Latin spins out Lachlan Fold project to double down on advanced Brazilian lithium play

Mining

Mining

Battery metals player Latin Resources is selling subsidiary Lotus Minerals – the sole owner of the Lachlan Fold Belt project – to Maverick Minerals to focus on its flagship Salinas lithium project in Brazil.

Rich in copper and rare earths, the Lachlan Fold Belt in NSW is emerging as a key province to supply the commodities needed for renewables and electric vehicles.

The Lachlan Fold Belt has seen major buzz this year following development approvals at McPhillamy’s and Bowdens, as well as Newcrest’s takeover by US gold giant Newmont.

The biggest prize there was Cadia, boasting at least a two-decade mine life and the potential to become a more than 100,000tpa copper producer alongside its gold bounty.

Latin Resources’ (ASX:LRS) Lachlan Fold project covers a range of commodities, and includes the Boree Creek copper project (EL9273), Peep O’Day gold project, Manildra and Burdette gold projects, Gundagai Ni-Cu-Au-PGE project, Boree Creek copper project (EL6638) and Mt Unicorn North project.

The spin out of the projects will allow LRS to focus on its flagship Salinas project, Cloud Nine project, Catamarca project and MT-03 project, while retaining exposure via a stake in Maverick Minerals.

Back at the Lachlan Fold Belt, Maverick has been established with a target of listing on the ASX in the coming months, IPOing at $5m at $0.20/share.

As part of the spin out transaction, Maverick will issue 6m shares at $0.20/share to Latin, along with a further 1m shares at $0.20/share to extinguish an inter-company loan payable by Lotus to Latin.

Latin will also have the right to appoint up to two representatives to the board of directors of Maverick.

Latin shareholders will be able to participate in the growth of Maverick, with the prospective nature of the Lachlan Fold Belt project warranting investigation by its own experienced board and management team.

“Maverick is in the fortunate position of having a great portfolio of projects to begin its journey and having the support of Latin Resources as a major shareholder and with a vested interest at board level too,” Maverick MD Sam Smith said.

Latin was a first mover into the red-hot Minas Gerais region of Brazil, where Sigma Lithium (TSXV:SGML) is enjoying huge success at the newly developed 766,000tpa Grota do Cirilo mine.

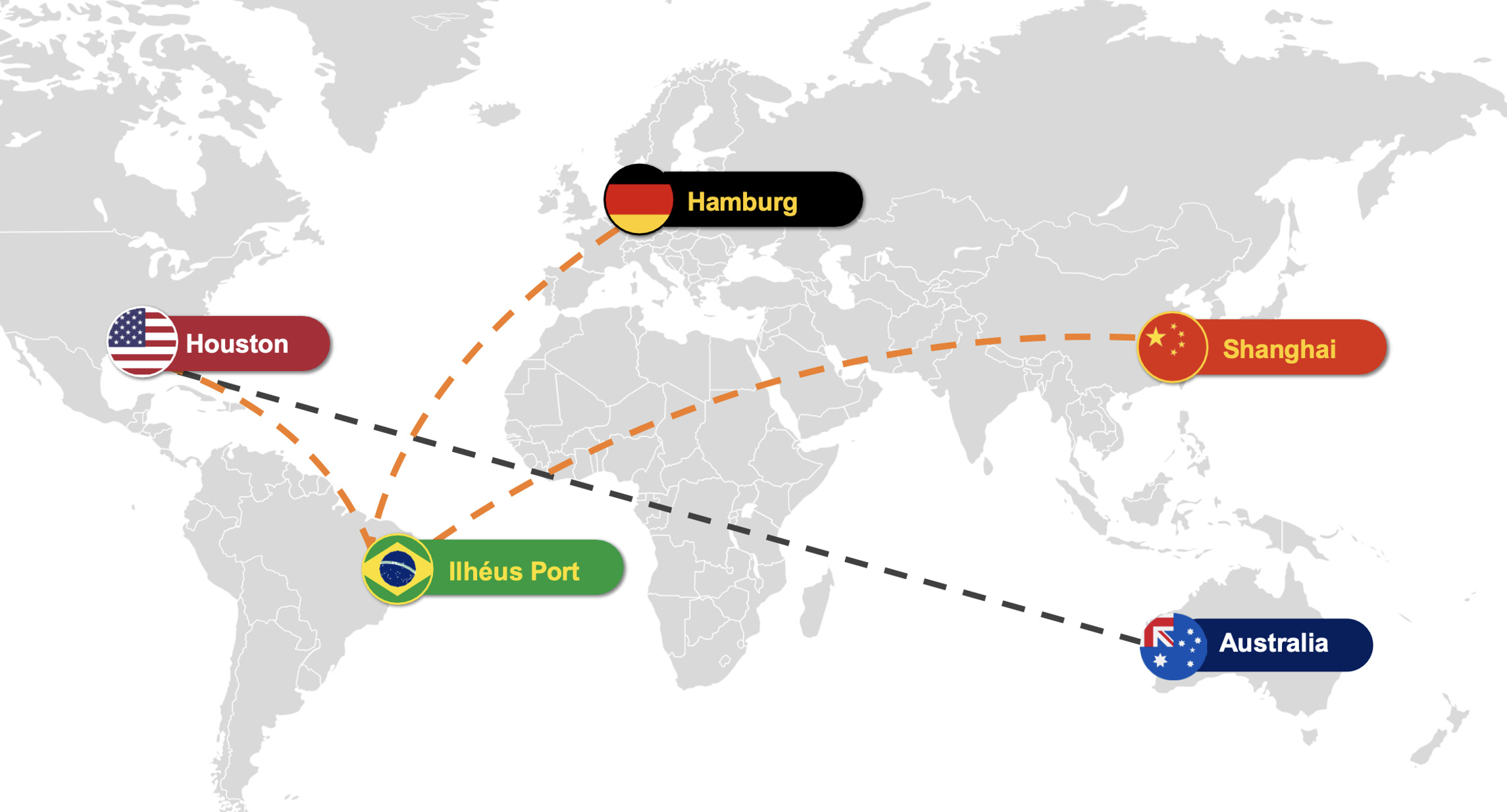

LRS’ Colina project, part of the Salinas tenements, hosts a 45.2Mt at 1.34% Li2O (~1.5Mt LCE) resource, and the preliminary economic assessment released last month flagged its potential to be one of the biggest, lowest cost spodumene mines in the world.

The study released from Salinas in late September forecast an after-tax NPV of $3.6 billion, revenue of $12.6 billion and an IRR of 132% with payback of seven months.

Colina is envisaged as a low-capital, two phase operation which will deliver two revenue streams, a 5.5% Li2O spodumene concentrate and a 3% Li2O spodumene tails concentrate product with Phase 1 life of mine average production of about 405,000tpa and 123,000tpa, respectively.

Meanwhile, a 65,000m drilling program is ongoing, with a potential resource update on the cards.

This article was developed in collaboration with Latin Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.