High Voltage: All the news driving battery metals stocks

Pic: Tyler Stableford / Stone via Getty Images

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Scroll down for a table showing the recent performance of 200 ASX battery metal stocks >>

INDUSTRY FOCUS

Chinese battery firm GEM has stopped buying cobalt from Glencore, as the price has fallen below that agreed in a three-year deal between the two companies. (Graphic courtesy of Reuters) #cobalt #commodities #resources #mining #china #metals #EV pic.twitter.com/bIziRpT5TW

— Gavin Wendt (@MineLifeReport) December 14, 2018

Cobalt spot prices are in the doldrums — and Chinese battery maker GEM is no longer buying from miner Glencore because of it.

This is because the market price has fallen below the agreed level under a contract signed when cobalt was peaking earlier this year.

Vanadium prices are settling down – and hopefully stabilising — with consultancy Mastermines reporting a Chinese spot price of $US19.50/lb for V2O5 flake, down from a recent peak of about $US37/lb.

And lithium prices have held up in the second half of the year – despite all the nay-saying, according to Benchmark Minerals Intelligence.

After the Q2 2018 drop, lithium prices have held up. Also reflected in average industry contract prices. @benchmarkmin pic.twitter.com/21nHEpz7KC

— Simon Moores (@sdmoores) December 16, 2018

Transforming Australia into a major battery hub

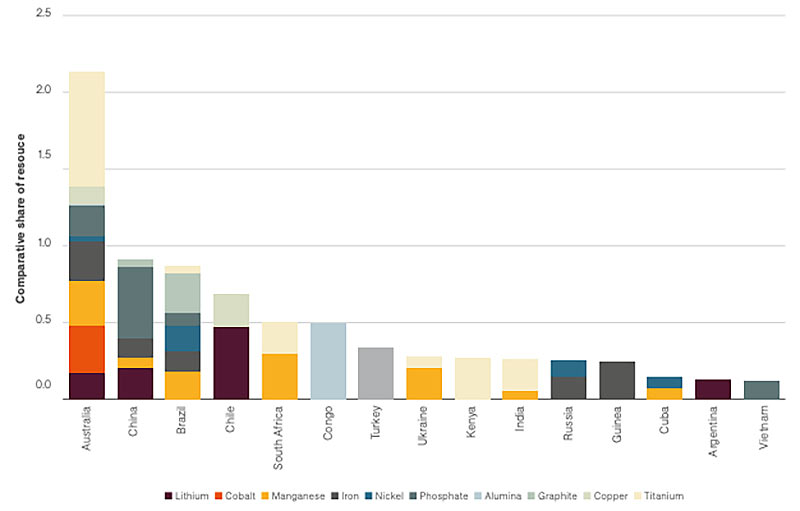

Many believe that booming global demand for lithium-ion batteries gives Australia a “once in a generation” opportunity to become a major battery processing, manufacturing and trading hub – but it needs to get a move on.

Australia has all the raw materials needed to produce batteries.

This potentially gives the country “significant global supply-chain advantages”, a new Australian Trade and Investment Commission (Austrade) report says.

According to Future Smart Strategies, Australia earns only $1.13 billion, or 0.53 per cent of ultimate value of its exported lithium ore.

An estimated $213 billion of value is added overseas through electro-chemical processing, battery cell production, and product assembly.

The Austrade report says critical components in advanced battery production — precursor, anode, cathode, electrolyte — can be made here.

But the critical gap in the supply chain is Australia’s lack of battery manufacturing technology, which is why we need one of the world’s big battery cell manufacturers to set up shop Down Under.

Austrade reckons we need to do this through incentives.

- Subscribe to our daily newsletter

- Bookmark this link for small cap news

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

A $2 billion 15GWh gigafactory in Townsville is already being developed by an international consortium called Imperium3, led by Boston Energy and Innovation, graphite company Magnis Energy Technologies (ASX:MNS), and US company Charge CCCV.

