Devil in the detail for HWK gold explorer spinoff Diablo

Mining

Mining

It is unusual for an exploration company to come along with assets as advanced as those with which Hawkstone Mining spin-off Diablo Resources plans to list.

Diablo (to be ASX:DBO) will join the ASX boards in the coming weeks with a suite of three highly prospective US-based gold and copper projects – all of which are drill ready and proximate to projects of significance in their region.

The projects were formerly on the Hawkstone books, but that company has turned its full focus to lithium in Arizona (it’s literally on the cusp of changing its name to Arizona Lithium), leaving the highly prospective suite of assets to be spun into Diablo.

“I think our shareholders understand that the Big Sandy lithium project is such a large project, with lithium in Arizona ideally located, and it’s a big potential resource,” Hawkstone MD Paul Lloyd, who will also become Diablo chairman, told Stockhead.

“When we brought these gold projects into Hawkstone they were dwarfed by Big Sandy, and therefore we don’t think they ever got the market valuation that was warranted.

“We’ve done a lot of work on the projects to get them to the point where they are drlll-ready, and we think they’ll create a lot more value for shareholders in a separate entity.”

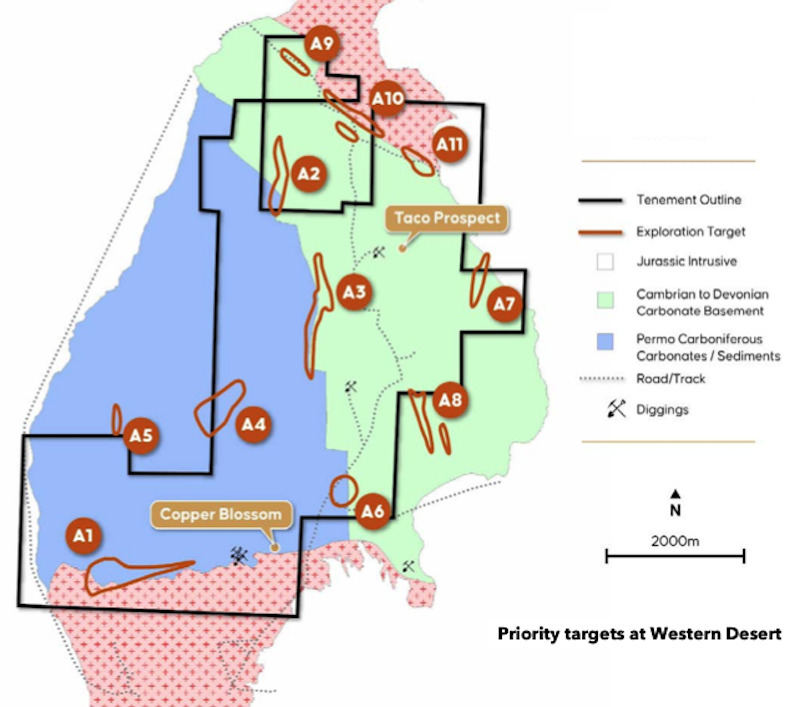

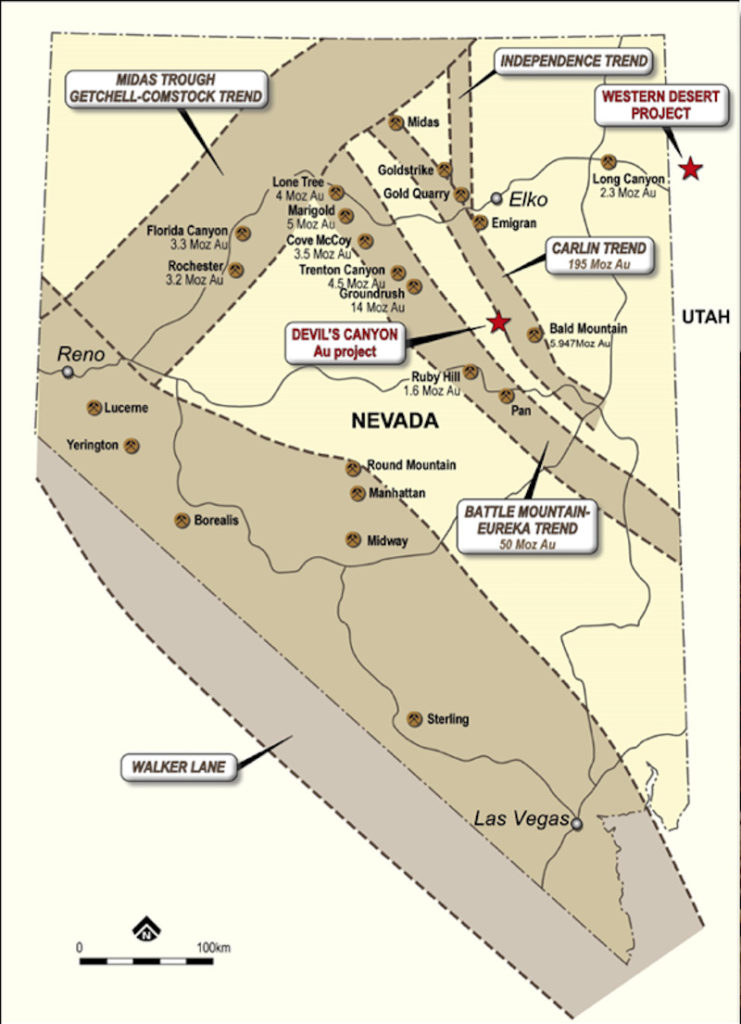

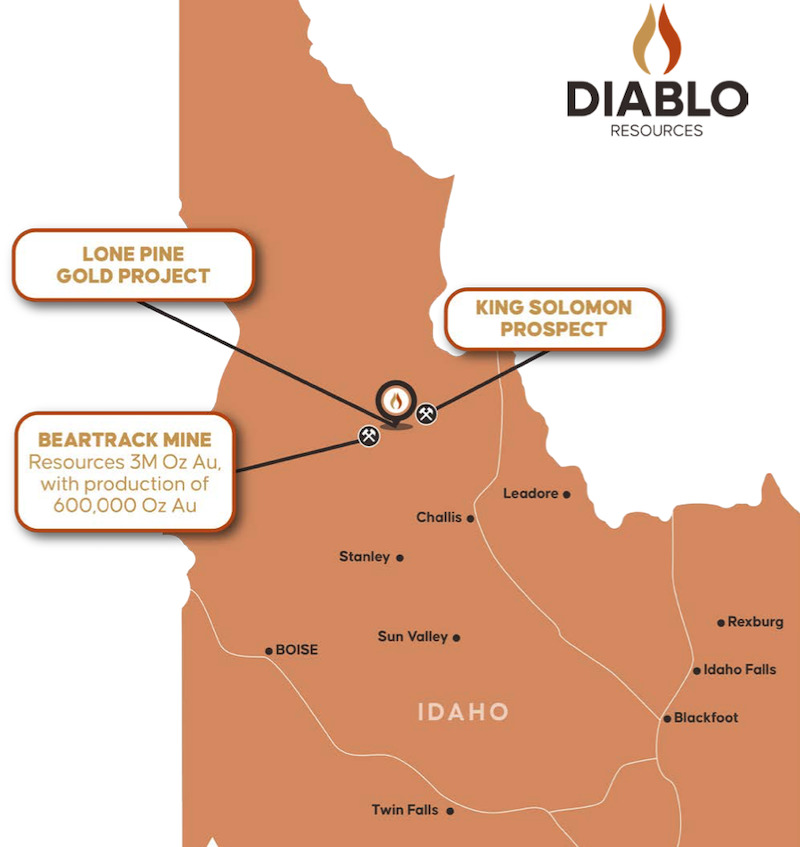

Diablo’s assets include the Devil’s Canyon gold project on the world-famous Carlin Trend in Nevada, the Western Desert gold-copper project 50km west of the Long Canyon gold mine in Utah, and the Lone Pine historical high-grade gold project 8km east of the 3-million-ounce Beartrack mine currently being explored by TSX-listed Revival Gold in Idaho.

Diablo’s name suggests heat, and the early signs suggest there’s plenty in the ground at each of its exploration projects.

At Devil’s Canyon, rock samples have returned astounding assays as high as 191.5 grams per tonne gold, 524g/t silver and 16.05% copper.

Samples from Western Desert have come in at 6.9g/t gold, 1495g/t silver and 5.09% copper, while historic drilling at Lone Pine returned assays including 1.2m at 17g/t gold and 1.9m at 12.9g/t gold with mineralisation open in all directions.

Lloyd isn’t planning on wasting any time in getting Diablo’s exploration efforts going, expecting to have approvals in place for drilling on at least one of the projects around the time of listing.

“It’s more than likely we’ll be able to commence drilling at Western Desert in Utah, which is very close to Long Canyon and a project where we’ve recorded some terrific surface numbers,” he said.

