Gold Digger: Feds inflation warning sends prices diving

Mining

Mining

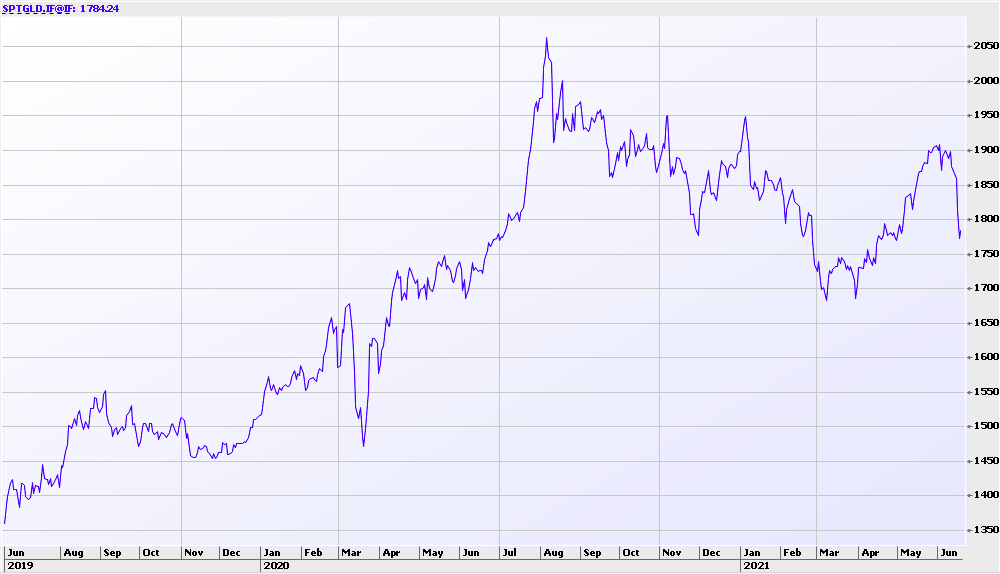

The market giveth and the market taketh. Truer words have never been spoken with gold prices diving nearly US$100 in less than a day after the US Federal Reserve signalled higher inflation and that interest rates could rise twice by 2023.

Gold is currently trading at about US$1,783.27 per ounce, a reversal from weeks of trading above US$1,800/oz that had analysts forecasting that US$2,000/oz gold was within reach.

The Fed’s forecast sent both the US dollar and 10-year US treasury yield up, which rather predictably led to an exodus away from gold.

All this despite Fed Chair Jerome Powell noting that the risk of two rate hikes should be taken with a “big grain of salt”, as the Reserve did view the spike in inflation as transitory.

“If inflation turns out to be truly transitory, the Fed should be happy to walk the hiking signals back,” Kitco News quoted TD Securities strategists as saying.

“Unfortunately for gold bugs, underlying inflation trends will remain distorted for months — which removes the immediate impetus for buying the yellow metal.”

Others considered the drop in gold prices to be excessive with Commerzbank analyst Carsten Fritsch saying that rate hikes in two years’ time are “too far off to warrant any such slump in price”.

Here’s how ASX-listed gold & silver stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| TRM | Truscott Mining Corp | 64 | 64 | 128 | 193 | 0.041 | $5,888,486.39 |

