Copper, zinc or iron ore: Which one performs best in 2022?

Pic: Tyler Stableford / Stone via Getty Images

Commodity prices rebounded hard in 2021, and the metals and mining sector benefitted. That trend looks set to continue into next year, according to S&P Global’s The Big Picture: 2022 Metals and Mining Industry Outlook report.

Rising demand for most mining commodities has created robust conditions for producers and explorers; conditions that S&P expects will persist in 2022, and in some cases, beyond.

“While we anticipate that metals prices will slip somewhat in 2022 from their current highs, medium-term supply constraints are setting the stage for historically above-average prices through to 2025 — driven mostly by increasing demand for materials used in the accelerating global energy transition,” it says.

“The supply constraints are expected to persist despite intensive exploration efforts, which we forecast to expand further in 2022.”

The report also flagged that few exploration discoveries will be developed in time to meet medium-term supply requirements.

“Faced with persistent if moderating demand, the industry is set up for a period of sustained growth,” they said.

Iron ore decarbonisation curbs Chinese steel production

Principal analyst Ronnie Cecil said that China’s intensified decarbonisation drive has applied the brakes to Chinese steel production in the second half of 2021, with negative implications for iron ore demand and prices.

“The Chinese steel sector, which accounts for an estimated 15% of the country’s carbon emissions, aims to reach peak emissions by 2025 and to achieve a 30% reduction from the peak by 2030,” he said.

“Chinese steel output fell for the third consecutive month in August. While this has dampened steel output growth year-to-date, pig iron production has slowed more acutely.”

Cecil said the supply constraints have buoyed domestic steel prices and – coupled with the recent drop in iron ore prices – led to a spike in Chinese steel mill profit margins in September.

“Chinese iron ore imports in the first eight months fell 12.5 million tonnes year over year, with higher shipments from Brazil and lower shipments from Australia as the country reduces its reliance on Australian commodities,” he said.

“Over the coming years, China’s decarbonisation push is expected to cause blast furnace closures, leading us to forecast an 18 million-tonne reduction in Chinese pig iron output in 2020-22.

“Demand for high-grade iron ore is expected to benefit from the decarbonisation push, due to the lower impurities and correspondingly higher productivity that it offers.

“Lower impurity iron ore consumes less coke and therefore emits less carbon. This is expected to benefit the direct-feed iron ore products, pellet and lump, and reinforce the premiums for high-grade iron ore.”

ESG hurdles could delay mine projects

“The recovery in ex-China steel production is also expected to moderate going into 2022, as surging power prices prompt electric arc furnace-based steel producers to reduce output,” Cecil said.

“We expect global seaborne iron ore supply growth to struggle, with few mine capacity additions in the pipeline.

“Rising environmental, social and governance hurdles could also potentially delay mine replacement projects in Australia and planned restarts in Brazil.

“The combination of underlying market tightness, potential supply disruptions and project delays, global supply chain issues and power constraints is likely to fuel increased iron ore price volatility into 2022.”

Major stocks to watch in 2022: FMG (ASX:FMG), BHP (ASX:BHP), and Rio (ASX:RIO).

Copper and zinc prices set to rise

Copper and zinc prices have soared in October, due to curtailed production of refined copper and zinc amid power shortages in China.

But according to S&P senior analyst Aline Soares and associate commodity analyst Mitzi Sumangil, the energy crisis may take some time to resolve, sustaining elevated copper and zinc prices – and it could negatively impact economic growth in 2022.

“On the supply side, mined copper output is expected to rise to 23.8 Mt in 2022 from 21.2 Mt in 2020, relieving tightness in the concentrate market,” they said.

“The industry still faces a big challenge, however, as our production forecasts for operating mines do not account for any ESG-related disruptions — an important factor that has affected mines, mainly in Chile where a water shortage has constrained output at some operations.”

Copper demand bolstered by electrification

The analysts said that refined copper output growth will lag refined copper demand in 2021-25.

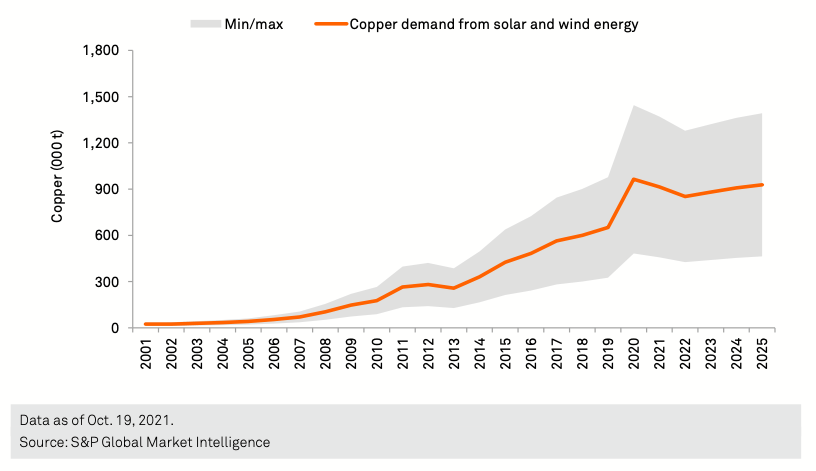

“With its significant use in solar photovoltaic panels, wind power generation and electric vehicle production, copper will be the key beneficiary of the energy transition,” Soares and Sumangil said.

“We forecast global copper demand from solar and wind energy generation to reach 852,000 tonnes in 2022 and the growing electric vehicle market to account for 1.1 Mt in 2022.

“In addition, we expect rising demand due to expanding electrification infrastructure and upgrades to telecommunications infrastructure, particularly in China and the US.”

Few new zinc mines expected to come online

Zinc is used in renewables to protect against corrosion, and Soares and Sumangil said there may be some advancements in the zinc energy battery storage space.

“These advancements are still subject to the challenges of lower life cycle and rechargeability compared with lithium-ion batteries,” they said.

“The zinc price will remain elevated, however, with fewer mines expected to start up in 2022-25 — especially in China, where mined zinc is estimated to decline to 3.8 Mt within the forecast period.”

Copper and zinc stocks to watch in 2022: South32 (ASX:S32), OZ Minerals (ASX:OZL), Sandfire Resources (ASX:SFR), Aeris Resources (ASX:AIS), and Hot Chili (ASX:HCH).

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.