Here’s why it could be time to start buying ASX gold stocks

Mining

Mining

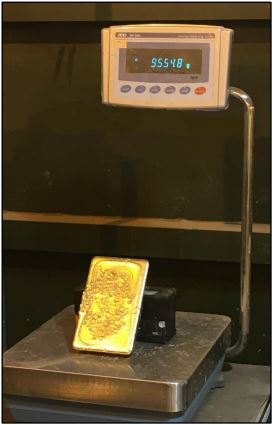

A large chunk of ASX-listed gold stocks have lost ground in the past four months as the strengthening US dollar put pressure on the price of the precious metal – but some analysts see this as a buying opportunity.

The price of gold fell below $US1160 ($1597) an ounce late last week — its lowest point in 19 months — before recovering slightly to trade at around $1190 an ounce.

The gold price is down about 12 per cent since April (see graph below).

This uncertainty has seen roughly 70 per cent of the 170 or so ASX-listed gold stocks tumble between 3 and 73 per cent in the past four months, compared to about 46 per cent over the past year.

>> Scroll down for a list of ASX stocks with gold exposure, courtesy of leading ASX data provider MakCorp

Blackstone Minerals (ASX:BSX), which has gold projects in Western Australia, has felt the most pain, with a 72 per cent drop in its share price since April.

Anova Metals (ASX:AWV) has slipped 68 per cent, Alicanto Minerals (ASX:AQI) is down 64 per cent and Aruma Resources (ASX:AAJ) has fallen 61 per cent.

While gold is traditionally the safe-haven investment when geopolitical tensions cause concern, investors have been increasingly flocking to the US dollar following threats of interest rate hikes.

“Given the current trade war ructions that have been generated by Donald Trump, the investors are obviously spooked by that,” expert resources analyst Gavin Wendt told Stockhead.

“I know the US markets have gone to new highs, but generally markets are quite concerned at the knock-on effects from trade — and what they’ve effectively done is they’ve chosen the US dollar as the go-to safe-haven.

“That probably ties in with the fact that there’s already some existing momentum there in the market from the point of view of interest rate rises.”

The US dollar gold price has been hit harder than the Aussie dollar gold price, but ASX-listed stocks are still feeling the pinch.

“In May the gold price was $US1360 and that’s come off by $US200 in the best part of three months,” Argonaut mining analyst James Wilson told Stockhead.

“The Aussie dollar gold price has really only come off from the highs maybe about half that — but it hasn’t stopped our market having that sort of contagion of a sell-down as well.”

The reason for that is a lot of gold players were trading at a substantial premium but weren’t showing big growth.

“As a general theme we’re not seeing the substantial growth that we’ve seen in previous years,” Mr Wilson said.

“Some of these guys are talking 10 per cent growth maximum and it’s coming from organic sources. It’s not coming through M&A [mergers and acquisitions].

“We haven’t seen a frantic period of M&A because of high asset prices. The market is sort of in a deadlock at the moment because they can’t grow and the market wants growth.”

Bargain buying

While there is “every likelihood” that the gold price will fall further, the current situation presents a perfect buying opportunity, according to Mr Wendt.

“From a fundamental perspective the falls in commodity prices I don’t think are justified,” he said.

“I think they are a tremendous buying opportunity now.”

And Aussie gold producers are particularly attractive because our weakening currency against the greenback means these guys are still making good margins.

“The share prices have been falling much faster than any sort of fall in the underlying profitability of these companies,” Mr Wendt explained.

“So from an Australian gold market perspective I think these companies look even better value because their values have fallen significantly more than any net impact on their earnings.”

ASX gold stocks to watch

An interesting stock to watch is Gascoyne Resources (ASX:GCY), which poured first gold at its Dalgaranga project in Western Australia at the end of May and is in the process of ramping up production to 100,000 ounces per annum.

A feasibility study completed in late 2016 placed the all-in sustaining costs – including everything except head office corporate costs – for the Dalgaranga project at $931 per ounce.

At the current Aussie dollar gold price of over $1660, that would give Gascoyne a nearly $400 million operating cash surplus based on the total expected output of 541,000 ounces over the initial six-year life.

