Bulk Buys: Iron ore prices stay elevated, demand outlook starting to improve for coking coal

A stacker/reclaimer at a WA iron ore shipping terminal. Image: Getty

- Iron ore fines prices traded this week at $US166.90 per tonne, up $US6.40 on a week ago

- Hard coking coal prices were $US5.25 lower on-week at $US128.30 per tonne at Queensland ports

- China’s steel reinforcing bar price is steady this week at $US667 per tonne

The immediate outlook for iron ore is still robust with the spot price at $US166 per tonne ($212.75/tonne) as cargo trading slowed to a crawl for China’s Lunar New Year holiday.

“Iron ore prices have been elevated since the Brumadinho tailings dam tragedy in Brazil first disrupted the market in early 2019,” said BHP in an earnings report this week.

The Australian iron ore shipper said its analysis of the seaborne market suggested that for a price correction to happen either Chinese demand or Brazilian supply would have to change “materially”.

“In the second half of the 2020s, China’s demand for iron ore is expected to be lower than today as crude steel production plateaus and the scrap-to-steel ratio rises,” it said.

Seaborne prices for iron ore are at their highest since late 2011, when the market was coming off a record of $US180 per tonne earlier in that year.

Iron ore futures contract prices, an indication of near term market conditions, were trading at $US160 per tonne for March and $US150 per tonne for June settlement on the Singapore Exchange, Tuesday.

“Liquidity remains limited in the iron ore market, with Chinese markets closed,” ANZ bank commodity analysts said in a report.

The bank added that earnings reports this week from top-tier iron ore producers would provide some insight into production and shipping volumes near term.

Earnings on target for BHP iron ore unit

In its latest earnings report, BHP said its iron ore unit was on target to achieve its earnings guidance for the 2021 financial year of $US10.2 billion.

All-in production costs for BHP’s WA iron ore business unit are $US12.46 per tonne, representing a before tax profit margin of 73 per cent.

“Record production partially offset unfavourable foreign exchange movements and higher third party royalties,” said the company in a presentation.

The company’s earnings report revealed BHP achieved an average free-on-board (FOB) price of $US103.78 per tonne for its iron ore shipments in the June to December 2020 period.

This compares to an average price it received for the commodity of $US78.30 per tonne for the June to December 2019 period.

BHP shipped 290 million tonnes of iron ore in 2020 and its new South Flank mine in WA is 90 per cent complete and forecast to start production mid-year.

The miner’s iron ore production was 145 million tonnes in the June to December 2020 half-year, up 5 per cent on the 2019 second half-year.

The company’s production guidance for the June 2021-ended financial year is 276 million to 286 million tonnes on a 100 per cent production basis.

Iron ore shipments from WA’s Port Hedland hit 42 million tonnes in January, up 4.3 per cent on year, although this was 9 per cent lower than December 2020.

“Recent ship tracking data showed a fall in exports from Australia, but exporters are keen to expand output amid strong demand,” said the ANZ analysts.

Ratings agency Fitch added its voice to a chorus of iron ore analysts saying prices for the commodity will trend lower over the next two years.

Fitch expects the iron ore price to average $US100 per tonne next year.

“We forecast global mine output growth to average 2.4 per cent over 2021 to 2025 compared to minus 2 per cent over the previous five years,” said Fitch, reported the Australian Financial Review.

On the other hand, other market experts such as investment banks Goldman Sachs and Morgan Stanley are adamant that iron ore prices are entering a new boom time.

“Policy driven demand is going to create a capex cycle that is bigger than the BRICs (Brazil, Russia, India, China) in the 2000s, not quite as big as the ’70s, but we are talking about that kind of a bull market in commodities,” Goldman Sachs’ global head of commodities research, Jeffrey Currie was reported as saying in a recent speech.

Mineral Resources aims for new mine start-ups

Australian mid-tier iron ore producer Mineral Resources (ASX:MIN) is to construct a new iron ore mine in WA’s Pilbara region and another at its Yilgarn production base.

The mining company is to bring online its Parker Range iron ore project mid-year, while its Wonmunna project is starting production this month, the company said in a report last week.

Wonmunna, part of the company’s Utah Point hub, is expected to deliver iron ore exports of 1 million to 2 million tonnes per year.

The Parker Range project is part of Mineral Resources’ Yilgarn production base that ships iron ore through Fremantle’s Kwinana bulk terminal and Esperance Port, both in WA.

Mineral Resources shipped 7.9 million tonnes of iron ore from its Yilgarn and Utah Point hubs in WA in the June to December 2020 period, up 17 per cent on the 2019 second half.

The company earned around $US119 per tonne for these shipments, at an average cost of $US76.50 to $US87.50 per tonne on a delivered-China price basis.

