You might be interested in

News

Closing Bell: ASX goes missing as new premiums lift health stocks; Bitcoin at US$68k

Mining

Magnis closes in on $320m funding via Singapore-based PEY Capital for Nachu graphite project

ESG

Mining

Labour costs will be “miniscule” for a large-scale Australian lithium ion battery maker, with raw materials – like lithium, cobalt, manganese, and graphite – usually making up 80 per cent of the cost, Magnis investor relations director Travis Peluso says.

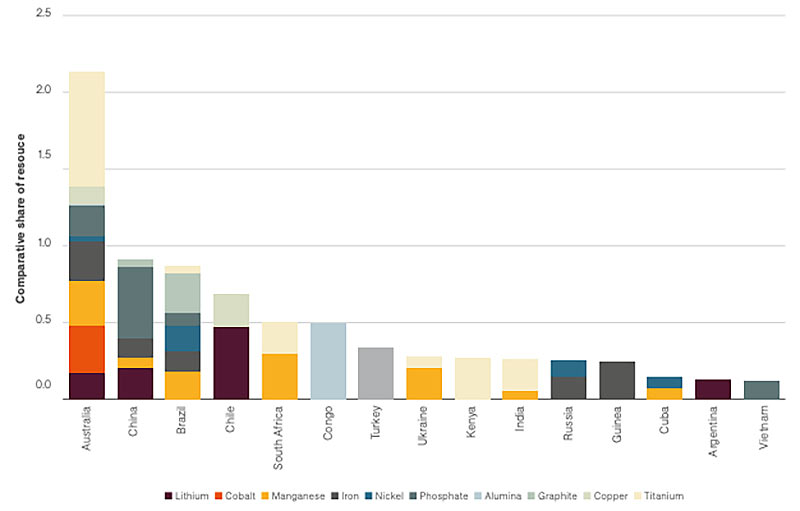

A new Australian Trade and Investment Commission (Austrade) report adds to the growing stack of analysis which shows Australia has all the raw materials needed to produce batteries.

This potentially gives the country “significant global supply-chain advantages”.

A $2 billion 15GWh gigafactory in Townsville is being developed by an international consortium called Imperium3, led by Boston Energy and Innovation, graphite company Magnis Resources (ASX:MNS), and US company Charge CCCV.

It’s one of three large scale gigafactories Imperium3 has in the works, with its 15GWh New York location the most advanced.

Imperium3 says 15GWh of production will equal 250,000 electric vehicle (EV) batteries, or 1 million home batteries each year.

The Townsville facility will produce either EV batteries, home storage battery units, micro grids to power small towns, or a combination thereof. First production is expected by 2021.

Mr Peluso says it makes sense to produce batteries locally.

With a project of Imperium3’s scale and size, labour costs are a very small portion of the overall cost of producing a battery cell, he says.

“The labour cost component in [battery] manufacturing is miniscule,” he says.

“It’s certainty under two per cent, probably closer to one per cent of the cost.”

Labour costs are one of the key barriers to entry for large scale manufacturing in Australia, but in battery-making a high level of automation takes care of much of the process.

“When you look at the cost of producing a battery cell, around 80 per cent of the cost is in those raw materials,” Mr Peluso says.

“There are cost advantages in sourcing those raw materials, like lithium, locally.”

Imperium3 is currently “dealing with a global group that has lithium assets in Australia”, Mr Peluso says.

Magnis also has its own advanced graphite project in Tanzania.

With batteries requiring roughly twice the amount of graphite than lithium, vertically integrating this graphite project into the battery plant “will give us some significant upside”, Mr Peluso says.

“That’s when we start to make up some serious ground on some other groups internationally.”

>>>High Voltage: All The News Driving Battery Metals Stocks