Gold Digger: Banking on it – ANZ upgrades gold outlook, SocGen sees further upside

Pic: Getty

- Spot gold prices are up since this time last week, and ASX goldies are benefitting

- ANZ upgrades its gold outlook for rest of this year, and 2024

- The week’s top ASX gold-related stocks led by: TG1, KGD and CPM

First things first, let’s just make a brief mention about Aussie gold.

Our Aussie-gold-wearing ODI team, that is, which scraped (well surged, really, with eight wins on the trot) into yet another World Cup final in the wee hours this morning.

India is absolutely the team to beat, etc, but could be quietly bricking it having to face the most successful World Cup cricketing nation of all time.

But enough from CricketHead. Speaking of bricking it, then, where are things at with gold prices compared with this about time last week?

Actually not too bad.

In dipping US dollars, gold is trading, at time of writing, for a healthy $1,989 an ounce. (In Aussie dollars, it’s changing hands for about $3,076 per oz.)

Meanwhile, as reported in Ground Breakers earlier: the ASX gold sub-index was up 2.6% in early trade to take the materials sector to 0.3% gain before lunch on Friday.

Analysts, such as Kitco’s Jim Wyckoff, are putting the reasonably good performance this week (after a lacklustre one last week) down to the tamer US inflation data that fed the Fed a few days ago.

The US dollar dipped this week, along with Treasury yields, after US weekly jobless claims increased more than expected. Consequently, expectations are still high that the US Federal Reserve will continue the pause in its interest-rate hiking cycle. Or better still, sit on something and pivot.

We are in a new Daily Cycle, 2nd in this Investor Cycle. Options Exp tomorrow-so I am expecting more meaningful advances next wk.

Fed pivot, advancing TLT, USD rolling over. All fundamentals you care to throw at it.

The USD 3 yr cycle low is going to suck the price down hard. pic.twitter.com/IMWro8Obf4

— Simon (@sich8) November 16, 2023

Hang on… how did the following tweet sneak in here?

Australia have done it!!

They have defeated South Africa yet again in a World Cup semi-final #SAvsAUS

It will be INDIA vs AUSTRALIA for the 🏆 pic.twitter.com/3YJ9aKN6Q1

— Cricbuzz (@cricbuzz) November 16, 2023

ANZ upgrades gold outlook for 2024

We know central bankers the world over are hot and heavy for gold this year, buying up in bulk – (particularly the People’s Bank of China), but big private banking entities are also on the gold-plated bandwagon. In least in terms of forecasting.

This week, ANZ released its latest precious metals report – ‘The Vault’ – citing various reasons to stay strong on the yellow metal.

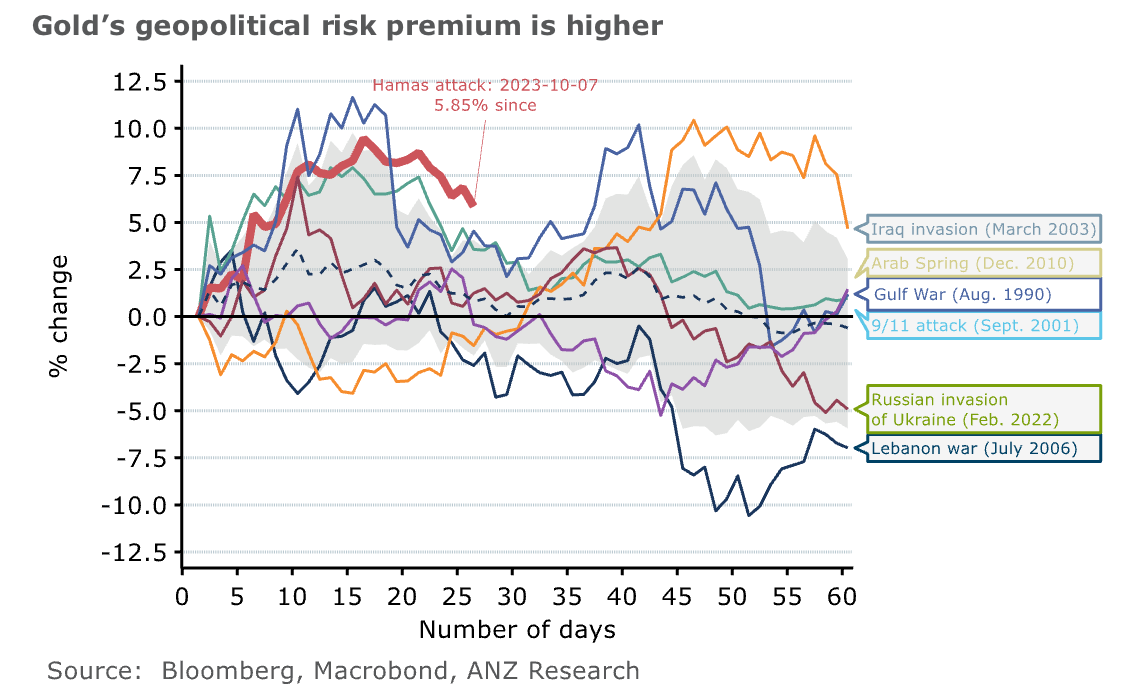

Not to be a doom-mongerer or anything, but the bank notes that geopolitical tension will “protect the downside in gold prices”.