The company expects to ship around 20 million tonnes of iron ore exports from its WA hubs in the June 2021-ended financial year.

ASX iron ore company share prices

| Code | Company | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| ADY | Admiralty Resources. | 0.017 | 31 | 21 | 240 | $19.7M |

| GRR | Grange Resources. | 0.4 | 14 | 27 | 74 | $462.3M |

| FMS | Flinders Mines Ltd | 1.5 | 9 | 53 | 32 | $253.3M |

| MGT | Magnetite Mines | 0.026 | 8 | 86 | 596 | $74.3M |

| MGX | Mount Gibson Iron | 0.92 | 6 | -6 | 15 | $1.1B |

| FMG | Fortescue Metals Grp | 24.87 | 5 | -1 | 126 | $75.2B |

| FEX | Fenix Resources Ltd | 0.245 | 4 | -13 | 444 | $109.1M |

| EUR | European Lithium Ltd | 0.069 | 3 | -1 | -19 | $63.9M |

| LCY | Legacy Iron Ore | 0.028 | 0 | -28 | 1767 | $174.9M |

| MAG | Magmatic Resrce Ltd | 0.15 | 0 | -9 | -59 | $24.6M |

| MIN | Mineral Resources. | 36.82 | 0 | -8 | 96 | $7.0B |

| CIA | Champion Iron Ltd | 5.27 | -3 | -1 | 124 | $2.6B |

| AKO | Akora Resources | 0.37 | -5 | -4 | $18.9M | |

| TI1 | Tombador Iron | 0.089 | -11 | 22 | 323 | $69.3M |

| SRK | Strike Resources | 0.185 | -20 | -12 | 285 | $48.9M |

Steel rebar prices trade in steady range in China

Steel reinforcing bar (rebar) prices at the Shanghai trading hub were steady during China’s holiday lull this week at $US667 per tonne.

Stockpiles of the steel product have been building ahead of the Lunar New Year holiday and have relieved some of the market’s recent upward price pressure.

“Chinese steel production has picked up against all expectations,” said Mark Eames, director of ASX iron ore company Magnetite Mines (ASX:MGT).

Current steel production in China is around 1.1 billion tonnes per year and has increased by around 200 million tonnes in the past few years.

“That means another 300 million tonnes a year of iron ore is needed,” he said.

No country that has produced steel in large volumes historically has ever seen production crash, he said.

China’s urbanisation levels are currently around 50 per cent compared to a level of 80 per cent in Europe and North America.

This indicates the Asian country still has some way to go to equal urbanisation rates in Western countries, he said.

This is a point often missed by market commentators who focus on monthly trade flows, and who perhaps overlook the growing gap between demand and supply for iron ore.

“Structurally market demand has gone up by hundreds of millions of tonnes, while supply has only gone up by tens of millions of tonnes,” he added.

Magnetite Mines is developing a new iron ore mine in its Razorback project in South Australia for which it is on course to complete a feasibility study by mid-year.

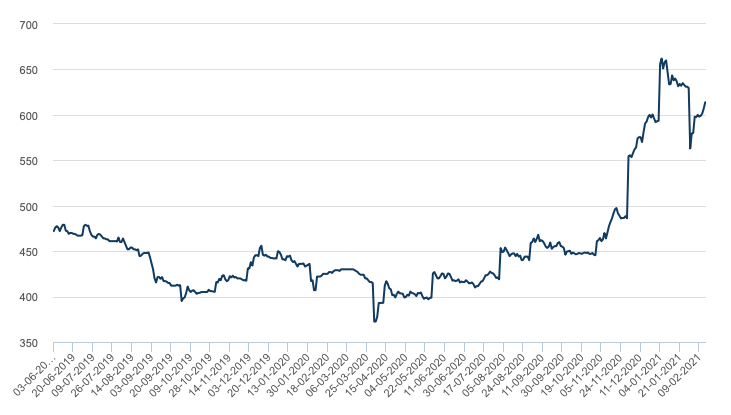

Elsewhere, on the London Metal Exchange, prices for its rebar steel futures contract have rebounded this week to $US614 per tonne, from $US543 per tonne a week ago.

This indicates that steel consumers and end users are starting to go through a re-stocking phase and are adding to their inventory.

This rise in LME rebar steel prices could translate into higher prices for similar Chinese product in the weeks ahead as the Asian country emerges from its Spring holiday.

Queensland coking coal prices drift lower in thin market

Prices for Australian hard coking coal ticked $US5 lower over the week to $US128.30 per tonne as non-Chinese buyers such as from Brazil and India took over in the spot market.

Cargoes of US origin coking coal continue to trade at prices higher than Australian cargoes by a margin of around $US30 per tonne for standard quality shipments.

