CBA commodity price outlook: Oil up, gold down in 2021

Mining

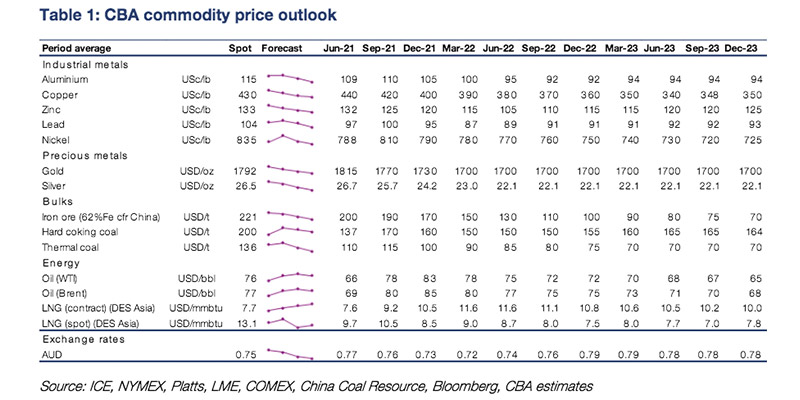

Most prices across the commodities complex are likely to ease back into the second half of this year, CBA says.

Oil looks to be the exception, where the bank forecast prices for brent crude to reach US$85/barrel by December.

The bank expects iron ore to ease back to around $170/tonne. while gold will dip back to the US$1,700 level amid rising strength in the US dollar.

Medium-term though, the bank has upped its forecasts for most commodities amid broader tailwinds for resources.

And in research this week, CBA commodities analyst Vivek Dhar detailed the bank’s “positive bias” on nickel prices due to “rising demand from the battery sector”.

Here’s a table of CBA commodity price forecasts through to the end of 2023:

Right now, around 70% of global nickel demand is driven by its use-case as in input in stainless steel.

That’s helped keep nickel prices supported amid the post-COVID economic rebound, starting with a major infrastructure push in China which is now extended to ex-China markets.

Conversely, the electric vehicle (EV) battery sector only accounts for around 7% of global nickel demand — a figure Dhar says is “expected to expand significantly”.

The long-term demand for batteries as part of the EV thematic is well-documented.

But Dhar added that the outlook for nickel should be assessed within the construct of changing trends in battery construction.

That’s because battery producers — particularly for EV passenger cars — are looking to adopt “higher nickel cathode chemistries to improve energy density”.

Better energy density equates to longer distances travelled between re-charges, and could mean nickel becomes a long-term leader in the commodities complex.

In 2020, the most popular construction ratio for nickel-manganese-cobalt batteries was six parts nickel, to two parts manganese / two parts cobalt (6:2:2).

“By 2030, this ratio is expected to increase to 9:0.5:0.5,” Dhar said.

In addition, higher nickel compositions are expected to grow more popular in the construction of batteries for other types of EVs including two-and-three wheelers, E-buses and commercial vehicles.

However, for markets outside of passengers cars, Dhar said nickel-cathode batteries may face increased competition from Lithium-Iron-Phosphate (LFP) batteries, which don’t use nickel.

That said, LFP batteries are “unlikely to dominate EV battery chemistries”, he said.

Instead, the use of LFP may become more prevalent in stationery batteries, where it already accounts for about half (49%) of the market.

According to data from Bloomberg New Energy Finance, that shares is expected to increase to more than 70% by 2030.

So as the electric battery market continues to develop, the prevalence of different battery composition chemistries will be an important trend to monitor.

“We think it’s certainly worth keeping an eye on LFP trends in coming years, to see whether LFPs play a more significant role than is currently expected,” Dhar said.