“Renewed geopolitical tensions will protect the downside in Gold prices. This is in addition to the conclusion of the US monetary tightening cycle and an imminent peak in the US Dollar.

“We expect central bank Gold purchases to remain strong.”

And the bank has upgraded its gold demand estimates for 2023 and 2024, as follows:

“Based on current pace of purchase, we upgrade our demand estimates to 1,050t from 750t for 2023 and 800t for 2024.”

ANZ also notes that central banks in emerging markets are also positioning themselves against rising debt levels in reserve currency economies (such as the US, Europe and Japan) as this increases the credit risk.

“US debt levels, for example, have increased 46% to 33trn since 2020, leaving credit risk high for US assets. This pattern is likely to continue as debt levels increase.”

And, citing the recent US labour data, the bank suggests it’s in line with the Fed’s softening stance on interest rates and potentially being on track to reach its 2% inflation target:

“US ISM Services PMI data confirm that underlying demand in the US is softening. This builds a case for declining UST yields and a moderating DXY, which is supportive for gold investment demand.”

SocGen sees further upside

Meanwhile, strategists at major, French-based multinational bank Société Générale (per FXStreet) also see more gains for gold from here and into next year.

They, similar to ANZ, cite interest rates peaking, US recession, unstable geopolitics and central bank buying as chief reasons to go for gold:

“US rates can come off more and sooner than rates in other OECD economies, signalling possible dollar weakness ahead, creating a tailwind for gold,” said SocGen, adding:

“With a recession in the US looming – however mild – there is a risk that the Fed will have to start lowering rates before sticky inflation budges, lowering carrying costs and elevating the expected return for gold.”

And, as Josh also notes in Ground Breakers, SocGen has also tipped prices rising to US$2,200/oz from the second quarter of next year after lower than expected US inflation data brought prices back into positive territory this week.

Meanwhile, this caught our eyes, too…

"The investment fund, which is famous for successfully shorting Lehman Brothers in the runup to the 2008 crash, now has a bigger stake in the SPDR Gold Trust than at any prior point, as gold prices have again started to rally in recent months…"

Source: https://t.co/sYsuH1uqHq

— Gold Telegraph ⚡ (@GoldTelegraph_) November 16, 2023

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| Code | Company | Price | % Week | % Month | % YTD | Market Cap |