Magnis investor relations director Travis Peluso says labour costs will be “miniscule” for a large-scale Australian lithium ion battery maker, with raw materials like lithium, cobalt, manganese, and graphite usually making up 80 per cent of the cost.

With a project of Imperium3’s scale and size, labour costs are a very small portion of the overall cost of producing a battery cell, he says.

“The labour cost component in [battery] manufacturing is miniscule,” he says.

“It’s certainly under two per cent, probably closer to one per cent of the cost.”

Labour costs are one of the key barriers to entry for large scale manufacturing in Australia, but in battery-making a high level of automation takes care of much of the process.

“When you look at the cost of producing a battery cell, around 80 per cent of the cost is in those raw materials,” Mr Peluso says.

“There are cost advantages in sourcing those raw materials, like lithium, locally.”

SMALL CAP SPOTLIGHT

Over the past 12 months only 30 stocks have come out ahead, with Argentina-focused explorer Galan Lithium (ASX:GLN) and China Magnesium (ASX:CMC) two standouts up 204 per cent and 114 per cent over the year.

Vanadium explorers Tando (ASX:TNO), Technology Metals (ASX:TMT), and Australian Vanadium (ASX:AVL) also performed well, up 76 per cent, 70 per cent, and 55 per cent respectively over the past year.

Change of plans — @NorthernCobalt will now look at drilling the Running Creek #copper #cobalt prospect ASAP — even during the wet season, when a lot of exploration programs go into hibernation #ASX #ausbiz $N27 https://t.co/WMYfsVBj01

— Stockhead (@StockheadAU) December 14, 2018

It’s been a slightly better week in the lead-up to Christmas for battery metals-facing stocks on the ASX.

Of the ~200 battery metals stocks on our list, about 67 lost ground, 58 were ahead and 64 were steady.

This week’s standout performers included Metals Australia (ASX:MLS) up 33 per cent to 0.4c, TNG (ASX:TNG) up 29 per cent to 12c, and High Grade Metals (ASX:HGM) up 27 per cent to 1.4c.

But Northern Cobalt (ASX:N27) topped the charts, up 38 per cent to 9c.

On Friday, Northern Cobalt told investors its “Running Creek” prospect had become a priority target after an IP survey identified what could be a huge copper and cobalt deposit at depth.

Investors loved the news, sending the explorer up almost 30 per cent to 8.5c by midday.

Induced Polarisation (IP) is a geophysical method used to identify the electrical chargeability of minerals below the earth’s surface, which helps explorers focus their drilling programs.

Northern Cobalt managing director Michael Schwarz told Stockhead the company had changed its plans and would drill Running Creek as soon as possible.

“We are pretty excited about this anomaly because it seems to be [directly linked] to the [existing] copper and cobalt mineralisation,” he said.

“The mineralisation could be both deeper and of a larger scale than we had previously thought.”

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| ASX Ticker | Company Name | One Week Price Change | 12 Month Price Change | Current Price (Mon Intraday) | Market Cap |