| ANL | Amani Gold Ltd | 33 | 100 | 100 | 100 | 0.002 | $18,580,495.12 |

| STK | Strickland Metals | 19 | 63 | 28 | 242 | 0.044 | $32,351,111.50 |

| MDI | Middle Island Res | 16 | 0 | -56 | -67 | 0.115 | $14,078,095.53 |

| AYM | Australia United Min | 14 | 0 | -11 | 300 | 0.008 | $14,740,619.88 |

| DTR | Dateline Resources | 13 | 47 | 120 | 120 | 0.11 | $39,666,501.00 |

| MTH | Mithril Resources | 13 | 0 | -11 | 13 | 0.017 | $39,953,961.70 |

| DRE | Drednought Resources | 13 | 8 | 18 | 420 | 0.026 | $69,112,169.31 |

| TMX | Terrain Minerals | 11 | 0 | -17 | 67 | 0.01 | $7,357,610.09 |

| NSM | Northstaw | 10 | 3 | -31 | 0.325 | $13,000,000.00 | |

| NAG | Nagambie Resources | 10 | -8 | 73 | 28 | 0.069 | $34,495,331.87 |

| AVW | Avira Resources Ltd | 9 | -14 | -14 | 100 | 0.006 | $8,250,240.00 |

| GED | Golden Deeps | 8 | 24 | 8 | 86 | 0.013 | $10,073,068.72 |

| ALK | Alkane Resources Ltd | 8 | 23 | 10 | 21 | 1.075 | $631,112,128.00 |

| BGL | Bellevue Gold Ltd | 7 | -8 | -37 | -13 | 0.825 | $693,585,960.03 |

| ARL | Ardea Resources Ltd | 7 | 12 | 29 | 102 | 0.555 | $71,495,525.92 |

| FFR | Firefly Resources | 5 | -5 | -24 | 254 | 0.105 | $35,344,045.95 |

| PF1 | Pathfinder Resources | 5 | 8 | 33 | 0.325 | $16,160,361.75 | |

| SMI | Santana Minerals Ltd | 5 | -15 | -41 | -18 | 0.115 | $13,113,753.14 |

| PNR | Pantoro Limited | 5 | 2 | 0 | 15 | 0.23 | $330,973,583.58 |

| VAN | Vango Mining Ltd | 4 | 11 | 13 | -33 | 0.07 | $75,629,315.14 |

| RND | Rand Mining Ltd | 4 | 5 | -17 | -25 | 1.495 | $85,029,561.70 |

| AXE | Archer Materials | 4 | 6 | 45 | 28 | 0.76 | $169,527,409.50 |

| DEX | Duke Exploration | 4 | -1 | 3 | 0.38 | $23,833,119.35 | |

| FFX | Firefinch Ltd | 4 | 4 | 214 | 344 | 0.44 | $372,911,644.35 |

| AAJ | Aruma Resources Ltd | 3 | 7 | -38 | 8 | 0.065 | $6,993,421.18 |

| BNR | Bulletin Res Ltd | 3 | 3 | -13 | -18 | 0.072 | $12,909,101.33 |

| CXU | Cauldron Energy Ltd | 3 | 17 | 14 | 71 | 0.041 | $18,695,979.99 |

| HRN | Horizon Gold Ltd | 2 | 5 | -6 | 88 | 0.44 | $46,944,487.04 |

| NWM | Norwest Minerals | 2 | -3 | 1 | -39 | 0.092 | $9,795,616.11 |

| RSG | Resolute Mining | 2 | -15 | -37 | -48 | 0.53 | $601,621,524.77 |

| CAZ | Cazaly Resources | 2 | 2 | 15 | 86 | 0.054 | $19,586,853.15 |

| PGD | Peregrine Gold | 1 | 1 | 0.345 | $10,022,984.85 | ||

| GIB | Gibb River Diamonds | 1 | 16 | -57 | 83 | 0.073 | $15,440,189.49 |

| SFM | Santa Fe Minerals | 1 | -8 | -5 | 48 | 0.089 | $6,480,872.22 |

| FG1 | Flynngold | 0.15 | $9,299,999.69 | ||||

| AQI | Alicanto Min Ltd | 0 | 4 | 13 | 117 | 0.13 | $42,622,769.93 |

| AGS | Alliance Resources | 0 | 0 | -12 | 1 | 0.145 | $30,162,484.43 |

| RMX | Red Mount Min Ltd | 0 | 5 | -13 | 163 | 0.0105 | $13,825,047.38 |

| CBY | Canterbury Resources | 0 | 3 | -12 | -8 | 0.097 | $10,850,924.11 |

| BTR | Brightstar Resources | 0 | 25 | -41 | 600 | 0.035 | $15,391,276.74 |

| SPQ | Superior Resources | 0 | 9 | -14 | 140 | 0.012 | $16,576,029.49 |

| SI6 | SI6 Metals Limited | 0 | -8 | -58 | 267 | 0.011 | $15,325,862.90 |

| DLC | Delecta Limited | 0 | 0 | 0 | 20 | 0.006 | $6,051,727.23 |