Some Chinese traders and steel plants have tried to re-sell pre-ordered Australian coking coal cargoes back to the spot market partly because of ongoing port issues in China.

The situation in China for Australian coal imports was laid bare in a report this week by Australian rail company Aurizon (ASX:AZJ).

The company has lowered its railings guidance for coal by 10 million tonnes in the June 2021-ended financial year to 200 million to 210 million tonnes.

“Subdued economic conditions, combined with restrictions on Australian coal imports by China, continue to weigh on export volumes,” said ratings agency S&P Global Ratings in a report on Aurizon.

BHP coal unit sees changing trade flows for Australian coking coal

Rest-of-the-world demand in the seaborne market for coking coal is starting to improve as uncertainty over China’s imports policy grows, said BHP in its earnings report this week.

“The industry faces a difficult and uncertain period ahead,” said BHP, one of the world’s largest producers of coking coal, and the largest shipper in Australia.

“Metallurgical coal prices faced by Australian producers in the free-on-board (FOB) market have been weak,” said the company in a report to accompany its financial results.

BHP received an average price of $US106.30 per tonne for its hard coking coal shipped from Australia for the June to December 2020 period, down from $US154 per tonne in the June to December 2019 period.

While trade flows are adjusting in the seaborne market, a mismatch is developing between the expected evolution of customer demand and the cost-competitive growth options available to producers, said the company in its report.

“Long term, we believe that a wholesale shift away from blast furnace steel-making, which depends on metallurgical coal, is still decades in the future,” the company said.

BHP’s metallurgical coal business unit in Queensland was on course for an EBITDA of $US100m, representing a profit margin of 3 per cent on its production cost of $US84.92 per tonne.

Export volumes of metallurgical coal were lower due to adverse weather and higher planned infrastructure maintenance in the June to December 2020 period, said the company.

The company expects to produce between 71 million and 77 million tonnes of metallurgical coal from its Queensland business unit on a 100 per cent basis.

In the first half of the 2021 financial year, BHP’s Queensland metallurgical coal production was 34 million tonnes, down 5 per cent on the June to December 2019 half year.

ASX coal company share prices

| Code | Company name | Price | %Wk | %Mth | %Yr | MktCap |

|---|---|---|---|---|---|---|

| BCB | Bowen Coal Limited | 0.055 | 6 | 20 | 2 | $ 51,862,924.41 |

| PDZ | Prairie Mining Ltd | 0.29 | 12 | 4 | 41 | $ 60,514,098.59 |

| AHQ | Allegiance Coal Ltd | 0.097 | 9 | 31 | -22 | $ 83,153,544.96 |

| MCM | Mc Mining Ltd | 0.135 | -21 | -21 | -71 | $ 20,846,639.93 |

| YAL | Yancoal Aust Ltd | 2.47 | 3 | -3 | -14 | $ 3,235,076,620.65 |

| CRN | Coronado Global Res | 1.25 | 0 | -1 | -34 | $ 1,674,493,469.00 |

| TIG | Tigers Realm Coal | 0.009 | 0 | 0 | 16 | $ 117,482,352.91 |

| MR1 | Montem Resources | 0.2 | -17 | -7 | $ 32,610,854.00 | |

| TER | Terracom Ltd | 0.135 | -10 | -18 | -51 | $ 105,505,068.20 |

| NAE | New Age Exploration | 0.012 | -20 | -14 | 300 | $ 14,244,364.92 |

| CKA | Cokal Ltd | 0.074 | -5 | -12 | 72 | $ 71,192,838.10 |

| ATU | Atrum Coal Ltd | 0.25 | 0 | -11 | -22 | $ 145,241,586.00 |

| WHC | Whitehaven Coal | 1.57 | 5 | -12 | -38 | $ 1,564,456,011.48 |

| PAK | Pacific American Hld | 0.023 | -4 | -8 | 9 | $ 6,690,282.90 |

| JAL | Jameson Resources | 0.09 | 0 | -18 | -51 | $ 28,816,529.55 |

| SMR | Stanmore Coal Ltd | 0.73 | -3 | -15 | -20 | $ 201,452,724.05 |

| LNY | Laneway Res Ltd | 0.006 | 0 | -14 | 0 | $ 24,537,928.56 |

| AKM | Aspire Mining Ltd | 0.097 | -2 | -8 | -8 | $ 49,240,787.55 |

| BRL | Bathurst Res Ltd. | 0.042 | -11 | -22 | -58 | $ 75,218,854.96 |

| NCZ | New Century Resource | 0.195 | 5 | -19 | -5 | $ 235,935,968.97 |

At Stockhead we tell it like it is. While Magnetite Mines is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.