You might be interested in

Mining

RIU Sydney Resources Roundup: Why junior explorers need your backing to make net zero a reality

Mining

Merry Xmas: All the commodities our experts think could rule the roost in 2023 ... oh, and 24 stock picks

Mining

Mining

Demand for high purity alumina (HPA) — a specialised product used in lithium-ion batteries, LED lights, and more – is growing a lot faster than supply. There are three advanced ASX stocks ready to take advantage.

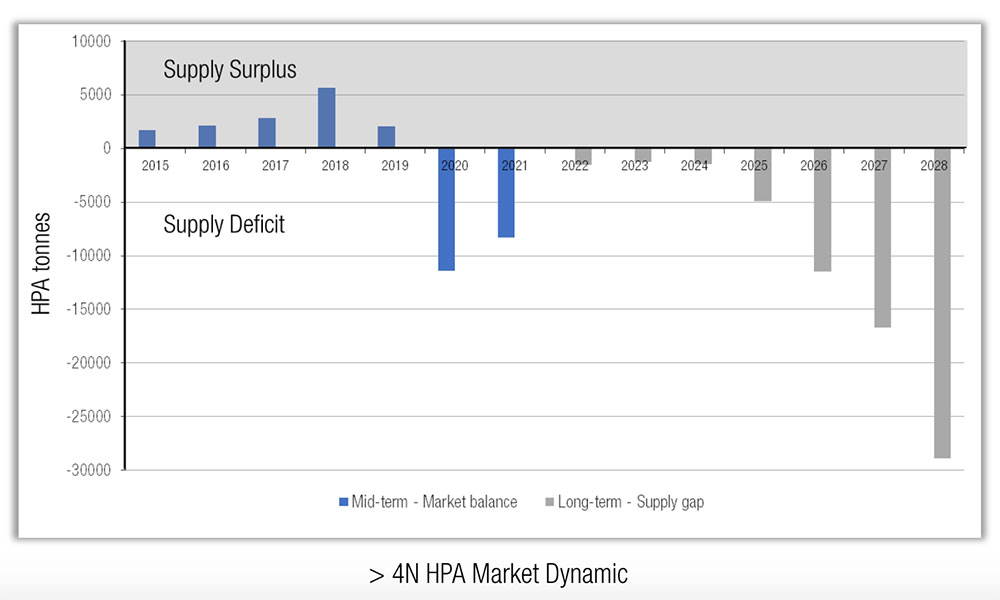

In December, CRU estimated that the ~60,000 tonnes per year ‘4N’ (99.99 per cent purity) HPA market would stay in relative balance until this year, after which supply deficits build to nearly 30,000 tonnes a year by 2028:

This niche market is about to get a rocket from the massive amounts of post-COVID-19 stimulus being poured into the nascent EV sector.

There’s up to ~5kg of HPA in every electric vehicle. Benchmark Mineral Intelligence principal James Clark said the multiplier effect of EV growth “means high purity alumina demand in 5 and 10 years will be very significant”.

And that is on top of demand from the established, but still growing, LED market.

“The market is going to double every ten years for HPA.” #EV

James Clarke, Benchmark

— Benchmark Mineral Intelligence (@benchmarkmin) August 28, 2020

There are three main HPA focused stocks on the ASX: FYI Resources (ASX:FYI), Alpha HPA (ASX:A4N), and Altech Chemicals (ASX:ATC).

These near term producers use completely different methods to achieve the production of high quality HPA.

But what these companies have in common are their huge operating cost advantages over existing producers in a growing, supply-constrained market.

Currently HPA is sourced from expensive feedstock, such as refined aluminium metal, which puts current global operating cash costs for 4N at around $US15,000/t.

FYI, Alpha and Altech reckon they can do it for $US6,217/t, $US5,940/t and $US9,900/t respectively, which means big profits at current 4N prices of between $US25,000 and $US30,000/t.

Alpha HPA’s 10,000tpa ‘HPA First’ development in Gladstone Queensland will make $US191m in free cashflow per year and cost $US209m to build.

Like FYI and Altech, the company is neck-deep in offtake and financing discussions.

The level of interest is fantastic, Alpha managing director Rimas Kairaitis says. Converting that interest into hard offtakes is the company’s current goal.

“The market looks to be maturing from an absolute ‘lower cost’ mentality to a ‘higher quality, higher performance’ mentality. This is moving HPA purity demand toward 4N and 4N+ purity,” he told Stockhead.

“What makes the news is the [billions of dollars] being spent of gigafactories for cell manufacturing. But feeding the battery gigafactories are very large separator manufacturer factories, cathode factories – they are the buyers of HPA.

“The applications of alumina in the cathode are rapidly expanding to accommodate better performance and stability from high nickel cathodes.

“Our costs are low, and our product purity is great. We are seeing very good demand there.”

There’s not the same level of available analysis on the much-larger LED market, but Alpha has been encouraged by the response so far.

Being a non-Chinese prospective producer is also a clear advantage in the current geopolitical climate, Kairaitis says.

“We have contacted a bunch of customers and have three test orders in the sapphire glass space, so far,” he says.

“These three groups have all cited wanting to diversify their supply chains out of China as the main reason to talk to us, which is great.”

WA-based FYI Resources estimates annual profits of ~US$88 million from its 8,000 tonnes per annum project, which is expected to cost $US189m to build.

Managing director Roland Hill says the company is “a little surprised” by just how much interest they are currently receiving from potential offtakers and finance partners.

“The general trend is that prices are being maintained, but the [demand is] growing quicker than forecast,” he told Stockhead.

“That’s probably reflective of our view on the market as well.

“During our discussions with offtake groups they tend to say that interest has increased, mainly through broader applications and consumer demand for a higher quality product.”

FYI published its project DFS in mid-March “with a fantastic set of numbers”, Hill says.

“It’s world class. We attracted an $80m equity financing facility as a result of that DFS, and late last week we announced a joint venture with Alcoa, the biggest alumina producer in the world,” he says.

“Alcoa had been looking at the HPA industry for a little while, did quite extensive due diligence on the market and on the peer group, and settled on us.

“We see some amazing things happening there.”

FYI have worked hard to de-risk the project so the prospect of getting into production is a lot higher, Hill says.

“Our investors are here for the long term rewards,” he says.

“It’s a very unusual business model with fantastic potential returns.”