“Gascoyne is just at that commissioning phase, so I think it could be one of the standouts because it really hasn’t received a lot of market recognition,” Mr Wendt said.

Over the past four months, Gascoyne’s share price has slumped around 30 per cent.

Dacian Gold (ASX:DCN), meanwhile, completed a $40 million capital raising (with the help of Argonaut) in July at $2.70 a share, and since then its shares have slipped back to $2.31.

Mr Wilson said the placement was more than three times oversubscribed.

“You’ll see investors who couldn’t get involved in that might be looking at getting involved now because it’s come off 15 per cent since that was all done,” he said.

“The sector is actually starting to offer value for the first time in probably six months.”

Dacian is currently ramping up to its production target of 200,000 ounces per annum at its Mount Morgans mine in Western Australia and expects to reach full production by the end of this year.

Looking mighty fine

So far there hasn’t been much corporate activity in the gold space, but that could change with the falling gold price potentially spurring the mid-tier players to once again look for cheap growth opportunities.

Players like Northern Star Resources (ASX:NST) and Evolution Mining (ASX:EVN) did a great job after the global financial crisis in securing good quality assets for not a lot of cash.

Mr Wendt believes this could be on the cards again.

“This is the perfect opportunity because it is very reminiscent of where we were probably back in 2011, when the gold price hit rock bottom in the wake of the GFC,” he said.

“[Evolution and Northern Star] are in just as good a position as they were back then except they are significantly larger businesses – they’ve got even more cash.

“So I would think that they would be keenly casting their eye around for growth opportunities.

“A company like Gascoyne is perfectly placed because if they can ramp up production I think they will do very well and they’re also going to be I think a very, very attractive takeover target for these companies that are wanting to acquire assets at rock bottom prices.”

Here’s a list of ASX stocks with exposure to gold courtesy of leading ASX data provider MakCorp.

Swipe or Scroll for full table. Click headings to sort

| ASX code | Company | 12-month price change | 4-month price change | Price Aug 17 (intraday) | Market Cap |

