Copper demand set to double over 30 years, as majors scramble for supply

Pic: Getty

Copper is surging, and the majors are out in force looking to shore up resources and take advantage of the market. But uncertainty remains around where supply will come from.

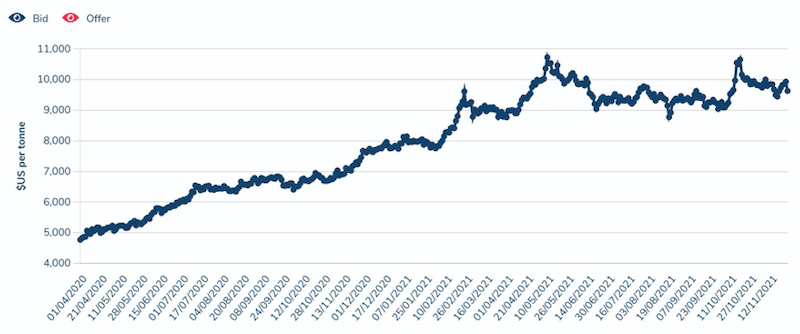

The copper price has more than doubled since April last year and M&A is picking up pace as majors like BHP forecast a doubling of copper demand in the next 30 years.

Double demand over 30 years. When you consider prices hit all-time highs and LME stockpiles fell to 47-year lows this year, that would be a serious trend to watch.

There was a lot of positive commentary out of the recent COP26 Summit in Glasgow surrounding copper’s importance to the clean energy transition.

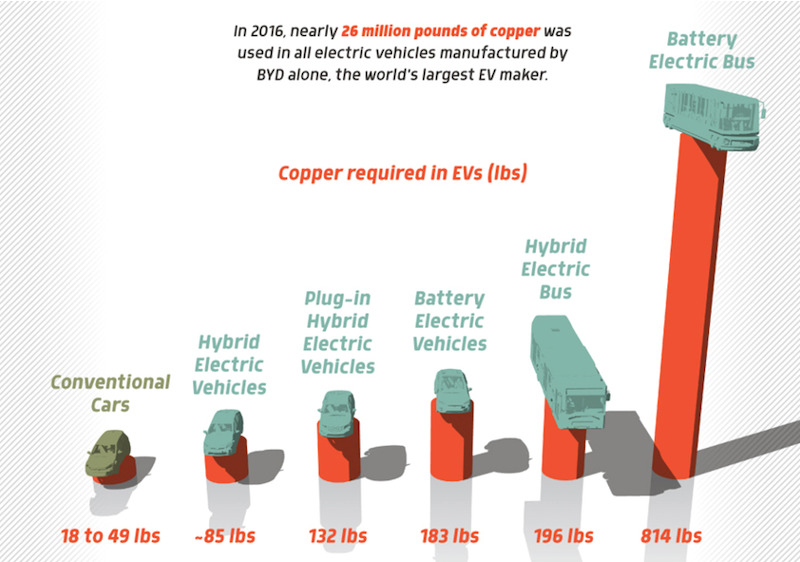

One of the key takeaways from COP26 was the large amount of copper needed to help the world slash its emissions and restrict global warming.

Wood Mackenzie estimates an additional 19 million tonnes of annual copper production – a 60% increase – is needed by 2030 to limit global warming to 2 degrees Celsius. A whole lot more copper is needed again to further restrict it to 1.5 degrees Celsius.

The infographic below says plenty. And that’s just the transport side of the equation.

But the experts predict there aren’t enough mines in production or in development to come close to meeting this level of required supply.

This has prompted some extremely bullish price predictions, like New York-headquartered resources fund manager Goehring & Rozencwajg recently forecasting the price will go past $US10 a pound (+$US22,046/t). Earlier this year, the fund manager forecast the red metal might even test $US33,000 a tonne.

On the back of this, markets have seen a flurry of M&A activity including Evolution Mining’s (ASX:EVN) recent $1 billion move to take full control of the Ernest Henry copper-gold operation from joint venture partner Glencore.

The full acquisition of the mine is expected to turn Evolution into a 60,000tpa copper producer to add to its gold production.

Gold miner Newcrest (ASX:NCM), meanwhile, plans to increase copper production by 37% to 175,000tpa by 2030.

With not enough major copper developments in the pipeline, existing explorers with quality projects are going to be in the box seat to supply the rapidly rising market.

Who’s got copper what?

Emmerson Resources (ASX:EMR) is the name on the lips of many when it comes to copper exploration, courtesy of recent monster copper intersections reported at the Hermitage project in the NT’s Tennant Creek region.

Emmerson hit 117m at 3.38% copper from 75m at Hermitage, with the headline hole abandoned in the middle of high grade mineralisation – 3m at 14.91 grams per tonne gold and 4.24% copper – due to drilling difficulties.

A diamond tail will continue the hole in the coming year, with investors no doubt keen to see what that continuation brings.