|---|---|---|---|---|---|---|

| MRR | Minrex Resources Ltd | 0.022 | 38% | 38% | -1% | $17,357,880 |

| NPM | Newpeak Metals | 0.001 | 0% | 0% | 0% | $9,995,579 |

| ASO | Aston Minerals Ltd | 0.034 | 0% | -11% | -5% | $47,917,378 |

| MTC | Metalstech Ltd | 0.15 | 25% | -21% | -37% | $29,233,711 |

| FFX | Firefinch Ltd | 0.2 | 0% | 0% | 0% | $236,569,315 |

| GED | Golden Deeps | 0.055 | 4% | 4% | -4% | $6,238,207 |

| G88 | Golden Mile Res Ltd | 0.024 | 0% | 20% | 0% | $8,234,738 |

| DCX | Discovex Res Ltd | 0.002 | 0% | 0% | 0% | $6,605,136 |

| NMR | Native Mineral Res | 0.032 | 7% | -42% | -8% | $6,921,767 |

| AQX | Alice Queen Ltd | 0.008 | -33% | -33% | -3% | $1,018,444 |

| SLZ | Sultan Resources Ltd | 0.016 | 0% | -11% | -7% | $2,371,041 |

| MKG | Mako Gold | 0.014 | 0% | -13% | -3% | $8,064,115 |

| KSN | Kingston Resources | 0.082 | -4% | -2% | 0% | $41,330,832 |

| AMI | Aurelia Metals Ltd | 0.105 | 5% | 21% | -1% | $185,376,753 |

| PNX | PNX Metals Limited | 0.004 | 0% | 60% | 0% | $16,141,874 |

| GIB | Gibb River Diamonds | 0.033 | -11% | -3% | -3% | $6,979,812 |

| KCN | Kingsgate Consolid. | 1.17 | 2% | 0% | -56% | $286,104,378 |

| TMX | Terrain Minerals | 0.0045 | 13% | 13% | 0% | $5,413,711 |

| BNR | Bulletin Res Ltd | 0.16 | -3% | 33% | 7% | $48,442,532 |

| NXM | Nexus Minerals Ltd | 0.038 | -3% | -17% | -16% | $15,562,405 |

| SKY | SKY Metals Ltd | 0.046 | 15% | 15% | 0% | $21,224,312 |

| LM8 | Lunnonmetalslimited | 0.7 | 0% | 4% | -20% | $151,939,369 |

| CST | Castile Resources | 0.057 | -8% | 14% | -4% | $13,788,438 |

| YRL | Yandal Resources | 0.07 | 21% | 56% | -3% | $11,046,216 |

| FAU | First Au Ltd | 0.002 | 0% | -33% | 0% | $2,903,987 |

| ARL | Ardea Resources Ltd | 0.47 | -19% | -13% | -24% | $102,197,505 |

| GWR | GWR Group Ltd | 0.077 | -10% | 3% | 2% | $25,376,116 |

| IVR | Investigator Res Ltd | 0.042 | 11% | 11% | 0% | $57,486,801 |

| GTR | Gti Energy Ltd | 0.0085 | 21% | -6% | 0% | $16,399,577 |

| IPT | Impact Minerals | 0.011 | -8% | 10% | 0% | $32,944,095 |

| BNZ | Benzmining | 0.355 | 11% | -7% | -6% | $34,622,807 |

| MOH | Moho Resources | 0.009 | 29% | 29% | -1% | $3,297,548 |

| BBX | BBX Minerals Ltd | 0.027 | 8% | 13% | -8% | $17,016,800 |

| PUA | Peak Minerals Ltd | 0.003 | 0% | -14% | 0% | $3,124,130 |

| MRZ | Mont Royal Resources | 0.165 | 0% | -3% | -1% | $13,578,664 |

| SMS | Starmineralslimited | 0.038 | 0% | -5% | -3% | $2,837,566 |

| MVL | Marvel Gold Limited | 0.01 | -9% | -17% | -2% | $10,365,488 |

| PRX | Prodigy Gold NL | 0.009 | 20% | 0% | 0% | $14,008,863 |

| AAU | Antilles Gold Ltd | 0.026 | 8% | 13% | 0% | $19,029,769 |

| CWX | Carawine Resources | 0.105 | 0% | -21% | 1% | $20,665,834 |

| RND | Rand Mining Ltd | 1.365 | 10% | 0% | 1% | $77,635,687 |

| CAZ | Cazaly Resources | 0.032 | -6% | -11% | 0% | $12,640,096 |

| BMR | Ballymore Resources | 0.125 | -4% | 14% | -3% | $18,274,658 |

| DRE | Dreadnought Resources Ltd | 0.0325 | -4% | -28% | -7% | $117,536,140 |

| ZNC | Zenith Minerals Ltd | 0.17 | 3% | 70% | -10% | $59,904,750 |

| REZ | Resourc & En Grp Ltd | 0.015 | 0% | 7% | 0% | $7,497,087 |

| LEX | Lefroy Exploration | 0.185 | 9% | 3% | -8% | $36,315,824 |

