Fe Limited will secure the controlling interest in a mature NT copper-gold project, with the initial focus to be an “early cashflow opportunity” at the ‘Orlando’ open pit.

Fe Limited (ASX: FEL) has inked a binding deal to acquire a 60% interest in the exploration assets of Gecko Mining Company (GMC) in the highly prospective Tennant Creek region of the Northern Territory in a cash and share deal.

FEL will also pay the first $10m of JV expenses incurred.

This package covers ~ 240 km2 in the highly prospective, high-grade Gecko – Goanna copper gold corridor which has historically produced more than 5.5 million ounces of gold @19.3 g/t and 488kt copper at 2.9%.

The Tennant Creek project is composed of three high grade copper and gold mineral resources — Orlando, Gecko and Goanna –historically defined under the JORC 2004 code.

While these numbers will have to be verified to bump it up to JORC 2012 standard, in FEL’s view there is no reason the existing historic resource estimates – totalling 122,000t copper and 145,000oz gold – would not be reliable.

Near term copper gold production

Potential for near term production exists from a cut back of the Orlando pit prior to underground development, initially at Orlando, followed by the Gecko and Goanna underground projects.

There are several options available for third party processing, the company says, which would lower initial capex costs.

Importantly, previous internal conceptual studies have shown positive economics based on lower pricing assumptions to current assumed commodity spot prices.

In the current and forecast pricing environment with commodity prices firming considerably since those studies, the company believes the Tennant Creek project offers a significant opportunity to enter the battery and precious metals space.

Big exploration upside

These initial resources are just the start.

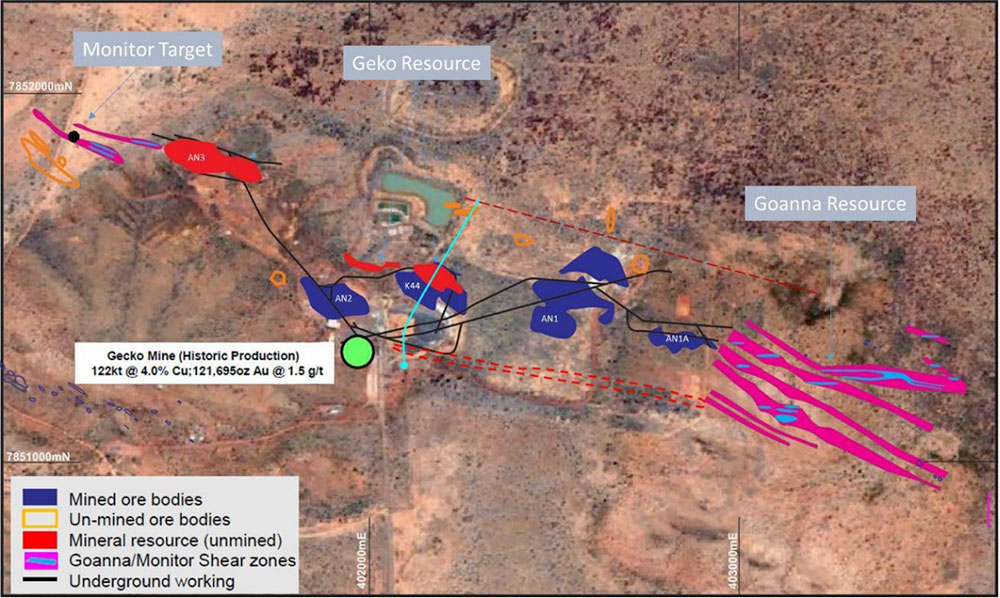

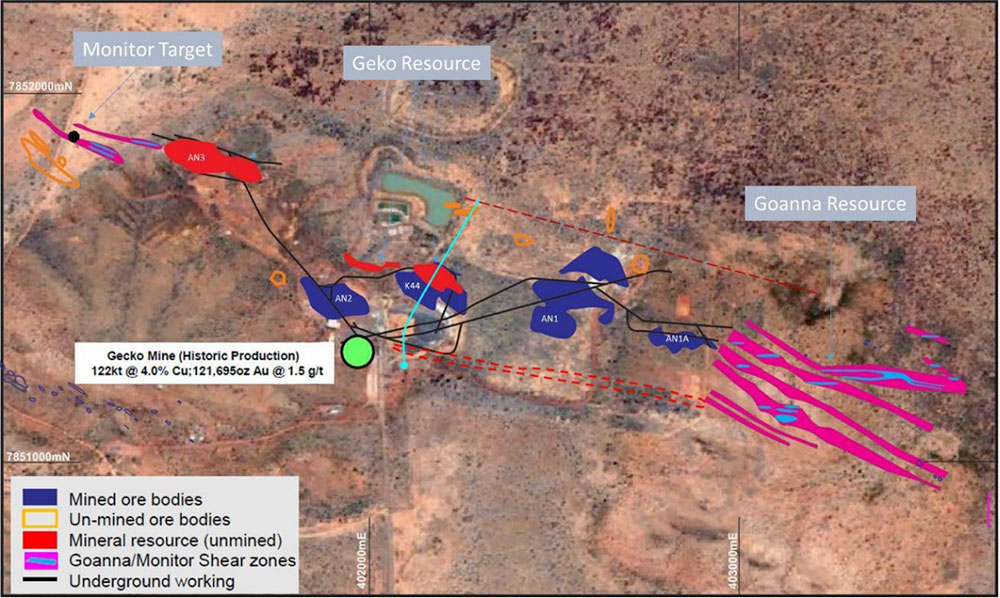

Several advanced copper-gold targets have already been identified within the mineralised Gecko – Goanna corridor, in addition to down dip and along strike extensions to existing resources.

The figure below shows the Gecko – Goanna corridor with unmined targets against mined ore bodies:

FEL anticipates additional drilling will be required along strike and down dip to validate the existing data as well as define the extent of mineralisation prior to estimation.

FEL intends to conduct this follow up drilling after assessment and development (if applicable) of early production operations at Orlando for cash flow generation in the short term.

“Mature copper / gold assets are hard to find in today’s market given the attractive thematic for those commodities, particularly for copper with its connection into the battery metals space,” FEL exec chairman Tony Sage says.

“The work that’s been done by since on the GMC ground since the project was acquired from Evolution Mining Ltd in 2020 has identified some interesting opportunities for us to evaluate with the potential to fast-track production.

“We are pleased to identify this opportunity to diversify our commodity exposure to supplement our high-grade iron ore at Wiluna and our other NT iron ore project Yarram, which is located just over 100km from Darwin port, which presents the opportunity for it to host a low-cost operation.”

This article was developed in collaboration with Fe Ltd, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

You might be interested in