|---|---|---|---|---|---|

| GCR | GOLDEN CROSS RES | 7.66666666667 | 3.10526315789 | 0.078 | 7.9M |

| VAN | VANGO MINING | 2.95833333333 | 1.83582089552 | 0.19 | 93.7M |

| MDX | MINDAX | 0.5 | 1.4 | 0.012 | 10.7M |

| CAY | CANYON RESOURCES | 2.60294117647 | 1.13043478261 | 0.245 | 77.3M |

| TLM | TALISMAN MINING | 0.125 | 0.317073170732 | 0.27 | 49.2M |

| GBR | GREAT BOULDER RE | 2.77272727273 | 0.276923076923 | 0.415 | 32.4M |

| DRM | DORAY MINERALS | 0.45652173913 | 0.264150943396 | 0.335 | 149.6M |

| CGN | CRATER GOLD MINI | 1.7 | 0.227272727273 | 0.027 | 7.5M |

| PLL | PIEDMONT LITHIUM | 0.619047619048 | 0.214285714286 | 0.17 | 92.3M |

| BGH | BLIGH RESOURCES | 0.0588235294118 | 0.2 | 0.036 | 10.3M |

| CTO | CITIGOLD CORP | 0 | 0.166666666667 | 0.007 | 13.4M |

| BGL | BELLEVUE GOLD | 2.51851851852 | 0.117647058824 | 0.19 | 73.8M |

| BCN | BEACON MINERALS | 0.0526315789474 | 0.111111111111 | 0.02 | 40.3M |

| CVS | CERVANTES CORP | -0.266666666667 | 0.1 | 0.011 | 5.9M |

| ARM | AURORA MINERALS | -0.239130434783 | 0.09375 | 0.035 | 3.5M |

| ARE | ARGONAUT RESOURC | 2.125 | 0.0869565217391 | 0.025 | 38.9M |

| TRY | TROY RES | 0.190476190476 | 0.0869565217391 | 0.125 | 57.4M |

| EMR | EMERALD RESOURCE | -0.116279069767 | 0.0857142857143 | 0.038 | 82.3M |

| ALY | ALCHEMY RESOURCE | 0 | 0.0625 | 0.017 | 7.5M |

| NST | NORTHERN STAR RE | 0.404958677686 | 0.0542635658915 | 6.8 | 4.3B |

| BNR | BULLETIN RESOURC | 0.290322580645 | 0.0526315789474 | 0.04 | 7.5M |

| AAR | ANGLO AUST RES | 0.816326530612 | 0.0470588235294 | 0.089 | 28.3M |

| MRP | MACPHERSONS RESO | -0.470588235294 | 0.046511627907 | 0.09 | 31.6M |

| ARX | ARC EXPLORATION | 0.155378486056 | 0.0431654676259 | 0.29 | 7.3M |

| PGI | PANTERRA GOLD | -0.377358490566 | 0.03125 | 0.033 | 4.3M |

| SLR | SILVER LAKE RESO | 0.170454545455 | 0.03 | 0.515 | 263.0M |

| NES | NELSON RESOURCES (listed Dec 2017) | -0.125 | 0.0294117647059 | 0.175 | 8.0M |