| GTR | Gti Resources | 0 | -4 | 5 | -15 | 0.023 | $14,823,913.95 |

| GSM | Golden State Mining | 0 | 33 | -9 | -47 | 0.16 | $13,653,479.07 |

| AOP | Apollo Consolidated | 0 | -8 | -2 | 4 | 0.285 | $85,438,074.05 |

| TRN | Torrens Mining | 0 | 100 | 0.27 | $18,418,033.26 | ||

| LCY | Legacy Iron Ore | 0 | 0 | -63 | 650 | 0.015 | $96,071,077.76 |

| CGN | Crater Gold Min Ltd | 0 | -6 | 0 | 70 | 0.017 | $20,867,429.74 |

| HRZ | Horizon | 0 | 9 | 25 | 25 | 0.125 | $70,996,900.00 |

| BRV | Big River Gold Ltd | 0 | 10 | -9 | 72 | 0.4 | $85,538,974.17 |

| TSC | Twenty Seven Co. Ltd | 0 | 0 | -33 | -20 | 0.004 | $10,642,758.24 |

| CTO | Citigold Corp Ltd | 0 | -8 | -8 | 120 | 0.011 | $30,580,000.00 |

| NPM | Newpeak Metals | 0 | 0 | -33 | 0 | 0.002 | $11,408,322.60 |

| NAE | New Age Exploration | 0 | -28 | 18 | 136 | 0.013 | $19,621,600.74 |

| MLS | Metals Australia | 0 | 0 | 0 | 0 | 0.002 | $8,454,376.09 |

| LNY | Laneway Res Ltd | 0 | 0 | -29 | 11 | 0.005 | $18,875,329.67 |

| KGM | Kalnorth Gold Ltd | 0 | 0 | 0 | 86 | 0.013 | $11,625,120.78 |

| TRY | Troy Resources Ltd | 0 | -36 | -60 | -59 | 0.035 | $26,514,731.88 |

| ALY | Alchemy Resource Ltd | 0 | -18 | -7 | -20 | 0.014 | $9,411,408.34 |

| REZ | Resourc & En Grp Ltd | 0 | -11 | -30 | 100 | 0.032 | $14,245,466.04 |

| MBK | Metal Bank Ltd | 0 | -10 | -18 | 18 | 0.009 | $10,701,614.74 |

| A8G | Australasian Gold | 0 | -3 | 0.165 | $5,463,965.27 | ||

| GWR | GWR Group Ltd | 0 | -7 | -2 | 375 | 0.28 | $84,780,204.04 |

| NML | Navarre Minerals Ltd | 0 | -23 | -47 | -26 | 0.1 | $64,624,215.10 |

| OKR | Okapi Resources | 0 | 3 | -5 | 25 | 0.2 | $10,669,726.20 |

| MAT | Matsa Resources | 0 | -1 | -33 | -47 | 0.077 | $24,013,168.62 |

| DTM | Dart Mining NL | 0 | 0 | -18 | 32 | 0.14 | $13,992,366.64 |

| VRC | Volt Resources Ltd | 0 | -10 | 218 | 84 | 0.035 | $83,311,483.54 |

| PRU | Perseus Mining Ltd | -1 | 8 | 7 | 23 | 1.38 | $1,661,849,058.85 |

| AME | Alto Metals Limited | -1 | -10 | -2 | 20 | 0.089 | $40,973,635.89 |

| STN | Saturn Metals | -1 | 5 | -34 | -16 | 0.42 | $49,484,384.40 |

| GOR | Gold Road Res Ltd | -1 | 3 | 11 | -2 | 1.425 | $1,259,659,312.34 |

| BDC | Bardoc Gold Ltd | -1 | -4 | -4 | -16 | 0.068 | $121,468,016.32 |

| KCN | Kingsgate Consolid. | -2 | -5 | 0 | 121 | 0.8525 | $194,554,308.40 |

| RRL | Regis Resources | -2 | -4 | -30 | -50 | 2.515 | $1,900,132,695.72 |

| MKG | Mako Gold | -2 | -10 | -18 | 22 | 0.09 | $23,151,744.18 |

| SBM | St Barbara Limited | -2 | -14 | -29 | -42 | 1.765 | $1,263,822,463.37 |

| HCH | Hot Chili Ltd | -3 | 3 | -8 | 106 | 0.037 | $114,854,272.65 |

| MAU | Magnetic Resources | -3 | 8 | 23 | 26 | 1.47 | $320,715,030.30 |

| BCN | Beacon Minerals | -3 | -3 | 7 | 7 | 0.035 | $125,423,415.08 |

| CYL | Catalyst Metals | -3 | 1 | -23 | -31 | 1.92 | $186,761,873.70 |

| AZS | Azure Minerals | -3 | -1 | -64 | 258 | 0.2575 | $81,642,716.07 |

| KAI | Kairos Minerals Ltd | -3 | 10 | -6 | 35 | 0.034 | $58,676,435.09 |

| LCL | Los Cerros Limited | -3 | -11 | 68 | 371 | 0.165 | $78,127,092.78 |

| SLR | Silver Lake Resource | -3 | -14 | -13 | -13 | 1.645 | $1,467,822,899.48 |