|---|---|---|---|---|---|

| WML | WOOMERA MINING | 0 | -91.9 | 0.081 | 9.1M |

| MTC | METALSTECH | 11.11111111 | -89.65517241 | 0.03 | 3.5M |

| WCN | WHITE CLIFF MINERALS | -7.142857143 | -89.51612903 | 0.013 | 3.0M |

| PNN | PEPINNINI LITHIUM | -16.66666667 | -88.37209302 | 0.005 | 3.4M |

| KLH | KALIA | 0 | -86.66666667 | 0.002 | 5.0M |

| RLC | REEDY LAGOON | 0 | -84.21052632 | 0.006 | 2.4M |

| FCC | FIRST COBALT | -9.090909091 | -83.7398374 | 0.2 | 67.9M |

| MEI | METEORIC RESOURCES | 0 | -81.53846154 | 0.012 | 6.9M |

| MRR | MINREX RESOURCES | 0 | -80 | 0.02 | 1.9M |

| LML | LINCOLN MINERALS | 0 | -80 | 0.007 | 4.0M |

| MTH | MITHRIL RESOURCES | 20 | -80 | 0.006 | 2.0M |

| N27 | NORTHERN COBALT | 38.46153846 | -79.54545455 | 0.09 | 4.2M |

| CRL | COMET RESOURCES | 3.703703704 | -79.25925926 | 0.028 | 6.5M |

| BSX | BLACKSTONE MINERALS | -25 | -79 | 0.105 | 11.5M |

| NWC | NEW WORLD COBALT | -20.83333333 | -78.16091954 | 0.019 | 10.6M |

| PSM | PENINSULA MINES | 0 | -77.77777778 | 0.004 | 3.0M |

| RIE | RIEDEL RESOURCES | 20 | -77.5 | 0.018 | 7.5M |

| ADV | ARDIDEN | 0 | -76.47058824 | 0.004 | 7.5M |

| EUC | EUROPEAN COBALT | -2.222222222 | -76.21621622 | 0.044 | 33.5M |

| MQR | MARQUEE RESOURCES | -11.42857143 | -76.15384615 | 0.062 | 2.7M |

| 4CE | FORCE COMMODITIES | 14.28571429 | -76.11940299 | 0.016 | 6.8M |

| PUR | PURSUIT MINERALS | -3.333333333 | -75.83333333 | 0.029 | 3.9M |

| GPP | GREENPOWER ENERGY | 0 | -75 | 0.004 | 5.5M |

| CLQ | CLEAN TEQ HOLDINGS | 2.564102564 | -73.94136808 | 0.4 | 294.8M |

| CCZ | CASTILLO COPPER | -11.11111111 | -72.88135593 | 0.016 | 11.5M |

| DHR | DARK HORSE RESOURCES | 0 | -72.22222222 | 0.005 | 9.9M |

| SUH | SOUTHERN HEMISPHERE | 0 | -71.875 | 0.045 | 4.0M |

| HGM | HIGH GRADE METALS | 27.27272727 | -70.83333333 | 0.014 | 6.3M |

| SI6 | SIX SIGMA METALS | 0 | -70.58823529 | 0.005 | 2.3M |

| TKM | TREK METALS | 14.28571429 | -70.37037037 | 0.008 | 2.5M |

| BMT | BERKUT MINERALS | -10 | -70 | 0.072 | 3.9M |

| LRS | LATIN RESOURCES | 0 | -70 | 0.003 | 8.6M |

| INF | INFINITY LITHIUM | -13.88888889 | -68.20512821 | 0.062 | 11.8M |

| AMD | ARROW MINERALS | 7.692307692 | -68.18181818 | 0.014 | 4.4M |

| LPD | LEPIDICO | 0 | -67.34693878 | 0.016 | 53.7M |

| BGS | BIRIMIAN | -2.5 | -66.94915254 | 0.195 | 46.7M |

| BAT | BATTERY MINERALS | 4.545454545 | -66.66666667 | 0.023 | 24.5M |

| CAD | CAENEUS MINERALS | 0 | -66.66666667 | 0.001 | 14.1M |

