Going where no man’s gone before: Koonenberry plants its flag in a fertile greenfields gold play

Mining

Mining

Koonenberry has a greenfields gold story in its sights but it believes understanding the region’s past is key to unlocking future value.

Everyone loves a good gold story. The thrill of discovery has long lured pundits to Australian shores, inspiring plenty of ‘Eureka!’ moments over the last 200 years.

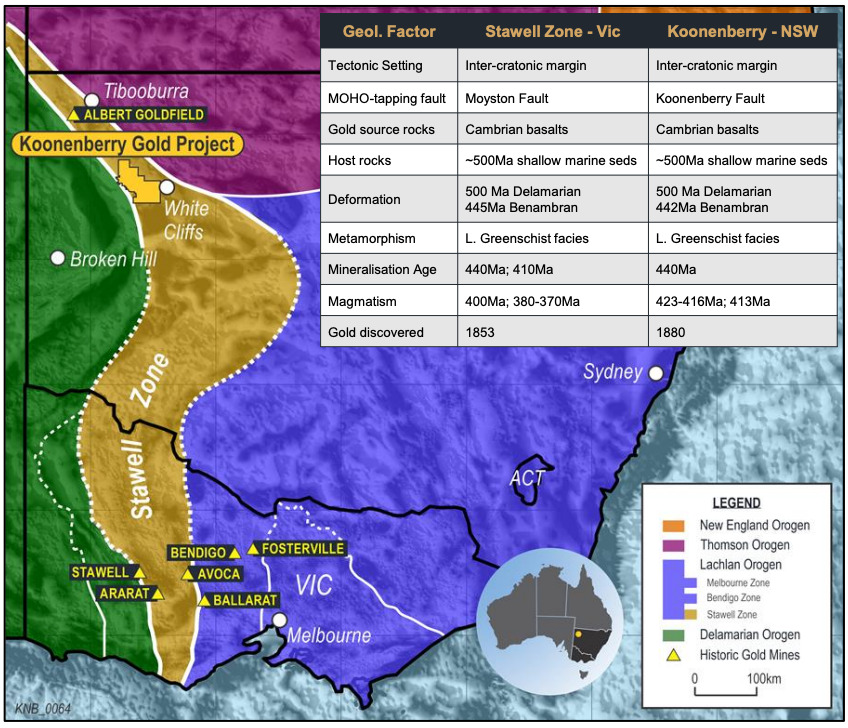

And while the hunt for precious metals has often led explorers to iconic regions like the Pilbara or the Lachlan Fold Belt, Koonenberry Gold (ASX:KNB) is interested in telling its story in an emerging mineral province.

We’re setting the scene in the Koonenberry Belt — an overlooked exploration district in northwest NSW with gold and copper upside. It’s home to KNB’s namesake project, which spans more than 2,000 square kilometres.

“There aren’t many places in Australia where you can put these big land packages together …if you want to get some land around Kalgoorlie, it’s kind of postage stamp stuff,” Koonenberry Managing Director Dan Power told Stockhead.

“The difference is that if we find something, and it’s on one of the structures that we think it’s associated with, then these things go for kilometres and kilometres and kilometres – and that’s all on our ground.”

Koonenberry’s expansive tenement package leaves the company with plenty of room to play with, particularly as it charts the course for in-depth greenfields exploration and drilling campaigns.

So, what’s on the cards as the precious and base metals explorer heads into 2023’s final quarter – and where to next for the Koonenberry Belt?

The Koonenberry Belt may have low exploration maturity, but its geological setting is garnering plenty of attention.

That’s because the region is believed to be an extension of the Western Victorian Goldfields’ Stawell Zone – an iconic district which hosts multi-million-ounce potential and the +5Moz gold mine of the same name.

The surrounding region’s production history, combined with extensive evidence of orogenic gold mineralisation, have put the once-overlooked Koonenberry Belt on the map.

“It’s really when you go into these greenfield settings that you have the potential to find multi-million-ounce deposits, particularly in belts that have been underexplored,” Power explained.

The attraction to greenfield developments is personal: Over the first seven years of his career, Power worked in the NT’s Tanami region for a suite of explorers, developers and producers – most notably gold mining stalwart Newmont Corporation.

“Even though [Newmont] has a massive mine, there are still lots of underexplored areas within that province,” the MD noted.

“I learned all the skills that you need – the patience and the passion and the teamwork – everything that’s required to build a successful exploration team.”