| TNR | Torian Resources Ltd | -3 | -38 | 11 | 4 | 0.031 | $26,951,001.71 |

| AWJ | Auric Mining | -3 | -3 | 0.15 | $6,368,766.71 | ||

| TIN | Tnt Mines Limited | -3 | -6 | -49 | -6 | 0.15 | $14,463,480.00 |

| HWK | Hawkstone Mng Ltd | -3 | -3 | 190 | 314 | 0.029 | $47,766,689.64 |

| SVL | Silver Mines Limited | -3 | 4 | 30 | 192 | 0.28 | $347,040,797.74 |

| AUT | Auteco Minerals | -3 | -8 | -14 | 46 | 0.083 | $150,046,104.24 |

| FML | Focus Minerals Ltd | -4 | -5 | -17 | 17 | 0.275 | $50,255,855.38 |

| NES | Nelson Resources. | -4 | -31 | -15 | 31 | 0.055 | $8,001,025.56 |

| S2R | S2 Resources | -4 | -18 | 8 | 38 | 0.135 | $42,510,309.17 |

| DCN | Dacian Gold Ltd | -4 | -19 | -27 | -40 | 0.27 | $250,422,032.30 |

| SSR | SSR Mining Inc. | -4 | -7 | -14 | 21.63 | $422,918,572.50 | |

| ICG | Inca Minerals Ltd | -4 | 4 | 136 | 551 | 0.125 | $51,390,492.88 |

| CMM | Capricorn Metals | -4 | 2 | 14 | 19 | 1.9 | $689,538,373.63 |

| OKU | Oklo Resources Ltd | -4 | -8 | -44 | -57 | 0.115 | $55,443,279.32 |

| TTM | Titan Minerals | -4 | -4 | 0 | 75 | 0.11 | $119,642,505.57 |

| BRB | Breaker Res NL | -4 | -14 | -17 | -38 | 0.1625 | $52,134,548.64 |

| MEU | Marmota Limited | -4 | -2 | -2 | -28 | 0.043 | $40,678,414.98 |

| RGL | Riversgold | -5 | -5 | -16 | -9 | 0.042 | $16,969,772.23 |

| WWI | West Wits Mining Ltd | -5 | 1 | 53 | 740 | 0.084 | $119,089,794.43 |

| AWV | Anova Metals Ltd | -5 | 5 | -20 | -13 | 0.02 | $28,661,884.00 |

| ARV | Artemis Resources | -5 | -45 | -50 | 49 | 0.058 | $72,789,863.76 |

| BMO | Bastion Minerals | -5 | 6 | 0.19 | $10,916,309.40 | ||

| WRM | White Rock Min Ltd | -5 | 22 | 3 | 23 | 0.555 | $51,030,930.36 |

| CAI | Calidus Resources | -5 | 16 | -7 | 7 | 0.46 | $187,966,323.09 |

| ZAG | Zuleika Gold Ltd | -5 | -5 | -33 | 17 | 0.035 | $14,353,268.06 |

| ENR | Encounter Resources | -6 | 26 | 3 | 13 | 0.17 | $53,678,608.91 |

| PNX | PNX Metals Limited | -6 | 21 | 21 | 0 | 0.0085 | $29,217,548.09 |

| BYH | Bryah Resources Ltd | -6 | -7 | 2 | 37 | 0.067 | $13,387,421.19 |

| WMX | Wiluna Mining Corp | -6 | -10 | -38 | -28 | 0.92 | $148,781,773.08 |

| EVN | Evolution Mining Ltd | -6 | -9 | -5 | -13 | 4.655 | $8,030,735,299.50 |

| ARN | Aldoro Resources | -6 | -1 | 144 | 358 | 0.33 | $26,504,346.99 |

| RMS | Ramelius Resources | -6 | -8 | 0 | -3 | 1.72 | $1,404,179,783.85 |

| GRL | Godolphin Resources | -6 | -6 | -36 | -9 | 0.16 | $13,457,667.52 |

| NCM | Newcrest Mining | -6 | -9 | -5 | -15 | 25.84 | $21,862,499,261.00 |

| TIE | Tietto Minerals | -6 | 5 | -22 | -21 | 0.31 | $148,260,273.20 |

| CWX | Carawine Resources | -6 | -13 | -4 | 35 | 0.23 | $24,500,227.95 |

| FAU | First Au Ltd | -6 | -17 | -12 | 25 | 0.015 | $9,219,431.31 |

| ZNC | Zenith Minerals Ltd | -6 | -13 | 73 | 96 | 0.225 | $67,702,806.90 |

| RML | Resolution Minerals | -6 | -2 | -48 | -67 | 0.0225 | $10,296,631.12 |

| IPT | Impact Minerals | -6 | -9 | -29 | 15 | 0.015 | $30,356,923.79 |

