Monsters of Rock: The outlook for coal is hot making Whitehaven ‘materially undervalued’ – Datt Capital

Mining

Mining

Coal stocks are having a moment amid the global energy crisis.

Today, Whitehaven (ASX:WHC) reported a record profit result of $2 billion (NPAT) for FY 2022 — a product of significantly improved realised thermal (power) coal prices.

The company raked in $325 per tonne, up 242% from $95/t in FY21.

EBITDA (Earnings before interest, tax and D&A) rose an astounding 15 times on the previous financial year, with a result of $3.1 billion achieved.

Free cash flow generated from operations was $2.6 billion. In FY21 it was $169m.

Emanuel Datt, Chief Investment officer and Founder of Datt Capital, says the outlook is also super positive.

“We consider the forward outlook is exceptionally strong, with the ongoing global energy crisis and the peak demand season of the Northern Hemisphere winter mere months away; providing strong upside risk both at company and commodity price levels,” Datt says.

WHC says it is #1 in the ASX100 for total shareholder returns. A fully franked final dividend of 40 cents per share will be paid on 16 September, taking the full year dividend to 48 cents per share.

“Whitehaven have emphasised its commitment to returning capital to shareholders via dividends and share buybacks, and we believe these initiatives will be strongly value accretive for shareholders,” Datt says.

“We consider the company’s current market valuation, of a mere $7.3 billion, at a (backwards looking) price earnings multiple of only 3.5x to be materially undervalued given the strong outlook for the industry, the quality of the company’s assets and the commitment towards aggressively returning excess capital to shareholders.”

Spot thermal coal prices (Newcastle specification) are already at circa $600/t, versus $325/t pricing achieved for FY22.

The upside is clear in FY23.

“The company continues to experience demand excess of its supply capabilities due to the high quality and highly-sought after nature of its coal products as well as its enduring relationships with East Asian customers primarily located in Japan and Korea,” Datt says.

“Any supply response to fulfil demand is unlikely to eventuate for at least 2-3 years, and even Whitehaven itself has been unable to lift production given constraints to permitting, labour and the sheer inability to finance new thermal coal developments.

“Accordingly, existing producers enjoy a significant and likely enduring competitive moat to any potential new entrants,” says Datt.

While diversified miner South32 (ASX:S32) waxes lyrical about the future facing metals in its portfolio, coal still contributes 31% of its earnings. Next is aluminium, at 20%.

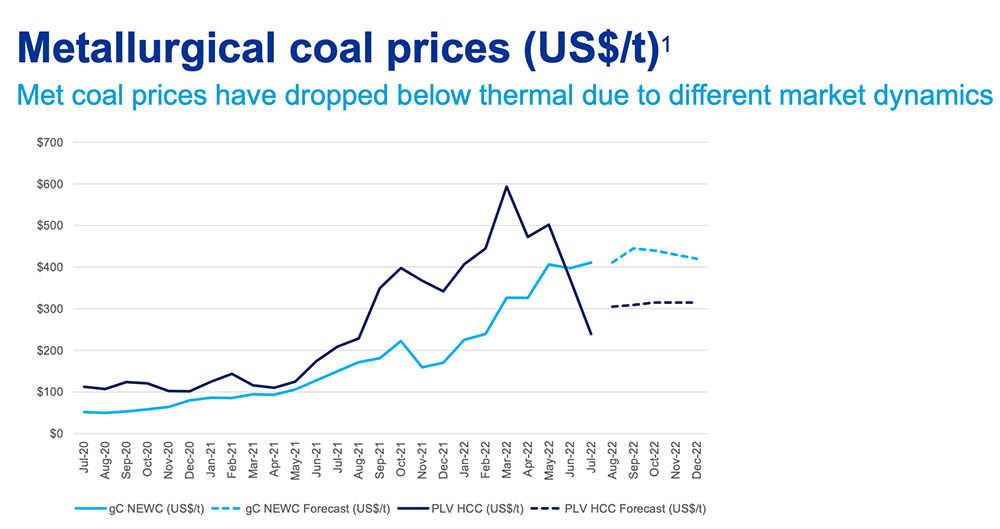

It’s mostly met (steel making) coal though, which hasn’t enjoyed thermal’s manic price increases:

Still, S32’s statutory profit after tax increased from a loss of US$195m in FY21 to a record US$2,669m. What changed? Everything became more profitable, led by coal.

For the year, S32 enjoyed higher realised prices for its commodities, including metallurgical coal (+US$1.545bn), aluminium (+US$1.027bn), alumina (+US$386m), nickel (+US$313m), manganese ore (+US$279m), energy coal (+US$88m), zinc (+US$59m) and lead (+US$23m).

Shareholders will now enjoy record returns in FY22 of US$1.3bn, equal to 10% of S32’s capitalisation, it says.

The company is increasing met and thermal coal production in FY23 to 6.5Mt and 900,000t respectively.