Mako Gold’s ‘district-scale’ exploration and expansion plans for Napié are starting to bear fruit

Mining

Mining

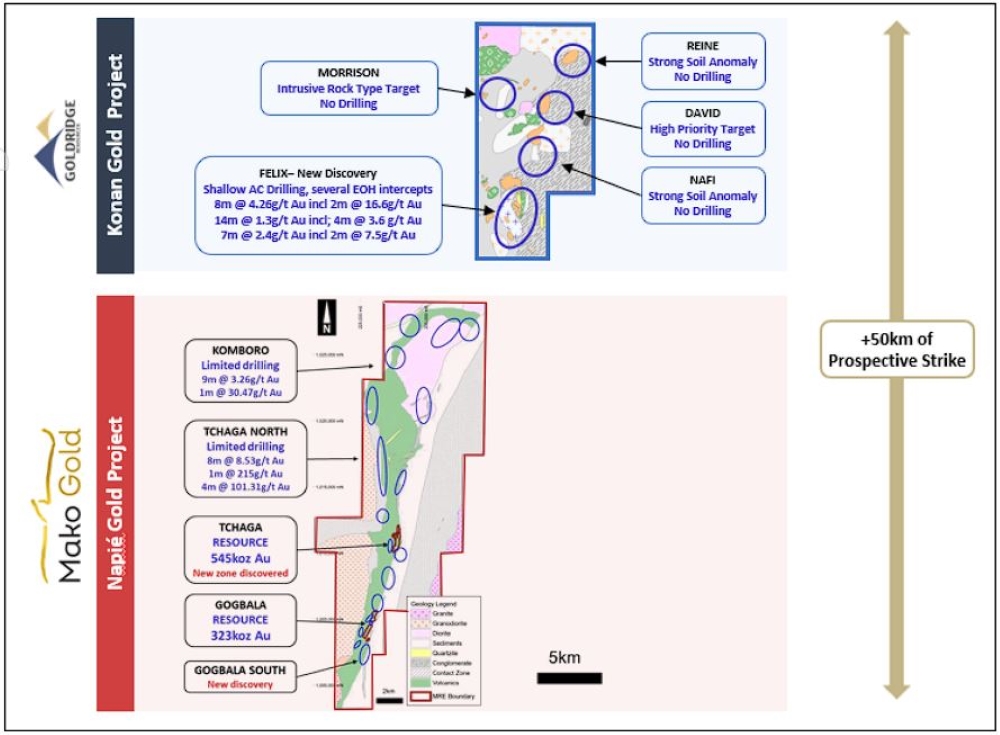

Special Report: Due diligence for the acquisition of Goldridge Resources and its Konan project is progressing, while exploration work at Mako Gold’s Napié project in Côte d’Ivoire is aimed at generating drill targets over its promising Tchaga North prospect.

Côte d’Ivoire is ranked one of the most robust mining jurisdictions in West Africa and already has ASX-listed companies operating gold mines in the country, including $2.5bn market-capped Perseus Mining (ASX:PRU) and the $690m-valued Tietto Minerals (ASX:TIE).

The latter’s founders are associated with privately-owned Goldridge Resources and its Konan project – which Mako Gold (ASX:MKG) is looking to acquire to expand Napié’s already strong 868,000oz gold resource.

MKG says due diligence for the potential acquisition of the Goldridge Konan permit is progressing well, with data evaluation ongoing prior to resuming negotiations in hopes of finalising the purchase.

The 150km2 Konan project hosts five high-priority gold anomalies defined by extensive soil geochem, trenching and limited AC drilling.

A maiden AC drill program by Goldridge was highly successful, with notable intercepts of 8m @ 4.26g/t gold from 34m to end-of-hole, including 2m @ 16.63g/t gold from 40m at hole KBAC22-144.

Goldridge’s Konan permit are just north of Napié and, if acquired, would increase MKG’s total landholdings to 374km2, as well as extend the strike length along the Napié fault to 50km, creating a district-scale gold camp.

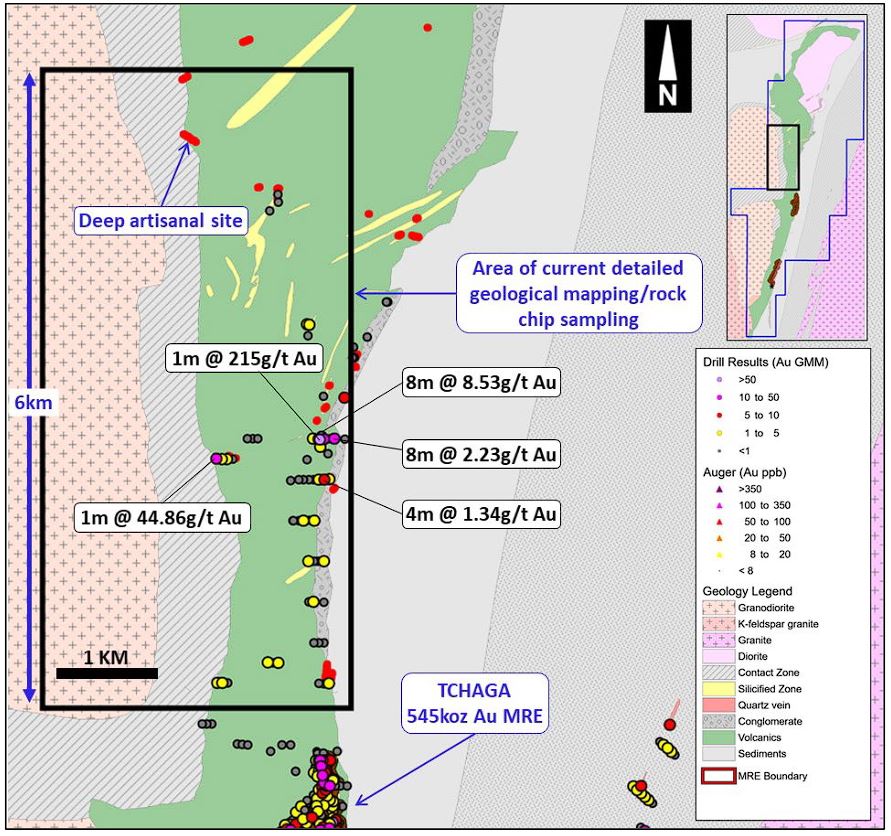

Current exploration work at Tchaga North is focused primarily on a western greenstone/granite contact where high-grade gold hits were discovered.

According to MKG, the low-cost work will generate new targets for a planned drill campaign at the untested new east west structural trend.

MKG says the discovery of these new structures is important because the limited drilling at Tchaga North to date was predominantly completed from west to east, therefore “presents new targets where drilling will be in a north-south orientation perpendicular to the newly identified structures”.

Geological teams are progressing mapping and rock sampling on 100m-spaced traverses over the 6km by 3km prospect where a wide-spaced RC program returned an impressive 1m @ 44.86g/t gold hit.

“We are pleased to be starting off 2024 with a focus on our flagship Napié project with low-cost exploration so that we can be ready to capitalise on an impending resurgence in the interest in gold exploration,” MKG managing director Peter Ledwidge says.

“Our field crews have been hard at work throughout December and into January and are continuing to map and rock chip sample our new high-grade gold targets focused on the western greenstone granite contact at Tchaga North and on the new structural trends.

“We have also been progressing our due diligence on the proposed accretive transaction with Goldridge and expect to be able to recommence negotiations with Goldridge shortly.”

This article was developed in collaboration with Mako Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.