| PRX | Prodigy Gold NL | -6 | -4 | 0 | 0 | 0.045 | $24,966,987.06 |

| WAF | West African Res Ltd | -6 | -13 | -12 | 5 | 0.9 | $821,345,767.56 |

| WGX | Westgold Resources. | -6 | -2 | -25 | 2 | 2.08 | $868,903,303.50 |

| IDA | Indiana Resources | -6 | -15 | 22 | 156 | 0.072 | $22,308,743.52 |

| CDT | Castle Minerals | -7 | 17 | 56 | 56 | 0.014 | $10,987,512.27 |

| KWR | Kingwest Resources | -7 | -8 | -48 | -36 | 0.084 | $16,768,256.85 |

| RED | Red 5 Limited | -7 | -14 | -33 | -46 | 0.1725 | $410,606,568.23 |

| KAU | Kaiser Reef | -7 | 6 | -33 | 4 | 0.275 | $27,106,339.12 |

| TBR | Tribune Res Ltd | -7 | -7 | -17 | -25 | 4.8 | $251,846,769.60 |

| TBA | Tombola Gold Ltd | -7 | -15 | -11 | 32 | 0.041 | $23,834,718.50 |

| IVR | Investigator Res Ltd | -7 | -1 | 51 | 441 | 0.092 | $125,774,927.67 |

| SKY | SKY Metals Ltd | -7 | -21 | -37 | -51 | 0.13 | $30,831,228.50 |

| A1G | African Gold Ltd. | -7 | 11 | 27 | 164 | 0.26 | $21,480,843.34 |

| BC8 | Black Cat Syndicate | -7 | -10 | -2 | -2 | 0.625 | $87,383,100.42 |

| DEG | De Grey Mining | -7 | -8 | 23 | 129 | 1.305 | $1,693,066,349.91 |

| MEG | Megado | -8 | -25 | -37 | 0.12 | $4,895,855.76 | |

| HAW | Hawthorn Resources | -8 | 2 | -60 | -59 | 0.048 | $16,342,265.04 |

| MEI | Meteoric Resources | -8 | -13 | -29 | 92 | 0.048 | $65,739,576.95 |

| MHC | Manhattan Corp Ltd | -8 | -14 | -57 | -8 | 0.012 | $18,315,344.32 |

| DCX | Discovex Res Ltd | -8 | -14 | -14 | 9 | 0.006 | $15,411,984.46 |

| KCC | Kincora Copper | -8 | -17 | 0.3 | $22,239,986.88 | ||

| ONX | Orminexltd | -8 | -17 | 96 | 13 | 0.045 | $24,654,275.33 |

| KRM | Kingsrose Mining Ltd | -8 | 0 | 53 | 53 | 0.055 | $41,610,419.06 |

| MCT | Metalicity Limited | -8 | 0 | -35 | -8 | 0.011 | $20,072,547.36 |

| SIH | Sihayo Gold Limited | -8 | -15 | -45 | -46 | 0.011 | $40,540,075.54 |

| TAM | Tanami Gold NL | -8 | -16 | -8 | 12 | 0.066 | $79,906,599.13 |

| SVY | Stavely Minerals Ltd | -8 | -22 | -44 | -28 | 0.485 | $127,871,111.48 |

| GSN | Great Southern | -9 | -17 | -39 | -54 | 0.043 | $20,475,918.90 |

| CST | Castile Resources | -9 | -20 | -9 | 72 | 0.215 | $44,934,777.23 |

| MGV | Musgrave Minerals | -9 | 0 | -1 | -16 | 0.375 | $191,960,261.64 |

| AMI | Aurelia Metals Ltd | -9 | -9 | -13 | -15 | 0.375 | $481,548,551.25 |

| KTA | Krakatoa Resources | -9 | -22 | -20 | 47 | 0.053 | $14,784,350.00 |

| OBM | Ora Banda Mining Ltd | -9 | -28 | -45 | -41 | 0.155 | $149,698,567.40 |

| ADT | Adriatic Metals | -9 | 1 | 18 | 94 | 2.52 | $483,562,810.92 |

| SNG | Siren Gold | -9 | 11 | -65 | 0.25 | $16,833,617.84 | |

| SAU | Southern Gold | -9 | -16 | -30 | -48 | 0.07 | $15,146,341.68 |

| MRR | Minrex Resources Ltd | -9 | -33 | -5 | 100 | 0.02 | $11,573,878.16 |

| OAU | Ora Gold Limited | -9 | -20 | -5 | 43 | 0.02 | $16,841,904.44 |

| MSR | Manas Res Ltd | -9 | 43 | 67 | 100 | 0.01 | $33,156,235.98 |

