You might be interested in

Mining

Monsters of Rock: Rio quiet on whether it wants to join BHP's copper race for Anglo American

Mining

Monsters of Rock: One year wait to revive manganese for South32 and Base becomes Ace

Mining

Mining

The Intergenerational Report has landed and it’s grim reading if you’re a coal producer.

But it provides plenty of positivity if you’re in the market of ‘energy transition metals’, with the fortunes of battery metal producers and thermal coal miners set to diverge over the course of the next 40 years.

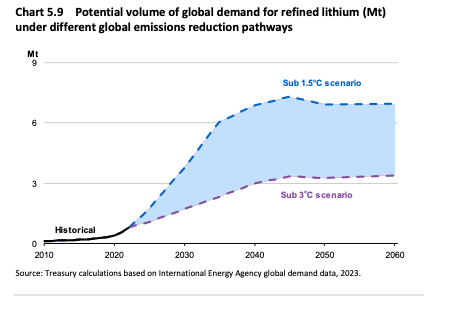

In a scenario that keeps global temperatures to Paris-aligned targets of 1.5C above pre-industrial levels, coal exports will decline to less than 1% of current levels, while demand for lithium will soar eight times over.

Even in a 3C scenario, lithium demand is projected to quadruple, with a 350% rise in demand for nickels that feed into electric vehicles like nickel, lithium, copper, graphite and more.

Demand for Australian thermal coal exports would roughly halve by 2063 in a scenario that keeps global temperature increase to 2C, with Treasury projecting a hit to the Australian economy from global warming of between $135-423 billion.

“Global demand of critical minerals will need to increase by around 350 per cent by 2040 for the world to reach net zero emissions by 2050,” the report presented by Treasurer Jim Chalmers today noted.

“Lithium, cobalt, manganese and rare earth elements are crucial to battery manufacturing. Rare earth elements are also essential for permanent magnets used in wind turbines and electric vehicle motors.

“In addition to significant known reserves, Australia has potential for more undiscovered minerals, with around 80 per cent of land mass largely under-explored.”

The biggest company on the reporting trail today, BHP (ASX:BHP) offspring South32 (ASX:S32), fell into the red after swinging from a US$2.67 million profit to a US$173m loss in FY23, trimming its final dividend to US3.2c (US$145m).

That saw total payouts fall from US$25.7c including a US3c special divvie in 2022 to US8.1c in FY23, though more will be returned by way of a share buy back, with US$133m still to be returned by March 31 after S32 ramped up its capital management program by US$50m to US$2.4b.

While aluminium, base metals and manganese production all increased, S32 saw underlying revenue falls 15% to US$9.05m, with underlying EBITDA sliding by 47% to US$2.534b and underlying earnings down 65% to US$916m.

That came down to a negative US$1.78b hit on lower commodity prices and US$539m on lower sale volumes (including at its Illawarra met coal, Cannington Silver and Worsley Alumina assets in Australia), as well as a $1.3b impairment on the value of its Hermosa assets in the US State of Arizona, where an investment decision is due early next year on the initial Taylor mine, a zinc-rich base metals deposit.

Speaking to media after the release of the results S32 MD Graham Kerr waved off concerns around the impairment of the old Arizona Mining assets, saying Taylor, along with the manganese dominant Clark deposit, would be a multi-decade asset.

The company has also pivoted heavily to copper, a rumoured potential buyer of the $2 billion Khoemacau mine in Botswana after paying around the same last year for a 45% stake in KGHM’s Sierra Gorda copper mine in Chile.

It’s also made a high grade copper discovery at the Peake prospect at Hermosa.

It comes as copper deposit owners in the United States struggle with approval times that stretch into the decades, with the US EPA blocking the development of the Pebble mine in Alaska in January on the grounds it could impact a major salmon habitat.

“I think no matter where you are around the world at the moment, it is difficult to actually permit, fast track or move forward with new projects. It is probably something that’s going to create a tightness in the actual market and provide price support for longer,” Kerr said.

While M & A opportunities emerge from time to time in copper, they come at a price, with South32 progressing earlier stage investments outside of the big Sierra Gorda buy.

“We also do have a large copper exploration portfolio in South America and the US predominantly Ambler Metals in Alaska and the San Juan region of Argentina,” Kerr said.

“As we mentioned on our call earlier today, at the Hermosa land package in Arizona at Peake we’ve had probably our best copper intercept we have actually seen and we certainly plan to continue to work that.

“We will look at M & A opportunities as they sort of come our way. But as you mentioned, everyone’s sort of chasing the same thing. So finding value in that space is not always easy.”

Mining stocks lifted 0.14% today, led by the gold sector and major producer Northern Star (ASX:NST).

Its shares popped 5.47% after reporting its highest cash earnings result in history and resolving to up its dividend payments by 23% YoY, albeit partly unfranked.