| ERM | Emmerson Resources | 0.06 | 0% | 0% | -2% | $31,593,168 |

| AM7 | Arcadia Minerals | 0.09 | 13% | -14% | -12% | $9,705,459 |

| ADT | Adriatic Metals | 3.21 | 0% | -9% | 6% | $755,842,289 |

| GMR | Golden Rim Resources | 0.013 | -28% | -35% | -2% | $10,648,591 |

| CYL | Catalyst Metals | 0.8075 | -3% | 24% | -37% | $173,924,460 |

| CHN | Chalice Mining Ltd | 1.57 | -11% | -23% | -473% | $618,451,653 |

| KAL | Kalgoorliegoldmining | 0.029 | 7% | 4% | -5% | $4,156,153 |

| MLS | Metals Australia | 0.04 | 13% | 21% | 0% | $22,465,303 |

| ADN | Andromeda Metals Ltd | 0.025 | 0% | 19% | -2% | $74,640,202 |

| MEI | Meteoric Resources | 0.2375 | -1% | 16% | 18% | $456,759,425 |

| SRN | Surefire Rescs NL | 0.01 | 0% | -23% | 0% | $18,367,531 |

| SIH | Sihayo Gold Limited | 0.0015 | 0% | -25% | 0% | $18,306,384 |

| WA8 | Warriedarresourltd | 0.057 | -8% | -7% | -11% | $28,811,763 |

| HMX | Hammer Metals Ltd | 0.053 | 4% | 20% | -2% | $44,320,367 |

| WCN | White Cliff Min Ltd | 0.012 | 9% | 0% | 0% | $15,084,223 |

| AVM | Advance Metals Ltd | 0.003 | -14% | -25% | -1% | $2,167,040 |

| WRM | White Rock Min Ltd | 0.063 | 0% | 0% | 0% | $17,508,200 |

| ASR | Asra Minerals Ltd | 0.012 | 33% | 71% | -1% | $20,386,879 |

| MCT | Metalicity Limited | 0.0015 | -40% | -25% | 0% | $8,502,172 |

| AME | Alto Metals Limited | 0.045 | 7% | 0% | -2% | $32,139,004 |

| CTO | Citigold Corp Ltd | 0.005 | -9% | 25% | 0% | $14,368,295 |

| TIE | Tietto Minerals | 0.595 | 3% | 53% | -11% | $665,927,366 |

| SMI | Santana Minerals Ltd | 0.7 | -7% | 30% | 5% | $129,817,001 |

| M2R | Miramar | 0.024 | 9% | -45% | -5% | $3,572,869 |

| MHC | Manhattan Corp Ltd | 0.004 | 0% | -20% | 0% | $11,747,919 |

| GRL | Godolphin Resources | 0.035 | 0% | -3% | -5% | $5,923,471 |

| TRY | Troy Resources Ltd | 0 | -100% | -100% | -3% | $62,920,961 |

| SVG | Savannah Goldfields | 0.055 | 0% | -15% | -14% | $11,024,212 |

| EMC | Everest Metals Corp | 0.095 | 6% | -27% | 2% | $15,511,895 |

| GUL | Gullewa Limited | 0.055 | 0% | 0% | -1% | $10,767,521 |

| CY5 | Cygnus Metals Ltd | 0.16 | 0% | 14% | -22% | $44,956,609 |

| G50 | Gold50Limited | 0.13 | 4% | 0% | -12% | $14,207,700 |

| ADV | Ardiden Ltd | 0.005 | -9% | -17% | 0% | $13,441,677 |

| AAR | Astral Resources NL | 0.079 | -5% | -4% | 1% | $61,804,752 |

| MGV | Musgrave Minerals | 0 | -100% | -100% | -21% | $230,571,100 |

| VMC | Venus Metals Cor Ltd | 0.105 | 0% | -5% | 3% | $18,972,868 |

| NAE | New Age Exploration | 0.0075 | 7% | 36% | 0% | $12,557,292 |

| VKA | Viking Mines Ltd | 0.011 | 10% | 10% | 0% | $12,303,101 |

| LCL | LCL Resources Ltd | 0.025 | 4% | -22% | -3% | $20,651,916 |

| MTH | Mithril Resources | 0.002 | 0% | 33% | 0% | $6,737,609 |

| ADG | Adelong Gold Limited | 0.007 | 17% | 0% | 0% | $3,577,934 |

| RMX | Red Mount Min Ltd | 0.004 | 0% | 0% | 0% | $10,694,304 |

| PRS | Prospech Limited | 0.027 | 29% | -4% | 0% | $5,493,999 |

| XTC | Xantippe Res Ltd | 0.001 | 0% | 0% | 0% | $17,528,005 |

| TTM | Titan Minerals | 0.032 | -9% | -22% | -4% | $48,798,504 |

| NML | Navarre Minerals Ltd | 0.019 | 0% | 0% | -2% | $28,555,654 |

| MZZ | Matador Mining Ltd | 0.045 | 15% | -6% | -7% | $15,770,773 |

| KZR | Kalamazoo Resources | 0.11 | -4% | 13% | -10% | $20,564,337 |