| TLM | Talisman Mining | -9 | -20 | 104 | 38 | 0.2 | $37,325,677.00 |

| NST | Northern Star | -9 | -11 | -20 | -24 | 10 | $11,797,307,142.66 |

| EMR | Emerald Res NL | -9 | -5 | 36 | 95 | 0.935 | $489,627,346.65 |

| NMR | Native Mineral Res | -9 | -13 | -42 | 0.27 | $7,491,510.00 | |

| CHZ | Chesser Resources | -9 | 21 | -36 | 93 | 0.145 | $67,875,318.75 |

| HXG | Hexagon Energy | -9 | -15 | 28 | 20 | 0.077 | $35,235,092.33 |

| BBX | BBX Minerals Ltd | -9 | -8 | -13 | 118 | 0.24 | $107,159,535.46 |

| HMX | Hammer Metals Ltd | -10 | -3 | 171 | 171 | 0.095 | $76,631,989.31 |

| AGG | AngloGold Ashanti | -10 | -13 | -13 | -28 | 5.2 | $474,585,309.80 |

| GBR | Greatbould Resources | -10 | -7 | 97 | 256 | 0.085 | $30,355,072.65 |

| RDN | Raiden Resources Ltd | -10 | 8 | -3 | 460 | 0.028 | $33,944,489.07 |

| RXL | Rox Resources | -10 | -18 | -45 | -38 | 0.028 | $68,559,311.13 |

| MTC | Metalstech Ltd | -10 | 77 | 12 | 64 | 0.23 | $36,916,233.12 |

| MRZ | Mont Royal Resources | -10 | -21 | -10 | 59 | 0.27 | $10,226,713.05 |

| SBR | Sabre Resources | -10 | -10 | -50 | 50 | 0.0045 | $7,573,786.42 |

| PAK | Pacific American Hld | -10 | -10 | -25 | 80 | 0.018 | $5,734,528.20 |

| AGC | AGC Ltd | -10 | -16 | 0.135 | $9,481,819.76 | ||

| AGC | AGC Ltd | -10 | -16 | 0.135 | $9,481,819.76 | ||

| DDD | 3D Resources Limited | -10 | 13 | 36 | 118 | 0.0045 | $17,461,674.41 |

| TSO | Tesoro Resources Ltd | -10 | -27 | -46 | 99 | 0.135 | $72,430,982.18 |

| TAR | Taruga Minerals | -10 | -37 | 29 | 200 | 0.054 | $27,801,207.83 |

| DGO | DGO Gold Limited | -10 | -14 | 2 | 10 | 3.01 | $231,688,006.20 |

| MVL | Marvel Gold Limited | -10 | 13 | -4 | 118 | 0.053 | $25,940,846.96 |

| AUC | Ausgold Limited | -10 | 2 | 2 | 132 | 0.044 | $71,340,729.35 |

| SRN | Surefire Rescs NL | -11 | -29 | -39 | 325 | 0.017 | $18,593,076.97 |

| MZZ | Matador Mining Ltd | -11 | 11 | 39 | 79 | 0.465 | $84,919,749.46 |

| MOH | Moho Resources | -11 | -11 | -29 | -6 | 0.067 | $7,332,553.54 |

| GBZ | GBM Rsources Ltd | -11 | 9 | 0 | 95 | 0.125 | $54,155,772.75 |

| KSN | Kingston Resources | -11 | -13 | -21 | 41 | 0.205 | $61,003,443.39 |

| AAU | Antilles Gold Ltd | -11 | 0 | 16 | 53 | 0.065 | $16,910,035.40 |

| MKR | Manuka Resources. | -11 | -24 | -17 | 0.32 | $32,294,823.10 | |

| NUS | Nusantara Resources | -11 | 0 | -5 | -16 | 0.28 | $66,489,172.03 |

| MML | Medusa Mining Ltd | -11 | 2 | 5 | 25 | 0.825 | $176,692,305.85 |

| NVA | Nova Minerals Ltd | -11 | 2 | -11 | 141 | 0.1375 | $241,127,263.82 |

| G88 | Golden Mile Res Ltd | -11 | -11 | 8 | 38 | 0.054 | $7,981,044.70 |

| GUL | Gullewa Limited | -12 | -13 | -31 | -28 | 0.076 | $13,860,355.60 |

| ASO | Aston Minerals Ltd | -12 | 5 | 306 | 392 | 0.1625 | $162,213,562.93 |

| ERM | Emmerson Resources | -12 | -15 | -16 | -39 | 0.064 | $33,381,978.76 |

| AQX | Alice Queen Ltd | -13 | 0 | -46 | -50 | 0.014 | $17,312,213.03 |

