You might be interested in

Mining

Reporting Rodeo: Here's how analysts think the ASX's big miners will shape up in March quarter reporting season

Mining

Here's why lower smelter prices spells opportunity for ASX zinc explorers

Mining

Mining

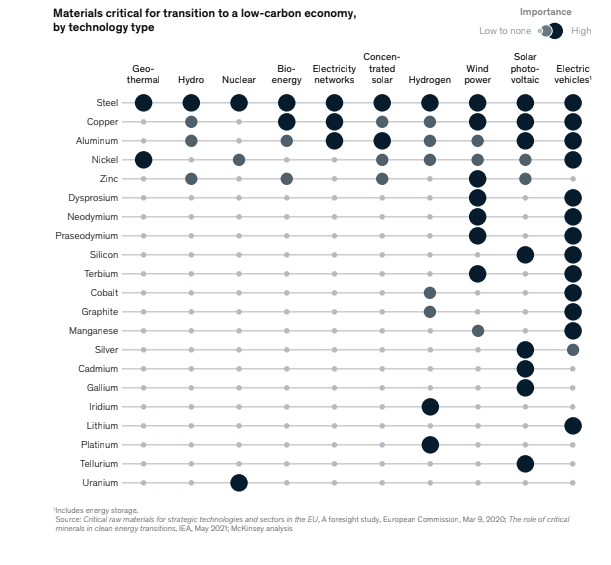

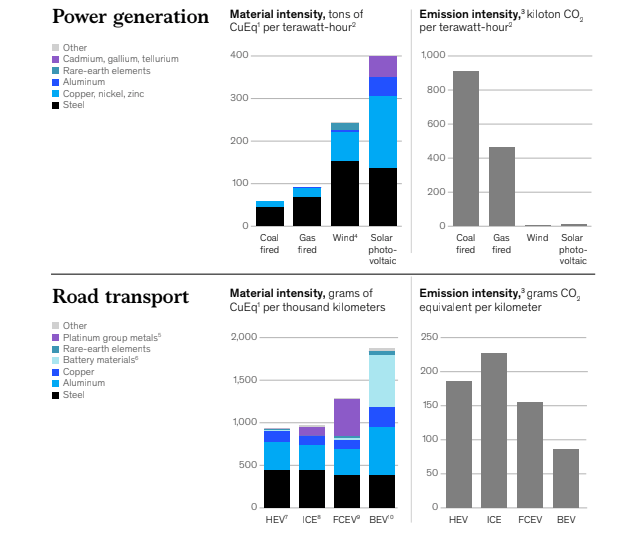

The rush towards net zero is expected to be metal-intensive, with raw materials such as lithium, cobalt, nickel, copper and zinc set to play a critical role as the world moves towards cleaner technologies.

Climate commitments made in Glasgow at COP26 last year has made reducing emissions a core principle for business, but the reality is these commitments are outpacing supply.

While companies around the world continue to embrace the pressure to decarbonise, it is clear metal and mining companies face a unique task – supply the critical materials needed to drive the massive technological transition ahead.

According to McKinsey & Company, requirements for additional supply will come not only from large-volume raw materials — for example, copper for electrification and nickel and lithium for battery EVs, which are expected to see significant demand growth – but also from niche commodities.

These commodities include things like tellurium for solar panels, and neodymium for the permanent magnets used both in wind power generation and EVs.

“Some commodities – most notably, steel — will also play an enabling role across technologies requiring additional infrastructure,” the management consulting firm said.

“The required pace of transition means that the availability of certain raw materials will need to be scaled up within a relatively short time scale — and, in certain cases, at volumes 10 times or more than the current market size — to prevent shortages and keep new-technology costs competitive.”

Like low-rise jeans, zinc is sometimes less fashionable than other metals, but while its primary application is in galvanising steel with heavy uses in infrastructure, it too has a critical part to play in the pathway towards decarbonisation.

Michael Jardine, the managing director of ASX-listed zinc company Ironbark (ASX:IBG) says as we cast our eyes forward, there are four key areas outside the non-traditional markets where zinc will come in handy.

“Wind turbines rely heavily on zinc coating to protect against rust and corrosion – it also helps to keep moisture from reaching the base metal and by doing so, prolongs the life span and maintains structural integrity,” he says.

A high amount of zinc also goes into new solar photovoltaic technology, Jardine explains, where zinc oxide is used to achieve greater solar-cell efficiency through increased energy conversion.