| CDT | CASTLE MINERALS | 11.11111111 | -66.66666667 | 0.01 | 2.2M |

| COB | COBALT BLUE | -2.325581395 | -65.2892562 | 0.21 | 26.8M |

| JRV | JERVOIS MINING | 17.5 | -65.18518519 | 0.235 | 51.4M |

| SRN | SUREFIRE RESOURCES | 20 | -64.70588235 | 0.006 | 2.6M |

| CUL | CULLEN RESOURCES | 4.761904762 | -64.51612903 | 0.022 | 3.1M |

| PGM | PLATINA RESOURCES | 11.11111111 | -63.63636364 | 0.06 | 15.8M |

| AVZ | AVZ MINERALS | -5 | -62.92682927 | 0.076 | 145.4M |

| CZN | CORAZON MINING | 20 | -62.5 | 0.006 | 7.6M |

| THX | THUNDELARRA | -13.33333333 | -61.76470588 | 0.013 | 8.3M |

| LI3 | LITHIUM CONSOLIDATED | 4.838709677 | -61.76470588 | 0.065 | 5.7M |

| MZN | MARINDI METALS | 0 | -61.53846154 | 0.005 | 11.9M |

| AZI | ALTA ZINC | 0 | -61.53846154 | 0.005 | 6.8M |

| RMX | RED MOUNTAIN MINING | 0 | -61.11111111 | 0.007 | 5.4M |

| MCT | METALICITY | 0 | -60 | 0.016 | 9.6M |

| ARL | ARDEA RESOURCES | -5.172413793 | -59.8540146 | 0.55 | 56.7M |

| SYR | SYRAH RESOURCES | 6.5830721 | -59.33014354 | 1.7 | 594.4M |

| SYA | SAYONA MINING | -18.18181818 | -59.09090909 | 0.018 | 30.9M |

| PSC | PROSPECT RESOURCES | -4.166666667 | -58.18181818 | 0.023 | 47.1M |

| CFE | CAPE LAMBERT RESOURCES | 0 | -58.13953488 | 0.018 | 18.2M |

| THR | THOR MINING | 16.66666667 | -57.57575758 | 0.028 | 20.1M |

| AUZ | AUSTRALIAN MINES | 0 | -57.29166667 | 0.041 | 115.3M |

| CGM | COUGAR METALS | 0 | -57.14285714 | 0.003 | 2.9M |

| NVA | NOVA MINERALS | -9.090909091 | -56.52173913 | 0.02 | 15.5M |

| CNJ | CONICO | 0 | -56.09756098 | 0.018 | 6.3M |

| DEV | DEVEX RESOURCES | 7.142857143 | -55.44554455 | 0.045 | 4.1M |

| VMS | VENTURE MINERALS | 0 | -55.31914894 | 0.021 | 10.9M |

| AJM | ALTURA MINING | -5.405405405 | -52.05479452 | 0.175 | 327.7M |

| LPI | LITHIUM POWER | -7.407407407 | -51.92307692 | 0.25 | 64.3M |

| EMH | EUROPEAN METALS | -10.81081081 | -51.47058824 | 0.33 | 49.9M |

| OKR | OKAPI RESOURCES | -2.272727273 | -50.57471264 | 0.215 | 7.4M |

| LKE | LAKE RESOURCES | -3.157894737 | -50.27027027 | 0.092 | 32.9M |

| CZR | COZIRON RESOURCES | -8.333333333 | -50 | 0.011 | 19.6M |

| SGQ | ST GEORGE MINING | 0 | -50 | 0.14 | 40.2M |

| SCI | SILVER CITY MINERALS | 0 | -50 | 0.014 | 3.4M |

| SBR | SABRE RESOURCES | 0 | -50 | 0.007 | 2.8M |

| MTB | MOUNT BURGESS | 0 | -50 | 0.005 | 2.2M |

| BDI | BLINA MINERALS | 0 | -50 | 0.001 | 4.4M |

| TAR | TARUGA MINERALS | -7.407407407 | -49.49494949 | 0.05 | 7.1M |

| LIT | LITHIUM AUSTRALIA | 1.052631579 | -49.47368421 | 0.096 | 43.6M |