“The gravity of the work we’ve already done there to date and the other technical work we’ve completed really gives us a lot of upside and there’s potential for great early-stage results from drilling.”

Located in the prolific Carlin Trend, where almost 200 million ounces of gold have been produced over the years, Devil’s Canyon is likely to be the Diablo flagship.

Lloyd said he had long aspired to working with a project in the region, and will have the chance to do so with Diablo.

“There’s been some really impressive rock chip samples come out of there already, and it sits only 20km west of Kinross Gold Corporation’s in-production Bald Mountain mine,” he said.

“Devil’s Canyon has similar geology to that deposit. We’d love to get in there and have four or five holes completed before the weather changes.

“In this area, you’re hunting for elephants, and those rock chip samples give us an indication that there’s something serious there. We’re really looking forward to drilling it.”

Minimal modern-day exploration has been carried out at Lone Pine, where 18 shallow holes were drilled in the 1990s at the King Solomon prospect.

The project includes a high-grade zone mined prior to 1907, where maiden drilling in 2020 returned significant high-grade results.

Drone magnetics are planned for Lone Pine in Q3 2021.

Floated by the same team behind the IPOs of BPM Minerals (ASX:BPM) and Pantera Minerals (ASX:PFE), there are some familiar names at management level for Diablo.

Experienced gold geologist Lyle Thorne, who was previously exploration manager for NTM Gold prior to its Dacian merger, will join as CEO, while Barnaby Egerton-Warburton and Greg Smith will serve as non-executive directors.

On the ground, the company is drawing on expertise of Harrison Land Services – a Utah based consulting firm which has proved itself to have significant knowledge of the western US.

“These projects, being in Utah, Idaho and Nevada, are all fairly close to their base at Moab,” Lloyd said.

“The team is headed up by Gavin Harrison, who has more than 20 years’ experience with rigs and staking ground, and who helped us acquire these projects to begin with. He’s invaluable.”

When it lists, Diablo will do so with 74.5 million shares on issue and a market capitalisation of $14.9 million, with $6.5 million cash on listing before costs.

“I expect we’ll look really good in the first six months because we’ll have such great newsflow,” Lloyd said.

“Any exploration success should effect the share price significantly.”

Diablo is expected to list on the ASX on October 12, 2021.