Guy on Rocks: Running the Rule over uranium, and… he’s right

Mining

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

A volatile week on the precious metals front with gold off 2.1% closing at US$1,789/ounce on the back of a stronger US$.

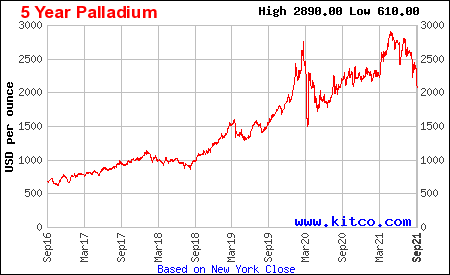

PGMs took an even bigger hit with platinum down US$70 to close at US$951/ounce and palladium (figure 1), the big mover down US$295 for the week to close at US$2,070/ounce.

Base metals had a good week as China released stockpiles.

Copper finished at US$4.39/lb (it was up to US$4.44/lb at one stage during the week) and remains at strong contango around 3-4 cents.

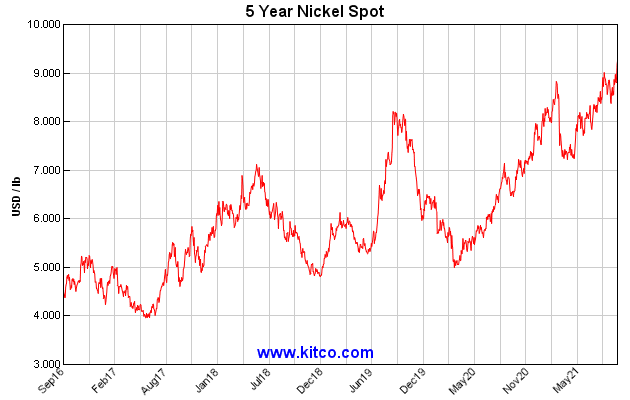

Aluminium hit a 13-year high, nickel (figure 2), one of my favourite picks, hit a 7-year high and is currently trading around US$9.20/lb.

Metallurgical coal also hit US$600/tonne in China.