| MLM | METALLICA MINERALS | 0 | -49.09090909 | 0.028 | 9.0M |

| KTA | KRAKATOA RESOURCES | 4 | -49.01960784 | 0.026 | 3.1M |

| INR | IONEER | -5.555555556 | -47.69230769 | 0.17 | 264.6M |

| BYH | BRYAH RESOURCES | -9.183673469 | -47.64705882 | 0.089 | 5.4M |

| CAZ | CAZALY RESOURCES | 9.523809524 | -46.51162791 | 0.023 | 5.3M |

| TKL | TRAKA RESOURCES | 10 | -46.34146341 | 0.022 | 7.0M |

| NMT | NEOMETALS | 0 | -46.34146341 | 0.22 | 122.4M |

| GPX | GRAPHEX MINING | -2.631578947 | -45.58823529 | 0.185 | 14.9M |

| EUR | EUROPEAN LITHIUM | 0 | -45.23809524 | 0.115 | 63.2M |

| AXE | ARCHER EXPLORATION | -2.941176471 | -45 | 0.066 | 14.3M |

| ARU | ARAFURA RESOURCES | -16.66666667 | -44.44444444 | 0.045 | 33.5M |

| TON | TRITON MINERALS | 7.142857143 | -44.44444444 | 0.045 | 40.8M |

| SXX | SOUTHERN CROSS | 0 | -44.44444444 | 0.005 | 5.4M |

| ASN | ANSON RESOURCES | 0 | -44.16666667 | 0.067 | 34.2M |

| HWK | HAWKSTONE MINING | -10 | -43.75 | 0.018 | 10.3M |

| ARM | AURORA MINERALS | 0 | -43.24324324 | 0.021 | 2.5M |

| KAI | KAIROS MINERALS | 0 | -43.18181818 | 0.025 | 21.3M |

| ESR | ESTRELLA RESOURCES | -15.78947368 | -42.85714286 | 0.016 | 8.4M |

| RNU | RENASCOR RESOURCES | 0 | -41.93548387 | 0.018 | 20.8M |

| GME | GME RESOURCES | 0 | -41.86046512 | 0.075 | 36.2M |

| BPL | BROKEN HILL PROSPECTING | -3.03030303 | -41.81818182 | 0.032 | 4.6M |

| AUR | AURIS MINERALS | -12.19512195 | -40.98360656 | 0.036 | 15.1M |

| GED | GOLDEN DEEPS | 0 | -40.98360656 | 0.036 | 6.2M |

| TRT | TODD RIVER RESOURCES | -5.063291139 | -40.94488189 | 0.075 | 11.4M |

| BAR | BARRA RESOURCES | -3.225806452 | -40 | 0.03 | 16.2M |

| FEL | FE | 21.42857143 | -39.28571429 | 0.017 | 6.3M |

| SVM | SOVEREIGN METALS | -5.405405405 | -39.13043478 | 0.07 | 18.8M |

| ENT | ENTERPRISE METALS | -15.38461538 | -38.88888889 | 0.011 | 4.2M |

| MZZ | MATADOR MINING | -4.545454545 | -38.23529412 | 0.21 | 11.3M |

| POW | PROTEAN ENERGY | -10.52631579 | -37.03703704 | 0.017 | 6.1M |

| ZNC | ZENITH MINERALS | 2.702702703 | -36.66666667 | 0.076 | 16.8M |

| BAU | BAUXITE RESOURCES | 0 | -36.36363636 | 0.056 | 12.0M |

| CHN | CHALICE GOLD | 4.545454545 | -36.11111111 | 0.115 | 32.0M |

| DEG | DE GREY MINING | -4 | -35.13513514 | 0.12 | 52.9M |

| PIO | PIONEER RESOURCES | 0 | -34.7826087 | 0.015 | 21.1M |

| AGY | ARGOSY MINERALS | -5.882352941 | -34.69387755 | 0.16 | 152.4M |

| MNS | MAGNIS ENERGY TECHNOLOGY | 1.694915254 | -34.06593407 | 0.3 | 183.3M |

