) news Indonesia could ban partially refined tin ingots from export from June, and a mining ban in the Wa State that could see 10% of tin concentrate supplies and much of China’s feedstock stay in the ground.

That has prompted its analysts to lift prices from US$20,000/t to US$25,000/t for 2023, a 25% lift.

But unusually for commodities forecasting, its long term price assumptions for tin — based off a looming supply cliff and rising demand from electronics (around half of primary tin supply goes into lead-free solder), EVs and solar panels — are extraordinarily bullish.

Updating my #tin price forecast to include increased $NVDA demand and loss of Indonesia/Myanmar supply pic.twitter.com/JK2typA4NB

— Tin Investor (@TinInvestor) May 24, 2023

Fitch thinks they will head to US$45,000/t by 2032, US$40,000/t from 2026 and US$41,000/t from 2027. That compares to Bloomberg consensus of US$33,750/t in 2026 and US$34,500/t in 2027.

Few other metals have such a bullish consensus narrative.

“We expect tin prices to remain on a firm uptrend in the coming decade. While prices will ease slightly from spot levels in 2023, they will still remain historically elevated, and edge higher to reach USD45,000/tonne by 2032,” Fitch says.

“In perspective, this is more than double when compared to the 2016-2020 average of USD18,729/ tonne. We expect tin demand to grow strongly, lowering the market surplus from 2024 onwards.

“On the supply side, a thin pipeline of tin mining projects will tighten the tin concentrate market, leading to increased competition among smelters and constrained ore feed for refined output growth.

“On the demand side, the global use of tin will increase rapidly through the metal’s use in electronics (especially as electric vehicles increasingly contain greater amounts of electronics in their body) and solar panels (in photovoltaic cells), cementing tin’s status as a commodity of the future. Ultimately, this will allow the market to tighten.”

There are some downside risks around the place. Take a look at China’s consumption issues, which have not recovered anywhere near as fast as expected after the end of its Covid Zero policy.

Tin stocks are also up after falling to somewhere in the order of two days of supply last year.

Fitch thinks global tin consumption growth will sit at 0.3% this year, down from 0.5% YoY in 2022.

“Global tin stocks have increased, particularly from June 2022 onwards, which will limit the potential for price increases. Through 2021, low levels of tin inventories driven by reduced output due to Covid-related restrictions helped to support the metal’s extensive rally and added to volatility in prices,” its analysts say.

“For LME stocks in particular, depleted levels pushed marginal prices higher, especially when they were at close to zero at the beginning of 2022.

“The recovery in inventories which we have observed over past months will place a lid on prices, eliminating chances of the strong rallies that were seen last year.

“That said, we do also highlight that liquidity on the LME remains fairly low, which does mean that higher levels of volatility are likely to remain a feature of trading in the short term at least.”

Unlike nickel and copper, tin prices are slightly up on where they were at the start of the year, trading at a tick under US$25,000/t.

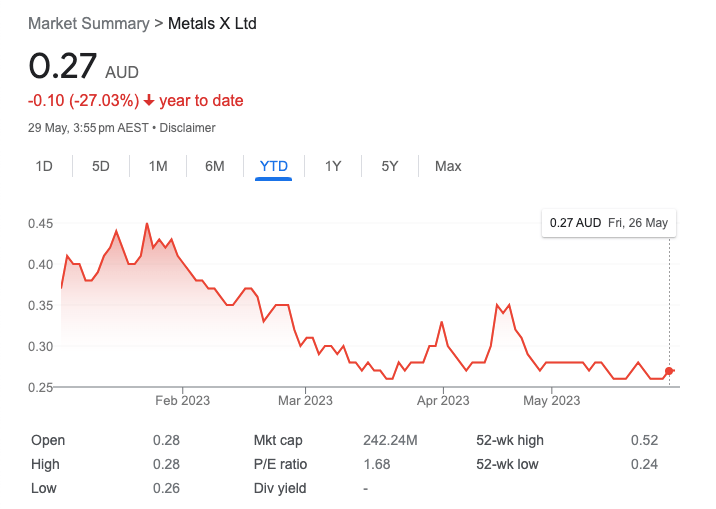

Yet the primary tin exposure on the ASX — Renison Bell mine co-owner Metals X (ASX:MLX) is down 27% year to date.

Bit of a disconnect here.

Spanish tin exponent Elementos (ASX:ELT) is down more than 50%, while Mount Lindsay tin and tungsten project ownerVenture Minerals (ASX:VMS) is also off in 2023 so far.

Stellar Resources (ASX:SRZ), owner of the high grade Heemskirk project in Tasmania, is up 10% YTD off a low base at 1.1c per share but down 45% over the past 12 months.

Back to the day to day and the materials sector finished up 1.1% on the back of stronger copper and iron ore prices, with a handful of battery metals stocks leading the charge.

Liontown Resources (ASX:LTR), MinRes (ASX:MIN) and Lynas Rare Earths (ASX:LYC) were all among the top performing large caps.

Gold miner Capricorn Metals (ASX:CMM), Nickel Industries (ASX:NIC), coal stock Coronado (ASX:CRN) and lithium mine Core Lithium (ASX:CXO) also found support.

Leo Lithium (ASX:LLL) meanwhile ended the day up 17.24% at an all time high of 85c, with the Malian lithium developer surging on a premium $106m investment from Ganfeng which will see the JV partners look to expand the soon to open Goulamina mine to 1Mtpa before the end of the decade.