Zinc air batteries, while not currently produced at scale, will prove to be a major source of growth going forward with its advantages for grid-scale batteries, he says, as they are five times cheaper than lithium-ion and more stable.

“You occasionally hear of lithium-ion over hearting and catching fire,” he said.

Canadian start up Zinc8 says its zinc-air hybrid flow battery “uses electricity from the grid to split the chemical zincate (ZnOH4) into zinc, water and oxygen, resulting in charged zinc particles that can store electricity for weeks at a time.”

“When electricity is required, the charged zinc is combined with oxygen from the air (and water), releasing the stored electricity and producing zincate, which is then cycled back to begin the process again,” the company said.

The zinc can be stored for months in the electrolyte and these particles are then pumped to the power stack when required, via a proprietary pumping mechanism designed and built in-house, where the charge is extracted and delivered to the grid.

And agriculture, Jardine says, is another key area, particularly for use in low yield areas.

“Adding zinc to the soil increases the yields and at the moment, India is one of the largest producers of zinc in various forms and is importing zinc in other forms such as fertilisers and adding it to low yield agricultural land which is having really positive impacts,” he said.

“It is a small market today, about 100,000 tonnes of zinc per annum is used for agriculture purposes but that’s in a global market of about 14 million tonnes.

“This area is roughly doubling each year, so 100% growth is very rapid especially considering that the overall growth of zinc market is growing at about 3% per year currently.”

Variscan’s (ASX:VAR) CEO Stewart Dickson said it is zinc’s use in renewable energy tech that is particularly important.

“We are seeing the application of zinc coatings being critical as renewables become a more crucial part of the energy mix and as more people become conscious about the cost and supply of energy,” he said.

“People are beginning to recognise the importance of zinc for the future, most notably in the US with the Biden administration talking about a $2 billion infrastructure bill and with it being classified as a critical metal in 2019 in the US and Canada.”

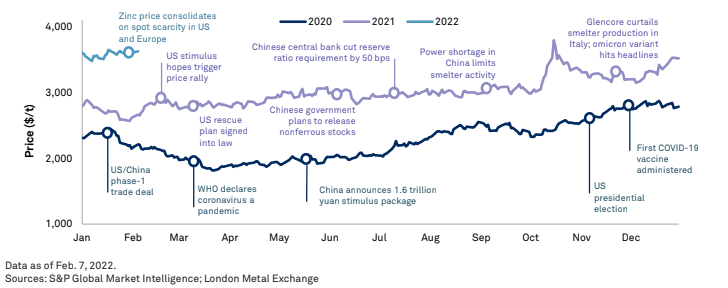

But another eye-catching trend is the price, which according to S&P Global Market Intelligence was up 31.2% year over year in January to $3,581 per tonne as tight supply countered subdued Chinese demand, and inflation concerns elsewhere fuelled expectations for interest rate rises.

The price of zinc on the London Metal Exchange hit a 14-year high in October last year and remains around that price.

“One can assume that supply is going to remain constrained and new projects are not coming online quick enough – so there is not enough mine development in the pipeline,” Dickson said.

“It is clear zinc will be in deficit this year and possibly into next year.”

That is, once again, against a backdrop of demand which is likely to rise as the world continues to transition to a low carbon economy, he says.

S&P Global Market Intelligence says manufacturing activity in the US and Europe remain in expansionary territory despite the global chip shortage weighing on auto production and sales.

“With the US Federal Reserve likely to raise interest rates in 2022 to curb inflation and the government ramping up infrastructure spending, the conflicting macroeconomic drivers are expected to result in US refined zinc demand growing 2.3% in 2022 and 2.6% in 2023,” the research firm says.

It says the price forecast for European refined zinc have slightly reduced, “with growth at 2.1% in 2022 after the European Central Bank, or ECB, announced it will taper asset purchases starting in the March quarter”.

Over the last two years, Altamin (ASX:AZI) managing director Geraint Harris says a number of different factors have contributed to the price increase, including shut downs in South America, industrial demand from China, and in the last three to four months the signal of shut downs from smelters due to the European energy hike.

While at multi year highs, the zinc price is nowhere near record boom highs of $4,603, which was last achieved back in November 2006.

But S&P Global Market Intelligence says it expects the zinc price forecast to average $3,320/t in 2022, “with an accompanying deficit of 331,000 tonnes, given Chinese economic weakness toning down demand, inflationary headwinds and stressed refined zinc supply.”

“Although we foresee the nearest surplus emerging in 2025, supply could still underperform given the joint effect of China’s long-term goal of decarbonisation and a dearth of European zinc projects.”