| BCN | Beacon Minerals | 0.027 | 4% | 0% | 0% | $101,432,741 |

| MAU | Magnetic Resources | 0.99 | -3% | 18% | 13% | $246,537,858 |

| BC8 | Black Cat Syndicate | 0.27 | 32% | 50% | -9% | $85,054,296 |

| EM2 | Eagle Mountain | 0.059 | -11% | -17% | -11% | $18,298,012 |

| EMR | Emerald Res NL | 2.555 | -1% | 2% | 137% | $1,574,990,960 |

| BYH | Bryah Resources Ltd | 0.02 | 25% | 54% | -1% | $7,172,106 |

| HCH | Hot Chili Ltd | 1.075 | 0% | 2% | 20% | $131,986,953 |

| WAF | West African Res Ltd | 0.8275 | -2% | 10% | -35% | $820,890,462 |

| MEU | Marmota Limited | 0.04 | -2% | 25% | -1% | $41,293,222 |

| NVA | Nova Minerals Ltd | 0.2425 | -3% | -8% | -44% | $53,776,940 |

| DCN | Dacian Gold Ltd | 0.285 | 0% | 27% | 19% | $346,788,267 |

| SVL | Silver Mines Limited | 0.165 | 0% | 0% | -4% | $224,693,143 |

| PGD | Peregrine Gold | 0.28 | -7% | 22% | -11% | $15,807,848 |

| ICL | Iceni Gold | 0.058 | -2% | -15% | -2% | $14,151,571 |

| FG1 | Flynngold | 0.072 | -26% | 20% | -3% | $8,864,868 |

| WWI | West Wits Mining Ltd | 0.012 | 0% | -14% | 0% | $29,164,700 |

| RML | Resolution Minerals | 0.004 | -20% | -20% | 0% | $5,029,167 |

| AAJ | Aruma Resources Ltd | 0.037 | 9% | 12% | -2% | $7,088,094 |

| AL8 | Alderan Resource Ltd | 0.008 | -43% | -43% | 0% | $8,854,890 |

| GMN | Gold Mountain Ltd | 0.0055 | 10% | -8% | 0% | $11,345,393 |

| MEG | Megado Minerals Ltd | 0.031 | -11% | -14% | -1% | $7,888,122 |

| HMG | Hamelingoldlimited | 0.084 | 0% | -1% | -6% | $13,230,000 |

| TBA | Tombola Gold Ltd | 0.026 | 0% | 0% | 0% | $33,129,243 |

| BM8 | Battery Age Minerals | 0.22 | 7% | -8% | -28% | $17,381,693 |

| TBR | Tribune Res Ltd | 2.96 | -4% | -6% | -107% | $162,126,358 |

| FML | Focus Minerals Ltd | 0.175 | 6% | 13% | -8% | $50,147,763 |

| GSR | Greenstone Resources | 0.005 | -29% | -44% | -3% | $8,192,498 |

| VRC | Volt Resources Ltd | 0.006 | -8% | -25% | -1% | $28,507,967 |

| ARV | Artemis Resources | 0.035 | 21% | 59% | 1% | $56,787,061 |

| HRN | Horizon Gold Ltd | 0.29 | -3% | -3% | -2% | $42,003,578 |

| CLA | Celsius Resource Ltd | 0.012 | 9% | 4% | 0% | $24,706,568 |

| QML | Qmines Limited | 0.076 | 7% | -17% | -9% | $15,186,676 |

| RDN | Raiden Resources Ltd | 0.068 | 36% | 196% | 6% | $189,171,031 |

| TCG | Turaco Gold Limited | 0.07 | 25% | 40% | 1% | $35,190,167 |

| KCC | Kincora Copper | 0.026 | -4% | -10% | -5% | $4,323,430 |

| GBZ | GBM Rsources Ltd | 0.014 | -7% | -18% | -3% | $9,925,149 |

| DTM | Dart Mining NL | 0.019 | 0% | -12% | -4% | $3,683,066 |

| MKR | Manuka Resources. | 0.048 | 9% | 7% | -4% | $25,313,403 |

| AUC | Ausgold Limited | 0.028 | -5% | -3% | -2% | $66,588,095 |

| ANX | Anax Metals Ltd | 0.028 | -3% | -18% | -3% | $13,946,611 |

| EMU | EMU NL | 0.001 | -33% | -33% | 0% | $1,667,521 |

| SFM | Santa Fe Minerals | 0.043 | 0% | 0% | -4% | $3,131,208 |

| SSR | SSR Mining Inc. | 18.15 | 0% | -16% | -490% | $422,787,020 |

| PNR | Pantoro Limited | 0.05 | 28% | 28% | -5% | $239,385,404 |

| CMM | Capricorn Metals | 4.58 | -2% | 3% | -2% | $1,665,494,715 |

| X64 | Ten Sixty Four Ltd | 0.57 | 0% | 0% | -7% | $130,184,182 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 20% | 0% | $11,963,157 |