| CYL | CATALYST METALS | 1.20168067227 | 0.0234375 | 1.31 | 92.0M |

| NCM | NEWCREST MINING | -0.0561534861956 | 0.0019870839543 | 20.17 | 15.6B |

| TBR | TRIBUNE RES | -0.0134328358209 | 0.00151515151515 | 6.61 | 330.7M |

| ORM | ORION METALS | 0.818181818182 | 0 | 0.02 | 8.9M |

| TYK | TYCHEAN RESOURCE | 0.666666666667 | 0 | 0.005 | 2.9M |

| TMX | TERRAIN MINERALS | -0.222222222222 | 0 | 0.007 | 4.5M |

| SBU | SIBURAN RESOURCE | 0 | 0 | 0.003 | 2.1M |

| SAR | SARACEN MIN HLDG | 0.403703703704 | 0 | 1.895 | 1.6B |

| RGL | RIVERSGOLD (listed Oct 2017) | -0.3 | 0 | 0.14 | 11.7M |

| MSR | MANAS RESOURCES | 0.666666666667 | 0 | 0.005 | 13.2M |

| MLS | METALS AUSTRALIA | 0.666666666667 | 0 | 0.005 | 11.7M |

| LNY | LANEWAY RESOURCE | -0.25 | 0 | 0.003 | 10.6M |

| ADN | ANDROMEDA METALS | 0.75 | 0 | 0.007 | 6.5M |

| SFM | SANTA FE MINERAL | 0.458333333333 | -0.0277777777778 | 0.175 | 12.7M |

| RBX | RESOURCE BASE | -0.46875 | -0.0285714285714 | 0.034 | 934.7k |

| WGX | WESTGOLD RESOURC | -0.12084592145 | -0.03 | 1.455 | 544.7M |

| DAU | DAMPIER GOLD | 0.2 | -0.0322580645161 | 0.03 | 3.6M |

| SMC | STRATEGIC MIN | 0.0694444444444 | -0.0375 | 0.385 | 27.3M |

| RSG | RESOLUTE MINING | 0.209523809524 | -0.0486891385768 | 1.27 | 967.3M |

| DGR | DGR GLOBAL | -0.258333333333 | -0.0531914893617 | 0.089 | 54.6M |

| GWR | GWR GROUP | 1.91666666667 | -0.0540540540541 | 0.175 | 44.2M |

| DGO | DGO GOLD | 1.94372294372 | -0.0568654646325 | 0.68 | 14.7M |

| TTM | TITAN MINERALS | -0.917142857143 | -0.0645161290323 | 0.029 | 73.9M |

| CHN | CHALICE GOLD MIN | -0.0625 | -0.0909090909091 | 0.15 | 39.5M |

| SBM | ST BARBARA | 0.390845070423 | -0.0919540229885 | 3.95 | 2.1B |

| RED | RED 5 | 0.5 | -0.1 | 0.063 | 79.5M |

| DEG | DE GREY MINING | 3.72972972973 | -0.102564102564 | 0.175 | 63.5M |

| RVY | RIFT VALLEY RESO | -0.333333333333 | -0.111111111111 | 0.016 | 14.7M |

| GUL | GULLEWA | 0.5 | -0.117647058824 | 0.03 | 4.5M |

| LTR | LIONTOWN RESOURC | 2.22222222222 | -0.121212121212 | 0.029 | 30.9M |

| BSR | BASSARI RESOURCE | 0.3125 | -0.125 | 0.021 | 46.8M |

| KGM | KALNORTH GOLD MI | -0.461538461538 | -0.125 | 0.007 | 6.3M |

| GBM | GBM GOLD | -0.363636363636 | -0.125 | 0.007 | 7.8M |

| GMN | GOLD MOUNTAIN | 0.063829787234 | -0.130434782609 | 0.1 | 49.5M |

| AOP | APOLLO CONSOLIDA | 1.31578947368 | -0.137254901961 | 0.22 | 39.2M |

| OVL | ORO VERDE | -0.142857142857 | -0.142857142857 | 0.006 | 9.3M |

| MAT | MATSA RESOURCES | -0.180790960452 | -0.147058823529 | 0.145 | 25.7M |

| MOY | MILLENNIUM MINER | 0.0555555555556 | -0.155555555556 | 0.19 | 150.5M |

| RMS | RAMELIUS RESOURC | 0.135802469136 | -0.155963302752 | 0.46 | 245.8M |

| RRL | REGIS RESOURCES | 0.0336787564767 | -0.16 | 3.99 | 2.1B |

| AZM | AZUMAH RES | -0.0869565217391 | -0.16 | 0.021 | 16.4M |

| TAM | TANAMI GOLD | -0.28 | -0.162790697674 | 0.036 | 42.3M |

| EVN | EVOLUTION MINING | 0.223451327434 | -0.164652567976 | 2.765 | 4.8B |

| NXM | NEXUS MINERALS | -0.0540540540541 | -0.166666666667 | 0.07 | 6.2M |

| CDV | CARDINAL RESOURC | -0.330708661417 | -0.174757281553 | 0.425 | 158.9M |

| STN | SATURN METALS (listed Mar 2018) | -0.175 | -0.175 | 0.165 | 9.2M |

| IRC | INTERMIN RES | 0.941176470588 | -0.175 | 0.165 | 39.5M |

| SAU | SOUTHERN GOLD | -0.267857142857 | -0.18 | 0.205 | 10.1M |

| SWJ | STONEWALL RESOUR | -0.608695652174 | -0.181818181818 | 0.009 | 23.4M |

| EGA | EGAN STREET RESO | -0.181818181818 | -0.181818181818 | 0.225 | 29.4M |

| GOR | GOLD ROAD RESOUR | -0.037037037037 | -0.192546583851 | 0.65 | 552.8M |

| ORN | ORION MINERALS | 0.5 | -0.19512195122 | 0.033 | 54.2M |

| ARL | ARDEA RESOURCES | -0.05625 | -0.201058201058 | 0.755 | 80.8M |

| FML | FOCUS MINERALS | -0.471264367816 | -0.206896551724 | 0.23 | 43.9M |

| DCN | DACIAN GOLD | 0.0947867298578 | -0.208904109589 | 2.31 | 533.0M |

| DRA | DRAGON MINING | -0.15 | -0.209302325581 | 0.17 | 15.1M |

| OKU | OKLO RESOURCES | 0.0740740740741 | -0.216216216216 | 0.29 | 104.0M |

| KTA | KRAKATOA RESOURC | -0.0588235294118 | -0.219512195122 | 0.032 | 3.6M |

| WAF | WEST AFRICAN RES | -0.178082191781 | -0.220779220779 | 0.3 | 207.2M |

| DMG | DRAGON MOUNTAIN | 0.4 | -0.222222222222 | 0.014 | 3.7M |

| AGS | ALLIANCE RESOURC | 0.142857142857 | -0.232 | 0.096 | 9.6M |

| ERM | EMMERSON RESOURC | -0.27 | -0.239583333333 | 0.073 | 29.6M |

| SMG | SOON MINING | -0.333333333333 | -0.241379310345 | 0.22 | 34.8M |

| RND | RAND MINING | -0.308196721311 | -0.246428571429 | 2.11 | 126.9M |

| SHK | STONE RESOURCES | -0.25 | -0.25 | 0.003 | 2.4M |

| CTL | CENTENNIAL MINING (suspended) | -0.357142857143 | -0.25 | 0.009 | 10.4M |

