EXPLAINER: How drilling results make the grade — Copper and Zinc

Pic: Getty

In the second episode of our new series on drilling grades we look at two more of 2022’s key base metals, Mr Copper and Mrs Zinc.

Let’s dig in.

Two fundamental factors to keep in mind when reading a company’s drilling results are:

- What is an average grade across the sector?

- What is the price context of the metal?

Unlike precious metals, base metal grades are expressed in terms of percentages (%) instead of grams per tonne (g/t).

But there’s more to consider than just grades when assessing the viability of a project.

Grades versus scale and prices

Operating copper mines currently have an average grade of 0.53% and the current copper price is about A$13,341 per tonne (at the time of writing).

In global zinc mining, grades of 2.5-3% are considered medium grade and the price is approximately A$4731 per tonne.

Copper projects under development now have an average grade of 0.39% or less, according to Mining Intelligence.

Copper, green energy and some geopolitics

The declining grade profile at projects across the globe comes as analysts forecast copper demand doubling in the next 30 years thanks to copper’s role in cleaner energy sources and electric vehicles.

This scenario underpins a favourable and rising price environment, but also the reality that a higher incentive price is needed for the development of new projects.

Such a scenario makes existing mines more profitable while supporting the development of some currently uneconomic projects.

Tickled zinc

Zinc has also found a home – nay, a mansion – in renewable energy infrastructure as a handy weapon vs. corrosion – and its value soared more than 50% in 2021.

Then there’s the anxiety around a greater concentration of global zinc production emanating out of China, the metal recently added to the US Geological Survey’s list of Critical Minerals.

The Biden Administration’s efforts to reduce its reliance on Chinese-produced zinc have boosted Western-based projects such as Ironbark Zinc’s (ASX:IBG) Citronen zinc-lead project.

Economies of scale, depth and width

President and CEO of Kincora Copper (ASX:KCC) Sam Spring says about 60% of the world’s copper comes from porphyry deposits. These deposits are generally lower grade than volcanogenic massive sulphide (VMS) and sediment hosted deposits.

However porphyry deposits usually offer greater economies of scale and support lower mining costs.

If the zone is close enough to the surface and large enough to be mined in bulk, huge trucks can process large volumes of ore at a relatively low mining cost and capital development.

Open pits are generally less than 300 metres deep and are several hundred metres in diameter.

Know your exploration results

Therefore, when considering exploration results investors need to factor in the type of mineral system and other important factors such as:

- Is the zone less than 300 metres deep?

- Is the drill intercept more than 100 metres thick?

As a rule of thumb, ore from open pit mines can be processed for $5-$15 per tonne. The cost of underground mining varies on a number of factors including the depth and complexity of the project, but it invariably costs significantly more than open pit mining (particularly when factoring upfront capital costs).

One of Australia’s largest gold/copper projects, Newcrest’s (ASX:NCM) Cadia, is currently extracting less than 0.4% copper equivalent, plus gold at grades of less than 1 gram of gold per tonne (g/t), with probable reserves of 1,400Mt gold and 1,400Mt copper, illustrating how below average grades can be profitable for a large project.

Australia’s second biggest porphyry copper mine after Cadia, CMOC’s Northparkes, has returned above average grades of 0.6% copper and 0.2g/t gold with probable reserves at the project of 103.26Mt gold and 103.26Mt copper.

Kincora is looking for the next Northparkes at Trundle Park, which sits in the same mineralised complex as Northparkes.

And now for some geometry

The geometry of the ore body is another very important factor that can have an impact on the cost of extraction, according to Ironbark Zinc Managing Director Michael Jardine.

“If the ore body is in a ‘pillow-like’ cross-section that lends itself easily to open pit mining, it will be much cheaper to extract than an ore body that is pivoted on the diagonal,” he says.

How the ore body lies will also affect the waste to ore ratio, with a horizontal ore body involving less waste than a diagonal one of equal grade.

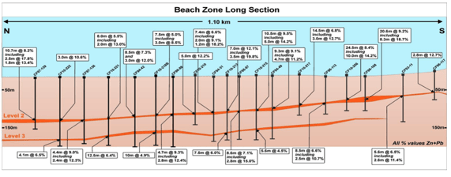

Diagrams of a project’s ore body are often included in announcements and presentations.

Hello moly: What else is in the deposit and are these elements a cost or benefit?

Copper is commonly found with varying levels of gold and in-demand mineral molybdenum, or ‘moly’, used to strengthen alloys.

Minerals such as lead, copper and silver are often discovered alongside zinc.

All these metals and minerals can boost a project’s viability. For example, Cadia’s gold mine operation has negative operating costs, with revenue from copper sales more than covering mining, processing and marketing costs.

However zinc, as well as other minerals such as rare earths, could also be found at some projects with radioactive elements including thorium and cadmium.

“As these deleterious elements are problematic to process, ore containing these elements are often sold at a discount,” Jardine says.

Jurisdiction: something gotten in the state of Denmark

Jardine says this is an extremely important factor to consider while evaluating exploration results.

As miners develop and operate projects on a multi-decade basis, they benefit from stable government, tax and permit regimes, as well as the ability to easily move funds in and out of a country.

He says that while Greenland, where Ironbark Zinc is developing Citronen, is a relatively ‘new frontier’ for mining, it benefits from the stability it derives from being part of the Kingdom of Denmark.

“There are opportunities there today that would have been extracted decades ago if they were in WA,” he said.

This article was developed in collaboration with Kincora Copper and Ironbark Zinc, Stockhead advertisers at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.