It’s not all about lithium as zinc demand in transition to renewables grows

Mining

Mining

As the global shift towards electrification by reducing dependence on fossil fuels towards renewables gains momentum, the minerals that will power this transition have come into focus.

While there has been much talk about lithium, particularly with battery technology, zinc has also emerged as an in-demand base metal.

The World Economic Forum (WEF) said zinc is one of the world’s most versatile and essential materials and the fourth most used metal in the world behind iron, aluminium and copper.

A key enabler in green technologies like solar and wind, the metal is used to prevent rust by creating a corrosion-resistant barrier. According the WEF, primary use of zinc include the galvanising process which protects iron and steel from rusting.

Furthermore, researchers are advancing zinc-ion battery technology that uses water-based chemistry and is considered safer, avoiding the fire risks of lithium-ion batteries.

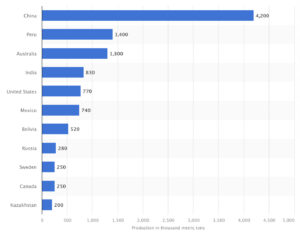

In terms of worldwide zinc mine production, China was the largest producer of the base metal in 2022, followed by Peru and Australia.

According to Shanghai Metals Market China’s data shows refined zinc output increased 13% in June 2023 compared to the same reporting period last year. If China is refining more of the metal for manufacturing, that means it’s importing more from places like Australia – with huge zinc mines to top up supplies.

Dominating production in Australia is Glencore with assets including the Mt Isa zinc mine in Queensland, along with the McArthur River mine in the Northern Territory.

Of other big zinc mines in Australia, the Dugald River mine, also near Mt Isa, is owned by China Minmetals.

Cannington, an underground hard rock mine and surface processing facility, is also located in the Mt Isa region, owned by base metals heavyweight South32 (ASX:S32).

M&A activity in the space is also worth noting as demand for the metal rises. South African Sibanye Stillwater recently acquired full ownership of zinc major New Century which was reprocessing tailings from the Century Zinc mine in North Queensland.

As demand for zinc increases here are some ASX-listed explorers and producers looking to get skin in the game.

BRX’s exploration efforts to uncover zinc are yielding positive outcomes with historical drill results at the southern end of its recently acquired Toro-Mambo-Tambo project in Argentina uncovering significant zinc mineralisation.

BRX managing director Arvind Misra told Stockhead he is proud to affirm the company’s unwavering commitment to zinc exploration, recognising it as a crucial metal with immense potential.

“The ever-increasing demand for zinc, driven by its diverse industrial applications and integral role in battery technologies, presents exciting growth prospects in the zinc market,” he said.

“Our team of experts has been diligently engaged in exploring and developing zinc resources to meet this rising demand.

“Leveraging advanced exploration techniques and cutting-edge technologies, we hold a strong belief in our capacity to discover valuable zinc deposits.”

He said for discerning investors seeking opportunities in the zinc sector, BRX stands out as a compelling option.

“Our impressive track record, deep-rooted emphasis on sustainable practices, and strategic partnerships solidify our position as a promising zinc company worth considering,” he said.

VAR is dedicated to acquiring, exploring, and advancing high-quality strategic mineral projects, with a portfolio of significant base-metal assets in Spain, Chile, and Australia.

The company’s primary emphasis lies in the development of advanced zinc projects in Spain. CEO Stewart Dickson told Stockhead VAR has recently initiated its Phase 3 underground drilling campaign at the San Jose mine in northern Spain.

“This round of drilling is focussed on testing in-mine prospective zones identified from the recent 3D model of mineralisation and mine developments as well as expanding zones of mineralisation via in-fill and step-out drillholes,” Dickson said.

Drilling is expected to continue through until the end of Q4 CY23 with VAR also progressing towards a maiden JORC-compliant Mineral Resource Estimate for the San Jose mine.

Dickson said San Jose mine and the wider Novales-Udias project benefits from a number of advantages as it seeks to reignite zinc production in northern Spain.

He said it’s located in the heart of the profilic Basque-Cantabrian Basin with well understood geology, hosts former world-class Reocin mine (closed 2003), one of the world’s largest MVT deposits and is one of Europe’s premier zinc-lead mining fields.

Furthermore he said its close to Santander wth excellent infrastructure, including airports and a deep water port less than 25km from the mine site with the Glencore San Juan smelter 80km via the A8 highway.

He said the mining licence for San Jose mine is in good standing with excellent high-grade drilling results from both surface and underground drilling campaigns.

Dickson said while it’s been a tough year for zinc with the price falling ~25% to currently US$2400/tonne he see’s a long term upside.

“To fulfil the target of net zero emissions, the world is going to need a lot more metal and minerals,” he said.

“Zinc is a critical raw material for energy transition and should be designated as such – currently it is, incorrectly, overlooked by the EU and Australian Government.”

AW1’s is focused on discovery and development of major base metal mineral deposits in Tier 1 jurisdictions of North America with its primary focus developing the advanced zinc-copper-indium deposit situated in West Desert, Utah, and conducting exploration activities across the wider project area.

Their project portfolio includes West Desert, Storm, Seal, and Copper Warrior. The West Desert Project is located in west-central Utah, ~160km southwest of Salt Lake City.

Earlier this year AW1 announced the West Desert maiden JORC resource showed a 44% increase in zinc metal over previous non-JORC resource.

The company has defined an Indicated and Inferred Resource of 33.7 million tonnes grading 3.83% zinc, 0.15% copper and 9 grams per tonne (g/t) silver, or a contained resource of 1.3Mt of zinc, 49,000t of copper and 10Moz of silver.

