You might be interested in

Mining

Born in the USA: Meet the Aussies charging America’s clean energy economy

Mining

Here’s how Ioneer could produce more lithium from Rhyolite Ridge, which is already going to increase US supply fourfold

Mining

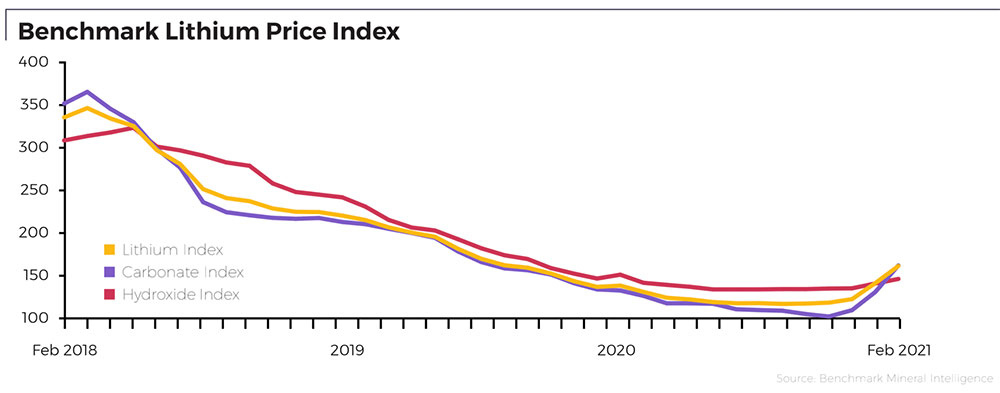

The lithium price recovery continues apace.

Chinese lithium carbonate prices surged 68 per cent in the first two months of 2021 on the back of high battery demand and a slower than expected transition to high nickel battery chemistries, according to Benchmark Mineral Intelligence.

Mined lithium material (usually sourced from hard rock or brines) is processed into ‘carbonate’ or ‘hydroxide’ to make cathode material for lithium-ion batteries.

Lithium carbonate – which has lagged hydroxide pricing since April 2018 – is now surging ahead due to high demand for lithium iron phosphate (LFP) cathodes, and a slower-than-anticipated transition to high nickel chemistries. Lithium hydroxide bolsters the performance and lifespan of batteries as nickel content increases.

Carbonate prices pushed the Benchmark Lithium Price Index up 14.4 per cent in February — its second largest move on record, after January 2021.

“While large price rises have so far been limited to China, pricing in the rest of the world has begun to move upwards towards Chinese levels with ex-Chinese carbonate prices up by an average of 17.1 per cent in February,” Benchmark says.

Spodumene — the main lithium bearing mineral mined from hard rock lithium mines, like those in WA – also continued to improve.

Prices were up by 10.8 per cent in February to ~$460/t “as many converters in China sought additional tonnes from producers at higher prices, in anticipation of supply tightness and further price increases”, Benchmark says.

In February, bullish sentiment and higher lithium prices inspired producers and hopefuls to raise cash from investors.

That includes ASX-listed project developers like Core Lithium (ASX:CXO), ioneer (ASX:INR), Argosy Minerals (ASX:AGY), and Infinity Lithium (ASX:INF).

Core raised $40m to advance the Finniss project near Darwin towards development.

Argosy’s Rincon project in Argentina is now “fully funded through to 2,000tpa lithium carbonate production and cash-flow generation” following a $30m placement, it says.

Infinity in Europe also has an extra $15m in the kitty, while US-focused ioneer completed a $80m placement just this morning.