| HAW | Hawthorn Resources | 0.093 | -7% | 2% | -2% | $31,156,452 |

| BGD | Bartongoldholdings | 0.24 | 4% | 2% | 4% | $44,968,173 |

| SVY | Stavely Minerals Ltd | 0.064 | -6% | -9% | -18% | $26,353,866 |

| AGC | AGC Ltd | 0.067 | 6% | 3% | 1% | $6,500,000 |

| RVR | Red River Resources | 0 | -100% | -100% | -7% | $37,847,908 |

| RGL | Riversgold | 0.011 | 10% | -15% | -2% | $10,463,876 |

| TSO | Tesoro Gold Ltd | 0.018 | -5% | 6% | -2% | $17,911,414 |

| OKR | Okapi Resources | 0.115 | -4% | -8% | -4% | $23,136,962 |

| CPM | Coopermetalslimited | 0.2375 | 70% | 107% | 0% | $11,441,795 |

| MM8 | Medallion Metals. | 0.062 | 7% | -14% | -9% | $19,074,402 |

| AUT | Auteco Minerals | 0.034 | 10% | 26% | -2% | $183,987,280 |

| CBY | Canterbury Resources | 0.024 | 4% | -11% | -2% | $3,468,565 |

| LYN | Lycaonresources | 0.175 | -8% | -24% | -10% | $8,013,750 |

| SFR | Sandfire Resources | 6.065 | -1% | 1% | 63% | $2,783,083,740 |

| NCM | Newcrest Mining | 23.35 | 0% | 3% | 403% | $20,880,287,592 |

| TMZ | Thomson Res Ltd | 0.005 | 0% | 0% | -1% | $4,881,018 |

| TAM | Tanami Gold NL | 0.035 | -10% | -8% | 0% | $38,778,203 |

| WMC | Wiluna Mining Corp | 0.205 | 0% | 0% | 0% | $74,238,031 |

| NWM | Norwest Minerals | 0.031 | 3% | -6% | -2% | $8,627,085 |

| ALK | Alkane Resources Ltd | 0.65 | 5% | 0% | 12% | $379,906,703 |

| BMO | Bastion Minerals | 0.019 | 19% | 0% | -2% | $3,555,640 |

| IDA | Indiana Resources | 0.056 | -3% | -3% | 0% | $34,908,912 |

| GSM | Golden State Mining | 0.024 | -4% | -36% | -2% | $4,203,942 |

| NSM | Northstaw | 0.081 | -12% | 145% | -7% | $9,850,414 |

| GSN | Great Southern | 0.023 | -12% | -12% | -1% | $17,356,609 |

| RED | Red 5 Limited | 0.3325 | 4% | 6% | 13% | $1,142,522,453 |

| DEG | De Grey Mining | 1.225 | 6% | -1% | -6% | $2,193,686,354 |

| THR | Thor Energy PLC | 0.028 | 12% | 4% | -3% | $5,221,784 |

| CDR | Codrus Minerals Ltd | 0.066 | 8% | 10% | -6% | $5,758,500 |

| MDI | Middle Island Res | 0.016 | 0% | -19% | -2% | $2,250,532 |

| BAT | Battery Minerals Ltd | 0.046 | 12% | 84% | -7% | $5,501,807 |

| POL | Polymetals Resources | 0.3 | 0% | 0% | 6% | $45,650,467 |

| RDS | Redstone Resources | 0.007 | -7% | -13% | 0% | $6,099,649 |

| NAG | Nagambie Resources | 0.03 | -9% | 43% | -4% | $21,523,874 |

| BGL | Bellevue Gold Ltd | 1.4525 | 5% | 1% | 32% | $1,614,352,820 |

| GBR | Greatbould Resources | 0.058 | -9% | -11% | -3% | $31,478,127 |

| KAI | Kairos Minerals Ltd | 0.0165 | -3% | -18% | 0% | $41,934,595 |

| KAU | Kaiser Reef | 0.155 | -3% | -11% | -1% | $22,920,970 |

| HRZ | Horizon | 0.031 | -9% | -6% | -3% | $23,833,445 |

| CAI | Calidus Resources | 0.175 | -1% | 25% | -10% | $103,740,291 |

| CDT | Castle Minerals | 0.0105 | 5% | 17% | -1% | $13,469,423 |

| RSG | Resolute Mining | 0.3725 | 1% | -2% | 17% | $777,103,255 |

| MXR | Maximus Resources | 0.049 | 23% | 58% | 1% | $14,427,260 |

| EVN | Evolution Mining Ltd | 3.75 | 2% | 8% | 77% | $6,613,861,925 |

| CXU | Cauldron Energy Ltd | 0.016 | 33% | 60% | 1% | $13,585,961 |

| DLI | Delta Lithium | 0.49 | -9% | -29% | 3% | $274,888,781 |

| ALY | Alchemy Resource Ltd | 0.01 | -13% | -17% | -1% | $11,780,763 |

| HXG | Hexagon Energy | 0.01 | 11% | 11% | -1% | $4,616,243 |

| OBM | Ora Banda Mining Ltd | 0.2 | 21% | 90% | 12% | $306,980,076 |

| SLR | Silver Lake Resource | 1.05 | -5% | 7% | -14% | $958,112,941 |

| AVW | Avira Resources Ltd | 0.002 | 0% | 0% | 0% | $4,267,580 |

| LCY | Legacy Iron Ore | 0.017 | 0% | -6% | 0% | $108,916,045 |

| PDI | Predictive Disc Ltd | 0.215 | 5% | 5% | 4% | $455,013,699 |

| MAT | Matsa Resources | 0.03 | 15% | 11% | -1% | $14,270,221 |

| ZAG | Zuleika Gold Ltd | 0.018 | 20% | -5% | 0% | $8,368,810 |

| GML | Gateway Mining | 0.019 | -10% | -30% | -4% | $6,629,651 |

| SBM | St Barbara Limited | 0.19 | -3% | 3% | -15% | $151,324,520 |

| SBR | Sabre Resources | 0.046 | 18% | 35% | 1% | $15,716,306 |

| STK | Strickland Metals | 0.1675 | -4% | 60% | 13% | $252,349,541 |

| ION | Iondrive Limited | 0.014 | 17% | 8% | -1% | $6,807,994 |

