You might be interested in

News

Closing Bell: ASX up as Block Inc soars 10pc; Rincon cranks up another 60pc gain

Mining

Yellowcake unearthed: Haranga Resources uncovers eight uranium anomalies by sampling termite mounds

News

Mining

Special Report: Haranga Resources is enjoying an early start to drilling at Saraya uranium project in Senegal following the earlier than expected arrival of the contracted reverse circulation drill rig.

The timing simply couldn’t be better given the increasingly positive sentiment towards uranium that has sent the price of yellowcake up towards the US$80/mark, with Sprott Asset Management outright calling it a bull market.

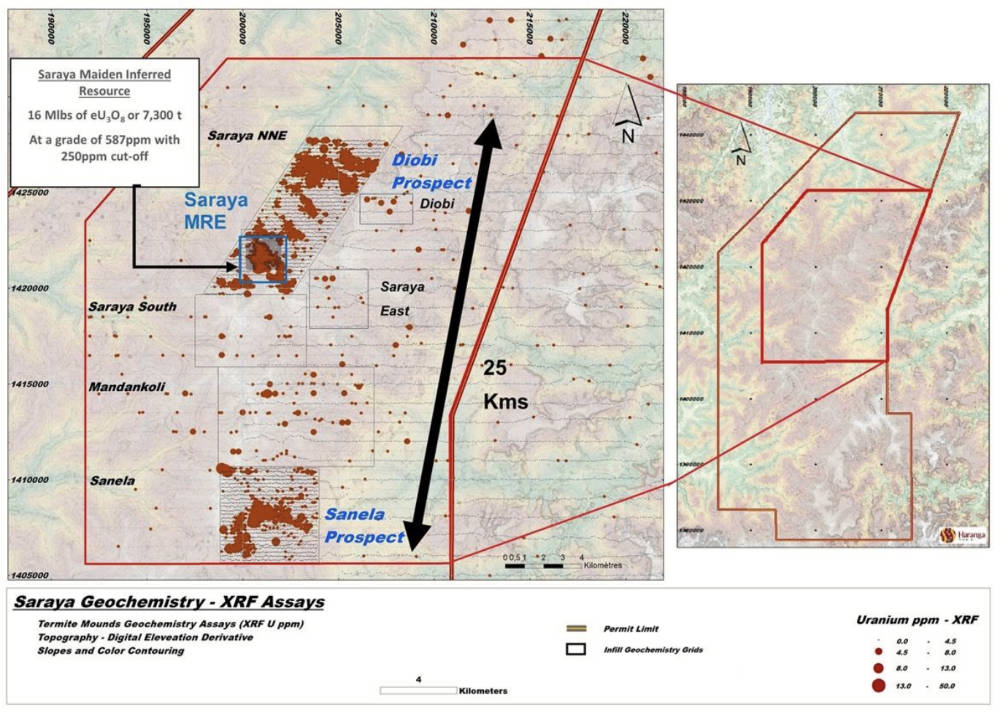

Haranga Resources’ (ASX:HAR) Saraya project already boasts an inferred resource of 12.5Mt at 587 parts per million (ppm) U3O8 for 16.1Mlbs of contained uranium, including a potentially open-pittable component with a resource of 13Mlb at 641ppm U3O8.

That this covers just 0.2km2 of the permit area speaks volumes about the potential for exploration to deliver resource growth.

Sampling of termite mounds over ~70% of the permit area has already indicated that uranium might be present at the Sanela prospect, which extends over 2km along a north-northeast structural trend similar to Saraya.

With the early arrival of the reverse circulation rig, HAR has started drilling at the Saraya deposit.

Results will be feed into a resource upgrade that will incorporate metallurgical results from test work to be undertaken by SGS Lakefield in Canada.

The company is also continuing auger drilling at the Diobi anomaly and will move the auger drill rig to the Sanela anomaly once access is secured.

“The RC rig arrived early and almost immediately after the signing of the contract. It has moved to the first pad and drilling will commence Monday morning, December 18,” HAR managing director Peter Batten said.

“Initially, the drilling at the Saraya deposit was scheduled for the end of the RC drilling campaign, with the results to feed into the MRE upgrade proposed to incorporate metallurgical results from test work to be undertaken by SGS Lakefield in Canada.

“Due to the late end of the wet season, harvests have been delayed and we are still in the period where the dry grass will burn. This has hampered the progress of the auger drilling, which was intended to locate and orientate the mineralisation below termite mound anomalies ahead of RC drilling.

“The XRF results from the auger work will determine whether the RC drill moves to Diobi or Sanela after completing the work at the Saraya deposit. Diobi and Sanela have been chosen due to the more advanced sampling completed on these two prospects and the high-level uranium anomalies reported.”

HAR has completed infill termite mound sampling at the Saraya South prospect and XRF testing of the 2,166 samples collected will commence following the completion of the 4,186 samples taken from Mandankoli.

All samples have been prepared at the company’s workshop facility and the samples are waiting to be assayed with our newly acquired hand-held XRF Vanta-M device.

The permit scale geochemistry survey, already covering 72% of the permit, will resume in early January, when the seasonable burning of dried grass will be completed and allow for easy access by the field teams.

This article was developed in collaboration with Haranga Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.