And while greenfield developments remain high-risk, high-reward, Power believes there are strong signs that his company is in the right rocks, such as its growing target portfolio and pipeline of gold-in-soil anomalies.

The Koonenberry project has seen plenty of change over the last few years, most notably after Power became MD and investment banking veteran Paul Harris took up chairmanship in 2022.

“I think coming into the project, there’s some good work that had been done in the past, but it needed some focus and direction,” Power recalled.

Much of that work involved unlocking land access and accelerating discovery through an early-stage drill program. And while the campaign didn’t unearth significant results at the time, Power believes that all roads lead to Rome – or in this case, the Bellagio prospect.

“[Bellagio] came about because we did some regional sampling and found gold in the rock chips,” Power said of the discovery.

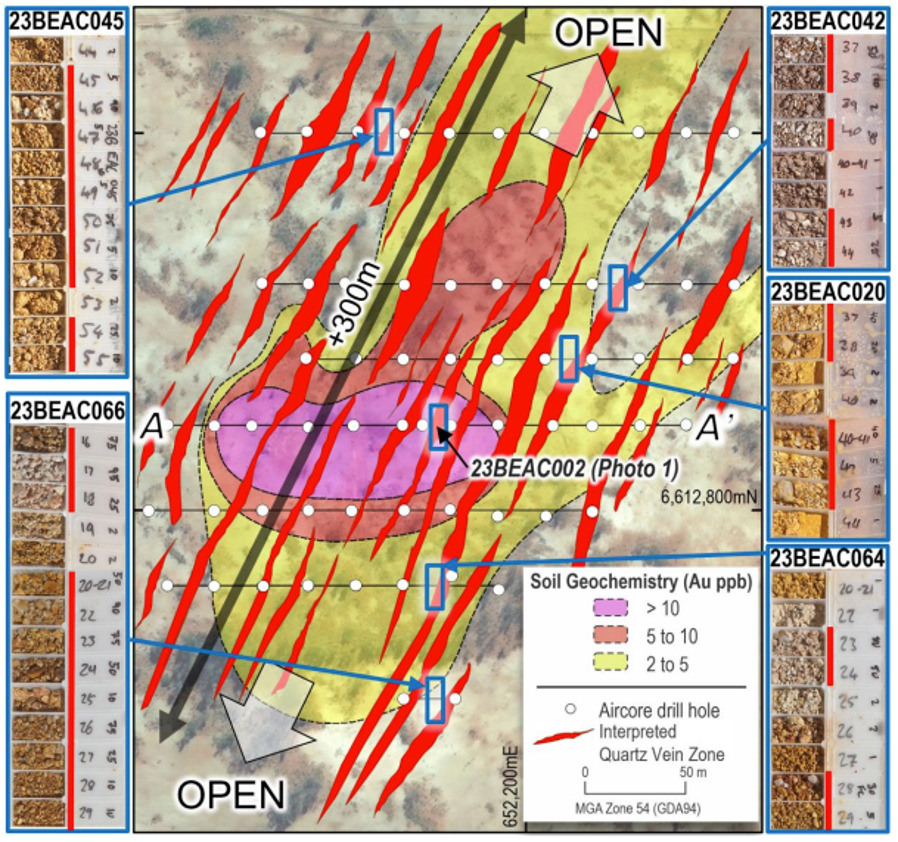

Those early results were nothing to sneeze at: Koonenberry uncovered around 22 g/t in rock chips – assays that pointed to the project’s past and future potential. There was only one thing to do: get boots back on the ground for further sampling and aircore drilling.

Fast forward to today, and on the back of the best bedrock gold result at Koonenberry to date – 10m at 1.61 g/t – the explorer is eager to see what else the drill bit turns up.

“On this initial drill section, gold is clearly associated with quartz veining,” Power explained in an early October release.

“Similar quartz veining has been intersected both to the north and south over a 300m strike length.

“We eagerly await assays from the rest of the program and are planning follow-up work based on these results.”

While Koonenberry is firmly in greenfields territory, its exploration mission is far from quixotic.