Across 2023-26, it is estimated the zinc price will average $2,961/t, 29.9% higher than the average 2010-20 price.

Here are some ASX small cap explorers that have exposure to zinc.

Ironbark owns the Citronen Zinc-Lead Project in northern Greenland, one of the world’s largest undeveloped zinc-lead resources with a resource of more than 13 billion pounds of contained zinc and lead metal.

Citronen’s 2021 bankable feasibility study (BFS) highlights the project’s post-tax NPV8 of US$363 million, a mine life of 20 years and post-tax-free cash flow of US$1.46 billion.

The project is highly advanced, having completed all feasibility studies along with resource and reserve drilling and about 70% of off-takes committed, Jardine says.

“The majority of permitting has been successfully navigated so far and we are now in the process of raising development capital.”

“That is something we did a lot of work on in 2021 and continue to focus on in 2022. It is difficult for me to say when that process will complete but when we do start building the project it will likely take three years of construction with a mine life planned for 20 years.”

He said that will certainly be pushed out much longer – to around 30 to 40 years potentially.

“We’ve had our project stamped as strategic by US government, the time is right for us, the supply demand forecast is really positive, I don’t believe there are enough new projecs coming online and the world is going to need more zinc, alongside more of the other things – more of everything,” Jardine says.

AZI owns the Gorno Zinc Project in northern Italy, right in the country’s industrial heartland, Harris says.

A scoping study was completed on the project in November 2021, with an estimated total production target of 6Mt containing 77% indicated and 23% inferred mineral resources. Harris says planned drilling programs will most likely extend the current mine life beyond the nine-year period.

Positive financial metrics include a post-tax net present value (NPV) of around US$211m ($288M), a post-tax internal rate of return (IRR) of around 50%, and a payback period of 3.5 years from final investment decision and 2.5 years from first concentrate production.

Ongoing metallurgical test-work and flowsheet design will target processing performance, equipment sizing, maximising metallurgical recoveries and optimising concentrate economics.

VAR owns two zincs focused projects in Spain – its flagship Novales-Udias project, where the San Jose Mine resides, and Guarjaraz.

Both projects are former producing assets, Dickson says, with the company currently undertaking phase-2 underground drilling activities at San Jose.

“The phase-1 campaign last year was enormously successful with eye-catching grades and new discoveries of lower ore bodies, and what we are doing now is expanding that and moving to understand what we potentially have there and what that means for potential restart opportunities,” he said.

In may last year, shares jumped as much as 211% after assay results from underground drilling revealed new zinc-rich mineralised lenses below the main gallery at San Jose Mine, which Dickson said was a major development considering it had received barely any drilling to test for low-lying lenses.

Most recently, VAR intersected new zones of high-grade zinc at San Jose in December of up to 8m at 20.17%, including 5m at 24.92% where Dickson said results were “exceptionally encouraging”.

CZL’s Piomosas Zinc Project spans more than 3,000 hectares in the northern Mexican state of Chihuahua, 350km from Mexico’s border with Texas.

During its latest quarterly report, the company said production was “significantly impacted” by a range of several incidents, including a group of armed bandits entering the Plomosas mine, “taking the security guard and employees at Plomosas captive and locking them in a sea container.”

The armed bandits stole around 90 tonnes of zinc and lead concentrates valued at ~US$90,000, CZL said.

Despite this, around 5,099t of ore was mined and 4,592t of ore was processed at 13.4% zinc, 7.1% lead, and 40.6g/t silver.

CLZ said 918 tonnes of zinc concentrate, and 277 tonnes of lead concentrate were also sold during the quarter.

NCZ owns the Century Mine about 250km northwest of Mount Isa where operations recommenced in August 2018.

After acquiring the project in 2016, NCZ undertook an economic rehabilitation plan to upgrade the existing infrastructure.

In January 2021, the company delivered half a million tonnes of zinc, which it claimed as a “significant achievement.”

Towards the end of 2021, NCZ carried out a second major, long-term zinc hedging transaction with Macquarie Bank at a fixed price for a total of 90,000t of payable zinc spread in equal monthly volumes of 3,750t over two years from January 1, 2022, to December 31 2023.

“The total value of hedging represents more than $650 million in forecast future sales from the current Century Mine tailings operations,” the company said.

Other players include Zinc of Ireland (ASX:ZMI), South32 (ASX:S32), Orion Minerals (ASX:ORN), and Zenith Minerals (ASX:ZNC).