| CLA | CELSIUS RESOURCES | 6.451612903 | -34 | 0.066 | 52.6M |

| BKT | BLACK ROCK MINING | 12.90322581 | -33.96226415 | 0.035 | 18.8M |

| PLL | PIEDMONT LITHIUM | -4.347826087 | -33.33333333 | 0.11 | 73.4M |

| GXY | GALAXY RESOURCES | 1.219512195 | -33.06451613 | 2.49 | 998.4M |

| ORE | OROCOBRE | 0.892857143 | -32.57756563 | 3.955 | 1.0B |

| RTR | RUMBLE RESOURCES | -4.347826087 | -32.30769231 | 0.044 | 17.1M |

| HMX | HAMMER METALS | 9.090909091 | -31.42857143 | 0.024 | 7.0M |

| LTR | LIONTOWN RESOURCES | 0 | -30.3030303 | 0.023 | 26.1M |

| TLG | TALGA RESOURCES | 5.194805195 | -30.17241379 | 0.405 | 89.3M |

| OAR | OAKDALE RESOURCES | 23.52941176 | -30 | 0.021 | 1.4M |

| AEE | AURA ENERGY | 0 | -28 | 0.018 | 19.3M |

| LCD | LATITUDE CONSOLIDATED | 0 | -27.27272727 | 0.016 | 5.0M |

| PLS | PILBARA MINERALS | -1.315789474 | -26.82926829 | 0.75 | 1.3B |

| BSM | BASS METALS | -6.666666667 | -26.31578947 | 0.014 | 35.5M |

| E25 | ELEMENT 25 | -15 | -26.08695652 | 0.17 | 14.3M |

| PM1 | PURE MINERALS | 15.38461538 | -25 | 0.015 | 4.4M |

| AYR | ALLOY RESOURCES | -25 | -25 | 0.003 | 4.7M |

| KDR | KIDMAN RESOURCES | -5.226480836 | -24.86187845 | 1.36 | 561.4M |

| ARE | ARGONAUT RESOURCES | 0 | -24.13793103 | 0.022 | 34.2M |

| VXR | VENTUREX RESOURCES | -2.777777778 | -22.22222222 | 0.175 | 42.0M |

| CXO | CORE LITHIUM | 15.09433962 | -21.79487179 | 0.061 | 38.0M |

| TAW | TAWANA RESOURCES | 0 | -21.51898734 | 0.31 | 179.2M |

| IDA | INDIANA RESOURCES | 3.773584906 | -20.28985507 | 0.055 | 5.3M |

| KSN | KINGSTON RESOURCES | -11.11111111 | -20 | 0.016 | 19.0M |

| MLS | METALS AUSTRALIA | 33.33333333 | -20 | 0.004 | 7.0M |

| NZC | NZURI COPPER | 3.703703704 | -20 | 0.28 | 82.9M |

| HIG | HIGHLANDS | 2.631578947 | -18.75 | 0.078 | 80.9M |

| KNL | KIBARAN RESOURCES | -3.846153846 | -16.66666667 | 0.125 | 35.8M |

| PMY | PACIFICO MINERALS | 0 | -16.66666667 | 0.005 | 8.1M |

| MIN | MINERAL RESOURCES | 6.504922644 | -16.32596685 | 15.145 | 2.7B |

| SVD | SCANDIVANADIUM | 5 | -16 | 0.021 | 7.4M |

| HAV | HAVILAH RESOURCES | -13.51351351 | -15.78947368 | 0.16 | 34.9M |

| HNR | HANNANS | 0 | -14.28571429 | 0.012 | 21.9M |

| AML | AEON METALS | 4.166666667 | -13.79310345 | 0.25 | 149.8M |

| AOU | AUROCH MINERALS | 4 | -12.35955056 | 0.078 | 7.7M |

| SRK | STRIKE RESOURCES | 4 | -8.771929825 | 0.052 | 7.6M |

| VRC | VOLT RESOURCES | 0 | -8.333333333 | 0.022 | 33.5M |