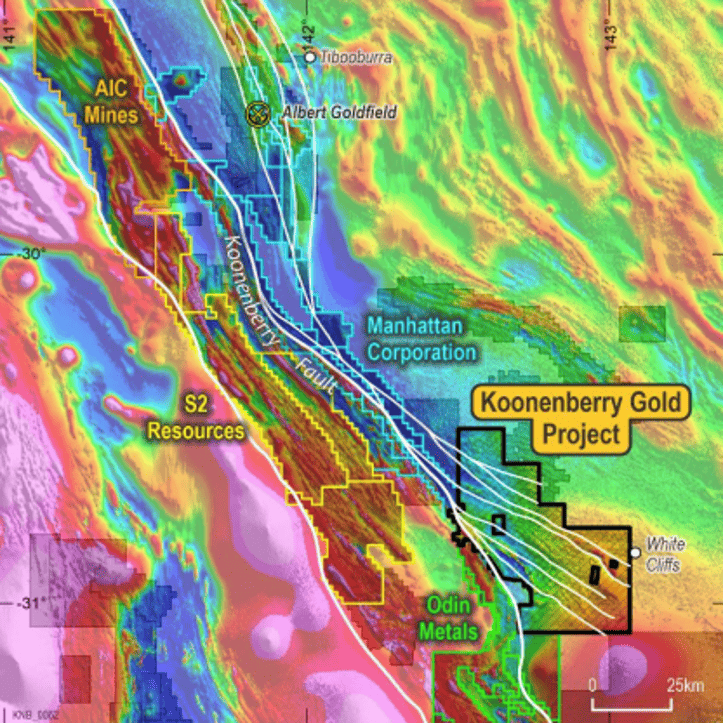

“We’re not the only company in this belt; there are lots of other smart people that have packed enormous tracts of land,” Power explained.

“You’ve got companies like S2 Resources, led by Mark Bennett – one of the best explorers in Australia in the last 15 or 20 years. Then there’s AIC Mines with around 4000 square kilometres of ground…it’s got the potential to turn into something really significant.”

As the company chases fresh precious and base metal bounty, Power is inspired by the likes of Pilbara gold darling De Grey Mining (ASX:DEG).

“They went out to a greenfields exploration setting where people didn’t think there would be gold and found a +10Moz deposit,” he told Stockhead.

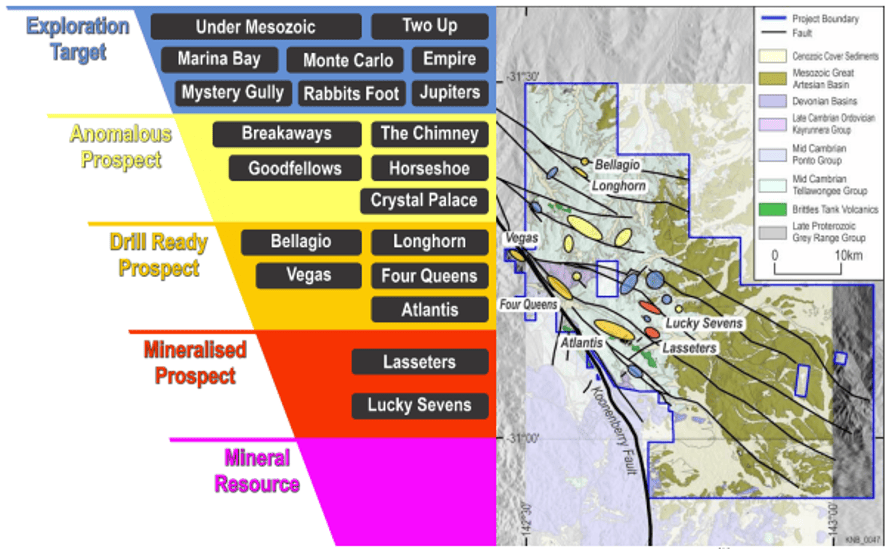

Beyond the recent Bellagio drill results (and the spate of assays yet to come), Koonenberry has a big decision to make – this time about drilling at other key prospects, such as the Atlantis target.

With a 6.5km gold-in-soil anomaly and rock chips bearing up to 15% copper, Power believes Atlantis could be an analogue for the Stawell Gold Mine, making it a strong contender for the next drill phase.

“[Atlantis] is a cracking prospect and definitely deserves drilling but obviously if we get outstanding results for Bellagio, then I think investors will want us to go straight back to that target,” Power explained.

Prospectivity aside, Atlantis and Bellagio aren’t the only drill-ready target on the radar. Koonenberry has also lined up the Four Queens, Vegas and Lasseters prospects for consideration, rounding out the top end of its expansive portfolio.

With a couple of irons in the fire – and more assays to come – Power reckons Koonenberry’s future is bright.

“There is significant potential for size and scale … we aim to expedite the return of assay results and will keep our shareholders updated with progress over the coming weeks,” he told ASX investors in September.

This article was developed in collaboration with Koonenberry Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.