Ironbark Zinc is blazing an EXIM Bank funding trail. Could others follow?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

As the world’s supply chain crisis and geopolitical tensions continue to make headlines, global superpowers are looking to secure the minerals they deem critical to their strategic needs.

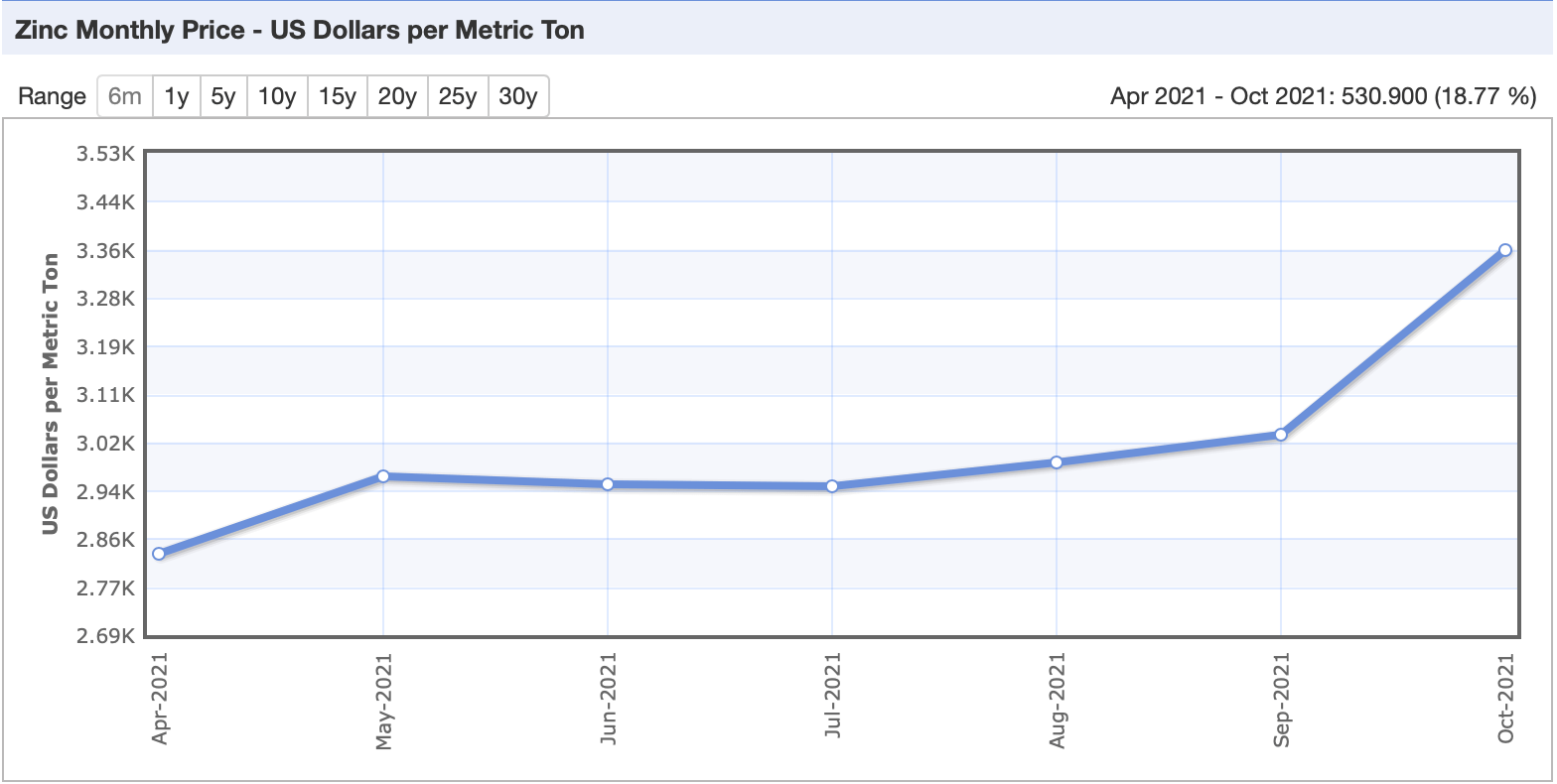

That includes zinc, which was recently added to the US Geological Survey’s (USGS) list of Critical Minerals on the back of serious price improvement driven by curtailed production amid power shortages in China – a nation on which the US is reliant for supply.

According to USGS, the US imported 83% of its domestic consumption of zinc last year – a hefty 710,000t – despite having 14 operating mines and three smelter facilities.

With the designation of zinc as a critical mineral, that reliance is clearly on the mind of the Americans, and a recent move by the government’s Export-Import Bank (EXIM) to grant its 402(A) support status to an ASX-listed zinc developer highlights this point.

Ironbark Zinc (ASX:IBG) was the recipient of the designation, which makes it eligible for special funding considerations under the ‘China and Transformational Exports Program’ (CTEP).

What does that actually mean?

That’s a very valid question. Probably the main question.

In 2019, the US government added the CTEP to the EXIM Bank charter – a move which set EXIM a goal of reserving no less than 20% of its total financing authority to support loans, guarantees and insurance at rates and terms fully competitive with those from China and some other countries.

The move was made for a number of reasons, including to neutralise export subsidies for competing goods and services offered by official export credit, tied aid or blended financing provided by China.

In essence, it allows Ironbark to apply for project development funding through EXIM on more favourable terms than it would otherwise be able to get.

Should its loan application succeed, EXIM may be able to offer the ASX-listed company extended repayment tenors, extended drawdowns and reduced fees.

Ironbark’s Citronen zinc project in Greenland, the subject of the funding, became the first standalone project globally to qualify for the designation.

It’s not been a short path. Ironbark had been working towards the designation for 15 months – blazing a trail which other ASX-listed developers will surely watch with interest.

Speaking to Stockhead, Ironbark managing director Michael Jardine said the strategic interest of EXIM Bank in Citronen made sense given the global economic climate.

“The US and Europe are both net importers of millions of tonnes of zinc metal per annum,” he said.

“Post-COVID, governments are much more focused on things like supply chain security, which also spills over into things like ESG demands as well.

“If Citronen was running today, it would be the 10th largest zinc mine in the world, and the largest in Europe by a considerable margin, so it has the ability to displace other metal sourced into Europe and America.

“Factor in further that the metal currently being imported almost certainly comes from regions with lower ESG standards, while Citronen would effectively be operating to EU standards on emissions, labour laws, supply chain certification, environmental monitoring and so on, and we think we have a really compelling project.”

Citronen has a mineral resource of 85 million tonnes at 4.7% zinc and 0.5% lead. A bankable feasibility study completed this year demonstrated a 3.3Mtpa operation which would deliver post-tax free cash flow of $1.46 billion.

CAPEX was reported at US$654 million. Ironbark expects to hear back on its EXIM Bank loan application this month.

Broader implications?

Mineral supply concerns don’t appear to be going away in a hurry, which could create further opportunities for those looking to develop projects in areas of strategic interest.

Jardine said he felt the export credit route was one historically underused by junior miners but felt awareness of such arrangements was growing.

“There have been instances on the ASX, particularly with things like potash, where export credit has been applied, and there are others in Greenland pursuing an EXIM-led strategy who are not as far advanced in discussions as we are,” he said.

“If we are successful, I expect it will be easier for others to follow in that slipstream, rather than trying to blaze a trail.

“If the application is successful for us, I hope it is successful for others as well, and the industry continues to grow.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.