Record Aussie gold prices as Meeka pushes toward ‘shovel ready’ at the Murchison Gold Project

Meeka Metals is considering opportunities such as toll milling to accelerate development of its Murchison gold project. Pic via Getty Images

- New infill drilling results point to likely resource upgrade for Turnberry deposits, part of Meeka’s ‘development-ready’ Murchison gold project

- Feasibility study already supports production of 663,000oz over an initial 9.3 years

- Meeka exploring toll processing opportunities to accelerate project development timeline and capitalise on current high gold prices

Special Report: A resource upgrade at Turnberry is on the cards as Meeka Metals looks to accelerate development of its Murchison gold project through toll milling of higher-grade starter pits.

Based on a +1.2Moz resource across several deposits in the Murchison goldfields, including the high-grade Turnberry open pits, Meeka Metals (ASX: MEK) could produce 663,000oz gold over an initial 9.3 years, according to the feasibility study published in July.

With the Australian dollar gold price continuing to trade at near-record highs, Meeka is exploring opportunities to accelerate its project development timeline through low capital options such as toll milling of higher-grade starter pits and scalable processing.

In the meantime, the drill rigs have been turning in the Murchison as part of the company’s strategy to build on the promising outcomes of the feasibility study.

Meeka managing director Tim Davidson said the feasibility study had highlighted that “significant value” could be added to the project by infilling and extending the resources, particularly at the Turnberry deposits.

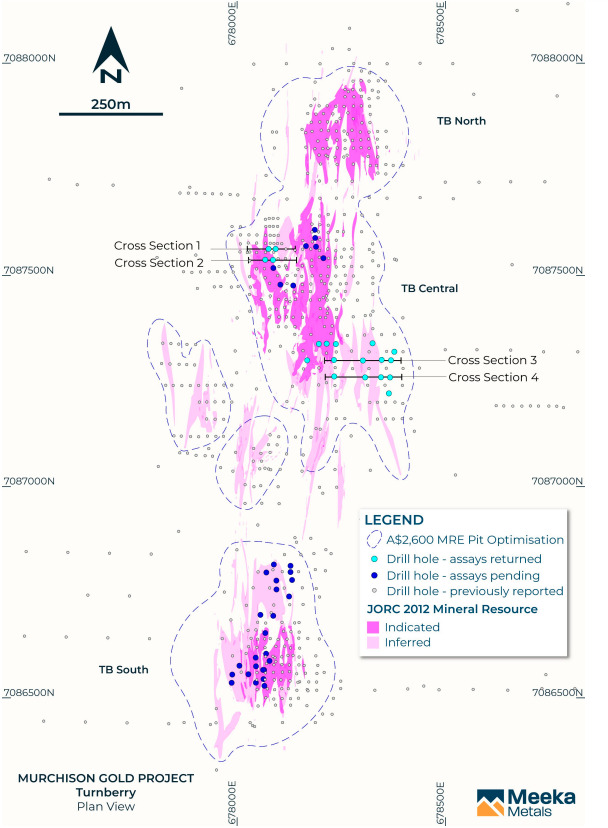

Turnberry currently hosts 685,000oz @ 2g/t gold across a series of open pits, including TB North, TB Central and TB South.

Updated geological model to support ‘development-ready’ status

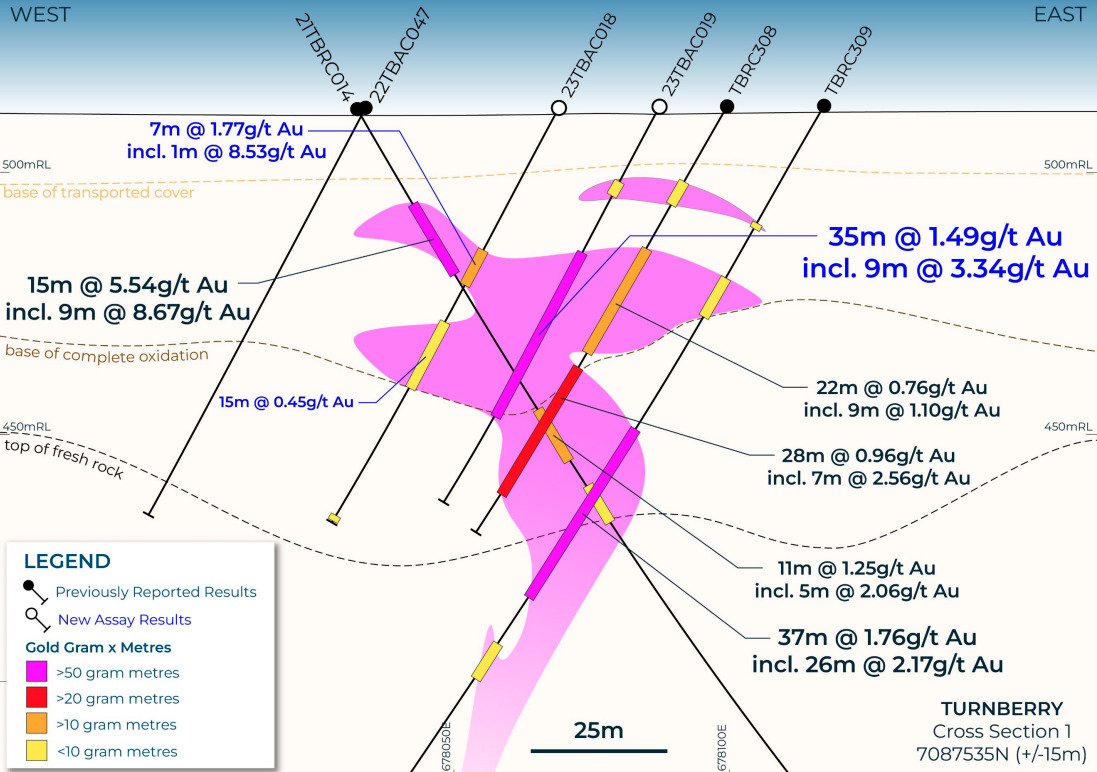

Initial assay results have been received from the first 19 holes of a shallow infill drilling program at Turnberry which intersected broad zones of oxide gold.

Best hits included 35m @ 1.49g/t gold from 30m (including 9m @ 3.34g/t gold), 22m @ 1.05g/t gold from 30m (including 6m @ 2.06g/t gold), 9m @ 1.56g/t gold from 45m (including 5m @ 2.29g/t gold), 9m @ 1.47g/t gold from 27m (including 6m @ 1.9g/t gold) and 7m @ 1.77g/t gold from 30m (including 1m @ 8.53g/t gold).

“These results infill areas with reduced drill density, confirming and in some cases expanding the broad zones of gold mineralisation in the mineral resource model,” Davidson said.

Assays for a further 32 holes covering 3,362m, drilled largely around the periphery of the open pit designs included in the feasibility study, are expected later this month.

A further 17 shallow infill drill holes covering 1,340m at St Anne’s are likely to be received next month.

“Once all results have been received, the open pit grade control model will be updated and is expected to further support the development-ready status of the project in a period of strong gold price,” Davidson says.

This article was developed in collaboration with Meeka Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.