You might be interested in

Mining

Variscan Mines hits the high-grade notes as latest drilling backs San Jose resource model

Mining

Variscan Mines identifies new drill targets in comprehensive geological assessment of San Jose

Mining

Mining

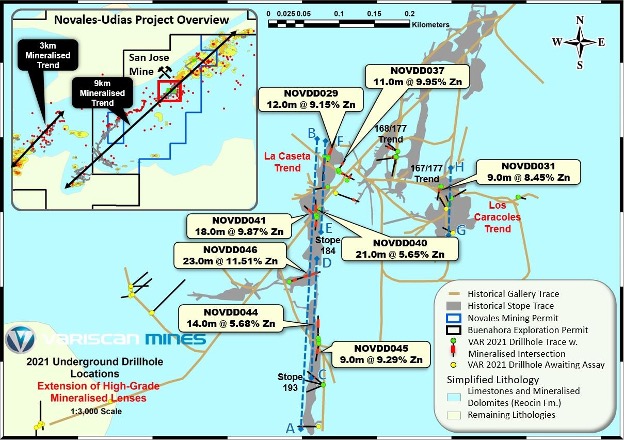

Variscan Mines (ASX:VAR) has bolstered the case for a major find at its San Jose mine in Spain, with underground drilling at the growing La Caseta trend delivering more high grade zinc and lead.

It was less than a month ago that Variscan captured the attention of the market with results from its La Caseta trend at San Jose, part of the broader Novales project in the Basque-Cantabrian basin.

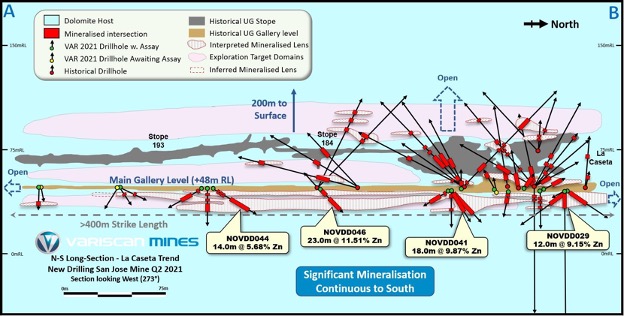

New assays have shown La Caseta, a high-grade mineralised lens located beneath the main gallery in the central zone of San Jose, continues for more than 400m to the south.

Impressive results included 23m at 11.51% zinc and 3.7% lead, 18m at 9.87%Zn and 3.24%Pb and 11m at 9.95%Zn and 5.58%Pb.

But that is not all, with at least eight wide intersections reporting zinc grade of more than 5% and three quarters of those 9% or higher.

Another mineralised lens above the main gallery has also been identified called Los Caracoles on the back of strikes of 9m at 8.45%Zn and 2.10%Pb and 5m at 5.12%Zn and 0.07%Pb.

Assays for another 30 drillholes are still pending, some with visual indications of zinc mineralisation, with follow-up campaigns expected to start shortly.

Importantly, the discovery of new mineralised lenses and potential for further discoveries in the central and south-west zones has reinforced the company’s conceptual model of San Jose.

It views San Jose as a multi-layered deposit of vertically-stacked, sub-horizontal high-grade lenses separated by dolostone, consistent with Mississippi Valley type zinc-lead deposits.

That is significant given one of the world’s longest running and richest MVT deposits, the world-class Reocin Mine, is just 9km away.

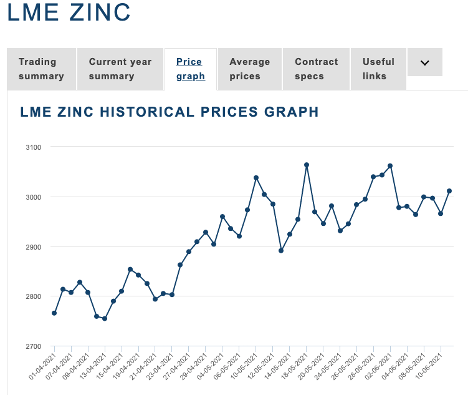

The price of zinc has not shot upwards in the post-pandemic commodities rush the way other base metals like copper have.

But it is on a nice, steady rising trend since the start of the pandemic last February.

Importantly, current LME spot prices of more than $US3000/t are roughly three to four times higher than they were when the San Jose mine was shuttered in the late 1990s.

The movement in the Variscan Mines share price since first announcing its high-grade zinc-lead discovery at San Jose last month has been more stark.

Before market open this morning it was a 300% gainer over the past month, moving from 3c to 12c, having touched even higher levels last week.

After the end of the 2000m diamond drill program the company believes there remains potential to uncover more high-grade mineralisation beneath historic workings.

That has Variscan Mines managing director Stewart Dickson optimistic about the explorer’s likelihood of adding “tonnage and scale”.

“These results extend the lower lens below the La Caseta Trend to over 400m, which remains open,” he said today.

“They also confirm the presence of high-grade mineralisation in the Los Caracoles Trend which has significant potential for discovering additional lenses.

“In particular drilling to test for lower lying lenses is justified.

“We will be following up these exciting drill results with further assays from drilling over the South West Zone, which is where mine activity ceased in the late 1990s, when zinc prices were approximately 4 times lower than today.

“We are optimistic that further drilling may yield promising results and if replicated could provide considerable scale and tonnage potential.

“With significant infrastructure in place, the Novales-Udias project, centred on the San Jose Mine has all the constituent elements to advance quickly and seriously consider re-start mining opportunities in due course”.

There is more news flow on the horizon at San Jose, with the assays from that previously mined South West zone on the way.

Surface drilling permitting is also under way, with mapping ongoing to identify targets at the Buenahora exploration licence, part of a 9km mineralised trend Variscan has mapped out across the Novales-Udias project, as well as the nearby Guajaraz project.

Should Variscan’s successful drilling escapades convert into an economic resource the company is well placed. San Jose is just 30km from the regional capital of Santander and 80km from Glencore’s San Juan de Nieva zinc smelter.

This article was developed in collaboration with Variscan Mines, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.