Significantly, about 81% of the resource is contained within the higher confidence “Indicated” category, which provides sufficient information on geology and grade continuity to support mine planning.

Formerly Venturex, DVP is a pick in the space of Minelife founding director and senior resource analyst Gavin Wendt who told Stockhead it is led by the “uber-successful miner Bill Beament” who formerly ran Northern Star Resources (ASX:NST).

“He has two potential zinc operations in his stable,” Wendt says.

“Firstly, the mothballed Woodlawn zinc-copper mine near Canberra, which is a high-grade zinc-copper-lead-gold-silver project, located within the world-class Lachlan Fold belt in NSW.”

The Woodlawn mine operated from 1978 to 1998 and processed 13.8Mt of ore from the open pit, underground and minor satellite deposits.

Following its closure, the project was acquired by the now delisted Heron Resources, which developed the underground mine and processing plant, investing ~$340 million in the project before it was put on care and maintenance in 2020. Heron was placed in administration in July 2021.

Wendt said DVP acquired the project with an 18.2 million tonne resource grading 9.8% zinc equivalent.

“Beament’s expertise is in underground mining and he is now expanding the high-grade resource base from underground drilling platforms before returning Woodlawn to production,” he says.

Woodlawn is in addition to DVP’s Sulphur Springs copper-zinc project in WA. Wendt said DVP holds mineral resources totalling 24.4 Mt at 1.2% Cu, 3.5% Zn and 18.7g/t Ag within its Pilbara projects.

“The company has identified three VMS mineral fields, hosting six known deposits,” he says.

“Previous studies pointed to the potential for annual production of 15,000t of copper and 35,000t of zinc.”

RTR is a base and precious metal explorer that owns the Earaheedy project 110km north of Wiluna in WA in the Earaheedy Basin and is another choice of Wendt in the zinc space.

The company has three separate deposits within the project include Tonka, Chinook and Navajoh.

“The deposits remain open with less than 35% of the 45km Unconformity Unit effectively drill tested,” Wendt says.

He said the total maiden inferred mineral resource estimate (MRE) of 94Mt @ 3.1% Zn+Pb and 4.1g/t Ag (at a 2% Zn+Pb cut-off) for 2.2Mt Zn, 0.7Mt Pb and 12.6Moz Ag of contained metal.

“It represents one of the largest zinc sulphide discoveries globally over the last decade,” Wendt added.

STK’s Iroquois project (80% Strickland and 20% Gibb River Diamonds (ASX:GIB)) is directly along strike from RTR’s Chinook zinc-lead discovery at the Earaheedy project.

It controls ~30km of strike extending from the Earaheedy project with diamond drilling returning impressively high zinc results including 4.3m of massive sulphide mineralisation grading 27% Zn – more than a quarter of the material contained in the recovered core – along with 0.1% Pb and 19.9g/t Ag from a down-hole depth of 226.7m.

Furthermore it is right at the end of a 58m intersection of polymetallic base metal mineralisation at 4.3% Zn and 3.7g/t Ag as it was drilled towards the target intrusion.

STK adds that the two holes were successful in intersecting the ‘feeder structure’ in the basement of the project.

This basement mineralisation represents part of the plumbing for a much larger mineralising system at Iroquois, it says.

The company plans to spin off Iroquois into a new listed company that will enable STK to focus on its flagship Yandal gold project.

STK recently pocketed $41 million in cash as well as 1.5 million NST shares after finalising a deal to sell its Millrose project to gold major Northern Star Resources (ASX:NST) .

“We now have one of the strongest balance sheets in the junior exploration space, along with a portfolio of very promising, advanced exploration projects,” CEO Andrew Bray says.

BM8 owns a 15% stake in the Bleiberg Project, encompassing 116 claims covering 65.8km2 and situated ~130km south of Salzburg in southern Austria.

The Bleiberg property is one of four significant lead-zinc deposits associated with the Periadriatic Lineament, a regional geological feature that extends from Italy through Austria and Slovenia to Romania. The deposits at Bleiberg are hosted in Triassic lagoonal sediments, indicating their geological origin.

BM8 recently announced that it has staked additional 100%-owned contiguous claims to the west-northwest of its existing earn-in claims at its Bleiberg Project in Austria.

The company said following early desktop assessments, it has identified a trend hosting potential extensions of the mineralisation to the west-northwest of the old Bleiberg mine workings and moved swiftly to secure this expanded land position by pegging the additional exploration licences.

BM8 says documentation for the staking process has been completed and submitted to the Austrian Mining Department with formal documentation anticipated within 6-8 weeks following internal processing.

And finally another pick of Wendt is small cap RFX which is not an explorer or producer of zinc but rather produces the world’s smallest and most scalable, commercially available, zinc-bromine flow battery.

“Redflow provides downstream zinc sector exposure and is unique in the context of the ASX in that it is developing customised zinc-bromine flow batteries for energy storage,” Wendt says.

“These batteries have the advantage of being able to operate in extreme temperature environments.

“The redox flow battery market is forecast to be worth US$4.5 billion by 2028.”

RFX batteries have high cycle-rate, long time-base energy storage, and are scalable from small commercial systems through to grid-scale deployments.

They also have secure remote management, 100% daily depth of discharge, a simple recycling path, no propensity for thermal runaway and sustained energy delivery throughout their operating life.

At Stockhead, we tell it like it is. While Belararox, Variscan Mines, American West Metals and Strickland Metals are Stockhead advertisers, they did not sponsor this article.