| RDS | Redstone Resources | -13 | 17 | 17 | 100 | 0.014 | $11,503,985.01 |

| RVR | Red River Resources | -13 | -10 | -23 | 157 | 0.1925 | $103,554,873.40 |

| WCN | White Cliff Min Ltd | -13 | -13 | -52 | 56 | 0.014 | $7,240,749.59 |

| PRS | Prospech Limited | -13 | -7 | -33 | 0 | 0.14 | $9,102,882.46 |

| PUR | Pursuit Minerals | -13 | 23 | 268 | 1403 | 0.07 | $67,297,525.87 |

| KZR | Kalamazoo Resources | -13 | -10 | -28 | -21 | 0.38 | $53,436,280.77 |

| AAR | Anglo Australian | -13 | -14 | -43 | -42 | 0.075 | $45,942,653.95 |

| ANX | Anax Metals Ltd | -13 | -21 | 63 | 255 | 0.075 | $26,964,159.53 |

| M2R | Miramar | -13 | -8 | -45 | 0.17 | $7,389,816.00 | |

| GML | Gateway Mining | -13 | -13 | -31 | 54 | 0.02 | $38,072,712.00 |

| EM2 | Eagle Mountain | -13 | -17 | 194 | 600 | 0.91 | $188,622,508.42 |

| SLZ | Sultan Resources Ltd | -13 | -24 | -2 | 73 | 0.225 | $15,992,909.47 |

| GMN | Gold Mountain Ltd | -14 | -22 | -22 | -35 | 0.032 | $24,567,197.57 |

| BAR | Barra Resources | -14 | -10 | -17 | 12 | 0.019 | $13,552,162.02 |

| PUA | Peak Minerals Ltd | -14 | -5 | -37 | 0 | 0.019 | $11,679,350.39 |

| CHN | Chalice Mining Ltd | -14 | -4 | 95 | 739 | 7.345 | $2,469,624,638.16 |

| TMZ | Thomson Res Ltd | -14 | -4 | 25 | 400 | 0.125 | $60,213,076.30 |

| XAM | Xanadu Mines Ltd | -14 | -35 | 3 | -16 | 0.037 | $45,202,239.00 |

| PKO | Peako Limited | -14 | -8 | 61 | 205 | 0.037 | $7,106,004.55 |

| NXM | Nexus Minerals Ltd | -14 | -14 | -42 | 52 | 0.073 | $18,799,678.67 |

| CY5 | Cygnus Gold Limited | -14 | -14 | -33 | 54 | 0.12 | $14,094,612.74 |

| GMR | Golden Rim Resources | -14 | -10 | -10 | 29 | 0.009 | $24,033,147.11 |

| VMC | Venus Metals Cor Ltd | -15 | 3 | -17 | -22 | 0.175 | $29,460,343.19 |

| PDI | Predictive Disc Ltd | -15 | -6 | 55 | 9 | 0.085 | $110,358,782.69 |

| BAT | Battery Minerals Ltd | -15 | -6 | -15 | 183 | 0.017 | $34,701,650.20 |

| LEX | Lefroy Exploration | -15 | 19 | 449 | 435 | 1.07 | $134,410,827.04 |

| MM8 | Medallion Metals. | -15 | 12 | 0.28 | $22,451,629.48 | ||

| E2M | E2 Metals | -15 | -8 | -58 | 100 | 0.28 | $41,293,561.65 |

| YRL | Yandal Resources | -15 | -29 | 27 | 57 | 0.47 | $45,577,103.34 |

| ADN | Andromeda Metals Ltd | -15 | 16 | -12 | 323 | 0.22 | $486,163,761.08 |

| EMU | EMU NL | -16 | -43 | -25 | 50 | 0.027 | $12,325,891.07 |

| CLA | Celsius Resource Ltd | -16 | -30 | -30 | 167 | 0.032 | $32,464,070.51 |

| VKA | Viking Mines Ltd | -16 | -16 | -16 | 329 | 0.026 | $26,552,719.21 |

| THR | Thor Mining PLC | -17 | -13 | 9 | 169 | 0.0175 | $10,673,455.96 |

| BNZ | Benzmining | -17 | -6 | 0.75 | $29,584,924.98 | ||

| AL8 | Alderan Resource Ltd | -17 | -27 | -51 | -69 | 0.049 | $14,897,054.60 |

| OZM | Ozaurum Resources | -17 | -4 | 0.13 | $6,762,600.00 | ||

| CEL | Challenger Exp Ltd | -20 | -25 | 5 | -4 | 0.225 | $166,383,471.66 |

| M24 | Mamba Exploration | -20 | -7 | 0.2 | $7,770,000.00 | ||