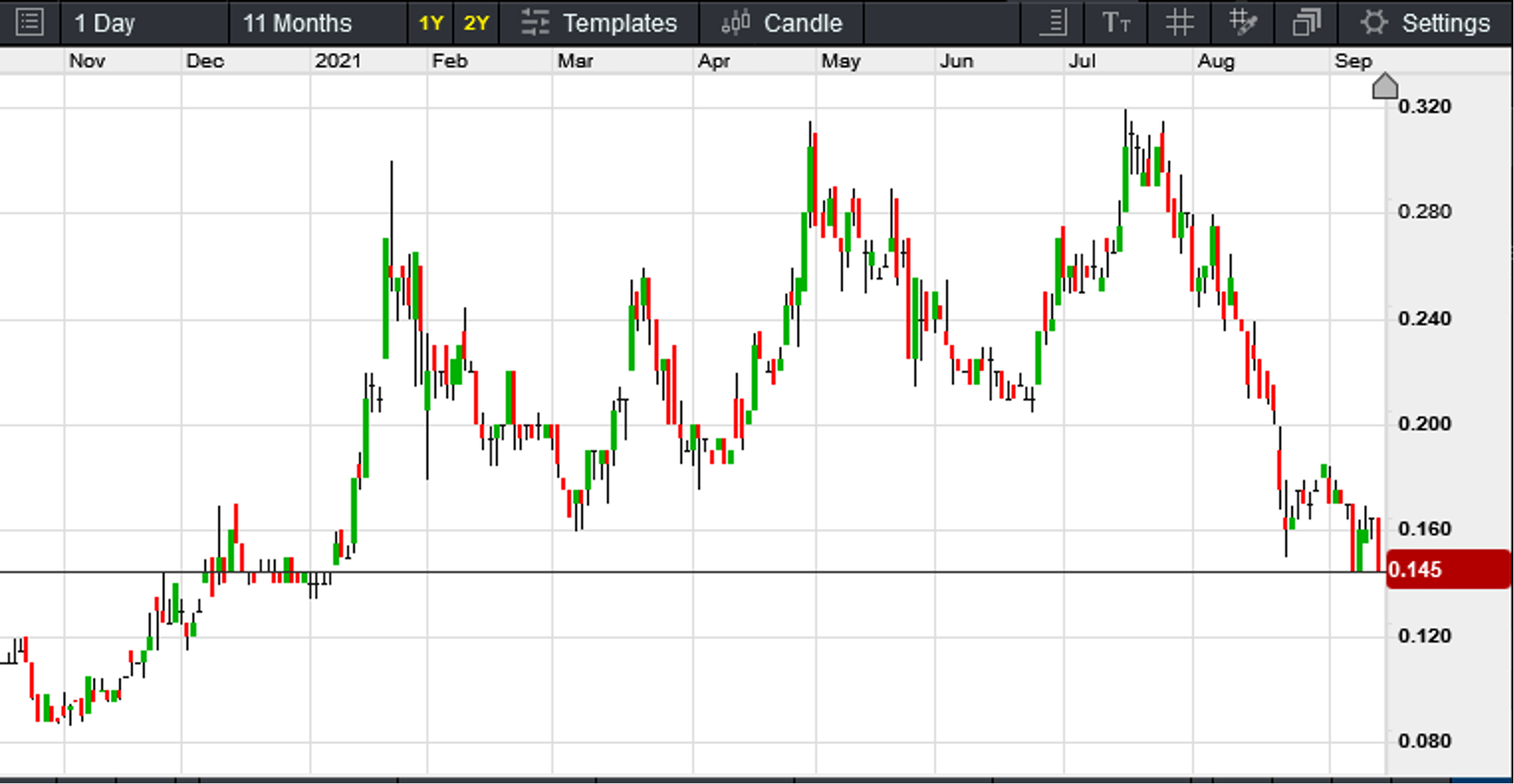

Everyone seems to have a view on uranium (figure 3) however Rick Rule thinks “you ain’t seen nothing yet”.

He is always one to have a massive swing and I think he is right.

With the Sprott Physical Uranium Trust Fund (SRUUF) putting to bed liquidity issues, uranium hit US$40/lb on Friday.

Rule further pointed out that most uranium producers in North America can’t yet restart operations even with $40/lb.

Going back a few years I looked at local projects such as Lake Way near Wiluna in Western Australia. Toro Energy (ASX:TOE) needed circa US$70/lb to make a reasonable rate of return.

As many of the Stockhead luminaries would be aware, the market tends to overshoot so I am thinking uranium might well go straight past US$70/lb into unchartered territory (for the last 10 years at least).

My opinion is that the yellow metal is going to take us to the promised land of clean, green energy, so a move to +US$70/lb is entirely justified.

Apparently Sprott is going to make an application to list the trust on the NYSE which will really put U in the spotlight.

Spare a thought for the iron ore sector which has gone from making outrageous profits to spectacular returns on the back of a 40% fall in iron ore, which according to Citi’s mining analyst Paul McTaggart should make for more believable earnings (figure 4) forecasts in the next few years.

McTaggart also pointed out that iron ore prices around these levels were likely to put the brakes on higher-cost producers outside of Australia and Brazil.

Citi estimate that if iron ore fell below $US100/tonne, China’s import from outside the major producing nations would fall from 200 to 120 million tonnes per annum.

China must deliver strong economic growth to keep the punters happy so putting the brakes on the property market (which accounts for 28% of Chinese GDP) and steel production longer term is not an option.

The cash costs of Rio, BHP and Fortescue are between US$15 to US$20/tonne so there is plenty of fat to withstand more iron ore price volatility.

I was dreaming of a supersized wall as the iron ore price (62% fines) hit US$237.57/tonne back in May of this year.

However, McGowan’s Wall (I believe the WA Premier has modelled himself on the Roman Emperor Hadrian; 117-138AD) between Western Australia and the east is now purportedly only going to be six metres high and made of stainless steel…

Hopefully when steel production resumes and the property market recovers from a 21% year-on-year decline we should see a corresponding increase in the iron ore price.

Given Africa’s love of coup-d’états (e.g., Guinea) the supply side looks as tight as ever. The Simandou iron ore deposit, 650km from port, now looks like a distance dream.

Fenix Resources (ASX:FEX) is looking like a hero, having entered into iron ore swap arrangements for around 600,000 tonnes from October 2021 to September 2022 at an average of approximately US$230/dmt against a current spot price of around A$178/dmt.

I believe the Chinese philosopher Ti-Ming was consulted on this trade.

Strike Resources (ASX:SRK) (figure 4) also announced (ASX Announcement, 9th September 2021) it has scheduled a shipment of 15,000 tonnes to a South American buyer of low impurity 66% Apurimac Premium Lump DSO from Peru in October of this year.

The objective is to secure a longer-term offtake arrangement, should this trial shipment be successful.

The stock has had a wild ride since our recommendation at 9 cents back in November last year.

Firefinch (ASX:FFX) (figure 5) recently announced (ASX Announcement, 2 September 2021) that all approvals are now in place for the Ganfeng funding package (US$194 million) that will see the 50:50 JV develop the Goulamina Lithium Project.

This positive news has seen the stock move from 15 cents in October when it was first recommended to the last trade of 67 cents.

I’ll drink to that…

With uranium on a tear looks like there is serious land grab going on with the likes of former peep show merchant Delecta (ASX:DLC) (figure 6) launching into uranium exploration with the stock up 30% to close at 1.3 cents on heavy volume.