| CEL | Challenger Gold Ltd | 0.07 | -10% | -17% | -11% | $93,207,829 |

| LRL | Labyrinth Resources | 0.006 | 0% | -14% | -1% | $7,125,262 |

| NST | Northern Star | 11.68 | -2% | 2% | 77% | $13,009,183,033 |

| OZM | Ozaurum Resources | 0.165 | 6% | 72% | 10% | $31,750,000 |

| TG1 | Techgen Metals Ltd | 0.066 | 144% | 106% | -2% | $5,093,107 |

| XAM | Xanadu Mines Ltd | 0.067 | -12% | -6% | 4% | $109,734,221 |

| CHZ | Chesser Resources | 0 | -100% | -100% | -9% | $65,818,414 |

| AQI | Alicanto Min Ltd | 0.042 | -18% | -11% | 0% | $25,844,146 |

| KTA | Krakatoa Resources | 0.042 | -2% | 147% | 0% | $16,961,019 |

| ARN | Aldoro Resources | 0.086 | 8% | -8% | -7% | $11,443,018 |

| WGX | Westgold Resources. | 2.12 | 3% | 8% | 125% | $961,454,142 |

| MBK | Metal Bank Ltd | 0.028 | -7% | -26% | -1% | $10,060,504 |

| A8G | Australasian Metals | 0.17 | -6% | -17% | -2% | $8,860,484 |

| TAR | Taruga Minerals | 0.01 | 0% | 0% | -1% | $7,060,268 |

| DTR | Dateline Resources | 0.011 | -8% | 10% | -3% | $14,442,401 |

| GOR | Gold Road Res Ltd | 1.8475 | -1% | 2% | 16% | $1,932,524,665 |

| S2R | S2 Resources | 0.175 | 3% | -17% | 1% | $71,766,016 |

| NES | Nelson Resources. | 0.005 | 25% | 25% | 0% | $2,454,377 |

| TLM | Talisman Mining | 0.1875 | 21% | 34% | 5% | $32,956,061 |

| BEZ | Besragoldinc | 0.165 | 38% | 32% | 11% | $64,805,640 |

| PRU | Perseus Mining Ltd | 1.785 | 2% | 9% | -33% | $2,376,265,644 |

| SPQ | Superior Resources | 0.024 | -4% | 14% | -3% | $44,029,290 |

| PUR | Pursuit Minerals | 0.01 | 0% | 18% | -1% | $29,439,714 |

| RMS | Ramelius Resources | 1.585 | -4% | -8% | 66% | $1,743,988,132 |

| PKO | Peako Limited | 0.005 | 0% | -17% | -1% | $2,635,424 |

| ICG | Inca Minerals Ltd | 0.013 | -19% | -32% | -1% | $6,893,596 |

| A1G | African Gold Ltd. | 0.033 | -8% | -25% | -5% | $5,587,270 |

| OAU | Ora Gold Limited | 0.006 | -8% | -20% | 0% | $39,355,173 |

| GNM | Great Northern | 0.02 | -9% | -5% | -4% | $3,092,582 |

| KRM | Kingsrose Mining Ltd | 0.047 | -4% | -4% | -2% | $34,616,220 |

| BTR | Brightstar Resources | 0.014 | 40% | 27% | 0% | $24,905,834 |

| RRL | Regis Resources | 1.79 | -1% | 10% | -27% | $1,325,619,608 |

| M24 | Mamba Exploration | 0.031 | -3% | -31% | -11% | $1,890,483 |

| TRM | Truscott Mining Corp | 0.058 | -2% | -8% | 2% | $10,055,289 |

| TNC | True North Copper | 0.13 | -7% | -26% | 8% | $40,275,425 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | -13% | 0% | $4,271,781 |

| KNB | Koonenberrygold | 0.036 | 0% | -12% | -3% | $4,310,967 |

| AWJ | Auric Mining | 0.066 | -4% | 40% | 0% | $8,113,295 |

| AZS | Azure Minerals | 4.03 | 2% | 64% | 381% | $1,843,891,892 |

| ENR | Encounter Resources | 0.38 | -3% | 52% | 20% | $150,844,043 |

| SNG | Siren Gold | 0.058 | 4% | -9% | -12% | $9,219,205 |

| STN | Saturn Metals | 0.14 | 8% | -3% | -4% | $27,560,245 |

| USL | Unico Silver Limited | 0.115 | 5% | 46% | -6% | $34,045,933 |

| PNM | Pacific Nickel Mines | 0.1 | 0% | 27% | 2% | $41,825,311 |

| AYM | Australia United Min | 0.003 | 0% | 50% | 0% | $5,527,732 |

| ANL | Amani Gold Ltd | 0.001 | 0% | 0% | 0% | $25,143,441 |

| HAV | Havilah Resources | 0.27 | 13% | 13% | -6% | $82,326,195 |

| SPR | Spartan Resources | 0.41 | -13% | -4% | 24% | $342,447,228 |

| PNT | Panthermetalsltd | 0.076 | 9% | 7% | -11% | $4,647,400 |

| MEK | Meeka Metals Limited | 0.036 | 0% | -8% | -3% | $42,694,522 |

| GMD | Genesis Minerals | 1.545 | 3% | 10% | 30% | $1,609,543,176 |

| PGO | Pacgold | 0.185 | -18% | -20% | -18% | $15,493,880 |

| FEG | Far East Gold | 0.16 | 3% | -11% | -32% | $28,896,994 |

| MI6 | Minerals260Limited | 0.35 | 1% | -16% | 1% | $84,240,000 |

| IGO | IGO Limited | 8.815 | -5% | -23% | -465% | $6,701,820,145 |

| GAL | Galileo Mining Ltd | 0.28 | -3% | -14% | -60% | $57,311,229 |

| RXL | Rox Resources | 0.205 | -2% | -9% | 3% | $73,806,572 |

| KIN | KIN Min NL | 0.057 | 2% | 21% | -1% | $63,620,130 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | -1% | $12,357,082 |