CuFe Limited (ASX:CUF) recently acquired a 60% stake in a project just 7km from Emmerson’s ground in the NT, and could be a nearby play to watch.

CuFe, an iron ore producer which recently changed its name from Fe Limited to reflect its commodity diversification, acquired its Tennant Creek project stake with the belief that its historic Orlando open pit – covered by one of three historically defined resource estimates available on the project – could offer potential for near-term production.

With such big hits down the road, it could be a project to watch in 2022.

Meanwhile, Cohiba Minerals (ASX:CHK) has been advancing exploration on its iron oxide-copper-gold (IOCG) prospective landholding in South Australia, right next door to BHP (ASX:BHP), and is about to embark on the busiest 15-18 months in the company’s history.

The heritage survey for the next major drilling program at its Horse Well project has been completed, with 13 drill sites approved by the Kokatha people.

“With the successful completion of the heritage survey and subsequent EPEPR, the company will have a very full year ahead in delivering the next stage of the Horse Well exploration program,” CEO Andrew Graham said.

Cohiba is undertaking a multi-million-dollar exploration campaign after drilling at its Horse Well prospect earlier this year encountered rock types typical of an IOCG environment and returned high grades of up to 12.15 per cent copper.

IOCG deposits, like Olympic Dam, can be massive, high grade, and simple-to-process concentrations of copper, gold, and other economic minerals. Olympic Dam is one of the world’s largest deposits of copper, gold, and uranium.

In Queensland, QMines (ASX:QML) is advancing a VMS development at its brownfields Mt Chalmers project.

Mt Chalmers was mined from 1898 to 1982, containing 3.9Mt at 1.15% copper, 0.81g/t gold and 8.4g/t silver for 73,000t of copper equivalent at 1.87% copper.

A resource upgrade was released at the start of December, coming in at 5.8Mt grading 1.7% copper equivalent for 101,000t contained copper equivalent.

Kincora Copper (ASX:KCC), meanwhile, is hunting major porphyry copper and gold occurrences on its Trundle project in the Macquarie Arc of the Lachlan Fold Belt, surrounded by legendary porphyry discoveries like the Northparkes mine and Cadia-Ridgway.

Recent drilling by the company indicates the junior explorer is getting very close to a big porphyry target.

That could be massive. The Trundle Project is said to bear striking similarities to the neighbouring Northparkes mine – Australia’s second-largest porphyry mine.

A copper play abroad

Colombia-focused copper-gold explorer Andean Mining, which will be one of the first IPOs of the new year, is advancing the El Dovio copper-gold project in Colombia, which is a high-grade volcanogenic massive sulphide (VMS) system with grades of up to 17% copper and 104 grams per tonne (g/t) gold.

The project is situated in an extensive belt known to host other polymetallic and VMS prospects and mines throughout western Colombia, Ecuador and beyond.

VMS deposits are rich in base and precious metals like copper, zinc, lead, gold, and silver. Because these deposits tend to cluster together, VMS camps can often be mined for a very, very long time.

Andean aims to list on the ASX in January following the successful completion of its IPO to raise up to $7m.

Over in Chile the ever-spicy Hot Chili (ASX:HCH) is cashed up, fresh off a $33 million placement backed by names as prolific as Glencore, which will allow it to upgrade the mineral resources at its Cortadera copper-gold discovery, advance the prefeasibility study for its broader Costa Fuego project and test several high-priority exploration targets.

Cortadera currently has a resource of 451 million tonnes at 0.46% copper equivalent, within the overall 724Mt at 0.48% copper equivalent resource of the Costa Fuego project.

In Namibia, Noronex (ASX:NRX) is actively accelerating its exploration efforts. That project sits on the highly prospective but underexplored Kalahari Copper Belt which spans parts of Namibia and neighbouring Botswana.

A number of applications were lodged in November over large parts of the area, which would bring the company’s overall holdings to more than 200km of prospective strike length. Big.

Two rigs are currently operational on the Okasewa prospect, having previously drilled the Witvlei project, and results of that drilling are expected over the coming months.

The old ASX copper faithful Sandfire Resources (ASX:SFR) is already a producer. But the company is looking beyond its DeGrussa project in WA to the fertile grounds of Spain, where it acquired the MATSA Mining Complex for some US$1.865 billion this year.

That project could just be the beginning – CEO Karl Simich said in October the company aspired to be a 500,000 tonne per annum copper miner within the next five years.

The company will wrap up DeGrussa in 2022 and open the smaller Motheo copper mine in Botswana the following year.

Local and abroad, other prolific copper exploration names include New World Resources (ASX:NWC), Eagle Mountain Mining (ASX:EM2), West Cobar Metals (ASX:WC1) and Peel Mining (ASX:PEX) – all of whom were quoted in a recent Stockhead copper price story available here.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.