Gold drilling success keeps Wiluna on path to sulphide production growth

Mining

Mining

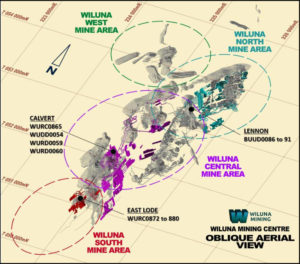

Special Report: Wiluna Mining’s sulphide strategy has received a shot in the arm (as did the share price) as drilling demonstrated the presence of a large-scale gold system at the Calvert area.

Sulphide resource drilling at Calvert at its namesake project in Western Australia’s Goldfields region returned a 76.5m intersection grading 1.77 grams per tonne (g/t) gold from a depth of 380.5m

And that’s not all.

Drilling has also returned 8m at 8.35g/t gold from 102m at East Lode South and a shallow hit of 5.15m at 18.25g/t gold at Lennon, well above the 5g/t that is considered to be high-grade.

Wiluna Mining (ASX:WMX) says the results support its stage one and two expansion plans that underpin its strategy to grow and increase geological confidence in the high-grade sulphide resource at its namesake project.

“These ongoing results from drilling ‘under the headframe’ are continuing to deliver into our stage-one sulphide strategy as we pursue shallow high-grade resource development targets,” executive chair Milan Jerkovic said.

“Our initial sulphide resource drilling program commenced at the Wiluna Mining Centre at Bulletin and Essex and has progressed to Calvert and the East Lode.”

Jerkovic noted that the company’s stage-one plan to convert the large sulphide inferred resources at Wiluna into higher confidence indicated resources that support mine planning continued to gather momentum and confidence with every hole.

“We believe that from these results we will add meaningful ounces to our already significant mineral resource, which is currently 6.4 million ounces, and our reserves which are currently 1.4 million ounces.

“We aim to convert resources to reserves very economically at approximately $50-$60/oz, and to discover mineral resources at $15/oz.”

Reserves growth is focused on high-grade, shallow zones, close to existing mine development that can be quickly brought into production at low cost.

Under this stage, Wiluna plans to begin underground mining of sulphide ore at a rate of 750,000 tonnes per annum, which is expected to produce around 120,000 ounces of gold each year from September 2021.

The operation currently produces about 60,000oz per annum.

Stage one will also include finding new, high-grade shoots that will enhance the ounces per vertical metre and, more importantly, increase the grade.

This will help the transition to stage two, which involves the increase in production to +250,000 ounces of gold and gold in concentrate over a long mine life.

The resource update is due in late September while the reserves update is expected to land in December.

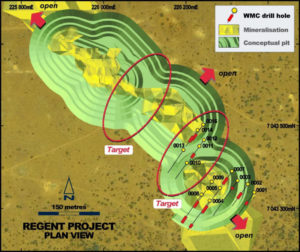

Wiluna has also completed resource infill and extension drilling at the Regent and Williamson gold deposits.

The top results from Regent were 8m at 3.93g/t gold from 157m, including 3m at 7.04g/t gold; and 11m at 3.24g/t gold from 140m, including 2m at 5.95g/t gold.

Meanwhile, Williamson returned hits of 22.1m at 2.86g/t gold from 133m, including 2.85m at 14.65g/t gold; and 10.65m at 1.81g/t gold from 177.35m.

Regent is an advanced resource conversion target just 8km from the Wiluna plant that is geologically similar to Wiluna-style deposits, with free-milling oxide and transitional mineralisation overlying fresh sulphides at depth.

The company says there is potential for the deposit to develop into a very large gold system with further extensional drilling along strike and at depth.

Meanwhile, a pit cutback is currently in progress on the southern part of the Williamson deposit, which provides the baseload free-milling feed during the transition to sulphides production from September 2021.

This article was developed in collaboration with Wiluna Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.