| TGM | Theta Gold Mines Ltd | 0.125 | 0% | -11% | 6% | $88,259,376 |

| FAL | Falconmetalsltd | 0.14 | 0% | -3% | -14% | $24,780,000 |

| SXG | Southern Cross Gold | 0.82 | -4% | 10% | 2% | $76,547,280 |

| SPD | Southernpalladium | 0.38 | 0% | -10% | -43% | $16,369,764 |

| ORN | Orion Minerals Ltd | 0.015 | -6% | -17% | 0% | $85,300,520 |

| TMB | Tambourahmetals | 0.11 | -27% | -19% | 1% | $10,367,544 |

| TMS | Tennant Minerals Ltd | 0.03 | 30% | 11% | 0% | $24,301,869 |

| AZY | Antipa Minerals Ltd | 0.016 | 7% | 23% | -1% | $62,022,119 |

| PXX | Polarx Limited | 0.008 | 14% | -20% | -1% | $12,476,934 |

| TRE | Toubaniresourcesinc | 0.13 | 24% | 24% | -3% | $16,733,208 |

| AUN | Aurumin | 0.021 | -13% | -25% | -4% | $6,687,305 |

| GPR | Geopacific Resources | 0.018 | 0% | 6% | -1% | $14,781,440 |

| KGD | Kula Gold | 0.029 | 141% | 121% | 16% | $10,820,000 |

| FXG | Felix Gold Limited | 0.049 | -2% | -29% | -7% | $5,104,375 |

Best-performing goldies over the past week

The week’s biggest gains

TechGen Metals (ASX:TG1) +144%

Kula Gold (ASX:KGD) +141%

Brightstar Resources (ASX:BTR) +40%

Besra Gold (ASX:BEZ) +38%

MinRex Resources (ASX:MRR) +38%

Who has news?

Which ASX goldies shined over the past seven days? In no particular preferential order, these did…

A resource upgrade at Turnberry is on the cards as Meeka Metals looks to accelerate development of its Murchison gold project through toll milling of higher-grade starter pits.

Based on a +1.2Moz resource across several deposits in the Murchison goldfields, including the high-grade Turnberry open pits, Meeka Metals could produce 663,000oz gold over an initial 9.3 years, according to the feasibility study published in July.

More here.

TechGen is currently in a trading halt due to capital raising. Expect an announcement early next week.

It’s done well again this week on the back of a stonking one last week, when it dropped an update on its projects.

Those include stage three drilling approval for its John Bull Gold Project and pegmatite mapping to kick off at Ida Valley with historic data identifying lithium and caesiumin soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault.

KGD brought home a 141% price hike this week thanks to a two-fisted clutch of white-gold (lithium)-based announcements that set the market alight.

And those were: confirmation that the drills are set to spin at the company’s “substantial” Cobra Lithium Prospect in WA next week – and that the drilling operation is ready-funded, thanks to a handsome $650,000 boost from a placement of shares at the issue price of $0.013 a pop.

More here.

Cooper Metals was a standout performer this week on the back of positive assay results from its Brumby Ridge and Raven copper-gold prospects at its Mt Isa East project in northwest Queensland.

Recapping:

The assay highlight in chief came from the initial RC drill hole 23MERC024 at Brumby, which saw an interception of 50m at 1.32% Cu from 80m including 2m at 6.1% Cu and 0.23g/t Au.

Drilling at Brumby Ridge also intercepted 72m at 1.5% Cu from 113m to end of hole, and mineralisation at the prospect is open in all directions, appearing to be improving with depth.

At Raven, meanwhile, the stats include: 15m at 1.0% Cu and 0.1 g/t Au from 35m within a wider intercept of 28m at 0.63% Cu & 0.061 g/t Au from 34m.

Further assay results from both prospects are due in December.

Brightstar Resources (ASX:BTR)

Emerging gold developer Brightstar Resources will assess whether its newly-declared maiden resource at Link Zone can be fast-tracked into production.

The company is well along the path to becoming a profitable gold miner in the Leonora-Laverton district of WA, cornerstoned by a mothballed processing plant and a +1Moz and growing resource inventory.

Meanwhile, the company is expecting imminent cashflow via mining joint venture currently under way at Selkirk and, potentially, a low cost mining start-up at the Link Zone, which is comprised of three deposits sitting between the Lady Shenton and Lady Harriet deposits at its Menzies Gold Project.

More here.

Spartan Resources has received firm commitments to raise A$25 million via a placement at A$0.40 per share to pursue a rapid pathway back to production at its Dalgaranga gold project in WA.

Dalgaranga produced over 70,000oz of gold in FY2022 before being placed on care and maintenance in November 2022 to implement an operational reset, designed to preserve the value of its extensive infrastructure and resource base while developing a new, sustainable operating plan.

More here.

At Stockhead we tell it like it is. While Kula Gold, Spartan Resources, Brightstar Resources and Meeka Metals are Stockhead advertisers at the time of writing, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.