| GML | GATEWAY MINING | -0.0526315789474 | -0.25 | 0.018 | 15.1M |

| HAW | HAWTHORN RESOURC | 0.620689655172 | -0.253968253968 | 0.047 | 14.5M |

| CAI | CALIDUS RESOURCE | 0.0294117647059 | -0.255319148936 | 0.035 | 45.3M |

| HHM | HAMPTON HILL MNG | 1.90909090909 | -0.255813953488 | 0.032 | 9.4M |

| HEG | HILL END GOLD | 0.181818181818 | -0.257142857143 | 0.078 | 12.0M |

| EXG | EXCELSIOR GOLD | -0.227272727273 | -0.260869565217 | 0.034 | 28.3M |

| DTM | DART MINING | 1 | -0.272727272727 | 0.008 | 6.9M |

| SIH | SIHAYO GOLD | 0 | -0.277777777778 | 0.013 | 24.1M |

| NUS | NUSANTARA RESOUR | -0.525 | -0.283018867925 | 0.19 | 23.4M |

| GBZ | GBM RESOURCES | -0.5 | -0.285714285714 | 0.005 | 5.3M |

| CGM | COUGAR METALS | -0.166666666667 | -0.285714285714 | 0.005 | 3.7M |

| PRU | PERSEUS MINING | 0.162711864407 | -0.292783505155 | 0.343 | 372.6M |

| MML | MEDUSA MINING | 0.338983050847 | -0.294642857143 | 0.395 | 81.0M |

| PDI | PREDICTIVE DISCO | -0.730769230769 | -0.3 | 0.021 | 5.0M |

| HMX | HAMMER METALS | -0.282051282051 | -0.3 | 0.028 | 7.3M |

| GCY | GASCOYNE RESOURC | -0.152941176471 | -0.300970873786 | 0.36 | 156.5M |

| GME | GME RESOURCES | 0.538461538462 | -0.305555555556 | 0.1 | 48.2M |

| NWF | NEWFIELD RESOURC | -0.358490566038 | -0.30612244898 | 0.17 | 98.8M |

| SMI | SANTANA MINERALS | -0.64 | -0.307692307692 | 0.009 | 4.9M |

| MDI | MIDDLE ISLAND RE | -0.235294117647 | -0.315789473684 | 0.013 | 9.1M |

| ALK | ALKANE RESOURCES | -0.432835820896 | -0.321428571429 | 0.19 | 96.2M |

| BGS | BIRIMIAN | 0.354166666667 | -0.322916666667 | 0.325 | 70.1M |

| EGS | EASTERN GOLDFIEL | -0.510638297872 | -0.323529411765 | 0.115 | 87.6M |

| E2M | E2 METALS | -0.361904761905 | -0.33 | 0.067 | 4.1M |

| WWI | WEST WITS MINING | -0.111111111111 | -0.333333333333 | 0.016 | 11.5M |

| BAR | BARRA RESOURCES | -0.307692307692 | -0.333333333333 | 0.036 | 17.1M |

| FEL | FE | -0.290322580645 | -0.333333333333 | 0.022 | 8.2M |

| KCN | KINGSGATE CONSOL | -0.0681818181818 | -0.338709677419 | 0.205 | 47.5M |

| PRX | PRODIGY GOLD | -0.281818181818 | -0.341666666667 | 0.079 | 36.6M |

| KRM | KINGSROSE MINING | -0.47 | -0.345679012346 | 0.053 | 38.0M |

| AUC | AUSGOLD | -0.2 | -0.351351351351 | 0.024 | 15.1M |

| MKG | MAKO GOLD (listed Apr 2018) | -0.4 | -0.368421052632 | 0.12 | 7.6M |

| BBX | BBX MINERALS | -0.340909090909 | -0.369565217391 | 0.145 | 55.5M |

| VEC | VECTOR RESOURCES | 0.25 | -0.375 | 0.015 | 19.4M |

| AME | ALTO METALS | -0.465909090909 | -0.381578947368 | 0.047 | 8.5M |

| HRN | HORIZON GOLD | -0.517857142857 | -0.386363636364 | 0.135 | 10.3M |