The company announced some high-grade uranium and vanadium results including 12 samples that recorded an average grade of 2,246ppm U3O8 (0.22%) with a peak value of 5,280ppm U3O8 (0.53%) at its Rex Uranium Project in the Uravan Mineral Belt of Colorado.

Early days but at a $13 million market capitalisation, I think another run on the stock is more than likely.

Just a warning, DLC is rated R 18+ and material is restricted to adults as it contains content that is considered high in impact for viewers.

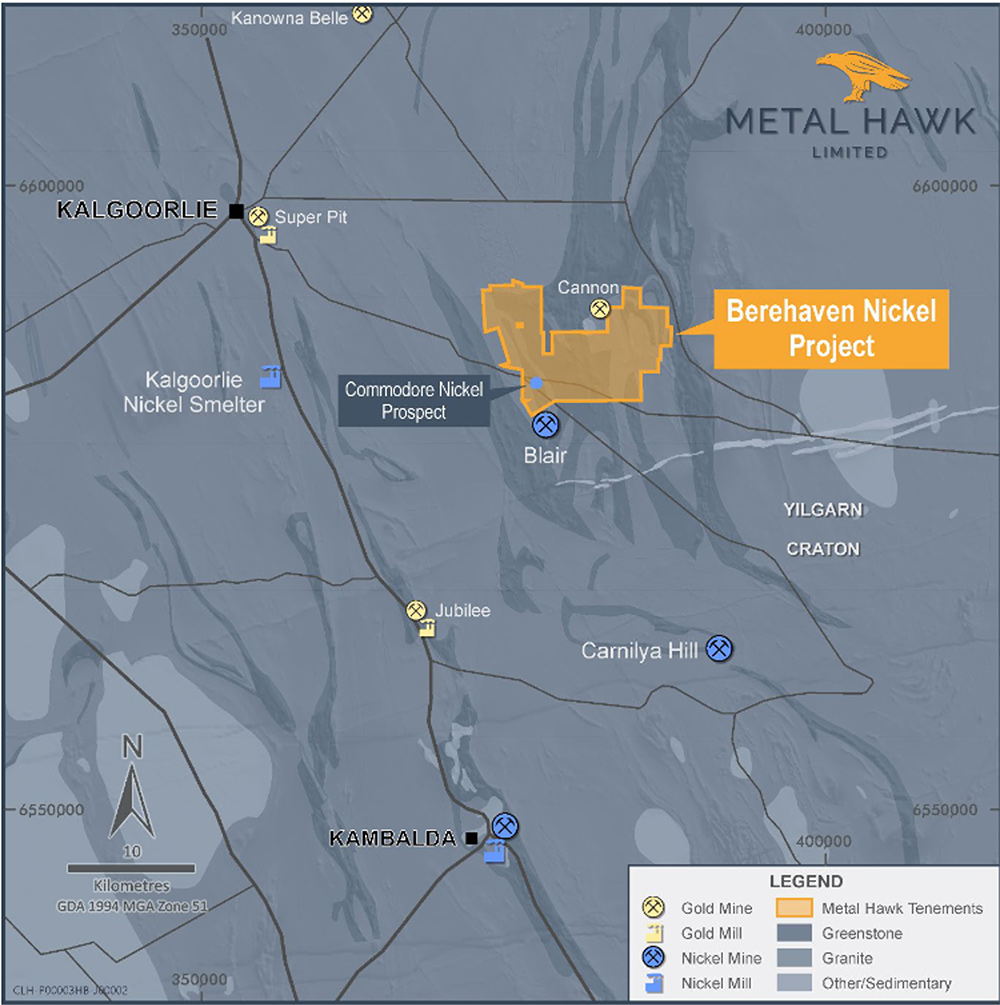

Nothing like hitting nickel in a nickel boom and right on cue there’s Metal Hawk Limited, ASX:MHK) with BVNC002 intersecting 2 metres of massive sulphide nickel mineralisation from 144-146 metres downhole (figure 9) at its 100% owned Berehaven Nickel Project (figure 8), situated 20km east of Kalgoorlie.

While assays are pending, portable-XRF analysis of reverse circulation drill chips has confirmed the high-grade tenor of mineralisation which characterises a number of the nickel deposits around Kambalda.

The Commodore Nickel Project is situated 5km north of the Blair Nickel Min (past production of 1.26Mt @ 2.62% Nickel for 39,200 tonnes of nickel) -figure 8.

Three RC drill holes targeted anomalous aircore holes containing end-of-hole Ni-Cu-PGE.

Early days and you may want to watch the price settle from its 270% jump to 69 cents today, but a good start and with a market capitalisation of around $30 million there may be some good opportunities to take a position here…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.