| XTC | Xantippe Res Ltd | -20 | 0 | -20 | -20 | 0.002 | $8,149,128.80 |

| GNM | Great Northern | -24 | 0 | 0 | 8 | 0.013 | $15,717,662.69 |

| ADV | Ardiden Ltd | -25 | -17 | -46 | 88 | 0.0075 | $15,045,479.51 |

| PNM | Pacific Nickel Mines | -27 | -29 | -31 | 20 | 0.036 | $7,736,221.30 |

Truscott Mining (ASX:TRM) +64%

Truscott was up on no news with the company telling the ASX that it was unaware of any reason for the increase in its share price or the volume of stocks traded.

Mithril Resources (ASX:MTH) +13%

It is not every day that one pulls out a gold intersection grading more than 200 grams per tonne (g/t), so when Mithril Resources reported a bonanza intersection of 2.1m at 235g/t gold and 2,554g/t silver within a broader 6.8m zone at 74g/t gold and 841g/t silver, punters reacted accordingly.

The result confirms bonanza grades in historical drilling at its Copalquin project in Mexico

Drilling at the equally exciting El Refugio discovery has also extended the structure to 650m long and 300m down-dip with drilling returning results such as 7.6m at 2.34g/t gold and 143.6g/t silver from 253.25m.

North Stawell Minerals (ASX:NSM) +10%

The grant of two new tenements that contain large-scale intrusive granites and diorites that have the potential to host intrusive-related gold mineralisation increased the size of North Stawell’s granted exploration tenure in Victoria up from 552.9sqkm to 601.9sqkm.

West Barrabool contains coincident magnetic and gravity anomalies situated around a diorite that cut through into the company’s neighbouring EL5443 and has the potential to host Wonga-style deposits.

The other tenement, Wimmera Park Granite, hosts another significant intrusive that cuts through the southern extension of the Wildwood basalt and may host significant remobilised gold targets around the alteration rim.

Exceptional copper, lead and vanadium intersections were intersected at the first eight of 15 reverse circulation wells at Golden Deeps’ Nosib Block prospect in Namibia.

This featured a top hit of 24m grading 1.33% copper, 4.77% lead, 1.37 per cent vanadium oxide and 3.67g/t silver from just 3m including a 6m zone grading 3.67% copper, 14.9% lead, 4.4% vanadium oxide and 12.16g/t silver from 6m.

Nosib Block was a high-grade copper-vanadium mine located west of Khusib Springs and 20km along strike from the company’s Abenab high-grade vanadium project.

Grade control drilling at Bellevue’s namesake project has returned results of up to 176.6g/t gold and demonstrated the excellent continuity of the orebody.

This drilling is key to the company’s strategy of development and further resource at the project.

Step-out and infill drilling is also continuing at the Marceline and Deacon North lodes with four surface rigs and two underground rigs targeting further resource growth.

At Stockhead we tell it like it is. While Mithril Resources is a Stockhead advertiser, it did not sponsor this article.