| DHR | DARK HORSE RESOU | 1.75 | -0.388888888889 | 0.011 | 19.2M |

| ODM | ODIN METALS | 1.5 | -0.4 | 0.15 | 23.1M |

| MOX | MONAX MINING | -0.5 | -0.4 | 0.003 | 2.2M |

| GMR | GOLDEN RIM RESOU | -0.466666666667 | -0.4 | 0.024 | 9.5M |

| AYR | ALLOY RESOURCES | 0.5 | -0.4 | 0.006 | 8.7M |

| EXU | EXPLAURUM | -0.384615384615 | -0.407407407407 | 0.08 | 38.4M |

| TLG | TALGA RESOURCES | -0.31746031746 | -0.422818791946 | 0.43 | 93.5M |

| WPG | WPG RESOURCES (suspended) | -0.615384615385 | -0.423076923077 | 0.015 | 13.6M |

| BDR | BEADELL RESOURCE | -0.772093023256 | -0.423529411765 | 0.049 | 83.7M |

| BLK | BLACKHAM RESOURC | -0.688405797101 | -0.426666666667 | 0.043 | 53.2M |

| OGX | ORINOCO GOLD | 0.0434782608696 | -0.435294117647 | 0.048 | 51.7M |

| ARS | ALT RESOURCES | -0.338983050847 | -0.442857142857 | 0.039 | 7.3M |

| KGD | KULA GOLD | -0.464285714286 | -0.444444444444 | 0.015 | 5.6M |

| TNR | TORIAN RESOURCES | -0.5 | -0.449275362319 | 0.038 | 7.8M |

| EAR | ECHO RESOURCES | 0.47619047619 | -0.456140350877 | 0.155 | 78.2M |

| PEC | PERPETUAL RESOUR | -0.44 | -0.461538461538 | 0.014 | 3.4M |

| OKR | OKAPI RESOURCES (listed Sep 2017) | 0.15 | -0.46511627907 | 0.23 | 7.9M |

| VKA | VIKING MINES | 0.428571428571 | -0.473684210526 | 0.02 | 7.8M |

| BRB | BREAKER RESOURCE | -0.653333333333 | -0.490196078431 | 0.26 | 39.4M |

| BC8 | BLACK CAT SYNDIC (listed Jan 2018) | -0.15 | -0.492537313433 | 0.17 | 9.7M |

| DTR | DATELINE RESOURC | -0.2 | -0.5 | 0.016 | 11.5M |

| CDT | CASTLE MINERALS | -0.214285714286 | -0.5 | 0.011 | 2.5M |

| NAG | NAGAMBIE RESOURC | 1.375 | -0.512820512821 | 0.095 | 38.9M |

| TAR | TARUGA MINERALS | 1.36363636364 | -0.518518518519 | 0.13 | 17.1M |

| 4CE | FORCE COMMODITIE | -0.1875 | -0.524390243902 | 0.039 | 16.5M |

| GED | GOLDEN DEEPS | -0.0333333333333 | -0.532258064516 | 0.029 | 5.0M |

| ANL | AMANI GOLD | -0.766666666667 | -0.533333333333 | 0.007 | 11.0M |

| CY5 | CYGNUS GOLD (listed Jan 2018) | -0.55 | -0.55 | 0.09 | 5.5M |

| AVW | AVIRA RESOURCES | -0.971428571429 | -0.555555555556 | 0.004 | 1.5M |

| TIE | TIETTO MINERALS (listed Jan 2018) | -0.64 | -0.576470588235 | 0.072 | 16.3M |

| AAJ | ARUMA RESOURCES | 0.285714285714 | -0.608695652174 | 0.009 | 5.1M |

| AQI | ALICANTO MINERAL | -0.718518518519 | -0.638095238095 | 0.038 | 4.4M |

| AWV | ANOVA METALS | -0.7625 | -0.683333333333 | 0.019 | 11.9M |

| BSX | BLACKSTONE MINER | -0.48 | -0.726315789474 | 0.13 | 13.0M |

Stockhead is proud to use MakCorp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to MakCorp’s website.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.