Making the grade: What to look for in gold and silver drilling results

Pic: Getty

High-grade drilling results make headlines. But what makes good grades across key commodities and what other factors should investors consider?

We’ll start this explainer series by focusing on gold and silver results, which are reported in grams per tonne (g/t).

Gold

At current gold prices (about A$2,500 per ounce at the time of writing) grades of 1g/t make an open cut project viable, while anything over 5g/t is considered high grade. Depending on the scale of underground mines, 4g/t can be viable.

Gold and silver are priced on international markets in troy ounces and there are 31.1 grams in a troy ounce. Therefore, a project with average grades of 1g/t will contain approximately A$80.38 (1/31.1 x A$2,500) per tonne of ore, before all costs.

Silver

Silver mines’ grades in 2020 were about 125g/t on average, with silver priced at approximately A$31 at the time of writing.

This gives silver miners $124.60 per tonne (125/31.1 x 31) of throughput, on average before all costs.

But that average would be higher at projects such as Silver Mines’ (ASX:SVL) Bowdens project, which has often recorded grades of over 1000g/t with current drilling consistently 300-500g/t.

As with other precious metals projects, additional metals have been found, with results from Bowdens in the Mudgee region of NSW showing above average zinc grades of 4-6% (based metal results are expressed as percentages), as well as gold, silver and lead. A recent example includes:

14.2 metres @ 374g/t silver equivalent (36g/t silver, 4.86% zinc, 2.35% lead and 0.23g/t gold) including:

4.6 metres @ 694g/t silver equivalent (72g/t silver, 8.76% zinc, 4.40% lead and 0.49g/t gold).

Average grades, length and depth

A tip for investors therefore is to consider a company’s average grades and look for drill cores that “start and end in mineralisation” rather than buying shares on just one excellent drill core result, as well as the scale of the deposit.

A useful method to consider this is to work out grams x metres.

For example, one company may report a bonanza grade of 50g/t over 4 metres, equalling 200 gram-metres.

However, another may report 2g/t over 300 metres, which works out to 600 grams-metres.

Price forecasts

What is the outlook for the metal price among industry analysts? And what forecast price has the company used in its feasibility study or its own outlook?

Prices of both gold and silver are forecast to rise next year. Meanwhile advances in mining and metals processing are making it more economical to refine lower-grade material that was previously left in the ground.

Location and Operating cost benefits

Nick Saunders, managing director of mining data comparison website Opaxe, says a project in an established mining area, such as Queensland or the Central NSW, has access to transport, processing facilities and other infrastructure. This could make a project with lower grade drill results more attractive overall than another in, say, central Australia.

‘Nearology’

Related to location is the concept of ‘nearology’, which suggests the chances of having repetitions of nearby deposits are high given that the geology and history of mineralisation is similar. This can be seen in the WA Goldfields, where infrastructure has been built up to support multiple mining projects.

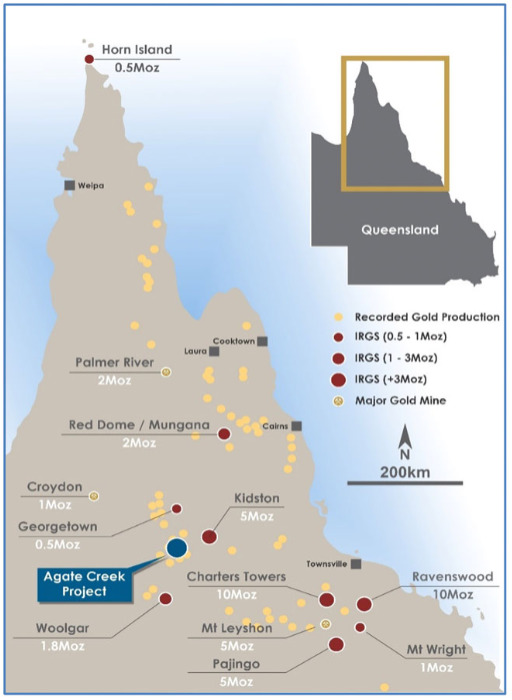

Another is Laneway Resources’ (ASX:LNY) Agate Creek. This gold project is only 60km west of the world class intrusion-related gold system (IRGS)

Kidston deposit, which averaged production of 200,000-300,000oz of gold each year for more than four and a half decades.

Takeover potential

Is the company a potential takeover target for a bigger player that could offer a windfall for shareholders?

To discover and develop a large resource in a safe jurisdiction typically takes between five to 15 years and costs millions of dollars. Therefore major miners, to replace their own mined reserves, seek to acquire developers and early-stage producers in safe jurisdictions.

This is a possibility for Big River Gold (ASX:BRV), given its large-scale Borborema project is in mining-friendly Brazil where heightened interest in the gold sector is driving some big mergers and acquisitions action.

Share prices of the target company generally spike, while those of the acquiring company can dip in the short term but rise in the longer term.

Company team

Lastly, Saunders said it’s always useful to assess the track record and experience of the management teams behind each company.

In the case of overseas projects, it’s also worthwhile checking that the team has experience in that particular country or region.

This article was developed in collaboration with Big River Gold, Laneway Resources and Silver Mines, Stockhead advertisers at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.