| TNG | TNG | 29.03225806 | -7.692307692 | 0.12 | 115.6M |

| ORN | ORION MINERALS | 0 | -7.407407407 | 0.025 | 46.8M |

| KOR | KORAB RESOURCES | 0 | -7.407407407 | 0.025 | 7.7M |

| ZEU | ZEUS RESOURCES | 0 | -7.142857143 | 0.013 | 2.3M |

| WKT | WALKABOUT RESOURCES | 3.333333333 | -7 | 0.093 | 28.9M |

| ADN | ANDROMEDA METALS | -14.28571429 | 0 | 0.006 | 7.6M |

| DTM | DART MINING | 0 | 0 | 0.007 | 6.5M |

| PAN | PANORAMIC RESOURCES | 0 | 0.267379679 | 0.375 | 183.0M |

| S32 | SOUTH32 | 9.046052632 | 2.950310559 | 3.315 | 16.7B |

| IRC | INTERMIN RESOURCES | -6.896551724 | 3.846153846 | 0.135 | 33.0M |

| SO4 | SALT LAKE POTASH | 5.434782609 | 4.301075269 | 0.485 | 99.1M |

| VMC | VENUS METALS | 6.666666667 | 6.666666667 | 0.16 | 15.3M |

| RIO | RIO TINTO | 5.434329395 | 7.49610316 | 75.86 | 110.0B |

| EME | ENERGY METALS | 0 | 11.11111111 | 0.1 | 21.0M |

| HXG | HEXAGON RESOURCES | 7.407407407 | 11.53846154 | 0.145 | 42.3M |

| POS | POSEIDON NICKEL | -2.325581395 | 13.51351351 | 0.042 | 111.0M |

| VML | VITAL METALS | 0 | 14.28571429 | 0.008 | 15.7M |

| GWR | GWR GROUP | 0 | 16.66666667 | 0.105 | 26.6M |

| SEI | SPECIALITY METALS | 16.66666667 | 16.66666667 | 0.014 | 6.7M |

| BUX | BUXTON RESOURCES | -7.142857143 | 18.18181818 | 0.13 | 17.7M |

| GBE | GLOBE METALS AND MINING | 0 | 20 | 0.018 | 8.4M |

| RDS | REDSTONE RESOURCES | 0 | 23.07692308 | 0.016 | 8.4M |

| IEC | INTRA ENERGY | -9.090909091 | 25 | 0.01 | 3.9M |

| FGR | FIRST GRAPHENE | 0 | 30.76923077 | 0.17 | 66.6M |

| DGR | DGR GLOBAL | 0 | 31.31313131 | 0.13 | 82.8M |

| CGN | CRATER GOLD MINING | -20 | 33.33333333 | 0.016 | 3.4M |

| CZI | CASSINI RESOURCES | -1.111111111 | 36.92307692 | 0.089 | 30.8M |

| BOA | BOADICEA RESOURCES | 28.57142857 | 38.46153846 | 0.18 | 9.5M |

| CHK | COHIBA MINERALS | 0 | 50 | 0.015 | 10.0M |

| ANW | AUS TIN MINING | 0 | 54.54545455 | 0.017 | 33.6M |

| AVL | AUSTRALIAN VANADIUM | -6.666666667 | 55.55555556 | 0.028 | 48.3M |

| TMT | TECHNOLOGY METALS | 4.166666667 | 70.45454545 | 0.375 | 26.3M |

| TNO | TANDO RESOURCES | -5.376344086 | 76 | 0.088 | 17.0M |

| OMH | OM HLDGS | -1.119402985 | 87.94326241 | 1.325 | 1.0B |

| CMC | CHINA MAGNESIUM | 0 | 114.2857143 | 0.03 | 10.6M |

| GLN | GALAN LITHIUM | -5.660377358 | 204.8780488 | 0.25 | 24.7M |

| JMS | JUPITER MINES | -3.636363636 | 227.1604938 | 0.265 | 519.1M |

| BEM | BLACKEARTH MINERALS | -2.298850575 | 0.085 | 5.2M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.