Leeuwin launches on ASX with nickel, lithium and REE projects under its belt

Mining

Mining

Leeuwin Metals has commenced trading on the ASX today, following an oversubscribed IPO raising A$8m.

Notably, one of the world’s largest globally diversified natural resource players Glencore was drawn to the company’s attractive suite of assets, taking a 9.97% cornerstone investment of the shares on issue.

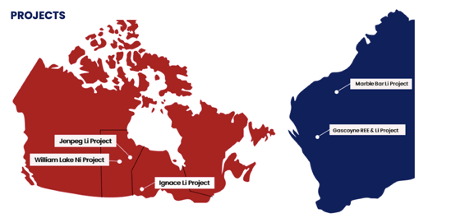

The projects include the flagship William Lake nickel sulphide project in the world-famous Thompson nickel belt in Manitoba, Canada, with Glencore and Leeuwin Metals (ASX:LM1) establishing a technical committee to leverage the mining giant’s expertise in Canadian nickel.

“We are very pleased to have the strong support of such a wide group of well informed, sophisticated investors and look forward to delivering value for our shareholders,” managing director Christopher Piggott said.

“We are particularly excited by the high-quality of the projects within the portfolio and the potential for significant discoveries to be made.

“We look forward to updating the market with news as we advance exploration across the projects.”

The funds raised from the IPO will be allocated towards exploring critical metals across the company’s portfolio of projects in Canada and Australia, starting with William Lake.

William Lake has over 500km2 of tenure in the Thompson Nickel Belt, which is a world renowned, highly fertile nickel belt with several existing nickel mines currently in production and historic production of over 2.5 million tonnes since the first discovery in 1956.

Notable results from previous exploration include 17.09m at 1.48% Ni from 398.9m to EOH, 1.18m at 6.16% Ni and 1.21g/t Pd from 282.9m and 6.4m at 2.85% Ni from 382.6m.

LM1 is currently resampling historical core for PGE’s, conducting surface geophysics and planning for drilling in Q2 2023 with advanced drill-ready targets.

The company also holds the Jenpeg lithium project, host to Spodumene Island in Manitoba, Canada, where historical samples include 7m at 1.7% Li2O and 7m at 1.4% Li2O.

The plan is to explore for a large-scale greenfields lithium opportunity within the project area.

Also in Canada, the company has an early-stage project near Ignace in Ontario where mapped pegmatites are yet to be explored for lithium mineralisation.

In Western Australia, LM1 also holds the Marble Bar project where its targeting LCT pegmatites similar to what is seen at Global Lithium’s (ASX:GL1) Archer Deposit, and at its Gascoyne project is targeting Li and REE mineralisation.

This article was developed in collaboration with Leeuwin Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.